Subsea Vessel Market is Full Steam Ahead

Since our last market update in the subsea space about a year ago both our current market view and forecasts have strengthened significantly.

While the demand picture is looking solid and arguing for a strong multi-year upcycle, the supply side has also started to wake from its slumber albeit ever so slightly at the time of writing. Moreover, we register an interesting dynamic on the shipowner side, where everyone is trying to position themselves for the impeding market boom.

Please note that vessel definitions and abbreviations in this part of our industry can vary, but for the purposes of this article, we will focus on what we at Fearnley Offshore Supply define as subsea construction vessels (CON), anchor handling construction vessels (AHCON), light construction vessels (LCV), and multi-purpose supply vessels (MPSV) above 68m length overall.

We have previously highlighted the severe tightness of vessel supply in the offshore construction space as project development in both oil and gas as well as offshore renewables are pulling on the same asset pool for a large range of work scopes. With that same combined demand firmly on a rising trajectory with forecasts pointing to a multi-year plateau of high vessel activity the market, we argue, will soon find itself in dire need for more tonnage.

Combine that with the fact of very limited fleet growth, and even a larger number of units exiting the industry in recent years, it is almost ironic that the largest number of construction support vessels is not the present fleet, but was recorded back in 2021.

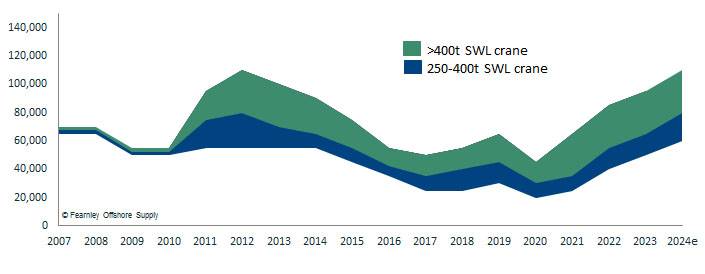

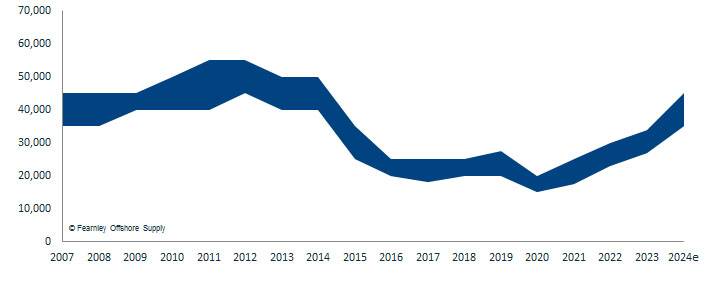

Coincidently, the market has vastly improved since 2021, especially from the shipowners’ perspective. Dayrates for construction support assets, as displayed on the graphs below, have improved by more than 100, 95, and almost 90% for construction vessels, light construction vessels, and multi-purpose units respectively. Other metrics as well, such as utilization for example, has also improved significantly in that same span of time, and while the aforementioned vessel exits has had some degree of positive impact herein, the most significant driver has undoubtedly been the demand development.

Construction Vessels, Rate level (USD)

Construction Vessels, Rate level (USD)

Chart Courtesy Fearnley Offshore Supply

Light Construction Vessels, Rate level (USD)

Light Construction Vessels, Rate level (USD)

Chart Courtesy Fearnley Offshore Supply

Multipurpose Vessels, Rate level (USD)

Multipurpose Vessels, Rate level (USD)

Chart Courtesy Fearnley Offshore Supply

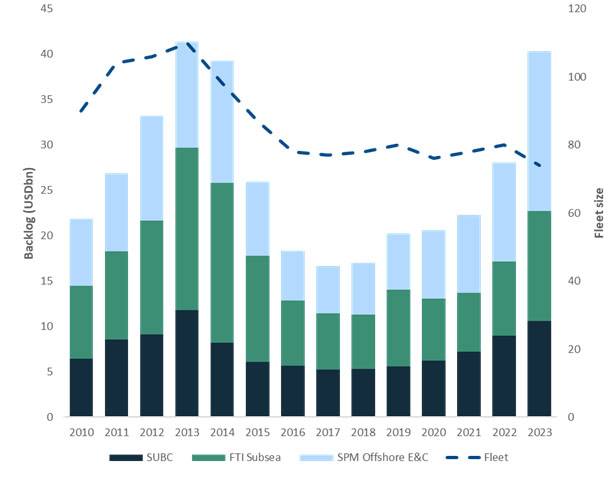

Another insightful method to measure the health of the subsea market is to analyze the order backlog of the Tier 1 offshore construction contractors: Subsea 7, TechnipFMC, and Saipem. When doing so, we find that as per the end of 2023, these companies’ combined backlog stood at almost the same value as the previous peak 10 years prior. With more than $40 billion of work in their books, the Tier 1 players have just around 2% less orderbook value than in 2013. As such we argue quite firmly that the market, in a lot of respects, have fully recovered.

Furthermore, back in the previous market upcycle the major subsea contractors significantly increased their controlled fleet, that is the owned and long-term chartered construction support vessels, through large newbuild programs, acquisitions, and long-term chartering. This made a lot of sense given the amount of work they were lining up and threading new water in terms of project complexity at the time.

As the market crashed in the following years, investments in offshore developments all but dried up and the Tier 1’s orderbooks were brought down with it. Unsurprisingly, these companies reduced their controlled fleet significantly by shedding older and non-core tonnage as well as letting charters roll off their engagement without replacements or renewal.

What is rather surprising, however, is that the controlled fleet of these same companies at the time of writing, when their orderbook stands almost at its previous record, is at its lowest in well over a decade. In fact, what we had previously assumed would be the through fleet figure for the Tier 1’s, at 78 controlled vessels during 2020, reached a new low at 74 units during as of the end of last year. Tier 1 Subsea Contractors Backlog and Controlled Fleet

Tier 1 Subsea Contractors Backlog and Controlled Fleet

Chart Courtesy Fearnley Offshore Supply

Therefore, we see no other alternative than that something has got to give, and in light of the vessel demand forecast for these assets, we are of the firm belief that the major subsea contractors sooner rather than later will make some strategic and significant investments. We are not alone in that belief by any means, and as a matter of fact we have seen several positioning moves on the supply side of the market.

Firstly, on an otherwise rather ordinary Thursday in March, not one, nor two, but three subsea construction newbuilds were announced all on the same day!

Rem Offshore confirmed the placement of a construction vessel at Myklebust Verft in Norway. The vessel will have a 250-ton crane and methanol power, enabling their first net zero emissions vessel of this type.

With an expected delivery in 2026, we see the announcement as the first major construction vessel newbuild in the current cycle. Furthermore, two SALT-designed light construction vessels were placed by an undisclosed owner the same day, which will be built at Wuchang Shipbuilding in China. The vessels will be prepared for alternative fuels, including a large battery package with expected delivery in 2026. The vessels are a further development of the successful SALT 305 design, which will be suitable towards both traditional oil and gas clients and core offshore wind scopes.

As we head into a stage of the cycle where vessel shortages could very well soon be reality, we see these newbuilds as a natural development. Other traditional owners have opted for the rearrangement of existing assets, with high corporate activity in recent weeks. Following the battle for Solstad Offshore between Aker and Kistefos, Siem Offshore announced the split of assets between the company founder and remaining shareholders.

Kristian Siem will exit the company he founded with nine vessels in exchange for 35% of the outstanding shares, which include three AHTS, four PSVs, and two subsea construction vessels. Kristian Siem’s Siem Sustainable Energy will become the new owner of the vessels, leaving Siem Offshore a fleet of 17 vessels. Following completion of the transaction, Siem Offshore will continue to manage the vessels on behalf of Kristian Siem for a minimum of one year.

Kistefos, owned by Christen Sveaas, will now be the largest owner of Siem Offshore, combined with being the major owner of Stockholm-listed Viking Supply Ships, which controls a fleet of six AHTS. The rationale for owning two OSV operators with separate organizations, in the same city now less, might be challenged in the near term, yet we have noted that there are no plans for consolidation as of now.

Havila Holding also made moves with the full acquisition of Volstad Maritime, where they have held 52.5% of the shares since 2017. The fleet consists of five subsea construction vessels and one diving support vessel, which is considered high specification and include three 250-tone crane DP-3 units. Havila Holding is now the controlling shareholder in Havila Shipping with a fleet of 14 vessels, joint owner of Skansi Offshore with five vessels and full owner of Volstad Maritime with five vessels.

Subsequently, we can say that the puzzle for securing high quality steel has started and multiple interesting developments have occurred on the corporate side in recent weeks. Investors with strong competence in the space are positioning themselves for a prolonged period of strong earnings, and we can expect further M&A activity going forwards as newbuilding is still limited owning cash generating steel is a top priority. Nonetheless it still bodes well for the future prospects of the subsea construction segment as these market movements all point to even brighter days ahead.