FPSO Demand Booming: 10 Units Expected to Be Ordered in 2022

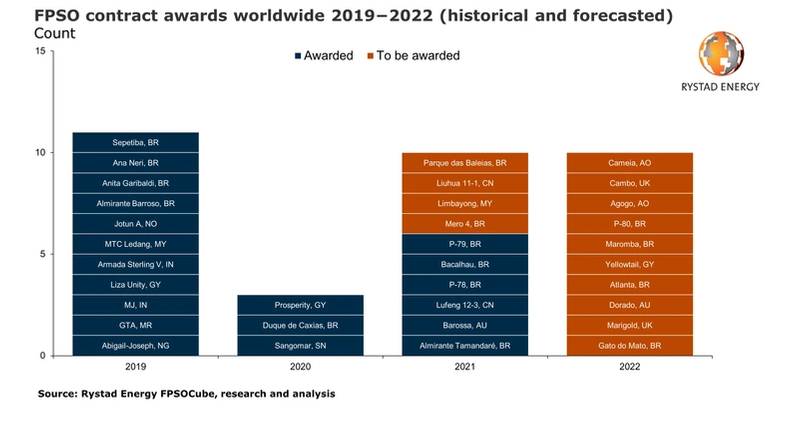

More FPSO contracts were awarded in the second quarter of 2021 than during the whole of 2020, with Rystad Energy expecting FPSO awards to reach a total of 10 units in 2021. Rystad has also noted muted interest from suppliers for some recent FPSO tenders, citing a nearly full capacity with several suppliers unable to take on new projects.

Further, Rystad sees another 10 FPSO orders in 2022, which will, according to the Norwegian energy intelligence group, create "a very healthy project line-up for contractors, effectively doubling their pipeline."

"Four FPSOs were awarded in the second quarter and we believe another four will be awarded before the end of the year. Including the two awards from the first quarter, this will bring the total tally up to 10 FPSO contract awards in 2021 – more than triple the three awards from 2020 – signaling a rapid comeback in FPSO contracting activity, despite the Covid-19 pandemic," the company said in a recent report.

The four FPSO contracts expected to be awarded before the end of the year include the Mero 4 and Parque das Baleias in Brazil, Limbayong in Malaysia, Liuhua 11-1 in China.

Aleksander Erstad, energy service research analyst at Rystad Energy said:"It’s not that contractors were out of business, there are currently over twenty FPSOs under construction, one of which is likely to start-up already this year. But after a weak 2020, the recent awards and the expected ones are doubling the pipeline, ensuring manufacturers will keep busy in the years ahead."

Per Rystad, the Brazilian oil giant Petrobras is currently evaluating bids for the two Brazilian FPSOs, Mero 4 and Parque das Baleias.

FPSO Supply Chain Nearing Full Capacity

"The Brazilian giant only received bids from one supplier for each of the FPSOs. For the larger unit, Mero 4, SBM Offshore was the sole bidder, while Yinson was the only player to bid for the smaller Parque das Baleias FPSO. The muted interest comes as the FPSO supply chain is nearing full capacity with several supplier unable to take on new projects," Rystad said.

In Malaysia, Rystad said, Petronas is evaluating bids for the Limbayong FPSO with a contract award expected to be handed out before the end of the year. Contractors involved in the bidding process are Yinson, MISC, Sabah International Petroleum, and a consortium comprising Bumi Armada, MTC and Shapoorji Pallonji.

Also, China’s CNOOC is eyeing for a cylindrical FPSO to redevelop the Liuhua 11-1 and Liuhua 1-4 fields in the South China Sea. The FPSO will be built in China and is likely to involve COOEC, Cosco and CIMC Raffles, Rystad added.

Another 10 projects are likely to be awarded in 2022, with the year expected to match 2021 in terms of FPSO awards. Most of the FPSO awards come from Latin America with four units bound for Brazil and one for Guyana. Angola and the UK are likely to see two awards each, and one is lined up for Australia, Rystad said.

A busy second quarter

A busy second quarter

A joint venture between Saipem and Daewoo Shipbuilding and Marine Engineering (DSME) recently won a contract to supply the P-79 FPSO to be deployed at the Buzios field in Brazil.

The contract is valued at $2.3 billion with Saipem’s share at $1.3 billion and DSME’s share accounting for the rest of the total value. DSME will build the hull and living quarters while Saipem will cover the topsides. The FPSO will be a newbuild with oil processing capacity of 180,000 barrels of oil per day (bpd), gas processing of 254 million cubic feet per day, and storage of 2 million barrels. The project will also give a boost to domestic Brazilian fabrication activity as Petrobras requires a 25% local content share.

The contract for Equinor’s Bacalhau FPSO was also finalized in the second quarter. On June 1, Equinor reached a final investment decision for the field development, triggering the full engineering, procurement, construction, and installation scope, which will be executed by Modec. Modec will also operate the FPSO for the first year.

The company has conducted the front-end engineering design and pre-investment on the FPSO under a contract signed with Equinor in early 2020, and the FPSO hull is already under construction by Dalian Shipbuilding Industry Company in China. Once completed, the FPSO will be one of the largest in the world with oil processing capacity of 220,000 bpd, gas injection of 530 million cubic feet per day, water injection of 200,000 bpd, and 2 million barrels of storage capacity.

In China, SK Innovation handed out a lease and operate contract to CenerTech for an FPSO to be deployed in the Lufeng 12-3 field. CenerTech will build the FPSO, then lease and operate it for a fixed period of 10 years. The contract is valued at RMB 4.43 billion ($684 million) with FPSO capital expenditure incurred by CenerTech estimated at RMB 2.41 billion ($372 million).

Petrobras contracted two FPSOs during the second quarter. In addition to P-79, the P-78 FPSO was contracted earlier in May. The P-78 was awarded to Keppel Shipyard under a turnkey contract valued at $2.3 billion. Keppel subcontracted the hull and living quarter scopes to Hyundai Heavy Industries for $762 million. The FPSO will have identical specifications as P-79.

Keppel will use its Brazilian shipyard BrasFELS on parts of the fabrication scope to fulfill the 25% local content requirement. The P-78 and P-79 FPSOs represent a change in Petrobras’ contracting strategy.

Petrobras had been contracting all FPSOs under lease and operate agreements. The switch to turnkey contracting, however, opens up to a wider set of potential suppliers, and Petrobras made the move as the leasing market for very large FPSOs is nearing full capacity, Rystad said.