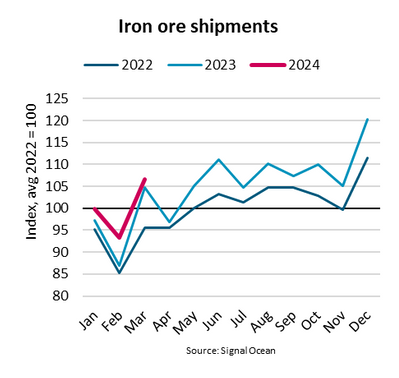

Iron Ore Shipments Up 3.8% Despite Weak Chinese Demand

In the first quarter of 2024, global iron ore shipments rose 3.8% y/y on expectation of strong Chinese steel production which, however, failed to materialise. Iron ore supply has grown faster than Chinese demand which could lead to weaker shipments ahead, says Filipe Gouveia, Shipping Analyst at BIMCO.

During the start of the year, Brazilian iron ore shipments typically slow down due to mining disruptions caused by heavy rainfall. However, this year conditions were better and Vale, a leading miner, increased output by 6% y/y, boosting shipments from Brazil.

In China, expectations of stronger steel production following the Chinese New Year led to strong iron ore prices. However, despite these expectations, steel production weakened 3.1% y/y while both iron ore shipments and domestic mining rose. Consequently, iron ore inventories in Chinese ports increased and are now at the highest levels since April 2022.

73.9% of the world’s seaborne iron ore shipments are bound for China as the country relies greatly on ore imports to produce steel.

“The Capesize segment greatly benefited from this increase in shipments, both due to the higher volume and the above average sailing distances between Brazil and China. This helped the Baltic Exchange’s Capesize 5TC index to average USD 24,286 per day, up 165.6% y/y,” says Gouveia.

For iron ore shipments to continue growing, Chinese steel production must recover, supported by either stronger domestic demand or higher exports.

The crisis in the domestic Chinese property sector has during the past years been a drag on both steel demand and economic growth. Unfortunately, leading indicators point to even weaker demand during the rest of 2024. During the first quarter of 2024, investment in real estate fell by 15% y/y and the floor area of new real estate starts decreased by 28.3% y/y. Steel demand from manufacturing and infrastructure could continue to rise, but overall domestic demand is expected to stagnate.

Abroad, growing steel demand could provide an outlet for Chinese steel products. During the first quarter of 2024, exports increased 30.7% y/y.

“While iron ore shipments could slow down, we still expect them to grow 1-2% in 2024, benefiting from a 1.7% increase in global steel demand as forecast by the World Steel Association. This may keep the Capesize segment strong as the fleet is only expected to grow 1.4% in 2024. Any further increase in Brazilian mining would lead to longer distances and an even tighter market,” says Gouveia.