European Oil Shipments Delayed After Cyber Attacks

Tanker and barge shipments in and out of Europe's biggest oil hub have been delayed by up to a week as four storage companies scramble to resume operations after cyber attacks, sources familiar with the matter said.Since the end of last week, storage company Oiltanking and oil trading firm Mabanaft, both owned by Germany's Marquard & Bahls, have been hit by hackers. Belgium's SEA-TANK and Dutch fuel storage firm Evos have also been affected.The companies have had to suspend some operations, affecting oil flows in the Netherlands, Belgium and across Germany.

Jurong Port Buys Lim Family's Stake in Universal Terminal

Singapore port operator Jurong Port has completed its acquisition of a stake in a major oil storage terminal in the city-state from the family behind collapsed oil trader Hin Leong Trading Pte Ltd, a port spokesman said on Saturday.The spokesman said government-owned Jurong Port had completed the purchase of a 41% stake in Universal Terminal from the Lim family. He declined to give details on the transaction.A lawyer for the family did not immediately respond to a Reuters email…

Amsterdam Completes First SIMOPS LNG Bunkering

Dutch LNG supplier Titan LNG's bunker barge FlexFueler001 has supplied LNG to Ramelia, oil and chemicals tanker owned by Sweden's Alvtank, while the ship was unloading cargo at the Oiltanking Terminal in Amsterdam.It is the first time a simultaneous operation (SIMOPS) has taken place with LNG bunkering in the Port of Amsterdam, allowing the Ramelia to unload cargo whilst receiving LNG bunkers."This important step, in which Oiltanking Amsterdam and Furetank Chartering joined, enables the receiving vessel to have a quicker turnaround in the port as it does not have to shift to a designated LNG bunkering location, such as the Titan LNG facility…

Enbridge, Enterprise to Develop GoM Crude Export Terminal

Enbridge Inc and Enterprise Products Partners LP on Monday signed an agreement to jointly develop a deepwater offshore crude oil export terminal in the Gulf of Mexico capable of loading Very Large Crude Carriers.Both pipeline operators will work to finalize an equity participation agreement that would provide Enbridge an option to purchase ownership interest in Enterprise's Sea Port Oil Terminal (SPOT), subject to SPOT receiving a deep-water port license, Enbridge said in a statement.The companies would first jointly develop the SPOT project, and depending on how the export market grows, would utilize Enbridge's Texas COLT deep-water port or a similar project."Enbridge and Enterprise Products are partners in the Seaway Pipeline system.

Kinder Morgan quits Crude Export Venture

Kinder Morgan Inc has dropped out of a recently proposed U.S. Gulf Coast deepwater crude export venture, the project's leader Enbridge Inc said on Monday.The $800 million project, known as Texas COLT, is one of eight similar projects proposing facilities that would move U.S. shale to overseas markets by loading supertankers able to carry up to 2 million barrels apiece.Pipeline operators Enbridge and Kinder Morgan disclosed plans to build an crude export terminal off Freeport, Texas, in January, and filed permit applications with the U.S. Maritime Administration. German oil storage firm Oiltanking Partners remains committed to the project, said Enbridge."The project does not align with our strategic priorities," Kinder Morgan spokeswoman Lexey Long said.

German LNG Terminal Signs New Pact

German LNG Terminal GmbH, the joint venture driving forward Germany’s first LNG terminal in Brunsbuettel, has reached another long-term commercial capacity agreement with an unnamed global LNG player.The gas infrastructure company consisting of N.V. Nederlandse Gasunie (Gasunie), Oiltanking GmbH and Vopak LNG Holding B.V said in a press release that the parties agreed on the commitment of a substantial part of the terminal capacity.Negotiations with other interested parties are ongoing. As a result of strong market demand, German LNG Terminal will apply for permits with a total terminal capacity of 8 bcma.Rolf Brouwer, Managing Director of German LNG Terminal GmbH…

Another Record Year for Port of Antwerp

With expected growth of 5.1% compared with last year, 2018 looks set to be a record year for the Port of Antwerp for the sixth time in a row."In 2019 the Port Authority will keep to the same course, further building a sustainable future for the port. In pursuit of this goal it is concentrating heavily on structural solutions to challenges such as mobility, the energy transition, digitisation and innovation," said a press release from the port authority.The expected total freight volume in 2018 comes to 235 million tonnes, a new record, with unparalleled growth in all types of cargo. The large expansion in container freight continues, reaching 130 million tonnes (up 5.8%) or 11 million TEU (up 5.5%).

Antwerp Port on Track to Sixth Record Year

Throughput continues to register growth in the Port of Antwerp. After record semi-annual figures, the total throughput after nine months stands at 177,026,550 tonnes – a sharp 6% increase compared with the same period last year.A press release from the company said that with these results, the port seems to be on track for the sixth record year in a row. The recent wave of investments moreover confirms the port’s appeal and reaffirms its role as a world player.Container traffic registered robust growth yet again, up by 7.1% (98,436,773 tonnes) compared with the first nine months of 2017. In terms of Twenty-foot Equivalent Units (TEUs)…

Antwerp Port on Track to Record Sixth Year

Belgian port Antwerp said that throughput continues to register growth in the port. After record semi-annual figures, the total throughput after nine months stands at 177,026,550 tonnes – a sharp 6% increase compared with the same period last year.With these results, the port seems to be on track for the sixth record year in a row. The recent wave of investments moreover confirms the port’s appeal and reaffirms its role as a world player.Maritime throughput continues to grow. Container traffic registered robust growth yet again, up by 7.1% (98,436,773 tonnes) compared with the first nine months of 2017. In terms of Twenty-foot Equivalent Units (TEUs)…

RWE Reserves German LNG Import Capacity

Europe’s leading energy companies RWE and German LNG Terminal GmbH, the joint venture driving forward Germany’s first LNG terminal in Brunsbüttel in Northern Germany, have reached an agreement for a considerable part of the terminal’s capacity on a long-term basis.This contract follows a successful “Open Season” in which market interest was tested. The total capacity of the combined LNG import and small-scale terminal will be 5 billion cubic metres. RWE has signed a contract that guarantees RWE access to substantial annual capacity.Andree Stracke, Chief Commercial Officer Gas Supply & Origination of RWE Supply & Trading GmbH, commented…

Methanol as an Alternative Fuel for Vessels

The Methanol Institute welcomed the findings of the Sustainable Marine Methanol (SUMMETH) project, which has backed the increased use of Methanol as a marine fuel. The research concluded that there are no obstacles to the efficient use of Methanol in a converted diesel engine and that smaller vessel conversion projects are feasible and cost-effective, with levels of safety that easily meet existing requirements. Switching to Methanol would offer immediate environmental benefits, including close to zero SOx and particulate matter emissions and significantly lower NOx emissions compared to conventional marine fuels or biodiesel. Joanne Ellis…

Odfjell Divests Share in Singapore Tank Terminal

Odfjell Terminals B.V. has entered into an agreement with a fund managed by Macquarie Infrastructure and Real Assets to sell its 50 percent ownership in Oiltanking Odfjell Terminal Singapore Pte Ltd for a price around $300 million. This implies an enterprise value of around $330 million for Odfjell Terminals B.V.'s share in the Singapore terminal. “This divestment is in line with our strategy to focus on the terminals where we have managerial control of the assets and to further invest in growth opportunities in our core markets, such as Houston and Rotterdam," said Frank Erkelens, CEO of Odfjell Terminals B.V. The transaction will result in a net gain for Odfjell SE of approximately $135 million (Odfjell SE's share).

Transnet Appoints Ngqura Liquid Bulk Terminal Operator

The Port of Ngqura is poised to play a vital role in ensuring the security of South Africa’s fuel supply, while creating a new petroleum trading hub for Southern Africa in anticipation of the relocation of existing liquid bulk facilities from Port Elizabeth. This follows the conclusion of an agreement between Transnet National Ports Authority (TNPA) and Oiltanking Grindrod Calulo (Pty) Ltd (OTGC)to plan, fund, construct, own, maintain and operate a new liquid bulk handling facility at the Port of Ngqura. The project is one of the Section 56 initiatives that TNPA has identified to encourage private sector participation as a key element…

Boskalis Bags Brazil's Terminal Expansion Deal

Royal Boskalis Westminster N.V. (Boskalis) has been awarded a contract by Açu Petróleo S.A. (joint venture company of Prumo Logística S.A. and Oiltanking Gmbh) for the expansion of the Porto do Açu Oil Transhipment Terminal in Rio de Janeiro State, Brazil. The contract has a total value of approximately EUR 120 million. The expansion comprises the deepening, widening and extension of the access channel and turning basin. In total, approximately 32 million cubic meters of sand, silt and clay will be dredged. The activities will commence immediately and are expected to be completed late 2017. For this project one jumbo and two large trailing suction hopper dredgers will be deployed. Currently, the terminal's access channel has a depth of 20.5 meters suitable to receive Suezmax type vessels.

Odfjell Sells Its Share in Oman Tank Terminal

Odfjell SE announced that Odfjell Terminals B.V. (OTBV), the joint venture holding company that owns and operates substantially all of Odfjell's tank terminals worldwide, has entered into an agreement to sell its 29.75 percent indirect ownership in Oiltanking Odfjell Terminals & Co. LLC (OOT) in Oman for around $130 million. The transaction will result in a net gain of approximately $90 million for OTBV. Closing of the transaction is subject to customary regulatory approval. Frank Erkelens, CEO of Odfjell Terminals B.V. commented, “We appreciate the cooperation we have had with our good partners in Oman, and wish them a successful future further developing the full potential of the terminal. Odfjell Terminals B.V.

Huge Port Envisioned by Tycoon Opens in Brazil - without Him

The launch this week of Prumo Logistica's $3.7 billion Port of Açu, the largest in Latin America, marked the revival of a Brazilian logistics hub many thought doomed when the empire of its former billionaire owner collapsed. Açu's more than 25 km (15.5 miles) of docks, piers and breakwaters is a much-needed step towards narrowing a crippling infrastructure gap in Latin America's largest economy. The Manhattan-sized industrial complex northeast of Rio de Janeiro, which officially opened on Tuesday, however, remains a far cry from the plans drafted by Eike Batista before his $60 billion EBX industrial empire disappeared almost overnight in 2013.

Measuring Shipping Emissions in the Arctic

A new global challenge and a compliance monitoring market are emerging, due to tightening environmental regulations. VTT Technical Research Centre of Finland Ltd, the Finnish Meteorological Institute, Tampere University of Technology and the University of Turku have joined forces in an international project – Shipping Emissions in the Arctic – with the aim of making the measurement of black carbon emissions from shipping more reliable. The initial results show that engine loads and fuel types have a major impact on black carbon emissions from ships.

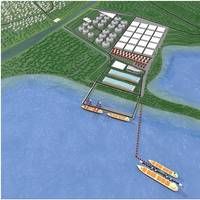

Prumo Sells 20% of Brazil Acu Oil Terminal to Oiltanking

Prumo Logistica SA , the Brazilian port operator controlled by U.S.-based EIG Global Energy Partners, agreed to sell 20 percent of its oil terminal at Brazil's Port of Açu to Germany's Oiltanking for $200 million, Prumo said on Thursday. Under the agreement Oiltanking will also manage the Port of Açu Oil Terminal, which has the capacity to transfer 1.2 million barrels a day of petroleum and can handle the largest oil tankers, known as very large crude carriers, or VLCCs, Prumo said in a statement. Oiltanking is a subsidiary of Marquard & Bahls, a family-owned company based in Hamburg. Prumo Logistica, formally known as LLX Logistica SA, was sold to EIG in 2013 as Brazilian tycoon Eike Batista's EBX oil, transportation, mining and energy group unraveled.

BP Exported Super-Light Texas Crude

BP Plc exported nearly 670,000 barrels of minimally processed super-light crude oil from the Houston Ship Channel more than a week ago, according to ClipperData, an industry firm that tracks crude movements. The 667,638-barrel cargo left Enterprise Products Partners' ship channel docks - part of the company's recent $4.41 billion acquisition of Oiltanking Partners LP - on Feb. 15 bound for Rotterdam in The Netherlands, ClipperData partner Abudi Zein said in an interview. The shipment's documentation said the cargo was processed condensate - a super-light form of crude - from the Eagle Ford shale in South Texas, he said. BP declined comment on the shipment or whether the company is among several companies that received U.S.

Enterprise: Clients Must Pay for Dock Work

Enterprise Products Partners LP said on Wednesday that companies using its crude oil storage facility in the Houston Ship Channel must pay extra for dock services, brushing off complaints from client BP Plc . "We believe if you want a service, you pay for it," Enterprise Chief Operating Officer Jim Teague told analysts when asked about concerns, first reported by the Wall Street Journal, that the company's strong position in Gulf Coast storage gives it too much pricing power. Britain's BP has reportedly told the U.S. Federal Trade Commission that Enterprise, a major midstream company, has started charging $1 a barrel in dock fees for crude it handles at the Houston site, on top of storage fees. Since Houston is the top U.S. petrochemicals port, the dock fees could add up to big revenue.

Consortium Wins Fuel Terminal Contract in Peru

A consortium formed by units of local builder Grana y Montero and Germany's Oiltanking won a 20-year contract for managing five fuel terminals in Peru, Grana y Montero said on Wednesday. The consortium will invest about $225 million in the project, with $190 million returned in the form of discounted payments to state-run energy company Petroperu, Grana y Montero said via email. Each company controls a 50 percent stake in the local consortium, said Grana y Montero, Peru's biggest construction company. Petroperu, which owns the terminals and awarded the management contract, has said it is planning a $3.5 billion expansion of its main refinery, Talara, to boost output by 50 percent to 96,000 barrels per day. (Reporting By Marco Aquino; Editing by Dan Grebler)

$642M Terminal Puerto Bahía Under Development

Pacific Infrastructure, a subsidiary of Canadian oil company Pacific Rubiales, is developing the multipurpose terminal Puerto Bahia in the South of Cartagena Bay on Colombia’s Caribbean coast. In September 2012 Pacific Infrastructure awarded the construction of the multipurpose terminal to a consortium formed by Isolux Corsán (Spain), Tradeco (Mexico) and Tampa Tanks (U.S.). The construction of Puerto Bahía is scheduled to be completed during the first half of 2015. The total…

Oiltanking Partners Report Q1 Distribution Increase

Oiltanking Partners, L.P. announced that the board of directors of its general partner declared a cash distribution of $0.495 per unit, or $1.98 per unit on an annualized basis, for the first quarter of 2014. The first quarter distribution represents a 5.3% increase over the prior quarter distribution of $0.47 per unit and a 22.2% increase over the prior year distribution of $0.405 per unit. The distribution will be paid on May 14, 2014, to unitholders of record on May 2, 2014. Oiltanking Partners, L.P.