Swedbank Adopts Poseidon Principles

Swedbank has signed the Poseidon Principles, a global framework for integrating climate considerations into lending decisions within ship financeThe Poseidon Principles provide a standardised methodology for data collection and reporting of emissions from banks’ shipping portfolios, with the overall ambition of supporting and facilitating the decarbonization of the shipping industry.The Poseidon Principles are consistent with the policies and ambitions of the IMO, including its…

Edda Wind Secures Green Financing for Newbuild Program

Edda Wind announced it has entered into a green term loan facility agreement for the pre- and postdelivery financing of four new commissioning service operation vessels (CSOV) under construction at Vard.The agreement is a €161 million green loan facility with Crédit Agricole Corporate and Investment Bank, Danske Bank A/S, DNB Bank ASA and SpareBank 1 SR-Bank ASA, with expiry in 2029 and a profile of 12 years. The facility corresponds to a leverage ratio of 60% of the total ready…

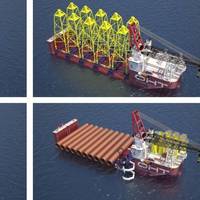

Havfram Secures Loan for Offshore Wind Vessel Construction

Offshore wind installation company Havfram has signed a Senior Secured Green ECA Term Loan Facility to fund its two wind turbine installation vessels ("WTIVs"), currently under construction at CIMC Raffles in China. The Facility was entered into with a syndicate led by DNB Bank ASA (Coordinator, Bookrunner, Green Loan Advisor and Agent) with SpareBank 1 SR-Bank ASA, Credit Agricole, Sparebanken Vest and Rabobank as Mandated Lead Arrangers and with Export Finance Norway as ECA lender.

Cadeler in Talks to Order Offshore Wind Foundation Installation Vessel

Danish wind turbine installation company Cadeler is contemplating a private placement of shares to raise funds to pay for a portion of a planned order for a newbuild offshore wind foundation installation vessel (F-Class) vessel.The company, which owns two offshore wind turbine installation vessels, with another two (X-class) on order, said Wednesday it planned to raise between $70 – 90 million through the placement of new ordinary shares with a par value of DKK 1.00 in the company at an offer price of NOK 32.32 per share, through an accelerated bookbuilding process.

MPC Container Ships to Acquire Songa Container

MPC Container Ships ASA (MPCC) announced it has reached a deal to acquire fellow Norwegian-based container shipping company Songa Container AS for $210.25 million on a debt and cash free basis. The transaction is expected to be completed by the end of July 2021.Upon closing, MPCC will acquire Songa’s fleet of 11 container vessels, with an average size of 2,250 TEU and an average age of 11.9 years , creating a combined fleet of 75 ships and a total capacity of roughly 158,000 TEU. Nine of the acquired ships are fitted with scrubbers while three are equipped with the highest ice-class.Constantin Baack, MPC Container Ships CEO, said, “This…

OHT Gets $135M Loan for 'Alfa Lift'

Oslo-listed offshore heavy transport and wind installation company OHT has received and accepted a firm offer for a USD 135 million Senior Secured Green ECA Credit Facility.The loan was accepted by OHT's ship owing company OHT Alfa Lift AS, which is building the offshore wind foundation installation vessel Alfa Lift in China. OHT ordered the Alfa Lift on speculation in 2018, and has since secured contracts to install foundations at the world's largest wind farm - the Dogger Bank in the UK.Sharing further details on the loan…

Corporates Pledge for Healthy, Productive Ocean

30 companies and institutional investors have signed up to the United Nations Global Compact (UNGC) Sustainable Ocean Principles committing to take action to secure a healthy and productive ocean.UNGC is a special initiative of the UN Secretary-General, the United Nations Global Compact works with companies everywhere to align their operations and strategies with ten universal principles in the areas of human rights, labor, environment and anti-corruption.The signatories to the principles include the container ship and supply vessel operator A.P. Møller – Mærsk, food and beverage company PepsiCo, and Norges Bank Investment Management, which manages one of the world’s largest funds with over US$ 1 trillion in assets.

Eagle Bulk Shipping Avails Loan Secured by 21 Vessels

American shipowner Eagle Bulk Shipping has announced that Eagle Bulk Ultraco, a wholly-owned subsidiary of the Company, has closed on a new five-year senior secured facility totaling USD 208.4 million, maturing in 2024. The global transporter of drybulk commodities said that the Facility is secured by 21 vessels, including the M/V Cape Town Eagle which was acquired earlier this month, and includes a term loan of USD 153.4 million and a revolving credit facility of USD 55 million.Gary Vogel, Eagle’s CEO, said: “We are very pleased that the Company continues to secure increasingly attractive debt financing and has increased its financial flexibility in the process.

Eagle Bulk Gets $208M Credit Facility

Connecticut-headquartered Eagle Bulk Shipping said that its wholly-owned subsidiary Eagle Bulk Ultraco has received a loan commitment from a consortium of banks for a new five year senior secured facility totaling approximately $208 million.According to the company, the Facility will include a term loan equating to approximately $153 million and a revolving credit facility of $55 million, and will be used to refinance the existing debt of Eagle Bulk Ultraco LLC and Eagle Shipping, as well as for general corporate purposes, including capital expenditures relating to the installation of exhaust gas cleaning systems, or scrubbers.Upon the closing of the transaction and the repayment in full of the Refinanced Debt…

Verus Petroleum Mulls 12-Fold Production Growth

Aberdeen, UK-based Verus Petroleum has secured a 12-fold increase in its production – from 1,500 to 18,000 barrels per day in less than a year – with the closing of three recent acquisitions on the UK Continental Shelf.A press release from the petroleum exploration and production services provider said that it has recently completed three significant acquisitions; an interest in the Babbage gas field acquired from Premier Oil on 6th December, on the back of completing transactions to acquire Cieco Exploration & Production (UK) Limited and Equinor’s Alba field interest in November.The private equity backed independent operator said that these three deals, each with an economic date of 1st January 2018, were funded by a combination of equity, existing cash reserves and debt.

AGR, First Geo to Merge

Norwegian offshore oil and gas consultancy and services companies First Geo (owned by Akastor), and AGR Bidco are set to merge."Akastor AS (Akastor), has entered into agreements with Silverfleet Capital, DNB Bank ASA and Nordea Bank Abp, filial i Norge (together the AGR stakeholders) to combine AGR Bidco AS (AGR) with First Geo AS," said a press statement.The Transaction will be carried out primarily as an asset deal, whereby assets in the current AGR legal structure and three legal entities will, together with First Geo, be transferred to a new legal structure, which in turn will be transferred to Akastor to establish the merged company.The merged company will be named AGR. Akastor will hold 100% of the shares in the company and 55% of the economic interest.

WFW Advises DNB on USD310m Loan to Star Bulk Carriers

International law firm Watson Farley & Williams (WFW) advised Norway’s DNB Bank ASA (DNB), as facility agent and security agent for a syndicate of banks comprising itself, ABN AMRO Bank N.V., BNP Paribas, Danish Ship Finance and Skandinaviska Enskilda Banken AB, in relation to a US$310m loan facility provided to Star Bulk Carriers Corp.Secured on 26 vessels in Star Bulk’s fleet, the facility consists of two tranches: (a) a first tranche of US$240m used to refinance Star Bulk’s debt under five existing facility agreements; and (b) a second tranche of US$70m used to finance the prospective capital expense for the retrofitting of vessels…

Shearwater to Buy Schlumberger’s Seismic Business

Norwegian marine geophysical services company Shearwater GeoServices Holding AS has entered into a definitive agreement to acquire the marine seismic acquisition assets and operations of Schlumberger’s geophysical services product line, WesternGeco.The transaction, which remains subject to regulatory approvals and other customary closing conditions, is expected to close in the fourth quarter of 2018.Houston based Schlumberger will receive cash consideration based on an enterprise value of $600 million plus a 15 percent post-closing equity interest in Shearwater. For a limited period, Schlumberger will be entitled to payments under an earn-out agreement linked to future vessel usage over and above specific thresholds.

KONGSBERG to Acquire Rolls-Royce Commercial Marine

Kongsberg Gruppen ASA (KONGSBERG) today entered into agreement with Rolls-Royce plc to acquire Rolls-Royce Commercial Marine, a world leading technology business within maritime operations. The transaction is structured as an acquisition by KONGSBERG of the marine products, systems and aftermarket services businesses carried out by subsidiaries of Rolls-Royce plc. The transaction does not include Bergen Engines nor Rolls-Royce's Naval Business. The parties have agreed a value for Rolls-Royce Commercial Marine of GBP 500 million (on a cash and debt free basis and with working capital at an agreed level). The final purchase price, will be determined based on Rolls-Royce Commercial Marine's cash, debt and working capital at time of completion of the transaction.

Allum Holding, Ferncliff Sell Stake in Saga Tankers

Norway-based shipping company Saga Tankers ASA said in a stock exchange announcement that Allum Holding AS and Ferncliff AS have today sold all of their 47,726,655 shares in Saga Tankers, representing approximately 17.9% of the share capital. Ferncliff AS has sold 6,235,316 shares in the Company and Allum Holding AS has sold 41,491,339 shares in the Company. The price per share in the Secondary Sale was NOK 1.65. DNB Markets, a part of DNB Bank ASA, acted as sole bookrunner for the Secondary Sale. Allum Holding AS and Ferncliff AS are both owned by Øystein Stray Spetalen, member of the Board of Directors of Saga Tankers. Following the Secondary Sale…

MPC Container Ships Acquires Fleet Worth $130

The Oslo, Norway-based MPC Container Ships AS has entered into a commitment to acquire a fleet of feeder container vessels with a total purchase price of USD 130 million. MPC Container Ships was formed in April 2017. Its main activity is to own and operate a portfolio of container ships with a focus on the feeder segment between 1,000 and 3,000 TEU. The company has also announced the successful completion of the private placement of 30.25 million new shares announced on 22 November 2017. The Private Placement was completed at a subscription price of NOK 47.50 per share, which was determined through an accelerated book-building process. The Private Placement will raise gross proceeds of approximately USD 175 million.

New Maritime Bank Opens Its Doors

A new niche bank for the shipping and offshore sector opened its doors for business on December 20, 2016. Serving the global maritime markets from its main office in Oslo, Maritime & Merchant Bank ASA (M&M) will provide secured lending in the form of first priority terms loans. “The sustained tight credit market for the maritime sector has left many companies owners seeking financing with few alternatives,” said M&M CEO, Halvor Sveen. “We believe M&M can fill a need for a specialized bank with experience in shipping and offshore that is able to contribute to good solutions for our customers.”

Euronav Acquires $ 750 mi Facility

The Executive Committee of Euronav NV today announced that it has signed a new USD 750 million senior secured amortizing revolving credit facility led by DNB Bank ASA and Nordea Bank Norge ASA acting as Coordinators, Mandated Lead Arrangers and Bookrunners and ABN AMRO Bank NV, ING Bank NV and Skandinaviska Enskilda Banken AB (publ) (SEB) acting as Mandated Lead Arrangers and Bookrunners and Crédit Agricole Corporate and Investment Bank acting as Lead Arranger whilst KBC Bank NV, Scotiabank Europe plc and Société Générale acting as Co-Arrangers. The additional lenders are Belfius Bank SA/NV and HSBC Bank plc. Nordea is also the facility agent.

KfW IPEX-Bank Finance For 2nd Star Cruises' Ship

With a loan of EUR 600 million, KfW IPEX-Bank is financing the construction of a second cruise ship for Star Cruises, the leading cruise line in Asia, at the Meyer Werft shipyard in Papenburg. The signing ceremony of the relevant contracts took place today in Hong Kong. The second new ship is expected to ship in the fourth quarter of 2017. In April this year, KfW IPEX-Bank had already completed the financing for a sister ship. Investment Bank and DNB Bank ASA, Singapore Branch the total loan amount available. Financing is provided with an export credit agency of the federal government (Euler Hermes cover) and binds the set by the OECD Ship CIRR (Commercial Interest Reference Rate) a.

Ezra to Consolidate EMAS Marine into EOC

Ezra Holdings Limited today announced plans to consolidate its Offshore Support Services division, EMAS Marine, into its associated company, EOC Limited, which is listed on the Oslo Børs, Norway. Upon completion of the transaction, the enlarged EOC Group will be one of the largest offshore support operators in Asia Pacific by asset value, managing an offshore services platform comprising over $1 billion in offshore support assets. Its diverse and versatile fleet of 50 offshore vessels is among the youngest in the region. The fleet has a combined bollard pull of almost 4,000 tons, more than 37,000 dwt and a total of almost 350,000 BHP, making it one of the strongest and most powerful in the region, with capabilities to operate globally at ultra-deep water depths.

Euronav Announces $340m Credit Facility

The executive committee of Euronav NV announced that it has signed a new $340 million senior secured credit facility led by ING Bank NV acting as sole Bookrunner and together with Citibank NA, Danish Ship Finance A/S, DnB Bank ASA and KBC Bank NV acting as Mandated Lead Arrangers whilst Belfius Bank NV, BNP Paribas Fortis NV, Deutsche bank AG and ITF International Transport Finance Suisse AG are acting as Lead Arrangers. ING is also the facility agent. The credit facility comprises of (i) a $192 million term loan facility and (ii) up to $148 million non-amortising revolving credit facility. The facility will be available as from today for the purpose of (i) refinancing four Suezmax vessels: the Cap Felix (2008 – 158…

GasLog Ltd. to Buy 2 LNG Vessels

GasLog Ltd. has entered into an agreement with Methane Services Ltd. an affiliate of BG Group, to acquire two modern tri-fuel diesel electric LNG carriers for a cost of $460 million. The two vessels, Methane Becki Anne and Methane Julia Louise, will be chartered back to BG for periods of nine and eleven years with further options by the charterer to extend the term of the time charter for each vessel by either three or five years. The nine and eleven year charters are very much in line with our expectations. They add approximately $580 million of contracted revenue(1) over the charter period and are expected to provide a combined annual EBITDA of approximately $46 million(2).

NY Shipping Conference Speakers Announced

Conference organizers have announced the speaker lineup for the 21st annual Hellenic-American and Norwegian-American Chambers of Commerce conference, often called the New York Shipping Conference. Entitled “The Life of a Ship”, the conference will feature luminaries including Steinar Nerbovik of Aker Philadelphia Shipyard, Ben Ognibene of Heidmar, Craig Stevenson Jr., Joseph Hughes of Shipowners Claims Bureau, Paal Johansen of DNV GL, and Angela Chao of Foremost Group . The event will be held on Wednesday, February 11 at the Waldorf-Astoria starting at 8:15 a.m. with conference registration and continental breakfast sponsored by DNB Bank ASA. The luncheon keynote speaker will be Sturla Henriksen, CEO of the Norwegian Shipowners’ Association, organizers said.