China Demand Drives 7% Jump in Minor Ore Exports

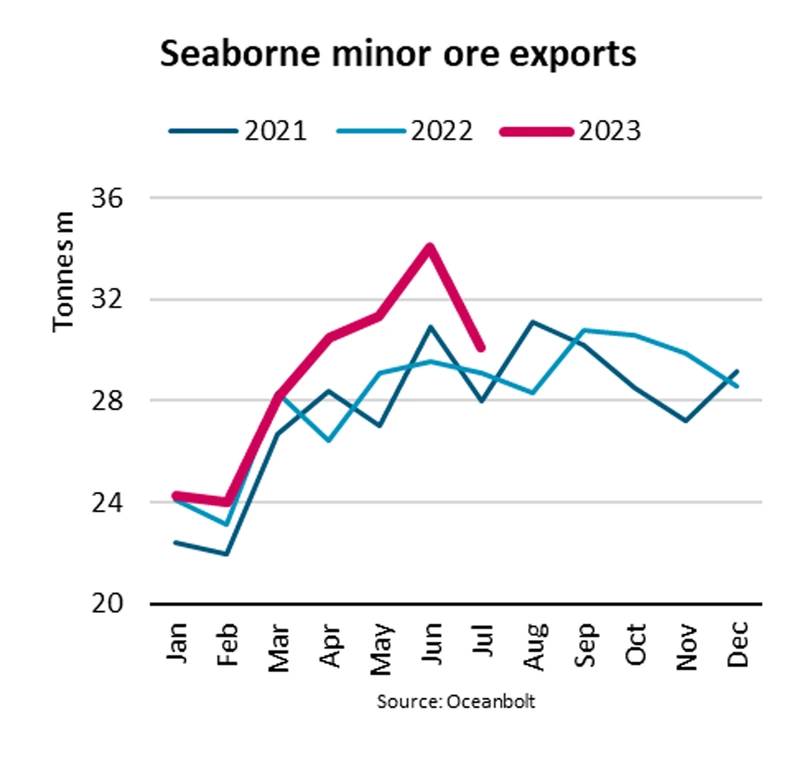

“Driven by continued growth in minor ore demand in China, global seaborne minor ore exports rose 7% y/y in the first seven months of 2023, vastly outpacing the 2% y/y growth in overall dry bulk exports,” says Filipe Gouveia, Shipping Analyst at BIMCO.

Accounting for 51% of seaborne minor ore exports, bauxite exports also led year to date growth with a 9% y/y increase. Bauxite is refined into alumina, the primary ingredient in aluminium production.

Chinese aluminium production has rapidly increased since the start of the Ukraine war. Chinese competitiveness has improved due to high energy prices in Europe and a rise in local car manufacturing has boosted domestic aluminium demand. Nearly 80% of all seaborne bauxite export volumes now head to China.

“Capesize bulk carriers have benefitted from an increase in bauxite shipments and now account for 11% of capesize demand. On top of the additional tonnage, sailing distances for bauxite shipments are 71% longer than the average capesize distance,” says Gouveia.

Due to the Indonesian export ban starting in June, Guinean exports have gradually replaced all Indonesian bauxite exports. Year-to-date, Guinean bauxite export volumes have risen 26% y/y, contributing to a further increase in average sailing distances for bauxite of 19% y/y.

Bauxite is the only minor ore transported by capesizes. Supramax and handysize ships transport 87% of other minor ore exports. Of these, nickel, manganese, chrome, and copper concentrate contribute the largest volumes.

Between January and July, seaborne exports of minor ores, excluding bauxite, grew by 4% y/y. Gains were driven by higher chrome, nickel, and manganese exports; all utilized in the production of stainless steel and batteries.

Since June, economic indicators in China have pointed towards a slowdown in economic activity and in July, minor ore demand drivers began to show weakness. China’s manufacturing PMI contracted, car manufacturing fell 14.2% y/y and alumina refining declined 2.1% y/y.

“Despite possible short-term setbacks to export growth, minor ore exports are expected to continue growing in the medium to long term. Decarbonisation of the energy sector is gaining momentum and aluminium, copper, and nickel are critical in this process. Since China imports nearly 70% of all minor ore seaborne volumes, short-term prospects will depend on the recovery of the Chinese economy,” says Gouveia.