Are Workboats Really Going Green?

Tugboat and towboat owners across the nation eye fuel efficiency and emission reduction technologies and techniques in advance of increasingly stringent regulations.

he first half of 2025 has seen a great deal of attention on emissions from vessels, with an eye towards their continued reductions in the coming years. Mid-April saw the International Maritime Organization (IMO)’s much anticipated Maritime Environment Protection Committee’s MEPC 83 meeting participants lay out plans for reduced greenhouse gas emissions in the coming years, which will be voted on later this year (at the October MEPC 84 meeting). If approved, the new rules would come into effect in 2027. According to the IMO, the participants arrived at a “legally binding framework to reduce greenhouse gas (GHG) emissions from ships globally, aiming for net-zero emissions by or around, i.e close to 2050…The IMO Net-zero Framework is the first in the world to combine mandatory emissions limits and GHG pricing across an entire industry sector.”

The plethora of regulations concerning fuels has attracted attention throughout the maritime community. Commentators have noted that MEPC 83 took place on the heels of January 2025 commencing of the “Fuel EU” initiative impacting both carbon and nitrogen emissions from vessels trading within, or into/ out of countries in the European Union. The new IMO measures (to be implemented through the International Maritime Pollution Convention, or “MARPOL”, if the IMO measures are approved in October) are very similar to the Fuel EU dictates- with rules incentivizing decreasing carbon intensities for fuels over time, but they are separate and distinct.

In the 2020’s and decades beyond, disparate maritime emissions reduction dictates might converge. An industry expert, Adrian Colson, who runs the “2050 Marine Energy” consultancy, told Marine News, “There’s been some hope that EU and IMO regulations will come together into one coherent body of rules.” Tolson opined in an interview with OPIS (a division of Dow Jones), that: “I think it’s pretty universal in the shipping community that they don’t want multiple regulatory regimes to deal with emissions. Ideally the MEPC83 framework will satisfy different national jurisdictions and unify the regulatory control under IMO.”

Though the United States is a signatory to the MARPOL convention (with U.S. flagged vessels subject to its Annex VI dealing with air pollution), the MEPC 83’s new attention-grabbing dictates on carbon emissions will not be applicable throughout the inland/workboat sector, as these pertain to vessels of 5,000 gross tons or more, trading across international borders. Maritime emissions rules have been enforced through U.S. Coast Guard (USCG) inspections; the USCG works in conjunction with the Environmental Protection Administration (EPA). Among the non-Federal jurisdictions at the state level, the California Air Resources Board (CARB) has been the most aggressive.

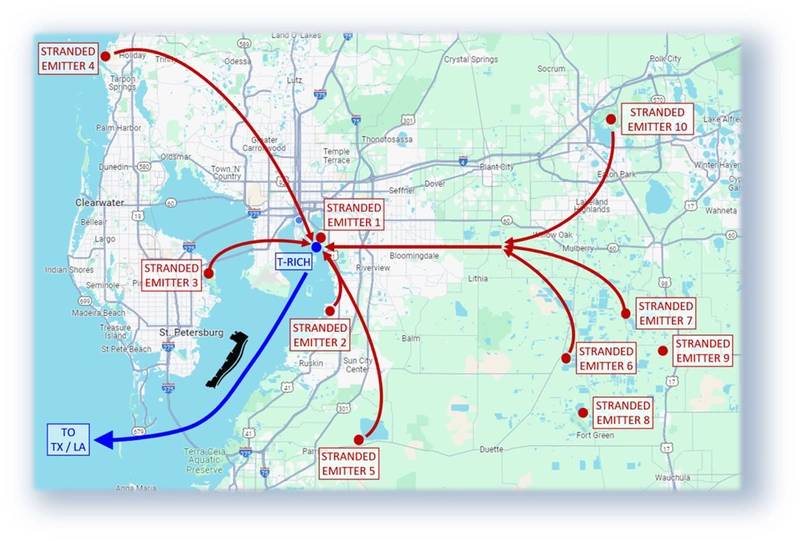

Map of CO2 Emitters and possible TRICH hub in Port Tampa Bay.

Map of CO2 Emitters and possible TRICH hub in Port Tampa Bay.

Map source TRICH

What is the U.S. Workboat Sector Doing?

In recent years, U.S. operators have implemented diverse strategies for reducing emissions. Moran Towing, with headquarters in New Canaan, Connecticut and operating tugs escort/ assist (as well as towing) all along the East and Gulf Coasts, told Marine News: “We were very pleased to see the results – an estimated 5,000 metric ton reduction of CO2 emissions since 2022, which is the equivalent of taking 1,000 cars off the road for a year.” Moran emphasized the importance of industry-wide efforts, saying: “The foundation of successful sustainability efforts is strategic collaboration. In 2021, we were part of a small group of like-minded companies that co-founded the Blue Sky Maritime Coalition with the aim of accelerating the North American maritime industry toward net-zero greenhouse gas emissions.” The company, which was the recipient of the highest level USCG William M. Benkert Marine Environmental Protection Award in 2024, adds: “On the newbuild side, since 2017 we have launched 10 tugboats that meet the EPA’s stringent Tier 4 emissions requirements, and all of them meet or exceed the Low Emissions Vessel standards.” Recent newbuilds include Mary Jane Moran, built at Master Boat Builders (Coden, Alabama) christened April, 2025 in Port Arthur, Texas.

Not surprisingly, vessels working in West Coast ports, or trading coastwise, have also played an important role in innovative efforts to reduce emissions. These include Crowley’s eWolf, an all electric ship assist tug built at Master Shipbuilders now serving San Diego. West Coast stalwart Saltchuck Marine is building a quartet of Robert Allan design escort tugs at Florida’s Eastern Shipbuilding, with the first to be delivered in 2026. According to Saltchuck, the new vessels will “comply with EPA Tier 4 and California Air Resources Board (CARB) environmental requirements.” Earlier, in 2021, Crowley Marine had begun fueling a San Francisco based tug, renamed Veteran (which had been chartered in from BayDelta Marine) with a biofuel blend. Recent newbuilds include Mary Jane Moran, built at Master Boat Builders (Coden, Alabama) christened April, 2025 in Port Arthur, Texas.

Recent newbuilds include Mary Jane Moran, built at Master Boat Builders (Coden, Alabama) christened April, 2025 in Port Arthur, Texas.

Photo source Moran Towing Corporation

A possible future game-changer, in early stages, is the recently announced conversion of a small tugboat, slated for operation in the Port of Los Angeles, to electric power (with a 450-kW dual-motor drivetrain powered by lithium-ion battery packs) by California-based Arc Boat company. The venture capital backed operation explains in its branding that: “…we're continuing to chart new waters until everything that floats is electric”. The company started with a line of electrified leisure boats, and now hopes to deploy its technology in larger tugboats. According to the company, “Tugboats allow us to scale our technology in a logical way that addresses a range of needs. Our retrofit is the beginning of a major workboat transition.”

CARB’s Commercial Harbor Craft Rules, with an aim of reducing emissions from vessels, in place since January, 2023, have been the center of a controversy with vessel owners and maritime industry trade associations representing them. The legislation, which is applicable to all manner of tugs, whether providing ship assist/ escort, towing, or propelling Articulated Tug Barges (ATBs) working in California ports, would essentially require existing vessels to meet increasingly stringent targets for vessel emissions. As a practical matter, in many cases, compliance would require boats to be retrofitted with new propulsion, well before the end of useful lives for their existing plant. A bill (in the California Assembly) to delay the legislation’s introduction was vetoed, in Sept. 2024 by California’s Governor.

The maritime business took notice, in mid-January 2025, when CARB scaled back enforcement efforts on surface transport modes, but with efforts aimed at the maritime sector remaining in place. The American Waterway Operators (AWO), representing the tug and barge industry in Washington, D.C., in a late January letter to the state’s Governor, focused on CARB requirements (approved by the EPA) concerning diesel particulate filters (DPFs). In the communication, AWO President/ CEO Jennifer Carpenter wrote that: “The U.S. Coast Guard (USCG) has expressed safety concerns over the installation of this technology, and CARB has failed to consider the repeated concerns about DPFs expressed by the USCG, vessel owners, and maritime labor unions.” After noting a likely retrofit cost of $5 million per vessel, she wrote that: “…new vessel designs must accommodate risky DPFs even though this technology does not currently exist”

A very limited number of grant programs for engine repowering are available in California. In 2024, Delta Audrey ( the same vessel which had been on charter to Crowley, built 2014, 6,800 HP from 2 x Caterpillar 3516C Tier 2 engines) and a near sister vessel, Delta Billie were both approved for $4.6 million and $2.35 million, respectively ,of “emission reduction grants” (funded jointly by CARB’s Carl Moyer Program and the Volkswagen Environmental Mitigation Trust). Grant money will supplement capital advanced by the tugs’ owner. Northern Marine tug JOE DERBAS

Northern Marine tug JOE DERBAS

Photo source Northern Marine

What lies ahead?

In the early days of the Trump 2.0 administration, the situation is nuanced. Sections of the EPA (which had approved the language in CARB’s new rules during the waning days of the Biden administration) have been in Trump’s crosshairs as the new administration is steering the agency towards a more lenient attitude on regulation of fossil fuels. At the IMO’s now concluded MEPC 83, the U.S. delegation did not support the proposals now moving forward; indeed, the U.S. representatives were reportedly absent from the IMO’s grand meeting hall in London in April, 2025.

Two other developments – carbon capture and emission trading – are in the very early stages in the U.S. maritime segment. Adrian Colson suggested that: “Smaller ships, within reason, may be better suited to near shoring supply chains and shorter voyages might suit vessels that require more frequent fueling of alternative fuel and disposing of CO2 from carbon capture.” It is also worth noting that CARB, on the West Coast, has set up the Low Carbon Fuel Standard (LCFS) which is linked to a “cap-and-trade” program, where emissions allowances, including those from the transport sector, can be traded, providing financial incentivizes for cleaner operations. To date, this program has been used shoreside- including in funding charging stations, rather than directly by vessel operators.

BIOFUELS Middle River tug GWYNETH ANNE with barge at Chicago.

Middle River tug GWYNETH ANNE with barge at Chicago.

Photo source Middle RiverMaritime trades in other parts of the country are also seeing efforts towards sustainability, with biofuels playing an increasing role in the business- not surprisingly on the rivers in the agricultural Upper Midwest. A recent posting from the Illinois Soybean Association (ISA) noted that “A bipartisan bill passed in 2022 to promote the use of higher biodiesel blends is making a significant impact once again in 2025.” Members in the ISA’s B20 Club (with B20 being a very common biofuel blend) includes the mid-sized barge outfit, American River Transportation Company (ARTCO), linked to grain giant Archer Daniels Midland (ADM), as well as Middle River Marine- a multi-modal bulk materials logistics provider (whose business includes tug and barge operations) with multiple locations in Illinois and northern Indiana waters.Another boat operator, Northern Marine LLC, based in Joliet, Illinois, covers the Illinois River system from Marseilles IL north through Chicago and over to the harbors in Indiana, with a fleet of seven tugs. Jeremy Nichols, Director of Development and Sustainability, explained to Marine News that: “We are currently running B17 biodiesel on our vessels…in 2024, we found 734 metric tons of carbon dioxide reduced through analyzing of our green initiatives, specifically use of bio fuels for our vessels accounted for 54% of that.”

Middle River’s Vice President of Operations, Pete Colangelo, told Marine News: "Middle River is committed to driving meaningful progress toward a sustainable future, and adopting the use of B20 biodiesel is a part of that commitment. By transitioning our fleet to this renewable fuel blend during the summer months, we’re achieving reductions in greenhouse gas emissions, improving engine longevity, and maintaining operational efficiency—all without requiring expensive infrastructure changes.” Talking about the B20 blend, he said that it’s a “… proven, practical solution that delivers measurable benefits. This isn’t just about checking boxes; it’s about implementing ‘real solutions for real change’ and making a positive impact on our communities and the world."

CARBON CAPTURE Image courtesy Aptamus Carbon SolutionsCarbon capture, mentioned by Tolson, enables usage of existing fuels with a carbon content, even as the world moves towards reduced emissions. The technologies enable emitted CO2 to be isolated and then transported to an underground location for sequestration. Capturing the carbon emissions from vessels at sea is still in very early stages; however, vessel transport of greenhouse gasses generated by industrial processes on land is also under consideration. Tampa, Fla based OSG (absorbed into Saltchuck in mid-2024) has received a pair of Federal grants for developing capabilities for potentially transporting CO2 generated at landside facilities around Tampa aboard an Articulated Tug Barge (ATB) designated as a liquefied carbon dioxide (LCO2) barge. The CO2 would be loaded into the barge from shoreside facilities (including Tampa Regional Intermodal Carbon Hub, or “T-RICH”, a hub in Port Tampa Bay that OSG would operate as these plans advance) and then discharged into underground storage locations offshore in the U.S. Gulf. The program, COAST20 (officially Carbon Ocean and Storage Transport 20) will also provide options for shoreside discharge in Louisiana and subsequent regasification before piping to underground storage on land.In May, American Bureau of Shipping (ABS) announced that it had awarded Approval In Principle (AIP) to Overseas Shipholding Group, Inc. (OSG), the parent company of Aptamus Carbon Solutions, for its preliminary design for the 20,000 dwt LCO2 barge. At around the same Aptamus entered into a deal with Entr, the consultancy arm of Aker Solutions, for the front end engineering and design (FEED) of the T-RICH- liquefaction processing terminal at Port Tampa Bay, and for a landside discharge and regassification terminal at LBC Tank Terminals, Baton Rouge, Louisiana, for COAST20.

Image courtesy Aptamus Carbon SolutionsCarbon capture, mentioned by Tolson, enables usage of existing fuels with a carbon content, even as the world moves towards reduced emissions. The technologies enable emitted CO2 to be isolated and then transported to an underground location for sequestration. Capturing the carbon emissions from vessels at sea is still in very early stages; however, vessel transport of greenhouse gasses generated by industrial processes on land is also under consideration. Tampa, Fla based OSG (absorbed into Saltchuck in mid-2024) has received a pair of Federal grants for developing capabilities for potentially transporting CO2 generated at landside facilities around Tampa aboard an Articulated Tug Barge (ATB) designated as a liquefied carbon dioxide (LCO2) barge. The CO2 would be loaded into the barge from shoreside facilities (including Tampa Regional Intermodal Carbon Hub, or “T-RICH”, a hub in Port Tampa Bay that OSG would operate as these plans advance) and then discharged into underground storage locations offshore in the U.S. Gulf. The program, COAST20 (officially Carbon Ocean and Storage Transport 20) will also provide options for shoreside discharge in Louisiana and subsequent regasification before piping to underground storage on land.In May, American Bureau of Shipping (ABS) announced that it had awarded Approval In Principle (AIP) to Overseas Shipholding Group, Inc. (OSG), the parent company of Aptamus Carbon Solutions, for its preliminary design for the 20,000 dwt LCO2 barge. At around the same Aptamus entered into a deal with Entr, the consultancy arm of Aker Solutions, for the front end engineering and design (FEED) of the T-RICH- liquefaction processing terminal at Port Tampa Bay, and for a landside discharge and regassification terminal at LBC Tank Terminals, Baton Rouge, Louisiana, for COAST20.

These types of solutions will benefit from financial incentives, and politics at the national level has recently been rearing its head. Tax credits for carbon capture projects (linked to “Regulation 45Q” in the Tax Code, enhanced by legislation enacted during the Biden administration) are under close scrutiny, in the ongoing discussions of a new tax package taking place on Capitol Hill. As the legislation moved through the House of Representatives, the language included some restrictions on the 45Q credits.

OPERATIONAL INNOVATION AND SCALING UP Northern Marine tug DEREK E in Chicago.

Northern Marine tug DEREK E in Chicago.

Photo source Northern Marine

Emission reduction is tied to much more than a choice of fuels. Moran Towing said: “… our recent sustainability programs have focused on optimizing our existing operations while leveraging new technologies. One example is our program to deploy Internet of Things (IoT) technology to increase the efficiency of our day-to-day tugboat operations.“ Jeremy Nichols, from Northern Marine, added that: “Other things we are doing are continuously looking at our vessel planning efficiency to reduce unnecessary or redundant trips, increasing the use of shore power when a vessel is idling,…” He also cited the switch to an electric crane which can replace multiple ground-based diesel cranes at Northern’s cleaning and servicing facility in Lemont on the Chicago Sanitary & Ship Canal, as well as looking at potential installation of a vessel exhaust capture system.

When asked about the course ahead, he said: “As we move through our vessel re-powering cycle, we are looking at what new technology can play into that we expect a very big announcement on that in the coming months.”With the advent of alternative fuels, size and scalability matters as much as ever. In the commercial realm, equity analyst Ben Nolan, in multiple reports on Kirby Corporation (NYSE: KEX) during his tenure at Stifel (he has subsequently moved on), had suggested that the giant was on the prowl for acquisitions, with economies of fuel buying at least partly playing a role in this thinking. Adrian Tolson had noted that fuel issues, and the need for buying power, would impact consolidation. In the OPIS interview, Tolson, with four decades in the business, noted that: “It’s hard to argue that this trend will not continue, and it is not only driven by alternative fuel adoption. There are clear advantages for larger shipping companies with greater financial strength to be able to address the challenges of modern shipping, which put decarbonization, digitalization and transparency front and center. We will see fewer small operators, but I am not sure they will entirely disappear. “

But he did offer a qualification, saying that: “Shipping has a unique ability to surprise us and perhaps this is one of those times as the market adapts to allow the small investor/owner a role in shipping.”