d'Amico Orders Two Product Tankers for $111m

d’Amico International Shipping S.A. subsidiary d’Amico Tankers D.A.C. signed a shipbuilding contract with Jiangsu New Yangzi ShipbuildingCo., China, for the purchase of two (2) new Long Range (LR1 – 75,000 DWT) product tanker vessels at a contract price of $ 55.4 million each. The ships are expected to be delivered in September and November 2027, respectively.Today the DIS’ fleet comprises 34 double-hulled product tankers (MR, Handysize and LR1, of which 26 owned, 5 chartered-in and 3 bareboat chartered-in) with an average age of about 8.8 years for its owned and bareboat chartered-in vessels.“This deal is aligned with our strategic objective of controlling a very modern fleet," said Paolo d’Amico, Chairman and CEO of d’Amico International Shipping.

Subsea Vessel Market is Full Steam Ahead

Since our last market update in the subsea space about a year ago both our current market view and forecasts have strengthened significantly.While the demand picture is looking solid and arguing for a strong multi-year upcycle, the supply side has also started to wake from its slumber albeit ever so slightly at the time of writing. Moreover, we register an interesting dynamic on the shipowner side, where everyone is trying to position themselves for the impeding market boom.Please note that vessel definitions and abbreviations in this part of our industry can vary…

One-on-One: Rob Langford, VP, Global Offshore Wind, ABS

As the U.S. offshore wind industry endures a predictable number of stops and starts during its adolescence, common mantras are ‘learn from the established European model’ and ‘embrace technology transfer from the offshore oil and gas sector.’ In Robert Langford, the American Bureau of Shipping has all of that and more bundled in one neat package.Rob Langford has worked in the offshore industry for more than three decades, ‘cutting his teeth’ in a UK design firm working in the North Sea oil and gas platforms, the holy grail of rigorous conditions in offshore energy production.

Belships Expands Its Newbuild Program

Belships announced has expanded its newbuild program with two new 64,000 dwt Ultramax bulk carriers scheduled for delivery in 2028.The Norwegian-based company now has a total of 10 newbuilds under construction at Japanese shipyards with delivery between 2024 and 2028. All vessels are leased on time charter for a period of 7 to 10 years from delivery, with purchase options around current market levels. There is no obligation to purchase any of the vessels. Cash breakeven for the vessels upon delivery is about $14…

SMM 2024 Exhibition Halls Already Nearly Fully Booked

The SMM 2024 trade show will run from September 3-6 this year, and organizers are expecting more visitors and exhibitors than last time; the exhibition halls are nearly fully booked.“We are expecting more than 2,000 international exhibitors from 70 nations,” says Claus Ulrich Selbach, Business Unit Director Maritime and Technology Fairs & Exhibitions at Hamburg Messe und Congress. “We are overwhelmed by the response. We are actually setting-up an additional hall to accommodate all requests.

Cruise Industry Reports Record Passenger Volumes

The global cruise industry reported record passenger volumes in 2023 as the sector continues its rebound following the lows of the COVID-19 pandemic.Cruise ships carried 31.7 million passengers in 2023, up 7% from previous highs recorded in 2019, according to latest figures published by the trade group Cruise Lines International Association (CLIA).Most increases were in the United States—which remains, by far, the world's largest cruise market—with an incremental increase of 2.7 million passengers…

Pelagic Partners Teams Up with Borealis Maritime to Grow PSV Fleet

Shipowner and shipping fund manager Pelagic Partners announced it has teamed up with asset management firm Borealis Maritime to invest in a pair of platform supply vessels (PSV).Built in 2021, the 89-meter Aurora Coey – formerly Viking Coey – and Aurora Cooper – ex-Viking Cooper – are both dual-fuel and capable of operating on liquefied natural gas (LNG), as well as being ammonia-ready. The ice-class sister vessels are fitted with hybrid battery power, and Low Loss Concept (LLC) solutions that further reduce emissions…

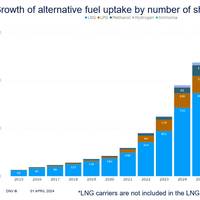

DNV: Five Alternative Fueled Vessels Ordered in March

According to the latest figures from DNV’s AFI platform, five new orders for alternative fueled vessels were confirmed in March 2024: two methanol, two ammonia and one LNG.Although this was a quiet month for the ordering of alternative fueled vessels, the overall trend remains strong, says DNV. For the first three months of 2024, 68 orders for alternative fueled vessels were made, compared to 44 in the first three months of 2023, representing year-on-year growth of over 50%.Jason Stefanatos…

Carnival Orders Excel-class Cruise Ship

Fresh on the heels of its first newbuild order in five years, the world's largest cruise company has placed an order for an additional vessel.U.S.-based Carnival Corporation on Tuesday announced it has signed an agreement with German shipbuilder Meyer Werft to build an Excel-class cruise ship for its Carnival Cruise Line brand for expected delivery in 2028.The ship will be the 11th Excel-class ship for the corporation's fleet across four of its brands, and the fifth to be sailed by Carnival Cruise Line.

Van Oord Doubles Profit, Announces New CEO

Van Oord concluded 2023 with revenue reaching record high and profits more than doubled.The company saw revenue growth across both its Dredging & Infra and Offshore Energy business units, which resulted in a significantly revenue increase of 42% to EUR 2.9 billion from EUR 2.0 billion in 2022.Net profit doubled to EUR 127 million from EUR 60 million in 2022. High fleet utilisation and the continued sharp focus on risk and contract management contributed to the improved results.The order book increased by 3% to EUR 4…

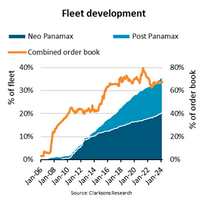

Ships Above 12,000 TEU Drive 100% Increase in Average Ship Size

Since 2006, the average container ship has doubled in size to 4,580 TEU and ships with a capacity of more than 12,000 TEU has accounted for 51% of the fleet’s capacity expansion. Today, just 626 ships provide 36% of the fleet’s capacity, and the trend is set to continue as the large ships dominate the order book, says Niels Rasmussen, Chief Shipping Analyst at BIMCO.When the Emma Maersk was delivered in August 2006, the ship was by far the largest container ship in the world. It is 400 metres long, 56 metres wide and has a capacity of about 17,800 (14,000 TEU when delivered).

Sharp Uptick Seen in Crude Tanker Ordering

Contracting activity for for crude tanker newbuilding has risen sharply to start 2024, driven by a steep rise in orders for very large crude carriers (VLCC), according to shipping organization BIMCO.In the first two months of 2024, crude tanker newbuild contracting surged to 7.4 m DWT, a 490% leap y/y. Notably, the 19 VLCCs ordered in January and February is more than was ordered for the entirety of 2023.Freight rates for crude tankers spiked at the start of the war in Ukraine, and they have largely stayed strong since, said Filipe Gouveia, shipping analyst at BIMCO.

Safe Bulkers Sells Two Vessels

Dry bulk shipowner Safe Bulkers on Wednesday announced it has reached deals to sell two of its vessels to undisclosed buyers.Through separate agreements, the Monaco-headquartered company will sell the 2010-built 92,000 dwt Post-Panamax Panayiota K at a gross sale price of $20.45 million and 2011-built 75,000 dwt Panamax Paraskevi 2 at a gross sale price of $20.3 million.The ships are scheduled to be delivered to their new owners in April and July 2024 respectively.Dr. Loukas Barmparis…

DHT Orders Four VLCCs

DHT Holdings announced it has entered into agreements to build four very large crude carriers (VLCC) in South Korea for delivery between April and December 2026.Two of the large tankers will be constructed at Hyundai Samho Heavy Industries and the other two at Hanwha Ocean (formerly known as Daewoo Shipbuilding & Marine Engineering), for an average price of $128.5 million. The contracts include options for an additional four vessels that can be delivered during the first half of 2027.The vessels have been ordered to Super Eco-designs and have carrying capacity of about 320,000 metric tons.

Japan Continues to Lead Shipowner Rankings

VesselsValue has unveils this year’s top 10 shipowning nations, reviewing the total asset values for vessels by beneficial owner country. From Japan's resolute leadership in the top position with a USD 206.3 billion fleet to the emergence of Hong Kong at USD 44.7 billion, asset values and ownership strategies have changed considerably over the last 12 months, says Rebecca Galanopoulos-Jones, Senior Content Analyst, Veson Nautical.The data provided by VesselsValue and analysed by Veson is valid as of February 2024.

The APAC Offshore Market: Riding the Wave of Success into 2024 and Beyond

2023 was the first year of real recovery for owners in the offshore supply market and yet we have barely skimmed the surface of what’s to come.The market is still on an upward trajectory with charter rates accelerating month-by-month, availability changing day-by-day, leading to earnings doubling and, in some segments, tripling since the lows of 2020. Current rates will remind many of the glory days of pre-2014 with the demand for OSVs projected to remain elevated for years to come.In general…

Demand for Maritime Shaft Generators Increasing

30 years ago shaft generators with PTI capability kept container ships sailing at top speed. That purpose gone, PTI/PTO is making a new comeback in more cargo shipping segments, this time for reducing emissions.Retrofitting a shaft generator is not an insignificant undertaking. Around 50 tons of equipment needs to be installed into the engineroom through a hole in the hull. A new section of shaft is usually required.That a few shipowners are undertaking such projects - Klaveness Combination Carriers on the Ballard…

Carnival Orders Another Cruise Ship from Meyer Werft

German shipbuilder Meyer Werft reports it has secured an order from U.S.-based Carnival Corporation for the construction of a new cruise ship for Carnival Cruise Line. The newbuild order is the first placed by Carnival Corporation in five years.Slated for delivery in 2027, the Excel-class ship will be a sister vessel to the 183,200 GT Carnival Jubilee, which was handed over at the end of 2023."Our Excel-class ships have been a tremendous addition to the Carnival fleet and proven very popular with our guests," said Christine Duffy, president of Carnival Cruise Line.

Safe Bulkers Sells 2005-built Panamax

Dry bulk shipowner Safe Bulkers announced Monday it has has reached a deal to sell the oldest vessel in its fleet to an undisclosed buyer.The ship is the Maritsa, a 76,000 dwt Panamax bulk carrier built in Japan in 2005. The vessel was sold at a gross sale price of $12.2 million and a forward delivery date from April 2024 to May 2024, New York-listed Safe Bulkers said.Dr. Loukas Barmparis, president of Safe Bulkers, said, “We continue our strategy to selectively sell older vessels…

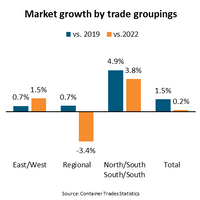

Container Market Growth Modest in 2023

In 2023, the container market grew 0.2% year-on-year, ending at 173.8 million TEU. Compared to 2019, before the COVID pandemic hit, the market grew 1.5%.“Container market growth has lagged behind overall economic development significantly, as the world economy has grown 10% since 2019,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.Highlighting the challenge for liner operators, the container fleet capacity in 2023 grew 21% vs 2019 and 8% vs 2022. The order book of new ships will add nearly 25% to the capacity during the next four and a half years.

DNV Confirms Energy Efficiency Gains for LNG Carries with DFE+ Propulsion

New Dual Fuel, Electric+ (DFE+) concept, developed by ABB and MAN Energy Solutions, has been recognized by DNV as a more energy efficient alternative to current conventional designs for liquefied natural gas (LNG) carriers.DNV has quantified the gains that owners of LNG carriers could expect to achieve using the new DFE+ solution and found that it could help LNG carriers boost energy efficiency by up to 7.5%, therefore enabling greater emissions reduction.The number takes into account the smaller machinery space requirements with ‘a conservative estimate’ of 5% greater cargo capacity…

Birdon Acquires Metal Shark's Bayou La Batre Shipyard

Australia's Birdon Group announced its U.S. subsidiary has reached a deal to acquire Metal Shark Boats' shipyard in Bayou La Batre, Ala.Birdon America said it will utilize the 32-acre facility for vessel repair work as well as newbuild activity, including construction of the U.S. Coast Guard's $1.187 billion 27-vessel Waterways Commerce Cutter (WCC) Program awarded to Birdon in 2022.Birdon Group CEO, Jamie Bruce, said, “The investment in this facility will not only ensure we deliver on our promise to the U.S.

Alternative Fuel Newbuilding Orders Strong in January

According to the latest figures from DNV's AFI platform, it was another strong month for alternative fuel orders. This was led by methanol fueled ships, where 23 new orders were registered. Around 70% of these were in the container segment with the remainder mainly made up of vessels in the bulk and RoRo segments.LNG continues to feature strongly, with 10 more LNG fueled ships added to the database. Car carriers and tankers made up the bulk of these orders, followed by RoPax.