MOL and Petrobras Sign Cargo Transfer Vessels Deals

Mitsui O.S.K. Lines (MOL) and Brazil’s state-owned energy giant Petrobras have signed a charter contract for cargo transfer vessel (CTV) SeaLoader 2, and agreed to start negotiations for a new CTV shipbuilding contract by the end of 2024.MOL signed the deal through its wholly owned subsidiary, SeaLoading Holding, which owns and operates CTVs.SeaLoading started a CTV agreement with Petrobras for SeaLoader 2 on a trial period in January 2022, and successfully completed more than 30 crude oil offloading operations from Petrobras' FPSOs located in the Santos Basin…

Venezuelan Oil Gets More US Buyers as Chevron Steps Up Loadings

Chevron Corp has stepped up sales of Venezuelan crude oil to rival U.S. refiners, adding PBF Energy Inc and Marathon Petroleum Corp to its list of customers for the crude, vessel tracking and loading schedules showed.U.S. Gulf Coast refiners, which historically processed Venezuelan oil, have shown a renewed appetite for the heavy sour crude grade after Chevron late last year received authorization from the U.S. Treasury Department to expand its operations in Venezuela and resume oil shipments to the U.S. after a four-year pause.Chevron, the last big U.S.

Valeura Energy Completes Modification of MT Jaka Tarub Vessel for Wassana Offshore Oil Field

Oil and gas company Valeura Energy said Monday that modifications to the MT Jaka Tarub crude oil storage vessel were complete, making the vessel compatible with infrastructure at its Wassana oil field, offshore Thailand.According to Valeura Energy, the vessel is capable of tandem crude oil loading/offloading. "Subject to favorable metocean conditions, the vessel will arrive at the Wassana field in the coming days, after which Valeura intends to resume oil production operations, targeting initial rates of up to 3,000 bbls/d, net to the 89% working interest share held by its subsidiary company Valeura Energy Asia Pte. Ltd." the company said.As reported by Offshore Engineer in December 2022…

Chevron Suspends Production at Thai Oil Field after Fatal Accident

Production at the Benchamas oil field in the Gulf of Thailand was suspended immediately after an accident last week and remains offline, U.S. oil giant Chevron Corp said in a statement on Monday.The announcement comes after an accident last week at an oil storage vessel caused seawater to leak into the vessel's hull, killing one crew member."We have recovered the body of our colleague who was fatally injured on March 13," a Chevron spokesperson said in a separate statement, adding that preparations were being made to return the body to the victim's family.

Thailand Rushes to Avert Spill After Fatal Accident on Oil Storage Ship

Authorities in Thailand on Thursday were working to avert a leak from a storage vessel carrying 400,000 barrels of crude oil.One crew member was killed after seawater entered the hull of the Benchamas 2 when a seal malfunctioned during maintenance earlier this week.Navy spokesperson Admiral Prokgrong Monthatphalin said multiple agencies were working to recover the body of the dead crewman, fix the leak and avert an oil spill."The vessel's condition is safe and weather conditions are not interfering with the rescue operations. However, there is no electricity in the engine room ...

EverWind Gets Approval for North America's First Green Hydrogen Facility

EverWind Fuels, a company founded by private equity veteran Trent Vichie, told Reuters it became the first green hydrogen producer in North America to secure the necessary permits for a commercial-scale facility on Tuesday.Provincial authorities in Canada granted environmental approval for EverWind to begin converting a former oil storage facility and marine terminal at Point Tupper in Nova Scotia into a green hydrogen and ammonia production hub.Green hydrogen is different than conventional hydrogen only in its production…

Yemen's Houthis Increase Pressure with Oil Port Attacks

Yemen's Houthi group is piling on pressure to extract economic gains in U.N.-led talks for an extended truce deal with attacks on oil ports in government-held areas, which officials say have disrupted crude exports, choking state revenues.Yemen's foreign ministry said in a statement that the Houthis launched a drone attack on the southern Qena port in Shabwa on Wednesday. The group's military spokesman said on Twitter that the operation "foiled an attempt to loot" Yemen's oil by preventing a vessel from docking.A joint statement by the U.S.…

Idled St. Croix Refinery Risks Explosion, 'Catastrophic' Releases

Equipment corrosion at an oil refinery in the U.S. Virgin Islands presents a risk of fire, explosion or other "catastrophic" releases of hazardous substances, U.S. environmental regulators said on Tuesday, after performing an inspection last month.The idled St. Croix refinery, formerly called Limetree Bay, was shut down by the U.S. Environmental Protection Agency in May 2021 after a series of chemical releases into the environment sickened neighboring residents. The refinery was sold in December 2021 for $62 million to West Indies Petroleum and Port Hamilton Refining and Transportation…

KNOT Takes Delivery of Dual-Fuel Shuttle Tanker. Charter Secured with Eni

Knutsen NYK Offshore Tankers (KNOT), an affiliate of NYK, has taken delivery of a dual-fuel LNG shuttle tanker built at Daewoo Shipbuilding & Marine Engineering yard in South Korea.

Cuba Boosts Fuel Imports, Reshuffles Shipping Operations After Terminal Fire

Cuba is using a combination of ship-to-ship transfers and floating oil storage to ease fuel scarcity and power cuts following a fire that destroyed a portion of its main oil terminal, vessel tracking data showed.Cubans have endured daily blackouts and long waits for gasoline in the aftermath of the blaze, which hit the 2.4-million-barrel Matanzas terminal and killed 16 people this month.Cuban President Miguel Diaz Canel's administration has increased fuel imports from Europe and the Caribbean while Venezuela and Mexico have helped the communist-ruled island with specialized crews and equipment to extinguish the fire, triggered by lightning, and rebuild infrastructure.More than 3 million barrels of Venezuelan crude and fuel, Russian oil, European diesel and liquefied petroleum gas from Domi

Russian Oil Tanker Bound for Fire-ravaged Cuban Terminal Diverts to Smaller Port

A cargo of Russian oil bound for Cuba's Matanzas terminal has been diverted to a smaller port, following a spectacular fire that destroyed a large portion of the island's main oil terminal, vessel monitoring data showed on Thursday.Lengthy power blackouts have followed the fatal blaze, which killed one firefighter and left 14 others missing. The outages are a sign of how the accident is aggravating a long-standing energy crisis due to an obsolete power grid and lack of fuel.The Liberia-flagged tanker NS Laguna carrying 700…

Venezuela Diverts Oil Cargoes as Cuba Terminal Fire Continues

Venezuela's state oil firm PDVSA diverted two crude cargoes set to discharge at Cuba's Matanzas terminal, Refinitiv Eikon data and company documents showed on Tuesday, as a fire that devastated 40% of the island's main storage facility continued for a fifth day.Lightning on Friday set one crude storage tank at the 2.4-million-barrel facility ablaze, later spreading to three others, resulting in massive power outages.As most of Venezuela's oil shipments to Cuba typically go to…

Devastating Fire May Force Cuba to Resort to Expensive Floating Oil Storage

An inferno at Cuba's largest oil storage facility has killed at least one firefighter, injured many more, and threatens to further swell the fuel import bill for the impoverished island nation that relies on foreign oil for everything from transportation to its power grid.Cuban officials may need to scramble to set up expensive floating storage capacity to handle imports aimed at easing an acute fuel scarcity, sources and experts said on Monday.Cuba relies on the 2.4-million-barrel Matanzas terminal…

Third Oil Storage Tank Collapses in Cuba Terminal Following Fire, Spill

A third crude tank caught fire and collapsed at Cuba's main oil terminal in Matanzas, its governor said on Monday, as an oil spill spread flames from a second tank that caught fire two days earlier in the island's biggest oil industry accident in decades.Cuba had made progress fighting off the raging flames during the weekend after drawing on help from Mexico and Venezuela, but late on Sunday the fire began spreading from the second tank, which collapsed, said Mario Sabines, governor of the Matanzas province…

Mexico, Venezuela Assisting Cuba Fight Massive Fire in Main Oil Storage Facility

Cuba sought on Sunday to bring under control a fire at its main oil storage facility that has killed one firefighter, drawing on help from Mexico and Venezuela to fight the raging flames.A lightning strike on Friday ignited one of eight storage tanks at the Matanzas super tanker port 60 miles east of Havana. A second tank caught fire on Saturday, catching firefighters and others at the scene by surprise. Sixteen people were missing.The second explosion injured more than 100 people…

Floating Oil Storage Stacks up in the Singapore Strait

The number of tankers used for storing fuel oil along the Singapore Strait has risen since the Ukraine war broke out and could rise further as more of Russia's supplies hit by sanctions head to Asia, industry sources and analysts said.A rise in floating storage supply along the strategic waterway is an indicator that more supplies are available to Asia, which will help ease tight markets. But, at the same time, it could limit a recovery in spot fuel oil prices for the year and weigh on Asian refining profits for the grade.Earlier this month…

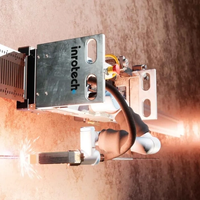

Welding Tech: Inrotech Partners with Gullco International

The Danish provider of mobile robotic welding and adaptive multi-pass welding technologies, Inrotech has partnered withGullco International, a manufacturer of automated welding and cutting carriages, modular automation, and custom automation solutions.The two companies will use their partnership to strengthen their customer offerings and market position. With this partnership, both companies combine their knowledge together and offer smart, easy-to-use automation solutions equipped with intelligent software and scanning technology for the growing need for welding automation technology…

Distressed Venezuelan Supertanker Discharging Oil Cargo in Asia - Sources

A U.S.-sanctioned Venezuela-owned supertanker that had mechanical problems since January is transferring its 2-million-barrel cargo of heavy crude to other vessels in Asia, according to three people familiar with the matter.The very large crude carrier (VLCC) Maximo Gorki left Venezuela in November amid an export push designed to generate funds for cash-strapped state oil company Petroleos de Venezuela (PDVSA), which has been under U.S. trading sanctions since 2019.Aging infrastructure problems, including a lack of oil storage and vessels, frequent refinery outages and export port congestion, are undermining PDVSA's increased oil production, impeding efforts to boost revenue, according to company documents and sources.

Fujairah Oil Terminal Invests in VLCC project. Expects Surge in Oil Trade

The Fujairah Oil Terminal is investing an estimated $45 million to upgrade the infrastructure at its storage facilities, betting on a surge in crude trading and storage demand at the United Arab Emirates oil hub, the company's chairman told Reuters.FOT's expansion, financed by a new $280 million debt facility, will connect its terminal to the Port of Fujairah's very large crude carrier (VLCC) loading facility and the Abu Dhabi Crude Oil Pipeline (ADCOP) pipeline, said Steve Bickerton…

Iranian Oil Tanker to Discharge 2 Million Barrels in Venezuela

An Iranian supertanker carrying about 2 million barrels of condensate this week began discharging at Venezuelan state-run oil company PDVSA's main oil port, according to a company document and tanker tracking services.PDVSA and state-run National Iranian Oil Company (NIOC) in the second half of last year started a swap deal to exchange Iranian condensate for PDVSA's heavy crude. The pact has proven to be key for sustaining Venezuela's oil output, which needs diluents including condensate for transportation and exports.Last year, the two state companies that are under U.S. sanctions exchanged some 4.82 million barrels of condensate for 5.55 million barrels of heavy crude, mostly transported in Iran-flagged vessels.

At Least Three Dead After Trinity Spirit FPSO Blast in Nigeria

At least three people died in Nigeria when the oil storage and production vessel, FPSO Trinity Spirit, exploded last week and four crew are still missing, the operating company said on Monday.The vessel had 10 crew on board when it exploded on Wednesday, Nigeria's Shebah Exploration & Production Company Ltd (SEPCOL) said, adding that three were found dead on Sunday after three people had been found alive last week."Our priority remains focused towards establishing the whereabouts…

KOTUG Canada Bags Charters for Three Vessels

Marine services and towage firm KOTUG Canada Inc., a partnership between KOTUG International and Canada’s Horizon Maritime Inc., has won a long-term agreement with Trans Mountain, operator of Canada’s only oil pipeline servicing the West Coast of Canada providing tidewater access to foreign markets for Canada’s petroleum resources. KOTUG Canada will provide escort towage to tankers loaded at Westridge Marine Terminal. "KOTUG Canada was selected for this purpose by shippers on the Trans Mountain Pipeline after a rigorous and competitive process facilitated by Trans Mountain.

Hornblower Acquires Two Offshore Vessels

Hornblower Group announced on Wednesday it has acquired two offshore vessels: the Seaward Explorer and Seaward Endeavor, previously the California Responder and Pacific Responder, respectively. Seaward Services, Inc. (SSI), part of the Hornblower Group of maritime businesses, is offering the multipurpose supply vessels for charter, with prompt availability.The Seaward Explorer and Seaward Endeavor were built at VT Halter Marine in Mississippi, commissioned by Marine Spill Response Company (MSRC) in response to the Exxon Valdez oil spill.