Appetite for New Container Ships is High

When only six ships with a capacity of 4,746 TEU were contracted in the fourth quarter of 2023, many might have thought that the container ship contracting spree that began in 2021 had finally cooled. However, the appetite for new ships remains high and year-to-date contracting already exceeds the 2023 full year total, reports BIMCO.

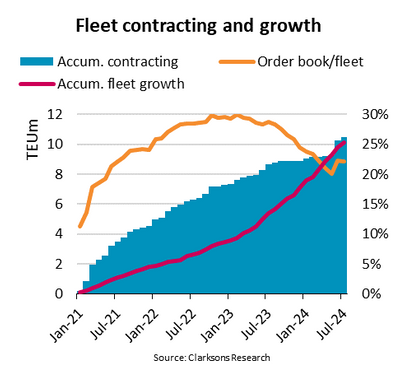

The total capacity contracted since the start of 2021 is now 10.47 million TEU, says Niels Rasmussen, Chief Shipping Analyst at BIMCO.

The 1.59 million TEU capacity contracted so far in 2024 is the third highest since 2008, only exceeded by the first seven months of 2021 and 2022.

In combination with the 8.86 million TEU contracted in 2021-2023, the previous four-year contracting record of 8.31 million TEU (2004-2007) has already been surpassed by far.

Compared to the size of the fleet at the beginning of 2021, the capacity contracted since then will add 44% new capacity. Actual fleet growth will however depend on how many ships are recycled.

“Ship recycling activity has been very low since 2021 and the 3.88 million TEU contracted and delivered since then has – along with capacity contracted before 2021 – already contributed to a 25% expansion of the fleet since January 2021,” says Rasmussen.

Since only 150 ships (0.24 million TEU) have been recycled since 2021, the many new ships delivered have not been enough to keep the average age of the fleet in check. The average age of container ships has increased from 13.0 years at the beginning of 2021 to 13.9 years today.

In the coming years, recycling could increase significantly and partly or fully retire the 10% of capacity and 20% of ships that are currently over 20 years old. However, the current order book/fleet ratio is 22% and even more ships could be contracted and delivered before the older ships have been recycled.

Although freight rates and time charter rates suffered a setback during 2023 because market growth could not keep pace with fleet growth, the Red Sea crisis has lengthened voyages and increased demand for ships this year. In fact, had the fleet not grown substantially before the Red Sea crisis began, it could have developed into a major supply chain crisis.

“The fleet is expected to grow at least 12% before the end of the decade, equal to an average annual growth rate of 2.4%. Although cargo volume growth might match that pace, we could see pronounced oversupply if fleet growth ends higher and the Red Sea crisis ends, lowering ship demand significantly,” says Rasmussen.