Ship Recyclers Short on Tonnage

Charter rates continue to climb as dry bulk carriers, Capes and even Panamax sectors reported rising rates this week, reports cash buyer GMS. This resulted in the ongoing shortage of tonnage that has been increasingly obvious at the bidding tables of late.

Yet, local port positions continue to report healthy arrivals and deliveries from the recent fire sale that saw both Bangladeshi and Indian waterfronts end another week on a busy note.

“Q1 2025 is proving itself to be somewhat of a turbulent time given that over USD 150/LDT has now been wiped off of vessel highs since Jan 2024 where a container breached the now long-forgotten USD 600/LDT mark, and ongoing economic / trade pressures continue to push vessel prices down while hampering sentiments and aggression from the various ship recycling destinations, despite an omnipresent demand permeating at new lows.”

The ability of ship recyclers to be aggressive is being curtailed at an increasing rate that continues to affect the global residual values of recycling candidates, when compared to the levels witnessed amidst the recent surge in supply back in January, followed by the ongoing and dithered supply since February.

And amidst mounting geopolitical pressures, ship recycling sales have slowed to such an extent that most yards are now either concentrating on recycling their recent deliveries, all while tier-2 recyclers lie dormant in wait to snag a new low-priced deal, helping demand stay afloat even if prices remain slippery.

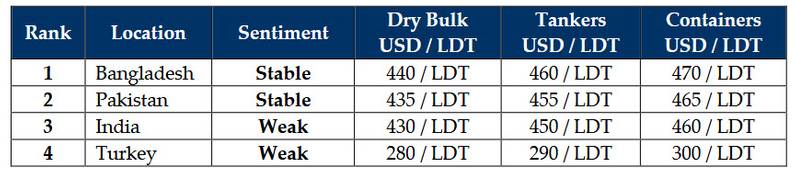

In Bangladesh, increasing protests and political clashes re-emerge, while Indian recyclers fail to maintain the trajectory of their prices leading to a gradual approach to Pakistani levels, which themselves have (inadvertently) rendered this market a touch more active of late and helped them slip into second place.

Turkey reported no meaningful change despite a surprising sale surfacing this week.

Overall, ship recycling yards keen to continue operations are busy upgrading their facilities ahead of the Hong Kong Convention’s (HKC) entry into force on June 26.

GMS demo rankings / pricing for week 10 of 2025 are: