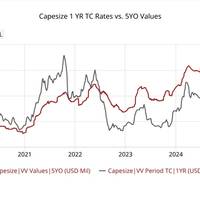

Capesize Values Hit 17-Year High

Global trade flows have adjusted to new geopolitical developments last week, with Red Sea diversions maintaining their grip on vessel demand patterns. Against this backdrop, timecharter earnings hit their highest levels since October 2024, with Capesize rates leading the rally while smaller segments lagged behind. The S&P market saw continued interest in modern tonnage as owners position for tightening supply fundamentals. Values for 5YO Capesizes of 180,000 DWT have rallied impressively this year…

Baltic Index Hits Two-Week Low

The Baltic Exchange's dry bulk sea freight index, which monitors rates for vessels moving dry bulk commodities, marked its lowest level in two weeks on Wednesday, pulled down by weaker capesize rates.* The main index, which factors in rates for capesize, panamax and supramax shipping vessels, fell 8 points, or 0.5%, to 1,634 points. The index hit its lowest level since March 12.* The capesize index shed 49 points, or 1.9%, to reach 2,581 points, a two-week low.* Average daily earnings for capesize vessels…

BDI Hits One-Week High as Commodity Markets Firm

The Baltic Exchange’s main sea freight index rose to its highest level in a week on Monday, supported by gains across all vessel segments amid strengthening demand and firmer commodity markets.The overall Baltic Dry Index (BDI), which tracks rates for ships carrying dry bulk commodities such as coal, iron ore, and grains, climbed 9 points, or 0.6%, to 1,652. This marks the index's highest level since March 17.Leading the upward momentum was the capesize segment, with its index rising 14 points, or 0.5%, to 2,690.

Capesize carries Baltic Index to One-month High

The Baltic Exchange's main sea freight index, which tracks rates for ships ferrying dry bulk commodities, hit more than a one-month high on Monday on the back of higher capesize rates.The index, which factors in rates for capesize, panamax and supramax shipping vessels, was up 45 points at 1,093 points, its highest level since Dec. 11.The capesize index rose 167 points to 1,615 points, a six-week peak. Average daily earnings for capesize vessels, which typically transport 150…

Capesize Segment Buoys Baltic Index

The Baltic Exchange's dry bulk sea freight index, which tracks rates for ships carrying dry bulk commodities, rose on Thursday, supported by higher capesize rates.The index, which factors in rates for capesize, panamax and supramax shipping vessels, edged up 3 points to 969 points.The capesize index was up 64 points at 1,164 points. Average daily earnings for capesize vessels, which typically transport 150,000-ton cargoes such as iron ore and coal, increased by $530 to $9,653.Dalian iron ore futures prices snapped a four-day losing streak…

Baltic Index Extends Gains as Capesize Rates Rise

The Baltic Exchange's main sea freight index, which tracks rates for ships carrying dry bulk commodities, rose for a second consecutive session on Monday, propped up by higher rates for the capesize segment.The index, which factors in rates for capesize, panamax and supramax shipping vessels, added 5 points to 1,814 points.The capesize index gained 43 points to 2,878 points.Average daily earnings for capesize vessels, which typically transport 150,000-ton cargoes such as iron ore and coal, increased $363 to $23,872.Iron ore futures climbed on Monday as renewed prospects of further fiscal stimu

Baltic Dry Index Ticks Down as Capesize Losses Offset Gains in Smaller Vessels

The Baltic Exchange's dry bulk sea freight snapped a 12-session winning streak on Tuesday, as pressure from lower capesize rates outweighed gains in smaller vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, was down 0.3% at 2,291 points.The capesize index .BACI snapped its nine-session rising streak, shedding 57 points, or 1.4%, to 4,148.Average daily earnings for capesize vessels, which typically transport 150,000-ton cargoes such as iron ore and coal…

Weaker Capesize Rates Push Baltic Dry Index Lower

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, dropped to snap a seven-session winning streak on Monday, weighed down by lower capesize rates.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, fell 3 points, or 0.2%, to 1,817.The capesize index lost 56 points, or 2%, to 2,707.Average daily earnings for capesize vessels, which typically transport 150,000-tonne cargoes carrying commodities such as iron ore and coal…

Higher Capesize Rates Drive Baltic Index Higher

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, rose on Monday, aided by firm capesize rates. The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, snapped a two-session losing streak after rising by 36 points, or 2.1%, to 1,737. The capesize index added 136 points, or 5.5%, to hit 2,610- its highest level in nearly five months. Average daily earnings for capesize vessels, which typically transports 150…

Baltic Dry Index Scales 11-month Peak

The Baltic Exchange's main sea freight index, which tracks rates for ships carrying dry bulk commodities, rose to an 11-month high on Wednesday, driven by robust capesize rates.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, gained 58 points, or about 3.4%, to 1,752, its highest level since Oct.

Baltic Index Falls on Weakness in Capesize Rates

The Baltic Exchange's main sea freight index edged lower on Thursday as a decline in capesize rates overshadowed advances in the panamax segment.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels carrying dry bulk commodities, ticked down by 7 points, or 0.6%, to 1,137.The capesize index fell 78 points, or 4.5%, to 1,674, declining for the third straight session.Average daily earnings for capesizes .BATCA, which typically transport 150,000-ton cargoes carrying commodities such as iron ore and coal, decreased by $643 to $13,883.Dalian iron ore futures

Capesize Spot Rates Hesitant Despite 5% Rise in Demand -BIMCO

“During the first five months of 2023, demand for Capesize ships increased 5% y/y while supply increased 3% y/y. Nonetheless, spot rate increases remain hesitant, largely due to concerns over China’s fragile economic recovery,” says Filipe Gouveia, Shipping Analyst at BIMCO.Demand growth was supported by a 4% increase in average haul while cargo volumes increased only marginally. Average haul increased due to higher exports from Brazil and Guinea and higher volumes of long-haul Russian coal.Supply rose due to a 2% y/y increase in the Capesize fleet and a 1% increase in fleet productivity.

Baltic Index Rises on Strong Capesize, Supramax Demand

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, rose on Tuesday, aided by higher rates for capesize and supramax vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, gained 40 points, or 2.6%, to its highest in eight weeks at 1,598.The capesize index was up 125 points, or 5.2%, at 2,509 — its highest since Dec. 22.Average daily earnings for capesizes, which typically transport 150…

Baltic Dry Index Gains as Capesize Rates Rebound

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, rose on Thursday buoyed by a rebound in rates of the larger capesize vessel segment.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, gained 28 points, or about 1.9%, to 1,484 - its biggest daily percentage rise since March 14.The capesize index added 104 points, or about 5.9%, to 1,856.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes carrying commodities such as iron ore and coal, increased $868 to $15,396.2Mean

Baltic Dry Index Snaps Six-session Losing Streak

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, ended a six-session losing streak on Monday, as an uptick in capesize rates outweighed losses in panamax and supramax segments.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, edged up nine points, or 0.8%, to 1,139.The capesize index gained 84 points, or 5.56%, to 1,596.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were up $694, at $13,237.China's state planner has allowed three c

Baltic Dry Index Logs Best Day in Nearly Three Months

The Baltic Exchange's dry bulk sea freight index rose on Thursday to mark its biggest one-day percentage gain since mid-September, underpinned by a jump in capesize rates.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities, gained 127 points, or about 9.1%, to 1,528 - its highest since Oct. 28.The capesize index climbed 372 points, or about 21.6%, to 2,095, its highest level since Oct.

Baltic Index Slips, but Posts Best Week in Almost 2 Months

The Baltic Exchange's dry bulk sea freight index marked its biggest weekly percentage gain in almost two months, although declining on Friday on a fall in capesize rates.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities, shed 14 points, or about 1%, to 1,324.The main index gained 11.4% for the week, its biggest rise since Oct. 7.The capesize index .BACI was down 51 points, or about 3.3%, at 1,519. It posted a weekly loss of 5.8%.Average daily earnings for capesizes .BATCA…

Baltic Dry Index Snaps Nine-day Losing Streak

The Baltic Exchange's dry bulk sea freight index rose on Wednesday for the first time in ten sessions, helped by an uptick in capesize rates.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels carrying dry bulk commodities, added 35 points, or about 3%, to 1,184.The capesize index added 127 points, or 11.6%, to hit its highest in a week at 1,219.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes of coal and steel-making ingredient iron ore, increased $1,049 to $10,106.Meanwhile, Dalian iron ore futures extended their

Baltic Dry Index Dips to Two-week Low

The Baltic Exchange's main sea freight index fell to a nearly two-week low on Tuesday as rates across its vessel segments declined.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, shed 53 points, or 2.5%, to 2,061 points, the lowest since July 14.The capesize index fell for the second straight session, losing 141 points, or 5.4%, to 2,455 points, a near two-week low.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were down $1,167 at $20,359."The biggest headache moving forward will li

Baltic Index Steady as Lower Rates for Smaller Vessels Offset Capesize Gains

The Baltic Exchange's main sea freight index was little changed on Tuesday as declines to multi-week lows in the panamax and supramax segments countered gains in capesize rates.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, edged down two points to 1,564 points.The capesize index .BACI was up for the second session, gaining 45 points, or 3.1%, at 1,510 points.Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal…

Baltic Index Rises on Higher Demand for Capesize Vessels

The Baltic Exchange's main sea freight index tracking rates for ships carrying dry bulk commodities, rose for a second straight session on Monday on higher capesize rates, while other vessel segments stayed flat.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, was up 28 points, or 1.6%, at 1,788 points.The capesize index gained 86 points, or 4.4%, at 2,041 points, on its best day in six.Average daily earnings for capesizes, which typically transport 150…

Baltic Sea Freight Index Posts Weekly Gain as Capesize Rates Jump

The Baltic Exchange's main sea freight index , tracking rates for ships ferrying dry bulk commodities, logged its first weekly gain since mid-June, as a jump in capesize rates outweighed declines in other vessel segments.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, was up 140 points, or nearly 7%, at 2,150 points, its highest since July 4. It rose 4% for the week.The capesize index rose 462 points, or 18.8%, to 2,919 points, its highest since June 20.

Dry Bulk: Capesize Rates Hit 6-month Low

The Baltic Exchange's main sea freight index fell for the third straight session on Monday as rates for capesize vessels declined to their lowest in more than six months.The overall index, which factors in rates for capesize, panamax, and supramax shipping vessels, lost 73 points, or 4.9%, to 1,404 points, its lowest since Jan. 28.The capesize index was down for the third consecutive session, falling 216 points, or 16.4%, to 1,098 points, its biggest drop in 11 days.Average daily earnings for capesizes…