Muted Tanker Fleet Growth Boosts 2024 Market Outlook

Niels Rasmussen, BIMCO’s Chief Shipping Analyst, predicts a stronger 2024 than 2023 for crude and product tankers.

This is despite weaker cargo volumes during the first half of the year.

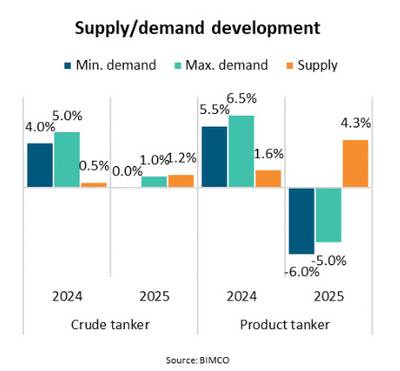

The BIMCO Tanker Shipping Market Overview & Outlook August 2024 states that muted fleet and supply growth in both markets during 2024 is a key enabler for the relatively significant strengthening of the supply/demand balance predicted.

Longer sailing distances due to rerouting of many ships via the Cape of Good Hope help ensure strong tonne miles and demand growth in 2024 even if cargo volume growth is limited. By 2025, based on the assumption that attacks on ships in the Red Sea may have ended, ships will be able to use normal routings throughout the year.

“Though we predict stronger growth in cargo volumes during 2025, the shorter sailing distances caused by the assumed return to normal routings will have a profound impact on tonne miles and therefore demand for ships,” says Rasmussen.

“We estimate that average sailing distances in the product tanker market will fall back to 2023 levels, whereas we estimate that the development in the crude tanker market will be less pronounced. Changes in the trade mix as the Atlantic/Pacific imbalance grows may ensure that average sailing distances will not fall all the way back to 2023 levels.”

Combined with weak supply growth, BIMCO therefore estimates that the crude market’s supply/demand balance will weaken only slightly during 2025.

On the other hand, the product tanker market will see a rapid expansion of supply in 2025 as the many ships recently contracted will begin to be delivered. As such, the forecast is for a potential for a significant weakening of the product tanker supply/demand balance.

“It is obvious that should ships not be able to return to normal routings in 2025, demand growth will be stronger, and we would then expect a slight strengthening of the crude tanker market, while the weakening of the product tanker market would be much less pronounced,” says Rasmussen.

During the first half of 2024, both markets have seen year-on-year growth in asset prices and time charter rates. Product tankers have also enjoyed a strong increase in freight rates, as measured by the Baltic Exchange, whereas weakness for both Aframax and Suezmax has kept a lid on the Baltic Exchange index for crude tankers.

As second-hand prices have increased more than newbuilding prices, the ratio between the price for a five-year-old ship and a newbuild has increased to on average 88% and 96% for product and crude tankers respectively.

BIMCO expects a strengthening of freight rates during the second half of 2024 compared to current levels.

“Though newbuilding prices depend on the combined order book of all ship sectors, we do not expect further large price increases unless dry bulk contracting activity picks up significantly. In this context it is also worth mentioning that several Chinese yards are expanding their capacity, which should also help to temper further price increases. We also doubt whether second-hand asset prices will increase significantly more relative to newbuilding prices.”

A shift back to normal routings as assumed in 2025 should begin to exert pressure on second-hand prices as well as on time charter and freight rates in the product tanker sector. The more balanced supply/demand development expected in the crude tanker sector may in the meantime help this market avoid a similar pressure.

Macro environment

Following 3.3% growth in the global economy during 2023, the International Monetary Fund estimates that the economy will grow 3.2% and 3.3% in 2024 and 2025 respectively.

On average, the Europe & Mediterranean, South & Central America and Sub-Saharan Africa regions are forecast to grow faster during 2024-2025 than they did in 2023. All other regions are forecast to on average grow more slowly than in 2023.

The average annual growth rates in North America, Oceania, East & Southeast Asia and South & West Asia are respectively forecast to be 12%, 8%, 6% and 2% lower than the growth rates in 2023.

Despite the predicted slower growth rates, the East & Southeast Asia and South & West Asia regions are still respectively forecast to drive 41% and 23% of global growth during the two years.