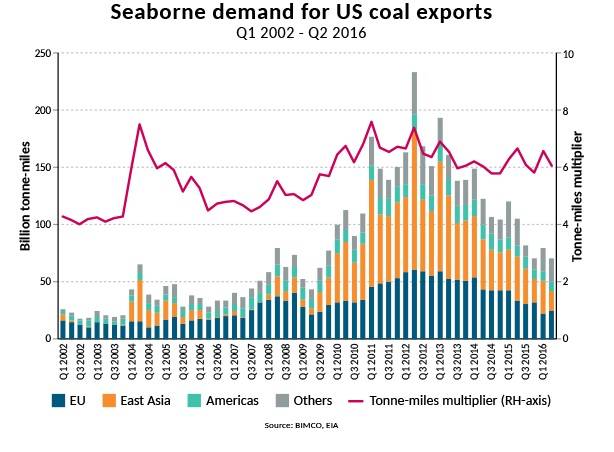

Since Q1 2013, the significance of U.S. coal exports has seen a considerable setback, with 2016 achieving the same levels as 2009. This is due to the long-haul routes carrying coking coal from the U.S. East Coast and U.S. Gulf Coast to East Asia, are not operating to the same extent and the EU is demanding less thermal coal, says shipping organization Baltic and International Maritime Council (BIMCO).

When BIMCO first published its story concerning U.S. coal in 2013, U.S. coal exports had the most significant coal trade in the world, measured by metric-ton-miles.

BIMCO’s Chief Shipping Analyst Peter Sand explained, “In 2015, U.S. coal exports generated 378 billion metric-ton-miles. This is only half the level of 2012, where it generated 715 billion metric-ton-miles.”

“This decrease in metric-ton-miles is a contributing reason to the current state of the dry bulk shipping market, as U.S. coal trade was responsible for 14.8 percent of the world seaborne coal trade in 2012, but only 7.7 percent in 2015,” Sand continued.

“The metric-ton-miles multiplier indicating the average distance coal is being travelled, has not changed particularly in that period and leveled around 6, since the peak in 2011. The unchanged multiplier emphasizes that the diminishing metric-ton-miles are solely due to a reduction in volumes across the board.”

“This means that the long-haul routes from the U.S. East Coast and U.S. Gulf Coast to East Asia still operate, but not to the same extent as in 2012. However, they have decreased at the same amount as the rest of the U.S. coal export trades.”

East Asian buyers accept sailing distance of 14,000 nautical miles

Coking coal to East Asia has had the second lowest decrease of the U.S. seaborne coal trades in transported cargo volumes, dropping 12 percent from H1 2015 to H1 2016. Coking coal to East Asia is primarily exported from U.S. East Coast and U.S. Gulf Coast and it is the coal trade route from U.S. with the longest sailing distance and thus generates the highest metric-ton-miles per metric ton transported.

Therefore, any fluctuations in this trade influences the dry bulk shipping market the most. 40 percent of all coal exports from the U.S. to East Asia came from the capesize-accommodating port in Baltimore Maryland, which emphasizes that the East Asian buyers accept a very long distance of more than 14,000 nautical miles when they import coking coal from the U.S.

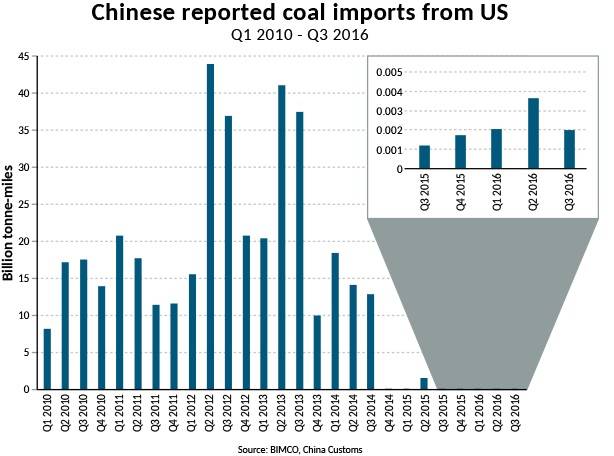

Chinese demand for U.S. coal close to zero

Japan and South Korea are the importers that are keeping the East Asian metric-ton-miles high, as China has not imported any significant amount of coal from the U.S. in the last two years. The metric-ton-miles generated from Chinese imported U.S. coal is at its lowest level since 2009.

Peter Sand adds: “In 2012, the spikes in metric-ton-miles from East Asia was solely generated by Chinese coking coal demand. However, since Q3 2014 the Chinese metric-ton-miles have been close to zero. This is due to China focusing on its regional suppliers and has, in the first three- quarters of 2016, imported 84.1 percent of all coking coal from Australia and Mongolia and next to nothing from the U.S.

This is a large loss for the dry bulk shipping industry, as the Chinese coking coal demand is now covered by shorter sailing distances from Australia, compared to sourcing from U.S. East Coast and U.S. Gulf Coast, and coal transported by land from Mongolia”.

United Kingdom leads the slide as Europe declines

The European market is the overall main importer of both U.S. thermal coal and coking coal, based on transported cargo volumes. The coal exported from the U.S. to the EU is down 38 percent for the first half of 2016 compared to the same period in 2015, but the EU is still claiming a 43 percent market share for H1 2016 compared to 47 percent in H1 2015. Despite this larger decrease - both measured on transported cargo volumes and percentage compared to East Asia- the effect is not as significant when the demand is measured in metric-ton-miles. This is due to the European demand for U.S. coal being covered by exports from U.S. East Coast and U.S. Gulf Coast, where the sailing distances are substantially shorter than the coal exported from U.S. to East Asia.

The coal exported from the U.S. to the U.K. dropped by two million metric tons from H1 2015 to H1 2016, a total decrease of 83 percent. This is the biggest decline for coal exported from U.S. to a single country. This is primarily due to the doubling of the U.K. carbon price floor (CPF), which has significantly increased the price of coal-fired energy production in the U.K. Therefore, the U.S. thermal coal exports to the U.K. are down 98 percent compared to the coking coal export being down 63 percent for H1 2016 compared to H1 2015. Read more about the declining U.K. seaborne coal import.