Scarcity of Ship Recycling Tonnage Continues

Despite the occasional smaller LDT candidate popping up for sale over recent weeks, there regrettably remains the ongoing scarcity of tonnage that is simply unable to fill the most basic of demands at the major ship-recycling destinations, reports cash buyer GMS.“As plots across Indian sub-continent markets gradually recycle through their respective shares of vessel deliveries through the first quarter of 2024, both Bangladeshi and Pakistani markets remain well-positioned despite the onset of the traditionally quieter month of Ramadan…

Sub-Continent Recyclers Hope for Better 2024

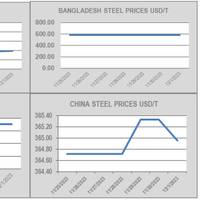

As we enter the last week of 2023, sub-continent markets struggle on, says cash buyer GMS, going the final furlong to round out what has been an overall disappointing year for pricing and volumes.Prices have collapsed from over $600/LDT to below $500/LDT over certain stages this year, seeing around $150/LDT wiped from residual values in a shock for owners and cash buyers alike.“Now that currencies and steel prices seem to have stabilized across the board for the time being, many will be hoping for a more bullish 2024, particularly as the supply of tonnage is set to increase – from both the dry

Ship Recycling Market Remains Slumped

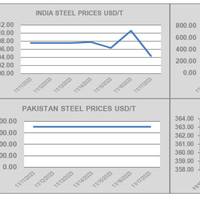

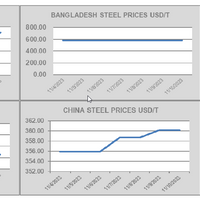

The lackluster end to the year in subcontinent recycling markets continues for another week as disappointed owners and cash buyers face selling their inventory into markets where prices have slumped, reports cash buyer GMS.Several dry bulk sales were below USD 500/LT LDT into India in the lowest confirmed deals for several months.Steel prices have declined in India by almost 10% in a shock to many, particularly as international steel prices have pushed on to an impressive extent over the last month.

Ship Recycling Markets Continue to Struggle

Ship recycling markets continue to struggle going into the final weeks of the year, reports cash buyer GMS. There has been very little activity or new sales to report, with most end users abstaining from buying and rather wishing to wait and watch developments.Contrary to many expectations, India has lost around 3,000 rupees ($35/LDT) from steel prices.Pakistan was buoyed by the news that their country will sign up to the Hong Kong Convention – which will enter into force from 2025…

GMS: Steel Plate Prices Not Yet as High as Hoped

As Diwali holiday celebrations concluded, Alang recyclers seem to slowly be filtering back to work amidst declining plates prices, sentiments, says cash buyer GMS, and local offerings that remain stagnant.“Unfortunately, this remains the ongoing dilemma across much of the Indian sub-continent ship recycling markets, especially as steel plate prices are yet to gain ground to the extent many in the industry had been hoping for thus far, whilst currencies simultaneously continue to cause ongoing worries for respective domestic markets.”On the flip side…

Ship Recycling Markets Remain Muted

Markets remain precariously poised as Diwali holidays occupy the sub-continent markets and the industry heads into the final months of the 2023, says cash buyer GMS. Although several sales have reportedly registered into India at some impressive levels, sentiments and pricing here remains muted overall.“On the Eastern end and in the lead up to the Bangladeshi elections due in mid-January 2024 - disruptions, protests, and even strikes have embattled the country and as such, it is expected to become even more challenging to get lines of credit open and deliveries completed into Chattogram…

Ship Recycling Market Cools

Inflation, fundamentals, currencies (except in India), vessel pricing, and overall weakening sentiments have beset the ship recycling market over the past week, reports cash buyer GMS.The effects have been felt across all the sub-continent ship-recycling destinations (even Turkey to an extent), which have cooled by about US$ 20/LDT over recent weeks, says GMS. However, India and Bangladesh have reported surprising increases in steel plate prices over the last week.“Seemingly on the back of global steel plate prices…

C&C Reports Record Demand for Barge Repair

Belle Chasse, La. shipyard C&C Marine and Repair said it is seeing record demand for barge repair work as high steel prices place a damper on newbuild activity.The yard, having recently signed a contract to reside over 200 hopper barges for an unnamed customer, said it is currently delivering refurbished hopper barges at a pace of one per week.“With current steel prices, operators are choosing to repair their existing fleet of barges rather than building new,” said C&C Marine and Repair’s owner Tony Cibilich.

GMS Reports Feverish Buying in Ship Recycling Markets

Cash buyer GMS reports another week of “astonishing” activity in sub-continent ship recycling markets, with owners and cash buyers primarily focusing on the Indian market where several extraordinarily priced container sales reportedly took place over the recent weeks.The $600/ton mark was even exceeded on a container unit once again, in what seems to be the surest sign yet, that sentiments and demand in Alang are back on track, says GMS.Pakistan is not too far behind India, with some select dry bulk sales to Gadani recyclers who are now re-emerging and have line of credit approvals in place…

Ship Recycling: Prices Continue to Fall

Prices continue to struggle across the major ship recycling markets, reports cash buyer GMS.Bangladesh further declined after depreciating currencies and sustained credit struggles, while Turkey suffered similarly with declining steel plate prices, the Lira, and its vessel prices.The supply of tonnage seems to have increased slightly over the last couple of weeks, particularly from the Chinese market. This has left owners and cash buyers chasing various recycling destinations amidst weakening prices.As forecasted a few weeks ago…

Baltic Dry Index Extends Slide for 10th Straight Session

The Baltic Exchange's main sea freight index of shipping rates for dry bulk commodities logged its 10th consecutive decline on Wednesday, hitting its lowest in two-and-a-half months as rates fell across all vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, dropped 53 points, or 3.9%, to 1,295 points, its biggest drop since February.The capesize index was down 110 points, or 5.4%, at a one-month low of 1,930 points, marking its biggest drop since April 18.Average daily earnings for capesizes, which typically transport 150,000-tonne ca

"Slim Pickings" on Available Tonnage for Ship Recycling

After some recent declines in the sub-continent markets, the ship recycling market appeared to have reached the bottom early this week as a certain “stability” across the markets led to some greater confidence to acquire some of the slim pickings of tonnage currently available for recycling.However, as the week came to an end, global currencies seemed to suffer against the U.S. Dollar in unison, as all of the major ship recycling destinations faced some declines (especially in Pakistan), leaving sentiments under pressure.

DSME Honors John Angelicoussis

Daewoo Shipbuilding & Marine Engineering (DSME) has held a tree planting ceremony in honor of the late John Angelicoussis who passed away in 2021.The ceremony included the unveiling ceremony of a plaque engraved with the picture of the former of Angelicoussis Group who is held in high regard by the shipyard particularly because he offered support whenever DSME was in need. This included support through the dissolution of Daewoo Group in 1998, the Lehman Brothers financial crisis in 2008, and the liquidity crisis that continued from 2015.Angelicoussis was born in Piraeus in 1948.

Ship Scrapping Business Picks Up with Dry Bulk Swoon

This week, several more sales have registered as sub-continent ship recycling markets come roaring back – and a previously subdued Bangladesh starts to seemingly find some form once again, with some workable L/Cs from privately financed (rather than state controlled) banks.Despite the ongoing discussions about an IMF loan in the amount of about USD 2 - 3 billion, end buyers have been working to find alternate ways to pay for vessels for some time now and without the troublesome central bank approval, which is denying the disbursements of U.S.

Ship Recycling Market Continues to Improve

Another solid showing from sub-continent markets has given encouragement to ship owners and cash buyers, to start testing potential prices with firm candidates. Indeed, several deals have been concluded off the back of these improved numbers, including one more Capesize bulker at firm levels basis an ‘as is’ Singapore delivery.Now that the Chinese New Year holidays have concluded, the expected bounce in freight markets has yet to materialize, so an increased number of dry bulk…

Ship Recycle Market Shows Some Positivity

After the last few weeks of insufferable performances from the major recycling markets, a shade of positivity was observed this week, as owners seem more confident in testing the waters and welcoming firm offers, especially those that are above $500/LDT.On the back of this seemingly positive note, one or two market sales of note even materialized this week and it does seem as though prices have bottomed out and sentiments have flatlined after losing a rather rattling $200/LDT, seen from the peaks witnessed earlier this year.Bangladesh continues to struggle with L/C financing limits, but the IMF loan is reportedly in the works of being approved and with most yards currently lying empty…

Ship Recycling: No Impetus

Recycling markets are ambling towards the end of the year without any real impetus, ability, aggression, or even an apparent willingness to engage in discussions to buy, so volatile has the situation been over the last two quarters.Prices have of course come off by about $200/LDT in the sub-continent markets since the stunning peaks witnessed over $700/LDT just earlier this year – for reference, on a standard Capesize Bulker, that is over $4 million lost on the residual value…

Ship Recycling Prices Continue to Slide

According to GMS, "some unbelievably low and unrealistic offers" have started to emerge from sub-continent markets this week, and as such, both owners and cash buyers would be well advised to leave ship recycling destinations alone for the time-being, especially until some sort of floor is reached and stability regains a foothold.It has become increasingly difficult to obtain any firm or serious offers from any recycling market, GMS reports, as currencies continue to suffer across…

Ship Recycling Prices Soften (again)

Sentiments have softened across sub-continent markets once again this week, as buyers appear increasingly reluctant to commit on fresh tonnage while fundamentals remain so shaky – especially as the markets have witnessed across the last couple of weeks, where currencies and steel plate prices took turns in tumbling.The Pakistani Rupee has breached historical lows and despite the odd flash of appreciation, has given Gadani Buyers extreme discomfort over the course of a torturous year of monumental declines.Bangladesh…

Shipbreaking: Starved of Supply!

India finally leads the way on pricing this week, as all of markets i.e. Pakistani, Bangladeshi and even the Turkish markets work their way towards Eid holidays and the end of the Holy month of Ramadan, GMS, which describes itself as the world's largest buyer of ships & offshore vessels, said in its latest weekly commentary.In fact, GMS said, several markets are likely to be closed anywhere from a couple of days (as in the sub-continent) with the Turkish market celebrating until Thursday.Overall…

Ship Recycling Market Prices continue Free Fall

The degraded performance across the ship recycling sector over the last few (and painful) months shows few signs of abating just yet, as it has been a veritable tale of misery, even though prices remain at some of the firmest levels we have seen over the last decade. Down from the peaks of $700/Ton, levels nearly $100/LDT lower have left a bad taste in most mouths in the industry.Certainly, the last time prices crashed from the psychological $700/LDT barrier was back in 2008, when even %800/LDT was briefly breached during the unprecedented boom years of the shipping industry…

Ship Scrap Prices Take a Turn for the Worse

Sub-continent markets have taken a turn for the worse this week, as collapsing steel prices in India and Eid holidays in Pakistan, Bangladesh, and Turkey have led to depressed sentiments and virtually no new offers emanating on any available tonnage.Most end users now want to wait-and watch-market developments before offering anew on vessels at far lower levels that seem more in line with the realistic $650s/LDT than the struggling $700s/LDT most in the industry were gunning for…

Ship Breaking: Prices Leveling Off

As we enter the traditionally quieter monsoon season, it is of little surprise to see recycling markets remaining inert and quiet, with rains / flooding hampering production at yards in Chattogram and Alang laborers returning to their hometowns as recycling activities come to a seasonal crawl. This may have inadvertently triggered the recent leveling of sub-continent steel plate prices as steel output diminishes and plate prices stabilize / firm in reaction, according to GMS.Although vessel prices have cooled off by $100/LDT in the sub-continent markets and about $250/MT in Turkey…