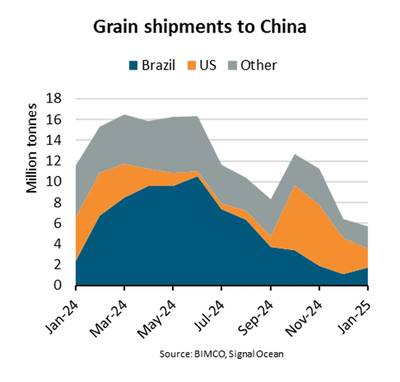

China Grain Imports Plummet 51%

“In January, grain shipments to China are estimated to fall 51% y/y, partly due to a decline in import demand for soya beans caused by low crusher margins. Although Chinese soya bean production decreased 1% y/y in 2024, inventories are high after a surge in imports in the first half of the year. Import demand for maize and wheat has also declined due to record high harvests in China in 2024,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.

As the world’s largest grain importer, China has for a long time strived to reduce its import dependence. According to the United States Department of Agriculture (USDA), the combined production of wheat, maize and soya beans has been steadily rising since 2018. In 2024, harvest volumes rose 2% y/y whereas consumption in the current marketing year is estimated to grow only 1% y/y.

Rising meat production and consumption in China have been the main drivers for grain shipments. Soya beans account for 71% of grain shipments to China while other grains used for animal feed account for an additional 10%. Wheat accounts for 7% of shipments and its consumption has largely stabilised since 2020.

“The slowdown in grain shipments to China is one of the factors negatively impacting dry bulk freight rates. Panamax ships have been especially affected as they carry 83% of grain cargoes to the country. On average, the Baltic Panamax Index was down 41% y/y in January,” says Gouveia.

On the exporter side, Brazil and the US are the largest origins of grain shipments to China, accounting for 47% and 22% of shipments respectively. So far this year, Brazilian cargoes have been faring better as they are only down 29% y/y, compared to a 57% y/y decrease for US cargoes. This has a positive effect on dry bulk demand since sailing distances for grains from Brazil to China are 26% longer than from the US, under normal Panama Canal conditions. However, it is not enough to mitigate the impact of such a steep decrease in cargo volumes.

As soya bean import demand has been weak, the exportable surplus in Brazil and the US has only increased, leading to lower prices. Brazil has already started harvesting its 2025 soya bean crop and volumes are expected to rise 10% y/y. Furthermore, during September and October 2024, the US harvested 5% more soybeans than a year earlier.

“Overall, we expect grain shipments to China to recover in the medium term, as soya bean inventories fall, and low prices incentivise purchasing. However, wheat and maize shipments could remain weak amid stronger domestic supply. Unless Chinese domestic demand significantly improves throughout 2025, grain shipments to China could fall short of 2024 levels,” says Gouveia.