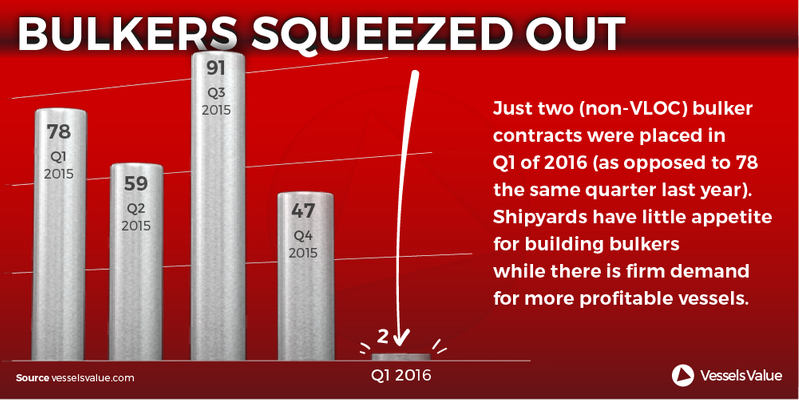

Bulkers Squeezed Out

Behind the news of the multiple VLOCs being ordered to service the Brazil-China iron ore trade lies the reality that just two non-VLOC bulker contracts were placed in the first quarter of 2016, says Craig Jallal, VesselsValue's Senior Data Editor.

The two non-VLOC orders of Q1 2016, which came from U-Ming Marine Transport, who signed a contract with Sumitomo Corp. and Oshima shipbuilding on February 15 for two 81,500 DWT Panamax bulkers, represent a stark contrast to the 78 non-VLOCs ordered one year ago in Q1 2015.

According to VesselsValue, shipyards have no real interest in building bulkers when there is still steady demand for more profitable vessels such as tankers, and owners can easily find readily available modern bulkers at prices below those expected by shipyards.

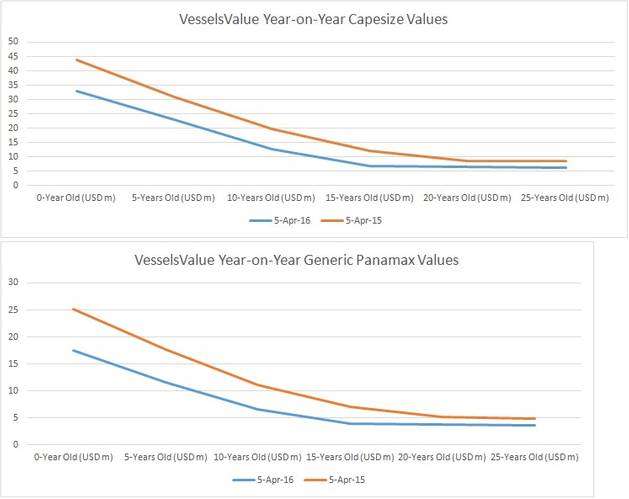

As the dry bulk market approaches 1980s level lows, prices for secondhand vessel continue to collapse, with 2016 values falling well below where they were in 2015, as shown in Figure 1.