Floating Production Orderbook Picks Up Steam

29 FPUs Ordered over last 12 Months

IMA has just completed an in-depth analysis of the floating production sector. The 175 page report Floating Production Systems: Assessment of the Outlook for FPSOs, Semis, TLPs, Spars, FLNGs, FSRUs and FSOs is the 48th in a series of IMA reports on the deepwater production sector that began in 1996. Some highlights from the new report are below.

Recent Order Pace Consistent With Our Five Year Forecast – In March we forecast orders for 128 to 192 production floaters over the next five years – an average of 26 to 38 production floaters annually. We also expected the ordering pace to be at the lower end of this range in the early portion of the forecast period – then accelerate as the growing number deepwater drill rigs generate an increasing number of deepwater finds. The order intake over the past year supports our March forecast.

Return of Speculative Orders – Five speculative production floater orders have been placed over the past twelve months, reflecting optimism about the future market. Four FSRUs contracted within the past year did not have lease contracts at the time the order was placed. Subsequently, lease contracts have been agreed for two of the units. Two FSRUs remain without contracted employment after delivery. Also a speculative FLNG contract was recently placed based on conversion of an existing LNG tanker.

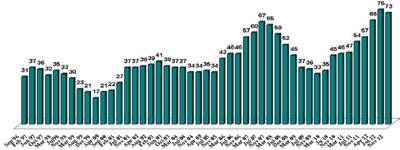

73 Floating Production Units Now On Order – The order backlog consists of 44 FPSOs, 7 production semis, 4 TLPs, 4 spars, 4 FLNGs and 10 FSRUs. In the backlog are 43 units utilizing purpose-built hulls and 30 units based on converted tanker hulls. Of the production floaters being built, 44 are owned by field operators, 29 are being supplied by leasing contractors. Brazil continues to dominate orders for production floaters. 26 units are being built for use offshore Brazil – 36% of the order backlog.

235 Floating Production Projects Being Planned – In terms of water depth, 27 percent of these projects are in ultra-deepwater, 15 percent are in water depth of 1000 to 1500 meters and 58 percent in less than 1000 meters. About 25 percent of the projects are in the bidding or final design stage, with major hardware contracts likely to be awarded within the next 12 to 18 months. Another 171 floater projects are in the planning or study phase.

Number of Planned Projects Has Been Growing – The number of floater projects now in the planning stage is 12 percent greater than a year ago, 64 percent higher than five years ago. Last year there were 210 floating production projects in the planning stage. Five years ago 143 projects were being planned. This increase reflects the bullish market fundamentals in the deepwater sector and the growing number of deepwater rigs available to look for oil and gas.

Deepwater Production Constraints Being Removed – According to Jim McCaul, head of IMA, “shortage of deepwater drill equipment has been a major bottleneck limiting deepwater development. This constraint is being removed. A large number of deepwater drill units have recently entered service and more than 95 drillships or semisubmersible drill rigs are on order. Delivery of these new units will increase deepwater drilling capability by 30 percent over the next several years – which will stimulate requirements for floating production project starts over the second half of this decade.”

Email: [email protected] or [email protected]