Following Big Loss in 2025, Oil Steadies

Oil prices steadied on the first day of trade in 2026 after registering their biggest annual loss since 2020 as investors weighed oversupply concerns against geopolitical risks including the war in Ukraine and Venezuela exports.Brent crude futures LCOc1 dropped 4 cents on Friday to $60.81 a barrel by 1029 GMT while U.S. West Texas Intermediate crude CLc1 was down 3 cents at $57.39.Russia and Ukraine traded allegations of attacks on civilians on New Year's Day despite talks overseen by U.S.

Venezuela Turns to Floating Oil Storage as Onshore Tanks Fill

Venezuela's state-run oil company PDVSA has started filling tankers with crude and fuel oil and keeping them in Venezuelan waters, as inventories have mounted due to the U.S. seizing Venezuela-linked ships at sea, according to company documents and shipping data.This month, the U.S. Coast Guard intercepted the Skipper and Centuries tankers in the Caribbean Sea, both fully loaded with Venezuelan crude. The Coast Guard this week was pursuing a third empty vessel that was approaching…

EU Introduces New Sanctions on Companies, Individuals Connected to Russian Oil

The European Union has adopted fresh sanctions targeting companies and individuals accused of helping Moscow to circumvent Western sanctions on oil exports that help to fund Russia's war in Ukraine.The EU has imposed 19 packages of sanctions so far, but Moscow has managed to adapt to most measures and is still selling millions of barrels of oil to India and China, albeit at discounts to global prices. Much of this is transported using a so-called shadow fleet of vessels operating…

Carney Changes Climate Requirements in Energy Deal with Alberta

Canada's Prime Minister Mark Carney signed an agreement with Alberta's premier on Thursday that rolls back certain climate rules to spur investment in energy production, while encouraging construction of a new oil pipeline to the West Coast.Under the agreement, the federal government will scrap a planned emissions cap on the oil and gas sector and drop rules on clean electricity in exchange for a commitment by Canada's top oil-producing province to strengthen industrial carbon…

Russian Oil Cargo Discharge at Indian Port Delayed Due to Insurance Scrutiny

A Western-sanctioned vessel with Russian oil destined for Indian Oil Corp has had discharge of the cargo delayed at a port in eastern India due to a hold-up in online verification of insurance cover provided by a Russian insurer, three industry sources with direct knowledge of the matter said.India earlier this year tightened insurance rules for ships calling at its ports, focusing on old and so-called shadow fleet vessels often used to carry Russian oil.Aframax vessel Tiger 6…

Chinese Oil Majors Invest in Onboard Oil Testing

China’s leading marine lubricant suppliers are embracing onboard oil testing technology. The adoption of portable lube-oil analyzers represents a shift in how the country’s oil majors including Sinopec, PetroChina, and CNOOC, look to service and support ships calling at Chinese ports.According to Germany’s CM Technologies GmbH (CMT), whose onboard test kits are already standard tool kits for European fleets, China’s lubricant producers are now integrating condition-based monitoring tools into their supply programs.“We are seeing a real transformation in China’s fuels and lubricants market…

Chevron Eyes Lukoil Assets

Chevron is studying options to buy global assets of sanctioned Russian oil firm Lukoil, five sources familiar with the process told Reuters on Monday.The U.S. Treasury gave clearance last week to potential buyers to talk to Lukoil about foreign assets. Chevron would join Carlyle and other firms in the race for the Lukoil portfolio worth at least $20 billion.The United States last month imposed sanctions on Russia's two biggest oil companies, Lukoil LKOH.MM and Rosneft ROSN.MM…

Russian Oil takes the Northern Sea Route to Brunei

Russia will deliver oil to Brunei via the Northern Sea Route for the first time this September, expanding its export reach through the strategic Arctic passage, two sources familiar with the shipping data told Reuters.Until now, NSR shipments have been limited to China due to its proximity to Russia’s Far East. Moscow has been actively promoting the route, which is shorter and less costly than moving crude through the Suez Canal, to other partners including India and the U.S.The…

Nigerian Navy Cracks Down on Oil Theft

The Nigerian Navy has arrested 76 vessels and at least 242 suspects in anti-oil theft operations, and destroyed more than 800 illegal refining sites during a two-year crackdown, it said on Thursday.Rampant oil theft from pipelines and wells has crippled Nigeria's oil industry in recent years, damaging government finances and stifling exports.Since June 2023, naval authorities have seized around 171,000 barrels of crude and millions of litres of illegally refined fuels from criminal networks…

A Predicted Stronger US Hurricane Season Could Increase Oil Supply Outages

An expected stronger hurricane season than average raises the risk of weather-related production outages in the U.S. oil industry, the U.S. Energy Information Administration said on Tuesday.WHY IT MATTERSA large portion of U.S. oil production and the bulk of the country's refineries are in areas prone to hurricanes along the U.S. Gulf Coast.That concentration means more than 1 million barrels per day of U.S. refining capacity, which is roughly 5% of daily U.S.

India OKs Russian Marine Insurers

India has approved three Russian insurers, including a unit of top lender Sberbank, to provide marine cover to ships arriving at Indian ports, a government notification shows, helping Moscow maintain oil supplies to a key market.India is the top buyer of Russian seaborne oil after China since Western nations shunned purchases and imposed sanctions on Moscow for its military action in Ukraine.With the granting of the permits to Sberbank Insurance, Ugoria Insurance Group and ASTK Insurance Company…

Venezuela's PDVSA Suspends Oil Loading Authorizations to Chevron

Venezuela's state oil company PDVSA has canceled several authorizations it had granted U.S.-based producer Chevron to load and export Venezuelan crude in April, three sources with knowledge of the decision said on Thursday.The cancellations follow U.S. President Donald Trump's imposition of tariffs on Venezuela's oil buyers. The suspensions also comes after Washington canceled key licenses last month to a handful of PDVSA partners and customers, including Chevron, that had allowed them to operate and export Venezuelan oil under exemptions to the U.S.

US Targets China Oil Storage Terminal in Iran-Related Sanctions

The Trump administration imposed sanctions on Iranian oil trading networks on Thursday, including on a China-based crude oil storage terminal linked via a pipeline to an independent refinery, just days before direct talks between the U.S. and Iran.The sanctions came after Secretary of State Marco Rubio said the U.S. will hold direct talks with Iran on Saturday in Oman. President Donald Trump said on Monday that Iran would be in "great danger" if the talks were unsuccessful.The U.S.

Russian Seaborne Oil Exports Remain Largely Unaffected by New Sanctions

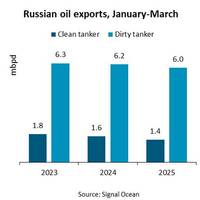

During the first quarter of 2025, Russian oil exports have fallen 6% year-on-year. Clean tanker exports were down 13% while dirty tanker exports fell 4%. “Despite the fall, it appears that exports have mostly been unaffected by the recent sanctions,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.In early January, the Biden Administration ramped up the pressure on Russian oil exports by sanctioning more than 180 ships and several individuals and companies involved in Russian…

Russian Court Lifts Suspension on Transneft Oil Berth

A Russian court overturned on Monday a decision by a regulator to suspend the operation of an oil berth at the Black Sea port of Novorossiisk controlled by Transneft, an industry source told Reuters.Transneft said last week it had suspended mooring number 8 at Novorossiisk for 90 days after a snap inspection by a transport watchdog.The Novorossiisk Commercial Sea Port (NCSP) is one of Russia's largest export outlets and the closure of one mooring is unlikely to affect its operations significantly.The source said the port was fined 200,000 roubles ($2,322) for unspecified irregularities.

CPC: Russian Court Rules Not to Suspend Oil Export Terminal

The Caspian Pipeline Consortium (CPC) said on Friday that a Russian court ruled that its Black Sea export terminal facilities should not be suspended, in a major victory for the Western-backed consortium.The decision looks set to avert a potential fall in Kazakhstan's oil production and supplies via the CPC, which accounts for around 80% of the country's oil exports.Industry sources told Reuters about a flurry of diplomatic activity over the pipeline's operations between Russia and Kazakhstan before the court ruling.Russia's oil pipeline monopoly Transneft said on Thursday that its head…

China's Iranian Oil Imports Will Slow Under US Sanctions

Iranian oil shipments into China are set to fall in the near-term after new U.S. sanctions on a refiner and tankers, driving up shipping costs, but traders said they expect buyers to find workarounds to keep at least some volumes flowing.Washington on Thursday imposed new sanctions on entities including Shouguang Luqing Petrochemical, a "teapot," or independent refinery in east China's Shandong province, and vessels that supplied oil to such plants in China, the top buyers of…

Russian Oil Discharged in China

A ship carrying Russian crude transferred from three smaller tankers that are under U.S. sanctions unloaded last week at a Chinese port, shiptracking data shows, ending an unusual month-long voyage highlighting the efforts of producers and traders to keep Moscow's oil flowing despite tightened curbs.The Panama-flagged Daban, one of dozens of non-sanctioned vessels drawn to the Russian oil trade by fat margins following the January 10 U.S. sanctions, was received at a berth run by the privately-controlled Qingdao Haiye Group at the port of Qingdao…

U.S. Targets 'Shadow Fleet', Iran's Oil Minister

The United States imposed sanctions on Thursday on Iran's Oil Minister Mohsen Paknejad and some Hong Kong-flagged vessels that are part of a shadow fleet that helps disguise Iranian oil shipments, the Treasury Department said.President Donald Trumpre-imposed a "maximum pressure" policy on Iran in February that includes efforts to drive its oil exports to zero in order to stop Tehran from obtaining a nuclear weapon and funding militant groups.Paknejad "oversees the export of tens…

Tariffs Keep Energy Industry on Edge

Over the last six weeks, U.S. President Trump has imposed and postponed tariffs on Canada and Mexico several times. The current situation seems to reflect something of a compromise, says Poten & Partners in an opinion released on March 7.Tariffs are in place, but they will not apply to goods covered by the North American trade agreement known as USMCA. Crude oil and refined products are covered under the USMCA, so provided the energy companies file the appropriate paperwork, they…

Asia's Oil Imports Drop 3%

Asia's crude oil imports are off to a weak start in 2025, as top importer China continues to buy less and new sanctions put the brakes on cargoes from the continent's top supplier Russia.Asia's imports for the first two months of the year are on track to be 26.17 million barrels per day (bpd), down 780,000 bpd from the 26.96 million bpd for the same period last year, according to data compiled by LSEG Oil Research.The drop of about 3% in crude imports by Asia in the first two…

New Oil Export Pact for Venezuela Could be in the Works - sources

The cancellation of a license for Chevron to operate in Venezuela could lead to the negotiation of a fresh agreement between the U.S. producer and state company PDVSA to export crude to destinations other than the United States, sources close to the talks said.U.S. President Donald Trump said on Wednesday he was reversing the license, accusing President Nicolas Maduro of not making progress on electoral reforms and migrant returns.U.S. Secretary of State Marco Rubio later said…

Trump Pressures Iran; Iran Threatens Strait of Hormuz Closure

U.S. President Donald Trump will restore his "maximum pressure" campaign on Iran and drive its oil exports down to zero, a U.S. official said on Tuesday.Iran has repeatedly threatened to close the Strait of Hormuz for traffic as a retaliation for Western pressure. That would shut down the region's trade and lead to a spike in oil prices.The Streit of Hormuz & OilThe strait lies between Oman and Iran and links the Gulf north of it with the Gulf of Oman to the south and the Arabian Sea beyond.It is 21 miles (33 km) wide at its narrowest point…