RCP Finance Secures Funding for Fuel Distributer in Maldives

Independent finance and capital structuring partner RCP Finance has successfully secured a $15 million credit facility from a leading Asian lender for The Hawks Pvt Ltd., a distributor of high-quality fuel in the Maldives.The Hawks caters to a range of local businesses including resort hotels, super yachts and navy vessels, with a total portfolio of more than 452 clients.Part of the credit facility has been used to facilitate the acquisition of the Bro Developer, a 2007 oil and chemical tanker with a carrying capacity of 15,000dwt.

Scorpio Tankers Wins $1 Billion Credit for New Vessels

Scorpio Tankers has received commitments from a group of financial institutions for a previously announced $1.0 billion term loan and revolving credit facility.The over-subscribed Credit Facility was capped at an amount of $1.0 billion, and is expected to be used to finance 45 product tankers. Scorpio Tankers currently owns, lease finances or bareboat charters-in 113 product tankers (39 LR2 tankers, 60 MR tankers and 14 Handymax tankers) with an average age of 7.4 years.The Credit Facility is expected to consist of a 50% term loan and a 50% revolving loan, and has a final maturity of five years from the signing date (but not later than June 30, 2028).Emanuele Lauro, Chairman and CEO of the company, said: “We appreciate our lenders and their commitment to the company.

Golden Ocean Acquires Six Bulk Carriers

Dry bulk shipowner Golden Ocean Group on Monday announced it has entered into an agreement to acquire six 208,000 deadweight tons (dwt) Newcastlemax vessels for a total consideration of $291 million. The newly-acquired vessels—each equipped with exhaust gas cleaning systems, or scrubbers—will be chartered back to their former owner, an unrelated third party, for approximately 36 months at an average daily time charter equivalent rate of approximately $21,000 net.Following the acquisition, Golden Ocean will be the world's largest publicly-listed dry bulk company in terms of dwt."This acquisition cements our position as the largest owner of modern Capesize vessels.

Matson Orders Three LNG-fueled Containerships from Philly Shipyard

U.S.-based ocean carrier Matson announced it has placed a $1 billion order with Philly Shipyard for the construction of three new 3,600 TEU Aloha Class containerships.The first vessel is expected to be delivered in the fourth quarter of 2026 with subsequent deliveries in 2027.Matson, which aims to achieve a 40% reduction in Scope 1 fleet emissions by 2030 and net-zero Scope 1 by 2050, said the three newbuilds will be equipped with dual fuel engines that are designed to operate on either conventional marine fuels or liquefied natural gas (LNG).

Digitalization: NAVTOR, Veracity by DNV Partner

NAVTOR signed an Integrated Partner agreement with Veracity by DNV, a deal intended to help shipowners and operators simplify reporting, enable sustainable shipping and unlock green finance.“Our ecosystem collects, aggregates and utilizes enormous amounts of business-critical data,” said Bjørn Åge Hjøllo, Chief Sustainability Officer, NAVTOR. “That is used to make shipping safer, simpler and more efficient – automating tasks, reducing fuel consumption, saving costs, and, in short, delivering complete asset awareness and control for our customers.

Diana Shipping Buys Sea Trade's Bulker Fleet for $330 Million

Greek shipowner Diana Shipping on Thursday announced it has acquired the bulk carrier fleet of U.S.-based Sea Trade Holdings in a $330 million cash and shares deal.The nine ultramax vessels, built between 2015 and 2018 with an average vessel age of approximately 5.4 years, are scheduled to be handed over during the fourth quarter of 2022, Diana said.The ships—STH Athens, STH London, STH New York, STH Sydney, STH Tokyo, STH Kure, STH Chiba, STH Oslo and STH Montreal—are all Japanese-built (Japan Marine United and Mitsui Engineering & Shipbuilding) and range from 60,309 dwt to 60,508 dwt.New York-listed Diana said it will pay for the deal using $220 million in cash and $110 million in the form of 18…

Gulf of Mexico: Helix Energy Solutions Buys Alliance Group of Companies

U.S. based offshore well services company Helix Energy Solutions Group has finalized the previously announced acquisition of the Alliance group of companies, bolstering its decommissioning footprint in the Gulf of Mexico.Alliance is a Louisiana-based privately held company that provides services supporting the upstream and midstream industries in the Gulf of Mexico shelf, including offshore oil field decommissioning and reclamation, project management, engineered solutions, intervention…

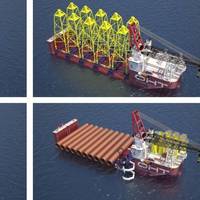

Cadeler Secures $192,3M Loan to Fund New Offshore Wind Vessels

Offshore wind installation contractor Cadeler has entered into a Senior Secured Green Revolving Credit Facility (“RCF”) of a 3-year term loan of EUR 185 million (around $192,3 million). Together with the company’s cash and cash equivalents, the RCF facility will be used to finance Cadeler's newbuild offshore wind turbine and foundation installation vessels, and acquisitions as well as for general corporate purposes."The RCF is secured by customary securities (inter alia) first priority ship mortgages on the company’s vessels…

Seanergy Acquires Secondhand Capesize Bulker

Seanergy Maritime Holdings Corp. announced Thursday it has agreed to acquire a secondhand bulk carrier from a Japanese owner.The 180,000 dwt Capesize vessel, to be renamed Honorship, was built at a Japanese shipyard in 2010.It is expected to be delivered within June 2022 and will promptly begin operating on a 20-24-month charter to with NYK Lines at an index-linked rate at a significant premium over the Baltic Capesize Index, Seanergy said.Seanergy said it has the option to convert the daily hire from index-linked to fixed for a minimum period of two months to a maximum of 12 months based on the same premium over the prevailing Capesize Freight Futures Agreements (FFA) curve.Stamatis Tsantanis…

CIT Increases Maritime Financing to $57 Million for Crowley

CIT, a division of First Citizens Bank, announced that its Maritime Finance business has recently increased its financing of shipping and logistics company Crowley to a total of $57 million as part of a larger credit facility. This financing applies to multiple Crowley vessels. "Crowley has a heritage of reliable shipping of more than 130 years, and this financing will help continue that safe and reliable service with a focus on innovation," said Vice President and Treasurer Steve Himes of Crowley.

'World's Largest OSV Fleet': Tidewater to Buy Swire Pacific Offshore

U.S.-based offshore support vessel owner Tidewater said Wednesday it had agreed to acquire Swire Pacific Offshore Holdings Limited (SPO), a subsidiary of Swire Pacific Limited for around $190 million. Tidewater said the transaction would create the industry’s largest fleet of offshore support vessels with 203 vessels in total, including crew boats, tug boats and maintenance vessels. "SPO’s fleet of 50 OSVs consists of 29 AHTS vessels and 21 PSVs; pro forma for the transaction…

German Court to Rule in Row Over Funding for Shipbuilder MV Werften

A German court will rule next week in a case brought by Genting Group against a German regional government after a row over funding for cruise shipbuilder MV Werften, which filed for insolvency on Monday.Genting, led by Malaysian tycoon Tan Sri Lim Kok Thay, bought MV Werften in 2016. The pandemic has hit the global travel industry, including cruise operators and led to production stops at shipyards that build cruise ships.Genting's subsidiary Genting Hong Kong said on Tuesday…

SCF gets $110m Credit Facility to Finance Ice-Class Shuttle Tankers

PAO Sovcomflot (SCF Group) signed a $110 million credit facility, for 10 years, with ING BANK N.V., SMBC BANK EU AG and UNICREDIT BANK AG, to finance two new ice-class shuttle tankers.The ships, scheduled to be delivered in Q1 2022, will serve the Sakhalin-1 project (oil and gas development in the Sea of Okhotsk, on the north-eastern shelf of Sakhalin Island, Russia. Exxon Neftegas Ltd. (an affiliate of Exxon Mobil) is the project’s operator and acts as the charterer for the vessels.

King’s Quay Floating Production Unit Reaches Texas

China's Cosco Shipping has earlier this month delivered the King’s Quay floating production unit to Ingleside, Texas, aboard its M/V Xiang An Kou semi-submersible heavy transportation vessel, after a long journey from South Korea.The 21,498mt platform, built by Hyundai Heavy Industries, will be used for Murphy Oil's offshore oil field developments around 175 miles south of New Orleans in the U.S. Gulf of Mexico.The King’s Quay floating production unit is scheduled to go into service in 2022.

MPC Container Ships Refinances Debt

Container ship opertor MPC Container Ships has entered into a $70 million three-year revolving credit facility agreement with CIT Group. The company said the loan had attractive terms.MPC Container Ships, registered in Oslo, Norway, said it had already made an initial drawdown of $40 million to refinance existing debt, and the rest would be used for vessel upgrades and other general purposes."As a consequence, the previous term loans with Beal Bank and CIT have been repaid in full. Further drawdowns under the facility will strengthen the free liquidity and may be used for vessel upgrades, investments or general corporate purposes," MPC Container Ships said.MPC Container Ships CEO Constantin Baack said: "Having secured significant charter backlog…

OHT Gets $135M Loan for 'Alfa Lift'

Oslo-listed offshore heavy transport and wind installation company OHT has received and accepted a firm offer for a USD 135 million Senior Secured Green ECA Credit Facility.The loan was accepted by OHT's ship owing company OHT Alfa Lift AS, which is building the offshore wind foundation installation vessel Alfa Lift in China. OHT ordered the Alfa Lift on speculation in 2018, and has since secured contracts to install foundations at the world's largest wind farm - the Dogger Bank in the UK.Sharing further details on the loan…

Valaris Set to Emerge from Bankruptcy as Reorganization Plan Approved

Offshore drilling company Valaris, the world's largest by fleet size, has received approval from the United States Bankruptcy Court for the Southern District of Texas of its prearranged plan of reorganization, and has agreed with Korea's Daewoo to delay deliveries of two newbuild drillships.The offshore driller filed for bankruptcy in August 2020, in a move to restructure its debt load and reduce debt by more than $6.5 billion.The company this week said that in addition to bankruptcy court confirmation, the plan received support from approximately 80% of the company's unsecured notes and bank lenders representing 100% of the company's credit facility claims.

Hapag-Lloyd Secures 'Green Financing' for LNG-powered Newbuilds

German shipping company Hapag-Lloyd has joined the shift to green financing, securing funds for six liquefied natural gas (LNG) powered, 23,500 TEU containerships it ordered in December 2020.The firm said it concluded two transactions according to the Green Loan Principles of the Loan Market Association (LMA), as verified by independent secondary party DNV GL, as the shipping industry increasingly turns toward financing linked to measurable sustainability targets."Our first green financings are a major milestone for us…

US Inland Waterways: High Waters & Swirling Currents

The inland waterway system, flowing through the United States heartland, is a microcosm of all that has been happening in 2020: trade tensions, infrastructure issues, shifting trends in fuel consumption and the pandemic that has gripped us since the winter months. Shortly after the initial coronavirus outbreak here in the U.S., maritime workers were deemed to be “essential”, paving the way for cargo flows to recover from their springtime nadir. As COVID-19 infections turned up on U.S. shores, the boats continued plying the waterways, albeit with reduced volumes in some cases.

Noble Corp. Files for Bankruptcy

Offshore oil and gas driller Noble Corp said on Friday it had filed for chapter 11 bankruptcy protection to restructure debt, following a historic fall in energy prices.The company said it would swap all its bond debt, which accounts for more than $3.4 billion of its total debt, with equity in the restructured company.Companies that operate offshore drilling rigs for major oil producers are facing a second wave of bankruptcies in four years, amid a historic drop in energy prices that will likely leave surviving drillers more closely tied to big oil firms.Noble expects to emerge with a new $675 million secured revolving credit facility…

TGS Makes Surprise $600 Mln Offer for Part of Rival PGS

Seismic surveyor TGS, a supplier of geological data to the global oil industry, on Thursday said it had made an unsolicited cash offer of $600 million for a key part of rival PGS.If successful, the offer to buy PGS's so-called multi-client library would significantly broaden TGS's worldwide geophysical data offering, the company said.PGS did not immediately respond to a request for comment from Reuters.In addition to spending cash from its current holding, TGS said it will borrow $200 million and also conduct an equity issue to pay for the transaction.While TGS' strategy has been one of rentin

SEACOR Marine Sells Windcat Workboats to CMB

New York-listed offshore vessel operator SEACOR Marine has agreed to sell its Windcat Workboats and its crew transfer vessel (“CTV”) business to the Belgian shipping and logistics group Compagnie Maritime Belge (CMB).Windcat Workboats owns and operates a fleet of 46 offshore crew transfer vessels, mainly in the European offshore wind sector, but also in the oil and gas industry and outside Europe. At the closing of the transaction, CMB will pay SEACOR Marine £32.8 million in cash…

SEACOR Marine Completes Sale of Windcat to CMB

New York-listed offshore vessel owner SEACOR Marine has completed the previously announced sale of its offshore crew transfer subsidiary Windcat Workboats to the Belgian shipping and logistics group Compagnie Maritime Belge (CMB).Windcat is headquartered in Lowestoft, United Kingdom and IJmuiden, the Netherlands and has joint ventures with two local partners, FRS Windcat Offshore Logistics in Germany and TSM Windcat in France. Windcat employs approximately 180 shore-based and sea-going personnel.The sale was completed on January 12…