Ship Scrap Prices Cool

A noticeable degree of concern remains evident in the sub-continent ship recycling markets, as both Bangladesh and (especially) India witnessed unexpected declines in steel plate prices over the week. Even the Turkish market recorded a cooling of its own, with sentiments there reportedly starting to simmer off.

Bangladesh saw steel prices cool off and jump back up by about USD 20/LDT over the last couple of weeks and a healthy number of Chattogram Buyers have subsequently decided to wait-and-watch market developments before offering firm on any fresh units.

Even in India - where the situation is worse and where plate prices have fallen even more than Bangladesh, Alang Buyers are also re-evaluating their offers and as such, we have seen several Cash Buyers reportedly rolling back (and in some cases, even withdrawing) their offers on certain India-only units, where levels escalated well beyond comfort levels.

Despite this, many in the industry are expecting the recycling markets to remain firm for the second half of the year, given that China has announced it will no longer be exporting steel, thereby no undercutting of local inventories and billet prices can be expected at the various recycling destinations.

Overall, most are not expecting any upcoming decline (collapse?) to be as bad as that of 2008 or even 2015, when prices tumbled at an alarming rate – largely in response to black swan events i.e. the financial crisis of 2008 and the aggressive dumping of Chinese steel in 2015.

Barring another major disaster and / or black swan event, there seems to be a small chance of a similar decline this time, as much of the disruption caused by Covid-19 seems to have been factored in and many consider the worst to be over as the global vaccine (and now booster shot) roll out continues.

Meanwhile, the Delta variant continues to cause concern across the globe, but as vaccination rates continue at pace and certain countries continue to gradually open (the U.K., Israel, U.S.A., etc.), a certain level of optimism continues to linger in the global markets.

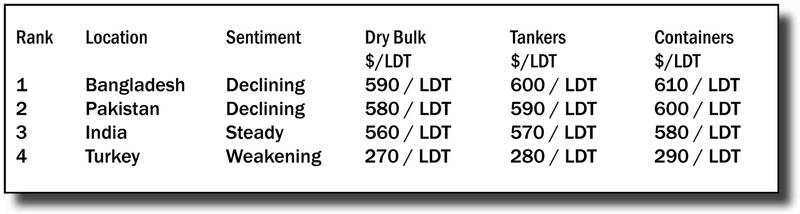

For week 34 of 2021, GMS demo rankings / pricing for the week are as below.