Consolidation is King – Tidewater and Swire Pacific Offshore

Tongues are wagging in the offshore sector, as one of the longest-running rumors in the market has finally come true. U.S. offshore vessel owner Tidewater Marine has acquired Singapore's Swire Pacific Offshore for USD 190 million, the company’s biggest powerplay since its acquisition of GulfMark Offshore back in 2018.But why SPO, and why now? In this article, VesselsValue's Head of Offshore, Rob Day, seeks to answer these questions and provide commentary on why this long-time…

Tidewater Names CFO, COO

U.S. offshore support vessel company Tidewater has announced the promotion of two key members of the company’s executive team, Sam R. Rubio and David E. Darling, to the positions of Chief Financial Officer and Chief Operating Officer, respectively.Rubio has been promoted to Executive Vice President and Chief Financial Officer, following his accomplishments serving as the Company’s Chief Accounting Officer and Controller since joining Tidewater following the combination with GulfMark Offshore, Inc. in 2018. Prior to joining Tidewater he served as GulfMark’s Senior Vice President and Chief Financial Officer, after holding the position of Chief Accounting Officer for over 10 years.

BY THE NUMBERS: the OSV Markets

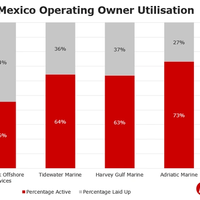

US Offshore Support Vessel Analysis 2018 and 2019. The US GOM Offshore Support Vessel (OSV) market is suffering, utilization remains poor, and many owners are still squeezed financially. However, a poor market forces people to adapt and for those willing to take risks, the upside can be extremely large.US Owners 2018 vs. 2019: Within the US GOM, 2018 saw a period of strategic thinking and tactical business decisions. Tidewater Marine completed their merger with GulfMark Offshore to create the world’s largest OSV player.

Tidewater Elects Larry Rigdon as Chairman

Tidewater, which owns and operates the largest fleet of offshore support vessels in the industry, announced that Larry T. Rigdon has been elected Chairman of the Board effective October 28th.Rigdon replaces Dr. Thomas R. Bates, Jr., who has recently resigned from the board, said a press note.Rigdon has been a member of the Tidewater Board of Directors since August 2017. He has extensive prior experience as an executive at Tidewater. Rigdon served as Interim Chief Executive Officer of Tidewater for the five-month period ended March 2018 and had previously joined the Company in 1992 upon the merger with Zapata Gulf Marine Corporation.After successive roles of increasing responsibility, he left the company as Executive Vice President in 2002.

Kneen Takes over as Tidewater CEO

Offshore vessels owner Tidewater announced on Wednesday that its board has appointed Quintin V. Kneen as President, Chief Executive Officer, and director, replacing retiring President, Chief Executive Officer and director John T. Rynd, effective immediately.Kneen, who has served as Executive Vice President and Chief Financial Officer of Tidewater since Tidewater’s November 2018 business combination with GulfMark Offshore, was President, Chief Executive Officer, and a director…

Tidewater Chooses UniSea

UniSea AS, a software developer and consultancy specializing in solutions for the shipping industry, has been selected by Tidewater Inc. as its partner in the digitalizing and standardizing of Tidewater’s business processes related to health, safety, environment and quality (HSEQ) and operations. The UniSea software suite will be implemented on all Tidewater vessels and in all offices in one of the largest contract’s in UniSea’s 21-year history.Tidewater Inc., headquartered in Houston…

Cautious Consolidation for OSV Companies Brings Market Change

Will a rising tide in the offshore oil markets float all the boats? In the U.S. Gulf of Mexico, that remains to be seen.Offshore services, exploration and production are on a roll. In early October, yet another business combination of big drillers was announced. In a sign of optimism, Ensco announced its plan for an all-stock acquisition of Rowan Offshore, worth around $2.4 billion. The new company will be domiciled in the United Kingdom, but will have a large presence in Houston.

Tidewater, Gulfmark Announce Filing of Definitive Proxy Statement

Parties say transaction could close on or about November 15, 2018.Offshore services providers Tidewater and GulfMark Offshore announced today the filing of the joint definitive proxy statement and prospectus with the U.S. Securities and Exchange Commission (SEC) regarding the pending business combination pursuant to which Tidewater has agreed to acquire all of GulfMark's outstanding shares in a stock for stock exchange. Both companies’ Boards of Directors continue to unanimously…

Harvey Gulf Proposes Merger with GulfMark

New York listed offshore services provider GulfMark Offshore, Inc. said it is reviewing an unsolicited merger proposal from rival HGIM Corp. (Harvey Gulf), just weeks after entering a definitive agreement to merge with larger rival Tidewater Inc.Harvey Gulf’s nonbinding competing offer submitted August 1 proposes that it be acquired by GulfMark and the combined company remain publicly listed. GulfMark common stockholders would own 41.2 percent and Harvey stockholders would own 58.8 percent of the combined company…

Tidewater and GulfMark Announce Merger

Tidewater Inc. and GulfMark Offshore, Inc. announced Monday that the boards of directors of both companies have unanimously approved a definitive agreement to combine the two companies, creating the industry’s largest owner of offshore support vessels and continuing consolidation in the offshore sector.The combined company will be operated under the Tidewater brand and will be led by Tidewater president and CEO John Rynd, with the industry’s largest fleet and the broadest global operating footprint in the OSV sector…

Darling, Parker join Tidewater

Tidewater has strengthened its management team with the appointments of David Darling as VP and Chief Human Resources Officer and Mark Parker as Vice President, Corporate Taxation. Darling joins Tidewater with over 24 years of domestic and international human resources experience, most recently as Senior Vice President and Chief Human Resources Officer for Gulfmark Offshore, Inc., where he was the Human Resource Director since 2007. Prior to Gulfmark, he served in executive human resources roles with Rigdon Marine and a subsidiary of Ford Motor Company. Darling has additional offshore vessel industry experience as a Vessel Master and Operations Manager.

Rubio Named CFO of GulfMark Offshore

GulfMark Offshore announced that Samuel "Sam" R. Rubio will be promoted to the position of Chief Financial Officer upon completion of the filing of the company’s Form 10-K. Rubio will replace James "Jay" M. Mitchell, who will transition his responsibilities to Rubio over the next several weeks. Rubio joined GulfMark in 2005 and became Vice President – Controller and Chief Accounting Officer in 2008 and was promoted to Senior Vice President – Controller and Chief Accounting Officer in 2012. Rubio has over 35 years of experience in accounting at both operating division and corporate levels as well as the management of accounting organizations.

Driver-less Ships: Autonomy in the Maritime Sector

In a show of prototypes, a pod of unmanned sailboats from around the world competes to cross “The Atlantic” test tank in Horten, Norway. Cross the real ocean, and the Sail Bots race similarly challenges scholarly robotic-vessel designers to North America for a bit of station-keeping, collision-avoidance and “cargo moves”. For all, the future seems bright — the first commercial runs of unmanned vessels are underway or scheduled worldwide. These earliest movers have the support of governments, Google and grateful clients.

GoM Stakeholders Energized Despite Lingering Oil Bust

Gulf of Mexico vessel builders – and their customers – adapt to a lean offshore market. After oil prices plunged in late 2014 – pressured by shale output – demand for offshore vessels in the Gulf of Mexico shrank, day rates for boats fell and non-working units were idled. This year, several GoM boat builders filed for Chapter 11, or voluntary bankruptcy, while others consolidated. The most diversified companies kept their heads above water. Today, the outlook's a bit brighter. Crude oil prices hit bottom early last year. Tidewater Inc.

GulfMark Sails Out of Bankruptcy

GulfMark Offshore, Inc. said it has completed its financial restructuring plan and emerged from bankruptcy protection under chapter 11 of the U.S. Bankruptcy Code. The company’s court-approved reorganization plan went into effect November 14, 2017, and converts approximately $429.6 million of outstanding bonds into equity, and raises approximately $125 million of new equity capital. “GulfMark is now positioned as one of the best capitalized companies in the global offshore industry,” said Quintin Kneen, President and Chief Executive Officer.

Wärtsilä Opening ‘Digital Acceleration Centers’

Wärtsilä has set out to accelerate new business ideas using a collection of “Digital Acceleration Centers” (DAC) scattered around the globe. The first DAC in Helsinki has been running in beta for several months and was officially launched today, and will be followed by the second to open in Singapore in December, as well as one in Central Europe and one in North America anticipated during 2018. Additional “pop-up” DACs will be tested with customers at other locations. Wärtsilä said opening the DACs is part of its digital transformation, which aims to help the company shift toward a data-driven, insights led, smart technology. Wärtsilä's Chief Digital Officer, Marco Ryan, explained, “The Digital Acceleration Center is all about getting business outcomes at pace.

Wärtsilä Tests Remote Control Ship Operating Capability

Wärtsilä said it has taken a further important step toward developing its Smart Marine capabilities by successfully testing the remote control of ship operations. The testing, which involved driving the vessel through a sequence of manoeuvres using a combination of Dynamic Positioning (DP) and manual joystick control, was carried out on August 21 off the North Sea coast of Scotland in collaboration with Gulfmark Offshore, the U.S. based operator who provided the vessel for the project.

OSV Companies Running Out of Options -Study

As oil continues to sell below $50 per barrel, 2017 could be one of the toughest years in decades for Offshore Supply Vessel (OSV) companies, according to a study of 44 companies in the industry by AlixPartners. The firm’s analysis highlights these companies’ rising debt burdens, making it increasingly unlikely that most of them can maintain solvency. The industry faces grave financial pressure, which is clear from recent bankruptcy filings and distressed mergers. Exploration and production (E&P) companies have drastically reduced their rig counts, causing demand for OSV services to plunge.

Thoma-Sea Launches US-flagged OSV

Technology Associates, Inc. (TAI) of New Orleans, La., announced that another derivative of a vessel built from TAI’s EnviroMax designs was launched. Thoma-Sea Marine Constructors, LLC has launched a 6,300 DWT Technology EnviroMax 310 OSV from its Lockport, La. shipyard on April 28. The owner of this vessel is a major oil and gas support vessel company. The EnviroMax 310 vessel is U.S. flagged and will serve worldwide markets. The vessel is being built to the latest ABS rules and has AMS…

Long Joins SEACOR Holdings as Executive VP

SEACOR Holdings Inc. has appointed William “Bill” C. Long as the company's Executive Vice President, Chief Legal Officer and Corporate Secretary, effective immediately. He will report directly to Charles Fabrikant, SEACOR's Executive Chairman and Chief Executive Officer. Long brings to SEACOR more than 20 years of business and legal experience with publicly-traded companies. Prior to joining SEACOR Holdings, Long served as Senior Vice President, General Counsel and Secretary of GulfMark Offshore, Inc., and previously spent more than 17 years with Diamond Offshore Drilling, Inc., where he was Senior Vice President, General Counsel and Secretary.

Seaspan Marine Names Reynolds President

Bart Reynolds has been hired to take over as president of Seaspan Marine, the company announced today. Appointed to lead Seaspan’s Marine Division, Reynolds joins the company with more than 20 years of experience in leadership positions and senior management. In the last 15 years, Reynolds has held positions in the offshore supply boat business in the United States, West Africa, the Mediterranean and Latin America, most recently serving as Vice President, Americas at GulfMark Offshore Inc. Prior to that, he worked at Tidewater Marine LLC as Area Manager, U.S. Operations.

BAE Systems Ship Repair: Leveraging Location, Infrastructure & Workforce

BAE Systems launches the first of four platform supply vessels it’s building for Jackson Offshore Operators, LLC., January 29, 2014. The vessels, being built in Jacksonville, Fla., will support drilling operations in the Gulf of Mexico and reflects the company’s continued growth in U.S. commercial shipbuilding and its support to the offshore oil and gas industry. BAE Systems Ship Repair is one of the many entities that make up BAE Systems U.S. subsidiary. Although BAE Systems Ship Repair devotes much of its production capability to naval customers…

As Operators Look for the Bottom, Gulf Gloom Persists

Gulf of Mexico vessel operators want to see sustained, higher oil prices. After a rough two years, supply boat owners and operators in the Gulf of Mexico hope crude oil prices will improve in 2017. That would encourage activity among the offshore drillers that they service and would put unemployed boats back in the water. Vessel owners aren’t necessarily banking on a good year ahead, however. “Utilization of OSVs and PSVs in the Gulf is below 50 percent now, down from about 70 percent a year ago and 90 percent two years ago…