Maersk Ramps up Suez Canal Return

Maersk said on Thursday that one of its services will resume using the Red Sea and Suez Canal this month, marking a key step towards ending two years of global trade disruption due to attacks on ships by Yemeni Houthi rebels.The Danish shipping group's share price fell more than 5% on the news, reflecting the likelihood of lower freight rates as vessels gradually return to the shorter Suez route.Shipping companies are weighing a return to the critical Asia-Europe trade corridor…

Red Sea Return Imminent for Container Shipping

Major carrier CMA CGM has announced its INDAMEX service will transit Suez Canal on fronthaul and backhaul voyages between India/Pakistan and US East Coast in a notable step towards a largescale return of container ships to the Red Sea region.The first vessel to complete a full service loop via Suez Canal will be CMA CGM Verdi, sailing from Karachi to New York on 15 January. eeSea by Xeneta data shows voyages via Suez Canal rather than Cape of Good Hope reduces full loop transit time on this service by two weeks…

Container Freight Rates Could Plunge with End of Houthi Attacks

Houthi militia have reportedly ceased attacks on Israel and shipping in the Red Sea, and the impact could be seismic for global ocean container shipping, warns Chief Analyst Peter Sand at Xeneta. However, an immediate largescale return to the region will require a series of further assurances.“Details are sketchy, and you cannot base the safety of crews, ships and cargo on the word of Houthi militia. Carriers need far more assurance than that and, perhaps more importantly, so do insurance companies…

Xeneta: Israel-Iran Conflict Threatens Safety and Stability of Ocean Supply Chains

Peter Sand, Xeneta Chief Analyst, shared insights following the escalation of the Israel-Iran conflict.“Geo-politics is once again threatening the safety and stability of global supply chains so we must hope for de-escalation in the conflict between Israel and Iran, with concerns it could see a de-facto closure of the Strait of Hormuz—a vital entry point for container ships calling at ports such as Jebel Ali and the wider Arabian Gulf region," said Sand.“Any closure of the Strait of Hormuz would see services re-routed…

Hapag-Lloyd Welcomes China-US Tariff Reprieve

German container shipping firm Hapag-Lloyd on Monday welcomed an agreement between the United States and China to temporarily slash reciprocal tariffs, saying it expected to be buoyed by a resulting increase in bookings from China to the U.S.The United States will cut extra tariffs it imposed on Chinese imports in April to 30% from 145% and Chinese duties on U.S. imports will fall to 10% from 125% for the next 90 days, the two sides said on Monday.Trade between the world's two largest economies plummeted in the midst of the trade standoff…

Potential Return of Container Ships to Red Sea Following US-Houthi Ceasefire Could Collapse Freight Rates

The prospect of a large scale return of container ships to the Red Sea following the announcement of a ceasefire between the US and Houthi militia in Yemen would flood the market with shipping capacity and cause a global collapse in freight rates, but the situation remains far from certain.Data released by Xeneta, an ocean and air freight intelligence platform, shows global TEU-mile demand would decrease 6% if container ships begin sailing through the Red Sea and Suez Canal again…

Trump's Tariffs Risk of Shipping Chaos

U.S. President Donald Trump's new tariff plan has the ocean shipping industry on edge as he stokes a trade war destined to stanch transport demand and send companies scrambling to manage the fallout.The Trump administration on Wednesday is set to announce "reciprocal tariffs" targeting nations that have duties on U.S. goods. That move would come after it slapped new import levies on products from Mexico, China and Canada - the top U.S. trading partners - as well as on goods including steel and autos.Major global container shipping firms like MSC…

Ocean Shipping Faces Uncertainty as Trade Threats Loom

The global ocean shipping industry that handles 80% of world trade is navigating a sea of unknowns as U.S. President Donald Trump stokes trade and geopolitical tensions with historical foes as well as neighbors and allies.That is the backdrop for this week's S&P Global TPM container shipping and supply chain conference in Long Beach, California, an annual event that marks the start of container shipping contract negotiating season.Attendees this year include industry heavyweights like container carriers MSC…

Proposed China Vessel Fees Come with Supply Chain Risks

Analysts caution that a new proposal to impose fees on China-built container ships entering the U.S. could trigger unintended consequences, including port congestion, rising freight costs, and shifts in global trade flows.The Trump administration has announced a plan to charge a $1 million fee every time a vessel operated by a Chinese carrier docks at a U.S. port. Additionally, the Federal Notice outlines potential extra charges for any China-built ships, even if operated by carriers from other nations.

Xeneta: Ocean Box Rates to Fall Again in February

Middle East ceasefire and Lunar New Year will see ocean container freight rates fall further in February - with carriers now taking action to slow the market decline.Latest data from Xeneta – an ocean and air freight intelligence platform – shows average spot rates from the Far East stand at USD 3 795 per FEU (40ft container) into North Europe and USD 5 085 per FEU into the Mediterranean – down 22% and 13% respectively since 1 January.Early data suggests spot rates will fall further on 1 February…

All Eyes on China as Trump Retakes the White House

Donald Trump’s victory in the US Presidential Election is has importers on edge, fearing another spike in ocean container shipping freight rates premised on President Trump's vow on blanket tariffs of up to 20% on all imports into the US and additional tariffs of 60% to 100% on goods from China.Data from Xeneta shows the last time that President Trump ramped up tariffs on Chinese imports during the trade war in 2018, ocean container shipping freight rates spiked more than 70%.

European Importers Shouldn't be Spooked by Freight Rates

Ocean container carriers are desperately trying to push spot freight rates up in early November to halt the market decline and strengthen their hand during negotiations with European shippers for new long-term contracts.Latest data from Xeneta’s ocean and air freight rate intelligence platform shows average spot rates on the major fronthaul trades from the Far East to North Europe and the Mediterranean are set to increase on November 1 between 15-25%.Average spot rates currently stand at 3 390 per FEU (40ft container) into North Europe and $3…

US Port Strike Leaves Huge Cargo Backlog In Its Wake

U.S. East Coast and Gulf Coast ports began reopening late on Thursday after dockworkers and port operators reached a wage deal to settle the industry's biggest work stoppage in nearly half a century, but clearing the cargo backlog will take time.The strike ended sooner than investors had expected, weakening shipping stocks across Asia on Friday as freight rates were no longer expected to surge.At least 54 container ships queued outside the ports as the strike had prevented unloading and threatened shortages of anything from bananas to auto parts.

US Dockworker Strike: Talks at a Standstill

A strike by 45,000 dockworkers halting shipments at U.S. East Coast and Gulf Coast ports entered its second day on Wednesday with no negotiations currently scheduled between the two sides, sources told Reuters.The lack of progress is raising concerns among those reliant on shipments that the disruption could be prolonged.The International Longshoremen's Association union strike has blocked goods from food to automobile shipments across dozens of ports from Maine to Texas, which…

ILA 'Scaremongering' with Hyperbolic Box Rate Claims -Xeneta

The International Longshoremen’s Association (ILA) on Tuesday has gone ahead with strike action at U.S. ports from Maine to Texas and accused ocean container carriers of ‘gouging customers’.The ILA confirmed the strike in an announcement yesterday, Monday, while at the same time claiming ocean container carriers are now charging $30,000 per container in a ‘whopping increase from $6,000 just a few weeks ago’.Xeneta data – which is based on more than 450 million crowdsourced datapoints – shows the ILA claim is misleading. Average spot rates on the major fronthaul from the Far East to U.S.

East Coast Dockworkers Strike Halts Half of US Ocean Shipping

Dockworkers on the U.S. East Coast and Gulf Coast began a strike early on Tuesday, their first large-scale stoppage in nearly 50 years, halting the flow of about half the nation's ocean shipping after negotiations for a new labor contract broke down over wages.The strike blocks everything from food to automobile shipments across dozens of ports from Maine to Texas, in a disruption analysts warned will cost the economy billions of dollars a day, threaten jobs, and potentially stoke inflation.The International Longshoremen's Association (ILA) union representing 45…

Trump's Tariff Increase Would Dramatically Raise Shipping Costs, Experts Say

U.S. presidential contender Donald Trump's plan to hike tariffs on imports if he is elected back to the White House in November would send cargo rates soaring and accelerate inflation, just like it did during his 2017-21 term, shipping and retail experts said.Trump, who is running against Democratic Vice President Kamala Harris in the Nov. 5 election, has floated second-term plans for blanket tariffs of 10% to 20% on virtually all imports as well as tariffs of 60% or more on goods from China, in a bid to boost U.S.

Container Shipping Spot Rate Growth Slows

Ocean freight container shipping spot rates are set to increase further, but there are signs the recent dramatic growth may be slowing.The latest data from Xeneta, the ocean freight rate benchmarking and intelligence platform, indicates spot rates on major trades out of the Far East will increase again on June 15, but to a less dramatic extent than witnessed in May and early June.Average spot rates from the Far East to US West Coast are set to increase by 4.8% on June 15 to stand at $6,178 per 40ft equivalent container (FEU).

Chinese Port Blast Raises Serious Safety Concerns for Container Shipping

A major explosion on board a containership berthed at the port of Ningbo-Zhoushan in China raises serious safety concerns, a shipping analyst said.The incident took place Friday, with video footage showing a massive explosion on board Taiwanese shipping firm Yang Ming Marine Transport Corp's vessel YM Mobility. There are no reports of casualties.The blast follows other major incidents in 2024, including the collapse of Baltimore Bridge in March after it was struck by a containership…

Potential US Seaport Strike May Cause Months-long Shipping Delays

A potential strike at U.S. seaports on the East Coast and Gulf of Mexico could back up cargo there for weeks or even months, shipping experts said on Wednesday.Retailers like Walmart and other importers have been rushing goods in ahead of the Sept. 30 expiration of the union contract covering some 45,000 dockworkers at three dozen seaports from Texas to Maine.Their goal? To land cargo in the U.S. before Oct. 1, when the International Longshoremen's Association representing those workers has vowed to strike if a new contract is not in place.Analysts at Sea-Intelligence…

US Retailers Rush Holiday Imports Amid Fears of Strikes and Supply Chaos

Retailers are fueling a summer rush of imports to the United States this year as companies guard against a potential strike by port workers and ongoing shipping disruptions from attacks in the Red Sea ahead of a shortened holiday shopping season.Container imports and freight rates surged in July, signaling an earlier than usual peak season for an ocean shipping industry that handles about 80% of global trade.July is expected to be the peak for U.S. retailers, which account for about half of that trade…

Singapore Port Congestion Shows Global Impact of Red Sea Attacks

Congestion at Singapore's container port is at its worst since the COVID-19 pandemic, a sign of how prolonged vessel re-routing to avoid Red Sea attacks has disrupted global ocean shipping - with bottlenecks also appearing in other Asian and European ports.Retailers, manufacturers and other industries that rely on massive box ships are again battling surging rates, port backups and shortages of empty containers, even as many consumer-oriented firms look to build inventories heading into the peak year-end shopping season.Global port congestion has reached an 18-month high…

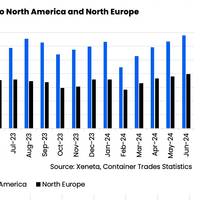

Have Container Volumes from China to North America Peaked?

Ocean container shipping demand from China to North America and North Europe continued to break records in June, but the latest data from Xeneta indicates it may now have peaked.The June highs came as importers rushed to protect supply chains amid the global disruption caused by conflict in the Red Sea.The latest data, released this week, shows 800,000 TEU were shipped from China to North Europe in June, which is the highest ever monthly figure on this trade (Source: Xeneta, Container Trades Statistics).While the trade from China to North America did not set a new all-time high…