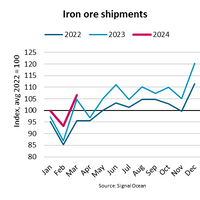

Iron Ore Shipments Up 3.8% Despite Weak Chinese Demand

In the first quarter of 2024, global iron ore shipments rose 3.8% y/y on expectation of strong Chinese steel production which, however, failed to materialise. Iron ore supply has grown faster than Chinese demand which could lead to weaker shipments ahead, says Filipe Gouveia, Shipping Analyst at BIMCO.During the start of the year, Brazilian iron ore shipments typically slow down due to mining disruptions caused by heavy rainfall. However, this year conditions were better and Vale…

Study Highlights Ammonia Bunkering Potential of Australia’s Pilbara

A feasibility study has highlighted the potential for using clean ammonia to refuel ships, particularly iron ore carriers, visiting the Pilbara region of Western Australia.The study, commissioned by Yara Clean Ammonia (Yara) and Pilbara Ports, was undertaken by Lloyd's Register, and looked at key areas including the estimated demand and likely availability of ammonia as a replacement shipping fuel. The potential risks and regulatory requirements for ammonia bunkering at the ports…

China Demand Drives 7% Jump in Minor Ore Exports

“Driven by continued growth in minor ore demand in China, global seaborne minor ore exports rose 7% y/y in the first seven months of 2023, vastly outpacing the 2% y/y growth in overall dry bulk exports,” says Filipe Gouveia, Shipping Analyst at BIMCO.Accounting for 51% of seaborne minor ore exports, bauxite exports also led year to date growth with a 9% y/y increase. Bauxite is refined into alumina, the primary ingredient in aluminium production.Chinese aluminium production has rapidly increased since the start of the Ukraine war.

Cyclone Ilsa Hits Australia's Northwest, Misses Iron Ore Export Hub

A tropical cyclone smashed into Australia's northwest coast as a category 5 storm, setting new wind speed records, but has largely spared populated regions including the world's largest iron ore export hub at Port Hedland, authorities said on Friday. Cyclone Ilsa made landfall early Friday morning with the highest intensity rating on a 1-to 5 scale and then moved inland as emergency crews urged several remote communities along the storm's path to seek shelter and remain indoors."Port Hedland ... escaped the brunt of the cyclone at this stage.

Iron Ore Price Soars, Fueled by hopes for China'sQ3 Rebound

Iron ore futures soared on Monday, extending a rally spurred by hopes of an economic rebound for top steel producer and consumer China in the third quarter, and support for the country's troubled property sector.The most-traded iron ore, for September delivery, on China's Dalian Commodity Exchange DCIOcv1 ended daytime trade 7.1% higher at 711 yuan ($105.27) a ton, after earlier hitting 723.50 yuan, its strongest level since July 14.Iron ore's front-month August contract on the Singapore Exchange SZZFQ2 was up 2.2% at $105.40 a tonne…

Benchmark Dalian Iron Ore Futures Plunge

Chinese iron ore futures dived more than 8% late on Friday after the country's regulators and industry association issued warnings against recent unusual price moves of the key steelmaking ingredient.Earlier on Friday, the National Development and Reform Commission (NDRC), which is the country's state planner, said it and the market regulator would dispatch investigation teams to the commodity exchange and key ports to look into iron ore inventories and trading in the spot and futures market.The NDRC…

China Steel Hopes Drives Iron Ore Demand

Dalian iron ore rose on Friday and advanced nearly 6% this week as traders returned from New Year holidays feeling optimistic about potential demand recovery in top steel producer China.Iron ore's most-active May contract on China's Dalian Commodity Exchange ended daytime trading 1.4% higher at 719 yuan ($112.78) a tonne, rising for a fourth straight session and touching 725.50 yuan earlier in the day, its highest since Oct. 27.On the Singapore Exchange, the steelmaking ingredient's most-traded contract expiring by end-February climbed as much as 0.7% to $128.25 a tonne…

BIMCO: Iron Ore Spot Rates Spike 163%

As the average length of the journey increases, partly due to port congestions in China, soaking up capacity and pushing up spot rates, shipowners will likely be enjoying high freight rates until the end of the year.Iron ore spot freight rates from Western Australia, to Qingdao, China have jumped 163% to USD 21.82 per tonne on 28 September 2021 compared with the same time last year. For a very large ore carrying Capesize ship transporting 200,000 tonnes of iron ore, this represents an increase in freight revenue from USD 1.66 million…

Chinese Iron Ore Imports Fall to 14-month Low in July - BIMCO

Chinese iron ore imports fell to 88.5 million tons in July, the lowest level since May 2020. The fall in July means that accumulated imports are lower than in the first seven months of 2020. Imports this year have totaled 649 million, a 1.5% decline from January to July 2020. In July, imports were down 21.4% from the same month in 2020 when they reached a record high of 112.7m tonnes.Steel production declines following government restrictionsIn addition to the July drop in iron…

China Goes from Driver to Brake for Crude Oil, Iron Ore and Copper

China has switched from driving global demand for major commodities to being a drag on growth, with July's customs data confirming the weakening trend for imports of crude oil, iron ore and copper.The exception to the trend was coal, but the sharp gain in July's imports of the polluting fuel are more a result of China having to go the seaborne market because of domestic policies that curbed local output.China, the world's biggest importer of crude oil, brought in 41.24 million tonnes in July, equivalent to 9.71 million barrels per day (bpd), according to official customs data released on Aug.

Iron Ore Futures Fall as Chinese Demand Softens

Chinese iron ore futures fell below a key 1,000 yuan per tonne level on Thursday, falling more than 5% to their lowest in more than two months as domestic consumption remains sluggish on steel production controls.The most active iron ore futures on the Dalian Commodity Exchange, for September delivery, plunged as much as 5.6% to 999 yuan ($154.54) per tonne, their lowest since May 27. They were down 4.6% to 1,009 yuan a tonne as of 0322 GMT."Domestic consumption (for iron ore) is weakening significantly...

Iron Ore: China Demand Powers Fortescue Shipments to Record

Australia's Fortescue Metals Group Ltd on Thursday narrowly beat its full-year estimate for iron ore shipments after a record fourth quarter, as strong demand from top consumer China offset the impact of bad weather.The world's fourth-largest iron ore miner fared better than rivals Rio Tinto and BHP, whose June quarter output dropped because of weather disruptions in Western Australia.Despite those disruptions, surging prices of the steelmaking ingredient and robust demand from China are expected to drive bumper earnings at miners…

Iron Ore Stumbles as Rising Supply Runs into China Steel Discipline

Iron ore prices have suffered their worst week for nearly 18 months amid signs that the two factors needed for a sustained correction may be coming into play - Chinese steel producer discipline and a recovery in supply of ore.The main Chinese domestic iron ore benchmark, the Dalian Commodity Exchange contract, dropped around 10% in the week to July 23, the worst weekly performance since February last year.The contract ended the week at 1,126 yuan ($173.77) a tonne, and has now slid about 17% from its record high in May.Benchmark spot 62% iron ore for delivery to north China , as assessed by co

Chinese Regulators Eye Irregularities in Spot Iron Ore Trading

China's state planner, the National Development and Reform Commission (NDRC), said on Monday it and the market regulator are jointly looking into the iron ore spot market and have pledged to crack down on hoarding and speculation.The move comes after NDRC said on Thursday that new rules on the management of price indexes for commodities and services will be effective Aug. 1 and will standardise price index compilation and transparency of information.During a visit to the Beijing Iron Ore Trading Center Corporation (COREX)…

China's Iron Ore Imports in April Drop Due to Bad Weather

China's iron ore imports fell 3.5% in April from a month earlier, official customs data showed on Friday, as shipments to the world's top iron ore consumer from major suppliers were disrupted by inclement weather.Arrival volumes of the steelmaking ingredient stood at 98.57 million tonnes last month, according to data from the General Administration of Customs.That compared with imports of 102.11 million tonnes in March and 95.71 million tonnes in April 2020."Shipments from Australia declined recently due to a cyclone in early April…

Port Hedland's Iron Ore Shipments to China Drop to Two-year Low

Benchmark Asian iron ore futures rose on Thursday as data showed monthly shipments of the steelmaking ingredient to China from Australia's Port Hedland dropped to the lowest in two years.Shipments from Port Hedland, the world's biggest iron ore export hub, totalled 30.73 million tonnes in February, when top steel producer China typically imports less due to the Lunar New Year holidays.That is the lowest since March 2019 and compares with 35.6 million tonnes in January and 33.3 million tonnes in February last year…

Fortescue CEO: Iron Ore Market to Remain Strong for Some Time

The global iron ore market is likely to remain robust for some time, given supply concerns and stronger-than-usual demand from top consumer China, Fortescue Metals Group Chief Executive Elizabeth Gaines said on Thursday."Not only in China, but the ex-China activity is also picking up to pre-COVID levels," she told a media call. "Our view is that the market will remain robust for some time."In China, activity rates didn't slow as much as is normal for the Lunar New Year because not as many workers returned home, she said.

Iron Ore Imports Outside China Show Signs of Recovery

The iron ore market is focused mainly on developments in China, which isn't surprising given the world's biggest buyer of commodities takes about 70% of global seaborne cargoes.But that other 30% does matter - and there are signs of a recovery in demand in the wake of the coronavirus pandemic.The total global volume of seaborne iron ore discharged at ports in January was 134 million tonnes, according to vessel-tracking and port data compiled by Refinitiv.This was up from 122.82 million tonnes in December and 125.18 million in November…

Iron Ore Shipments from Australia's Port Hedland to China Rise 16%

Iron ore shipments to China from Australia's Port Hedland rose by 16% in December from a month earlier, despite a short weather-related shutdown, the Pilbara Ports Authority said on Friday. Iron ore exports to China rose to 40.0 million tonnes from 34.44 million tonnes in November, data from the authority showed. Total iron ore exports from Port Hedland rose to 46.5 million tonnes from 41.61 million tonnes in November. Strong shipments from the world's largest iron ore export…

Iron Ore Under Pressure as China Port Stockpiles Grow

Iron ore futures slipped on Monday on rising port inventory of the steelmaking ingredient in China, though optimism over prospects of strong domestic steel demand for the rest of the year kept losses in check.The Dalian Commodity Exchange's most-traded September iron ore contract closed down 0.3% at 817 yuan ($116.91) a tonne, stretching losses into a third consecutive session.Iron ore's August contract on the Singapore Exchange dropped 0.7% to $106.31 a tonne in afternoon trade, extending losses into a fourth session.China's imported iron ore inventory stocked at ports rose for a fourth strai

SL Mining Ships First Iron Ore Cargo

SL Mining, a wholly owned subsidiary of Gerald Group, has announced that its first shipment of iron ore concentrate has set sail from Freetown Port (Queen Elizabeth II) in Sierra Leone, West Africa.The 55,000t of high-grade iron ore concentrate was shipped on MV Cooper vessel under the brand Marampa Blue.The loading of over 55,000 tonnes of high grade >65 percent iron ore concentrate was completed on June 16, 2019, sailing the same day. This maiden shipment will be delivered to customers in China. The next shipment is expected to occur in the next few days.Sierra Leone’s Minister of Mines and Minerals, Rado Yokie said that iron ore exports had been dormant for four years: “Today is a historic day,” said Mr. Yokie.

Iron Ore Spikes on Shipment Concerns

China's iron ore futures extended gains on Friday after touching a record high in the previous session, as concerns persisted over tight supply amid declining shipment from Rio Tinto and expectations of strong demand.Mining giant Rio Tinto on Wednesday lowered its guidance on volumes of iron ore it expects to ship from the key Pilbara producing region in Australia for the third time since April.It now puts the upper limit as much as 5.7% under its original forecast, giving a window…