French LNG Tankship Linings Maker Sets IPO Price

Reuters – Gaz Transport & Technigaz (GTT), a subsidiary of GDF Suez, Total and private equity fund Hellman & Friedman, said in a statement it had priced its IPO at 46 euros per share, valuing GTT at approximately 1.7 billion euros.

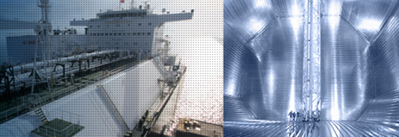

Earlier this month, GTT - the world's No. 1 maker of insulated hull linings for tankers that carry liquefied natural gas (LNG) - proposed an indicative price range of 41 to 50 euros per share that would have valued the company at between 1.52 billion and 1.86 billion euros, taking into account an overallotment option of 15 percent of shares offered.

GTT said in a statement the offering was a great success with international and French institutional investors as well as with retail investors in France.

Trading in GTT's shares will start on February 27.

Following the offering, and assuming full exercise of the over-allotment option, GDF Suez will hold 40.38 percent of GTT's share capital; Total and H&F respectively each 8.76 percent.

Gross proceeds of the offering are about 621 million euros, the company said.

GTT, based outside Paris, has 70 percent of the market for the high-tech alloy membranes that line the hulls of the world's LNG carriers. Its main customers are Korean and Chinese shipbuilders.

Source: Reuters