Larger Ships, Demand Driving Port Investment Boom

Rising global container port demand and ever larger vessels are driving terminal operators to make significant investments in additional capacity, according to the Global Container Terminal Operators Annual Report 2015 published by global shipping consultancy Drewry.

Drewry predicts average global container port demand growth of 4.5 percent per annum through to 2019. This equates to an additional 168 million teu of port traffic, bringing the global total to nearly 850 million teu. Asia accounts for over 60 percent of the forecast global demand growth. At the same time, the deployment of ultra large container ships and the formation of new mega alliances are adding to capacity pressures on global/international terminal operators.

In response to this, a number of the 23 companies that are considered by Drewry to be global/international terminal operators are making significant investments in additional capacity over the next five years.

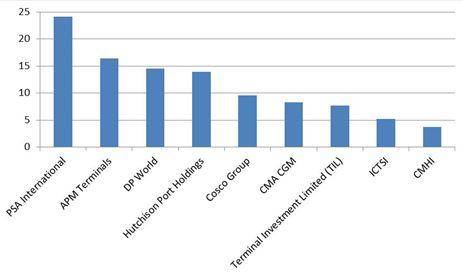

APM Terminals and DP World are the most active in terms of the number of new projects in the pipeline but PSA International is adding the most capacity in absolute terms, particularly in its home port of Singapore. Hutchison, CMA CGM, TIL and ICTSI also have significant plans, with the latter’s expansion representing a 40 percent increase over the current capacity of its portfolio. The primary expansion focus of the global/international terminal operators is greenfield developments in emerging market locations, with acquisition and divestment activity having reduced from last year.

Not all of the global/international players are actively investing though. A number of them, mainly shipping line owned portfolios, have little or no expansion plans, and several have engaged in divestment of assets in order to raise cash. At the same time there are several aggressive and fast growing companies seeking to join Drewry’s exclusive club of global/international operators. Ports America and Yilport are the leading contenders for such status in the coming years.

Gulftainer also has ambitious plans, and Shanghai International Ports Group maintains an appetite for international expansion. Meanwhile financial investors continue to buy and sell stakes in terminal and port companies.

Owning and operating container terminals on an international basis remains a profitable business but is facing significant challenges ahead. Neil Davidson, Drewry’s Senior Analyst for Ports and Terminals said, “The typical EBITDA margins for global/international terminal operators remain in a range from 20-45 percent and the 2014 financial results were much in line with previous years, illustrating the consistency and reliability of container terminal operators’ profitability. However, maintaining these margins will become increasingly challenging in the face of the demands created by bigger ships and alliances.”

“The global container terminal industry is facing unprecedented challenges as a result of the deployment of ever larger container ships, combined with the creation of larger shipping line alliances. These two interrelated factors are placing significantly greater demands on ports and terminals and having far reaching consequences, driving up operating costs and capital expenditure requirements,” added Davidson.