Qatar's Bigger LNG Expansion to Squeeze US, Other Rivals

Qatar's planned expansion of liquefied natural gas (LNG) production could see it control nearly 25% share of the global market by 2030 and squeeze out rival projects including in the United States where President Biden paused new export approvals, market experts say.Qatar, one of the world's top LNG exporters, plans an 85% expansion in LNG output from its North Field's current 77 million metric tons per year (mtpa) to 142 mtpa by 2030, from previously expected 126 mtpa.Some market experts said that the move will have an impact on global projects in the United States…

Bid Round Raises Optimism in Brazil's Deep Water Industry

On December 13, 193 blocks were auctioned in Brazil’s oil and gas licensing round, signaling strong optimism for the industry, according to Wood Mackenzie.Highlights from these bid rounds included:• The total amount in bonuses was US$85 million• 44 blocks were acquired in the Pelotas Basin, a frontier area. Petrobras will operate 29 and Chevron 15• All Basins managed to attract bids, even Parana Basin• A single Brazilian operator, Elysian, acquired 122 onshore blocks• BP, Equinor…

Russia Pledges More Oil Data to Ship Trackers

Russia has pledged to disclose more data about the volume of its fuel refining and exports after OPEC+ asked Moscow for more transparency on classified fuel shipments from the many export points across the vast country, sources at OPEC+ and ship-tracking firms told Reuters.Russia is the only member of OPEC+ which contributes to export cuts rather than production cuts as part of its participation in the group's agreement to curb supplies. Market analysts have struggled to verify…

OPEC+ Prepares for 2024 Demand Uncertainty

Speaking after the November 30 OPEC+ meeting, Ann-Louise Hittle, vice president, Macro Oils, at Wood Mackenzie, said: “The decision by OPEC+ to continue with its previously announced production cuts and Saudi/Russia to extend their voluntary production cuts to the end of Q1 2024 is not a surprise, given current pricing and the uncertainty in the market over the strength of the global economy and oil demand growth. What is new is the additional voluntary cuts for Q1 2024 and announced by several OPEC+ producers.” The full tally of the additional cuts has not yet been announced…

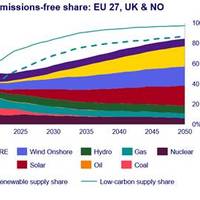

Emissions-Free Power Supply Expected to Rise to 85% by 2030 in Europe

The European power market will see its carbon intensity plummet as the region pursues ambitious climate-energy policies, but flexibility is key to enable this change, according to Peter Osbaldstone, Research Director, Europe Power & Renewables at Wood Mackenzie.Speaking at the Enlit Europe event in Paris, Osbaldstone told delegates that emissions-free supply will climb from 65% today to 85% by 2030, with 67% of power from renewables, according to latest Wood Mackenzie analysis.“The…

China Leads Global Renewables Race

Currently on target to reach a record-breaking 230GW of wind and solar installations this year, China leads the global renewables market. This is more than double the number of US and Europe installations combined, according to latest report ‘How China became the global renewables leader’ by Wood Mackenzie.Wind and solar project investment for China is expected to reach US$140 billion for 2023, according to the report’s findings.Alex Whitworth, Vice President, Head of Asia Pacific Power and Renewables research at Wood Mackenzie…

Biden's Clean Energy Agenda Faces Mounting Headwinds

Canceled offshore wind projects, imperiled solar factories, and fading demand for electric vehiclesA year after the passage of the largest climate change legislation in U.S. history, meant to touch off a boom in American clean energy development, economic realities are fraying President Joe Biden’s agenda.Soaring financing and materials costs, unreliable supply chains, delayed rulemaking in Washington and sluggish permitting have wrought havoc ranging from offshore wind developer Orsted’s project cancellations in the U.S.

Daphne Technology Sets Up Shop in Houston

Daphne Technology has established a U.S. subsidiary, Daphne Technology USA, and has appointed Jamie Brick, to lead its North American operations from Houston, Texas.Daphne Technology says its core focus is the development of sustainable solutions to combat harmful emissions. The company's SlipPure after-treatment system, which reduces methane emissions in the exhaust of natural gas-fueled engines (aka “slip”), has received approval in principle (AIP) from Lloyd's Register (LR) and DNV.

Private Investment Needed to Scale Up Low-carbon Hydrogen Power - Wood Mackenzie

Considerable private investment is required to scale up the low-carbon hydrogen economy in the United States by 2030, a report by consultancy Wood Mackenzie said on Tuesday, adding that the $7 billion allotted by the U.S. Department of Energy (DoE) to regional hubs was a significant step.Last week, the Biden administration announced seven proposed "hydrogen hubs" over 16 states would share $7 billion in federal grants. The two largest projects include $1.2 billion each for Texas…

Biden’s Offshore Wind Target Slipping Out of Reach as Projects Struggle

President Joe Biden’s goal to deploy 30,000 megawatts of offshore wind along U.S. coastlines this decade to fight climate change may be unattainable due to soaring costs and supply chain delays, according to forecasters and industry insiders.The 2030 target, unveiled shortly after Biden took office, is central to Biden's broader plan to decarbonize the U.S. economy by 2050. It is also crucial to targets of Northeast states hoping wind will help them move away from fossil fuel…

Asian Buyers May Seek US LNG if Australian Disputes Worsen

Major Asian buyers of LNG could seek US cargoes in the coming weeks if worker-related disputes at key LNG facilities in Australia escalate, analysts said, as electricity demand continues surge due to warm weather.Uncertainty over labour disputes at western Australian facilities run by Woodside Energy Group and U.S. major Chevron have spurred Asian LNG prices to their highest in five months, and analysts say they could rise further.As many as 700 workers at the Australian facilities could potentially down tools over pay and job security, the first of them as early as Sept.

Record US Crude Exports, Rising Shale Output Boosts Oil Flow to Houston

Oil pipelines from the top U.S. shale field to Houston that have run half empty are filling again as rising output has absorbed most of the space on lines to the main south Texas export hub in Corpus Christi.U.S. crude exports climbed to a record of about 4.5 million barrels per day (bpd) in March, spurred by recovering Chinese demand and competitive pricing for U.S. oil. Sanctions on Russian crude purchases by the European Union and Britain also have boosted demand.Pipelines…

Big Oil Splits Over Production vs Carbon Storage in Gulf of Mexico Auction

Exxon Mobil Corp on Wednesday bid for offshore blocks to store carbon dioxide underground during a government oil and gas lease sale in the U.S. Gulf of Mexico, while rivals Chevron Corp and BP Plc targeted areas for production.The largest U.S. oil company has been selling oil production blocks in the U.S. Gulf since 2018 as it shifts to more lucrative fields elsewhere. And yet, it bought dozens of blocks in the past couple of years in the same basin with a new purpose: burying carbon dioxide instead of pumping oil.The government oil license auction generated $264 million in high bids…

Frontiers Extend as Developers Eye Floating Wind Potential

America may have only entered the offshore wind sector recently, but it is wasting no time in playing catch-up. The White House has set targets of 30 GW of offshore wind capacity by 2030 and 110 GW by 2050. The focus so far has centred on bottom-fixed installations, but the prospect of higher energy yields in deeper waters where the wind blows stronger and longer now beckon. The White House has also set a floating wind deployment target of 15 GW by 2035.From a standing start, there are immense challenges in America’s offshore wind development.

China Eases Australian Coal Ban

The increasing need to secure energy supplies after easing COVID-19 restrictions has pushed China to gradually resume Australian coal imports and urge domestic miners to boost their already record output.The lifting of the unofficial ban on Australian coal imports, which were halted in 2020 in a fit of Chinese pique over questions on COVID's origins, is the clearest sign yet of the renewed ties between them. The resumption is also a reminder of their economic interdependence as Australia's raw materials play a crucial role in fuelling the export-oriented economy of China…

Australia Gas Price Cap Boosts LNG Import Terminal Plans but Adds risk

Australia's plan to control domestic natural gas prices, which producers say will deter the development of new supply, is expected to boost the prospects for proposed LNG import terminals but potentially defeat the government's aim to cut energy bills.Parliament is set to pass legislation on Thursday to cap gas prices at A$12 per gigajoule (GJ) for a year and then require a "reasonable price" for domestic sales after the cap expires.Industry players say the plan, which surprised producers…

This Decade's Oil Boom is Moving Offshore - Way Offshore

Global oil companies are pumping billions of dollars into offshore drilling, reversing a long decline in spending on the decades-long projects, including some in the remote iceberg waters far off Canada's Atlantic coast.Surging oil prices are encouraging the investments, along with Europe's mounting energy demand as the Ukraine-Russia war drags on. Offshore production sites are more expensive to build than onshore shale, the last decade's investment darling. But once they are up and running…

OpEd: Time To Shine for US Offshore Wind

It is clear only a few weeks into 2022 that this year can be a watershed moment for American offshore wind. The Department of the Interior has positioned 2022 to be a record year in terms of offshore wind lease offerings and project greenlights.At the end of 2021, the Bureau of Ocean Energy Management (BOEM), the regulatory agency responsible for offshore wind lease sales, released the document, Offshore Wind Leasing Path Forward 2021–2025. The document maps out potential new wind lease sales.

Indonesia Coal Crunch Continues, Some Firms Declare Force Majeure

Indonesia's coal supply situation remains critical, the state utility said, following the country's ban on exports of the fuel that drove up prices in top customer China on Tuesday.Indonesia, the world's top exporter of the coal used in power plants and China's largest overseas supplier, on Saturday announced the ban on exports during January to avoid outages at domestic generators. Indonesian authorities are set to reexamine the export ban on Wednesday.Late on Monday, Indonesia's state-owned electric utility Perusahan Listrik Negara (PLN) warned that "this critical period is not yet over"…

U.S. to Hold Offshore Wind Lease Sale for Two Areas in the Carolinas

The U.S. will hold a wind energy auction for two lease areas offshore the Carolinas on May 11, the U.S. Department of the Interior said Friday, as the Bureau of Ocean Energy Management (BOEM) has completed its environmental review.The lease areas cover 110,091 acres in the Carolina Long Bay area that, if developed, could result in at least 1.3 gigawatts of offshore wind energy, enough to power nearly 500,000 homes, the Department of the Interior said."The Biden-Harris administration is committed to supporting a robust clean energy economy…

Canada Sees West Coast LNG Revival as World Scrambles for Gas

Canada is taking a second crack at developing a liquefied natural gas (LNG) export industry on its west coast a decade after soaring costs and indigenous opposition derailed a previous wave of proposed LNG terminals.This time, companies are focusing on smaller west coast projects they bet will be cheaper and faster to build."Smaller project are easier to manage, especially in Canada," Enbridge chief executive Al Monaco told Reuters in an interview. "The need for global LNG is clearer now than it was before, we're getting a second chance and I hope we don't blow it this time.

Ban on Russian Commodity Exports to Accelerate LNG Growth, Energy Transition - Wood Mackenzie report

War in Ukraine is transforming the outlook for the supply, demand and price of hydrocarbons and the pace and cost of the energy transition. While the precise timing and implementation of future bans on Russian commodity imports are difficult to predict, a rewriting of energy trade flows is now underway. With the global economy on a knife edge and energy prices structurally higher, there a real risk of some global supply being lost. Europe’s push for more liquified natural gas…

BP Delivers Carbon Offset LNG Cargo to CPC in Taiwan

Oil major BP said Monday that its BP Singapore branch had delivered its first carbon offset liquefied natural gas (LNG) cargo to CPC Corporation, Taiwan (“CPC”), to the Yung An terminal in Taiwan in September 2021. The LNG was sourced from BP’s LNG portfolio."This is BP’s first delivery of carbon offset LNG in the Asia-Pacific region, following its first delivery globally to Sempra LNG at the Energia Costa Azul terminal in Mexico in July 2021. This new carbon offset LNG offer strengthens BP’s natural gas offering in the region…