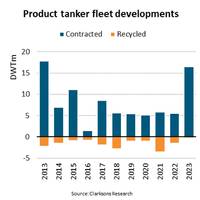

Product Tanker Scrapping Drops 82%

“In 2023, only seven product tankers with combined deadweight tonnes (DWT) capacity of 265,000 were recycled. This was a year-on-year drop of 82% compared to 1.5 million DWT (27 product tankers) recycled in 2022. It was also the lowest level of recycling seen since records began in 1996,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.Strong earnings and second-hand values, as well as a reduction in newbuilding deliveries, have likely contributed to the very low level of…

Ship Scrapping Business Picks Up with Dry Bulk Swoon

This week, several more sales have registered as sub-continent ship recycling markets come roaring back – and a previously subdued Bangladesh starts to seemingly find some form once again, with some workable L/Cs from privately financed (rather than state controlled) banks.Despite the ongoing discussions about an IMF loan in the amount of about USD 2 - 3 billion, end buyers have been working to find alternate ways to pay for vessels for some time now and without the troublesome central bank approval, which is denying the disbursements of U.S.

Ship Recycling Market Continues to Improve

Another solid showing from sub-continent markets has given encouragement to ship owners and cash buyers, to start testing potential prices with firm candidates. Indeed, several deals have been concluded off the back of these improved numbers, including one more Capesize bulker at firm levels basis an ‘as is’ Singapore delivery.Now that the Chinese New Year holidays have concluded, the expected bounce in freight markets has yet to materialize, so an increased number of dry bulk…

Ship Recycling Endures a Turbulent 2022

Like much of the world, one word adequately describes the ship recycling market in 2022: turbulent.According to GMS, prices reached decade long peaks above $700/LDT in the first quarter of the year before crashing back down by about $200/LDT, with certain trades seeing below the $500/LDT barrier and even into the high $400s/LDT on certain occasions.On the West End, the situation was no different in Turkey, where levels too hit a record $500/Ton for a brief period, only to plummet about half in value (about $250/MT) in a rather short period…

Ship Recycle Market Shows Some Positivity

After the last few weeks of insufferable performances from the major recycling markets, a shade of positivity was observed this week, as owners seem more confident in testing the waters and welcoming firm offers, especially those that are above $500/LDT.On the back of this seemingly positive note, one or two market sales of note even materialized this week and it does seem as though prices have bottomed out and sentiments have flatlined after losing a rather rattling $200/LDT, seen from the peaks witnessed earlier this year.Bangladesh continues to struggle with L/C financing limits, but the IMF loan is reportedly in the works of being approved and with most yards currently lying empty…

Markets: Ship Scrapping Perks Up

Following the sale of Capesize bulkers for recycling last week, the trend has continued this week as well, with further transactions reportedly taking place on units – including Capes and a Suezmax tanker, as the market finally shows signs of life after an absolutely inert summer, according to GMS.All of the major ship recycling destinations are still poised rather precariously, and Pakistan has seen some further depreciations on the currency towards the end of this week, whilst the country continues to battle floods…

Ship Recycling Markets Settles at the $600/ton Range

After the recent falls sustained across all sub-continent recycling markets, there does seem to be a new floor in the low $600s/LDT that has been reached.As expected, there have been instances of opportunistic offerings below the $600/LDT mark. However, very few sales (if any) have taken place in the high $500s/LDT, as there remain virtually no potential units to offer to Recyclers at these lower levels.If any new sales do take place in the weeks ahead, it is certainly clear that a $100/LDT fall has been fully materialized and optimistically…

Ship Recycle Market Continues Downward Trend

The ongoing sub-continent collapse in prices fully materialized this week, with all sectors talking down the market and refusing to offer anew on any fresh tonnage whilst they wait for markets to stabilize. As the Ukraine conflict endures, fundamentals continue their collapse at all of the major recycling destinations, as plate prices take turns to precipitously plummet (in India this week) and a combination of the two have likewise afflicted Bangladesh.A global currency meltdown at the major recycling destinations has also been unfolding…

Ship Recycling Prices Continue Downward Trend

Another woeful week of declining sentiments has left all of the major global ship-recycling markets on edge as the industry approaches the summer / monsoon months in the sub-continent. Moreover, it seems doubtful (at present) that any more noteworthy deals will likely be concluded, especially with the industry in such a state of disarray.Depreciating currencies and plummeting steel plate prices (especially in Pakistan this week alone) have left nearly all of the major recycling…

Ship Scrap Prices Continue to Fall

It has been a woeful week across all of the major ship recycling markets, with some tumultuous declines leading to minimal interest and offers on any available tonnage.It increasingly seems as though it may be a much softer summer given prevailing sentiments, especially as prices ease back towards the (still impressive) $650s/LDT mark.Most of the deals concluded at $700/LDT (or above) were always seen as precariously positioned, and it remains to be seen whether end buyers will be happy to dip back into the buying at these comparatively lower levels…

Ship Scrap Prices Take a Turn for the Worse

Sub-continent markets have taken a turn for the worse this week, as collapsing steel prices in India and Eid holidays in Pakistan, Bangladesh, and Turkey have led to depressed sentiments and virtually no new offers emanating on any available tonnage.Most end users now want to wait-and watch-market developments before offering anew on vessels at far lower levels that seem more in line with the realistic $650s/LDT than the struggling $700s/LDT most in the industry were gunning for…

Shipbreaking: Ship Recycling Prices Head Up Again

According to GMS, it has been another impressive week in both the Indian and Pakistani markets, with reportedly several sales taking place above the $700/LDT mark. These levels seem increasingly indicative of a market that is firm and these repeat record levels should hold for the time-being (especially after the recent volatility). Capacity also remains ripe across the sub-continent markets and demand is certainly firm in both India and Pakistan, as levels push on off the back…

Markets: Volatility Remains in the Ship Scrap Market

It has been another challenging week in the sub-continent markets, with a resurgent India and a Bangladeshi market that is still reeling from some of the recent falls in local steel, which have seen nearly $50/LDT knocked off the prices this week alone, according to GMS.India has managed to regain over half of the falls seen over the previous few weeks, but the market overall does remain extremely volatile.Commodity prices and volatile currencies show few signs of cooling off any time soon, as the Russian invasion of Ukraine enters its second month and thus far shows no signs of abating.

Concerns Around War in Ukraine Help to Keep Ship Scrap Prices Strong

It was another incredibly firm showing from the sub-continent markets this week, according to GMS, particularly Bangladesh and even a recently resurgent India (who now seem to be competing even more on tonnage), whilst Pakistan misses out on units once again, largely behind on the numbers due to local concerns surrounding the impact of the ongoing war in Ukraine.Except China, local steel plate prices have made some impressive gains across the board in the top recycling international destinations this week, especially in India and Bangladesh.

War Shocks: Ship Scrap Prices Spike on Russian Invasion of Ukraine

According to ship recycling leaders at GMS, sub-continent markets remain firmly poised for another week, particularly in Bangladesh and a now resurgent India.Pakistan, as seems to be typical for the market there, has gone quiet over much of the international uncertainty surrounding the possible outcome of the recent Russian invasion of Ukraine.Bangladeshi buyers have in turn, ramped up their buying and price offerings, mindful of the fact that some increased oil / gas prices due to the unfolding crisis in Ukraine…

As Steel Prices Rise (again); Ship Scrapping Prices Rise, Too

Following recent upward moves on domestic steel plate prices at nearly every major recycling destination, it was another week of firm pricing and a sub-continent market that is still on an aggressive footing for the most part.Demand remains rampant and capacity at yards remains open for any available tonnage (market or otherwise), leading to bidding wars on any of the marginal number of choice units hitting the recycling markets.L/Cs are of continuing concern across the sub-continent destinations…

Bangladesh's Hazardous Shipyards Launch Race for Cleaner, Safer Future

When Samrat Hossain first started cutting up old ships weighing thousands of tonnes in a southeast Bangladesh shipbreaking yard a decade ago, all he would wear was a cap or a helmet.But these days, the 27-year-old spends nearly an hour each day before work putting on his protective gear, which includes special masks, gloves, boots, and a suit."A lot has changed in the last 10 years. Before, PPE (Personal Protective Equipment) was not a factor. But today we are not allowed to work without it…

Ship Recycle Prices Settle - GMS

Prices have settled into a new reality this week as end buyers get back to buying at levels just shy of the historical peaks seen this year, closer to (and in some cases, just over) $600/LT LDT from the market leaders, on high-spec units.It has been a phenomenal year for the sub-continent ship recycling markets thus far, which has seen prices more than double in the space of the last 12 months, especially as supply gets tight. At the peak of the pandemic in the middle of 2020…

Ship Scrap Prices Cool

A noticeable degree of concern remains evident in the sub-continent ship recycling markets, as both Bangladesh and (especially) India witnessed unexpected declines in steel plate prices over the week. Even the Turkish market recorded a cooling of its own, with sentiments there reportedly starting to simmer off.Bangladesh saw steel prices cool off and jump back up by about USD 20/LDT over the last couple of weeks and a healthy number of Chattogram Buyers have subsequently decided…

VLCC Owners Avoid Scrapping ... For Now

During the first seven months of 2021, only three actively trading Very Large Crude Carriers (VLCCs) have been sold for demolition. The current market for seaborne transportation of crude oil is weak and has caused freight rates to drop to multi-year lows. Despite this, crude oil tanker shipowners are not seizing the opportunity to reduce capacity and send less efficient units to the demolition yards.The subdued demolition activity is seen at a time when steel prices offered in Bangladesh, India, and Pakistan – the world’s top ship demolition locations – are at an all-time high.

Ship Recycle Prices Hurtle past $600/LDT

Demo markets continue their upward trajectory this week surpassing the $600/LDT barrier on a number of select units. This may be due to a general paucity in the overall supply of tonnage over these quieter summer/monsoon months, while local steel plate prices have regained momentum of late, especially after stalling a few weeks ago.Just how much longer this momentum will last remains to be seen. But for now, fundamentals for this seemingly sustained rally (of demand and pricing)…

Ship Recycling Prices March Higher, Doubling in a Year

Far from the traditionally expected slowdown during the monsoon / summer months, sub-continent recycling markets fired on at pace once again this week, and a slowdown in the supply of tonnage of late is likely contributing to some overly aggressive offerings from hungry end buyers.Steel plate prices in Bangladesh and Pakistan continue to firm, while India has cooled off and remains tentative on any fresh/incoming vessels, especially after a bullish last few weeks.Notwithstanding, there certainly must be a ceiling on proceedings as prices have doubled over the last year, reaching the ongoing un

Ship Recycling Prices, Activity Remain at Historic Highs, say GMS CEO

Dr. Anil Sharma, CEO and founder of GMS, is a dominate player in the world’s ship recycling business. MR TV caught up with him in late June 2021 for insights on the pace and direction of ship recycling activity and pricing.Dr. Sharma, to start, can you give us an overview of the ship recycling market as you see it today?Thank you, Greg. Let's start with prices because that's the news of the hour. Today we are at about 70% of record numbers in the ship recycling market. In 2008…