Chinese Oil Majors Invest in Onboard Oil Testing

China’s leading marine lubricant suppliers are embracing onboard oil testing technology. The adoption of portable lube-oil analyzers represents a shift in how the country’s oil majors including Sinopec, PetroChina, and CNOOC, look to service and support ships calling at Chinese ports.According to Germany’s CM Technologies GmbH (CMT), whose onboard test kits are already standard tool kits for European fleets, China’s lubricant producers are now integrating condition-based monitoring tools into their supply programs.“We are seeing a real transformation in China’s fuels and lubricants market…

China’s Sinopec Reroutes Supertanker from US-Sanctioned Port

The latest U.S. sanctions on a major Chinese crude oil terminal have forced refining group Sinopec to divert a supertanker and ask some plants to cut crude processing rates, according to ship tracking data and Chinese consultancies.A supertanker carrying oil to the Chinese port of Rizhao in Shandong province changed its destination over the weekend after the U.S. imposed sanctions on an import terminal at the port on Friday, LSEG data showed.Shortly after the U.S. announcement…

US Sanctions on Iranian Oil Target Sinopec

The latest U.S. sanctions on Iranian petroleum exports deal a blow to Chinese refining giant Sinopec by targeting a terminal through which the state major handles one-fifth of its crude oil imports, industry executives and analysts said.The sanctions announced on Thursday further complicate U.S.-China relations, coming ahead of planned talks between Presidents Donald Trump and Xi Jinping later this month.The move follows China's decision to tighten controls on rare earth exports…

Tankers Hesitate and Adjust Course at Strait of Hormuz

At least two supertankers made U-turns near the Strait of Hormuz following U.S. military strikes on Iran, shiptracking data shows, as more than a week of violence in the region prompts vessels to speed, pause, or alter their journeys.Washington's decision to join Israel's attacks on Iran has stoked fears that Iran could retaliate by closing the strait between Iran and Oman through which around 20% of global oil and gas demand flows.That has spurred forecasts of oil surging to $100 a barrel.

Tankers Transiting Strait of Hormuz Face Disruption as Tensions Rise

At least two supertankers made U-turns near the Strait of Hormuz following U.S. military strikes on Iran, shiptracking data shows, as more than a week of violence in the region prompts vessels to speed, pause, or alter their journeys.Washington's decision to join Israel's attacks on Iran has stoked fears that Iran could retaliate by closing the strait between Iran and Oman through which around 20% of global oil and gas demand flows.That has spurred forecasts of oil surging to $100 a barrel.

Oil and Gas Traders to Seek Tariffs Exemptions from China for US Imports

Oil and gas traders are likely to seek waivers from Beijing over tariffs that the Chinese government plans to impose on U.S. crude and liquefied natural gas (LNG) imports from February 10, trade sources said on Thursday.Shortly after tariffs on China imposed by U.S. President Donald Trump took effect on Tuesday, China's Finance Ministry said it would impose levies of 15% on imports of U.S. coal and LNG and 10% for crude oil as well as on farm equipment and some autos, starting on February 10.Four tankers, carrying 6 million barrels of U.S.

VLCC Rates Spike as US Sanctions Bite

Supertanker freight rates jumped after the U.S. expanded sanctions on Russia's oil industry, sending traders rushing to book vessels to ship supply from other countries to China and India, shipbrokers and traders said.Chinese and Indian refiners are seeking alternative fuel supplies as they adapt to severe new U.S. sanctions on Russian producers and tankers designed to curb the world No. 2 oil exporter's revenue due to its war in Ukraine.Many of the newly-targeted vessels, part of a so-called shadow fleet that seeks to avoid Western restrictions…

Plaquemines LNG Plant Nearing Test Mode Startup

A tanker full of liquefied natural gas (LNG) docked at Venture Global LNG's Plaquemines export plant in Louisiana, according to shipping data from LSEG on Friday, in what energy analysts said was a sign the plant could start up in test mode soon.The vessel named Qogir came from Norway full of LNG, according to LSEG data and energy analysts.LNG plants under construction, like Plaquemines, use super-cooled fuel to test and cool equipment in preparation for startup.After Plaquemines started pulling in small amounts of natural gas from U.S.

Esgian Week 27 Report: A Lull in Contracting

Esgian provides an update on the current lull in contracting in its Week 27 Rig Analytics Market Roundup.Report SummaryContractsAban Offshore-owned 250-ft jackup Aban II has received a letter of award (LOA) from Oil India for an offshore work program in Andhra Pradesh, India.Shelf Drilling North Sea has secured a new 17-month contract for the 400-ft Shelf Drilling Winner (previously known as Noble Sam Turner) jackup rig with TotalEnergies EP Denmark.Drilling Activity and DiscoveriesThe…

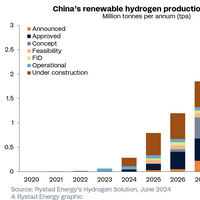

China Solidifying Lead in Global Electrolyzer Market

Mainland China's national plan identifies hydrogen as a key element in its low-carbon energy transition strategy. The nation is committed to using hydrogen for decarbonization, with Rystad Energy projecting the installation of approximately 2.5 gigawatts (GW) of hydrogen electrolyzer capacity by the end of the year.This capacity is expected to produce 220,000 tonnes per annum (tpa) of green hydrogen, 6-kilotonnes-per-annum (ktpa) more than the rest of the world combined. Under its national plan…

QatarEnergy Places $6B Order for 18 LNG Vessels to China’s CSSC

QatarEnergy has signed an agreement with China State Shipbuilding Corporation (CSSC) for the construction of 18 ultra-modern QC-Max size LNG vessels, marking a significant addition to its LNG fleet expansion program.The new vessels, with a capacity of 271,000 cubic meters each, will be constructed at China’s Hudong-Zhonghua Shipyard, a CSSC wholly-owned subsidiary, and will feature state of the art technological innovation and environmental performance.Eight of the 18 QC-Max size LNG vessels will be delivered in 2028 and 2029…

Equatorial, TFG and Sinopec are Singapore's Top Three Marine Bunker Suppliers in 2023

Equatorial Marine Fuel Management Services, TFG Marine and Sinopec Fuel Oil Singapore were the top three marine bunker suppliers in Singapore, the world's largest bunker hub, in 2023, latest data from the port authority showed.Equatorial maintained its top position for a second consecutive year, while Trafigura's TFG Marine rose one spot to become the second largest supplier, data from Singapore's Maritime and Port Authority showed.Sinopec Fuel Oil Singapore jumped 16 spots to become the third largest supplier, the data showed.

LNG Carrier Loses Power, Unable to Leave Terminal

Shipments of LNG from Australia Pacific LNG have come to a halt after a loaded tanker docked at the site lost power, operator ConocoPhillips and co-owner Origin Energy said on Tuesday.So far two LNG cargoes have been delayed, and Origin warned "it expected that more LNG cargoes will be deferred", as the stricken vessel was blocking other tankers from entering the facility on Curtis Island off Australia's east coast.APLNG, which has a capacity of 9 million metric tons per annum (mtpa) of LNG…

Sinopec Signs 27-Year LNG Supply Deal

State-owned Chinese firm Sinopec signed a new 27-year LNG supply and purchase agreement with QatarEnergy, the two companies said on Saturday.Under the agreement, the two companies will cooperate on the second phase of the Gulf Arab state's North Field expansion project, which will supply 3 million metric tons of LNG per year to Sinopec.A partnership agreement was also signed under which QatarEnergy will transfer a 5% interest to Sinopec in a joint venture company that owns the equivalent of 6 million tons per year of LNG production capacity in the North Field South project.The deal, signed at

QatarEnergy to Sign Long-term Asian LNG Supply Deal on Thursday - Source

QatarEnergy will sign a long-term liquefied natural gas (LNG) supply deal with an Asian entity on Thursday, a source with direct knowledge of the matter told Reuters.The deal will be one of many to come this year as the major LNG producer secures sales for its North Field expansion project, the source said on Tuesday. Competition for LNG ramped up last year after the Ukraine war, with Europe in particular needing vast amounts to help replace Russian pipeline gas that used to make up almost 40% of the continent's imports.

MODEC to Deliver Highly Complex FPSO for Equinor's $9B Project Offshore Brazil

Japanese FPSO supplier MODEC has won a contract with Equinor to supply an FPSO vessel for the BM-C-33 block of the Campos Basin offshore Brazil. The order comes just days after Equinor and its partners Repsol Sinopec Brasil, and Petrobras took the $9 billion investment decision to develop the BM-C-33 project in Brazil. Located in the Campos Basin, BM-C-33 comprises three different pre-salt discoveries – Pão de Açúcar, Gávea and Seat – containing natural gas and oil/condensate…

China Importing Russian Oil at Record Pace

China's seaborne imports of Russian oil are set to hit a record this month after refiners took advantage of cheap prices as domestic fuel demand rebounded, but Russia's plan to cut exports will likely cap buying in coming months.Hefty Chinese buying, alongside robust Indian demand, has been spurred by steep price discounts but is providing Moscow much-needed revenue after the Group of Seven imposed a $60 price cap on Russian crude."Price is the king," said a purchasing manager…

Oil Shipping and Refining Firms Benefit from Western Sanctions on Russia

Western sanctions on Russia have significantly reduced state oil revenues and diverted tens of billions of dollars towards shipping and refining firms, some with Russian connections.Most of the winners from the sanctions are based in China, India, Greece and the United Arab Emirates, at least 20 trading and banking sources said. A handful are partly owned by Russian companies.None of the firms is breaching sanctions, the sources told Reuters, but they have benefited from measures…

Chinese Shipyards Feast on Record LNG Tanker Orders as S.Korea Builders Fully Booked

China is making fast inroads in the market for newbuild liquefied natural gas (LNG) tankers as local and foreign shipowners turn to its shipbuilders for the specialty vessels because long dominant yards in South Korea are fully booked. Three Chinese shipyards - only one of them having experience building large LNG tankers - won nearly 30% of this year's record orders for 163 new gas carriers, claiming ground in a sector where South Korea usually captures most of the business.

Germany to Get New Qatari LNG flows Through QatarEnergy, ConocoPhillips Deal

Germany is set to receive new flows of Qatari liquefied natural gas (LNG) from 2026 after QatarEnergy and ConocoPhillips COP.N on Tuesday signed two sales and purchase agreements for its export covering at least a 15-year period. Since Russia's invasion of Ukraine in February, competition for LNG has become intense, with Europe in particular needing vast amounts to help replace Russian pipeline gas that used to make up almost 40% of the continent's imports.The deal, the first of its kind to Europe from Qatar's North Field expansion project…

Qatar Pens 27-year Deal with China as LNG Competition Heats Up

QatarEnergy has signed a 27-year deal to supply China's Sinopec with liquefied natural gas (LNG), the longest such LNG agreement so far as volatile markets drive buyers to seek long-term deals. Following Russia's invasion of Ukraine in February, competition for LNG has become intense, with Europe in particular needing vast amounts to help replace Russian pipeline gas that used to make up almost 40% of the continent's imports."Today is an important milestone for the first sales and purchase agreement (SPA) for North Field East project…

Ecochlor and SINOTECH Ink MOU

Ecochlor and SINOTECH have announced a new agreement to advance long-term sales, marketing and technical assistance and to foster mutual maritime relationships worldwide.The recent signing of a Strategic Cooperation Framework Agreement, in the form of a Memorandum of Understanding (MoU), has formalized the alliance between Ecochlor, Inc. (USA) and SINOTECH, CCS Co., LTD (China) in sales, marketing, after-sales support and technical assistance in engineering for the SINOTECH carbon capture and storage (CCS) unit.

Chinese Defense Firm Takes Over Lifting Venezuelan Oil for Debt Offset

China has entrusted a defense-focussed state firm to ship millions of barrels of Venezuelan oil despite U.S. sanctions, part of a deal to offset Caracas' billions of dollars of debt to Beijing, according to three sources and tanker tracking data. China National Petroleum Corp (CNPC) stopped carrying Venezuelan oil in August 2019 after Washington tightened sanctions on the South American exporter. But it continued to find its way to China via traders who rebranded the fuel as Malaysian, Reuters has reported.