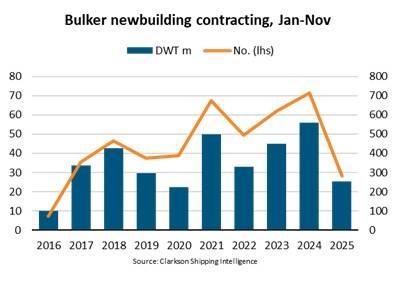

Bulker Newbuilding Contracting Drops to Five-Year Low

Between January and November 2025, the capacity of bulker newbuilding contracting has fallen 54% y/y to 25m DWT, reaching its lowest level since 2020. Consequently, the dry bulk orderbook is now 4% smaller than a year ago, accounting for 11% of the dry bulk fleet.

“Contracting has likely eased due to a cloudy market outlook,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.

The number of ships contracted has seen an even steeper decline, down 61% y/y so far in 2025. Only 281 ships have been ordered, the lowest number since 2016. While contracting has fallen across all segments, orders in the capesize segment, which contains the largest ships in the dry bulk fleet, have been comparatively higher.

The outlook for freight rates over the next two years appears strongest for the capesize segment. Cargo demand growth could soften but sailing distances are expected to lengthen, boosting tonne mile demand. Furthermore, supply growth is estimated be low amid limited deliveries. Capesize ships face the longest lead times with 77% of contracting so far this year scheduled to be delivered after 2027.

“Contracting in the supramax and panamax segments has declined significantly, falling 76% y/y and 55% y/y respectively. Both segments have comparatively large orderbooks and therefore an expected increase in ship deliveries in 2026 and 2027. In addition, their demand outlook appears weak, while a potential return of ships to the Red Sea poses a further downside risk to demand for these segments. These factors could lead to weaker freight rates over the next two years, which might be discouraging newbuilding contracting,” says Gouveia.

Chinese shipyards have received 81% of new orders in terms of ship capacity, up nine percentage points compared to 2024, at the cost of Japan’s market share. China has thereby remained by far the most dominant shipbuilding nation in the bulk sector in 2025, despite the previous announcement of the now suspended USTR port fees on Chinese built ships. Shipments to or from the US only account for 8% of global cargoes, which, paired with several fee exemptions, likely contributed to continued preference for Chinese yards.

One factor supporting newbuilding contracting is a 3% drop in prices since the start of 2025, compared to a 4% increase in five-year-old second-hand prices. Currently, a five-year-old second-hand ship will on average sell for 93% of the price of a newbuilt. This is a reflection of a strengthening of market conditions and freight rates during the second half of the year. While lower prices could theoretically encourage contracting, lead times for new orders remain high. Therefore, ships ordered today may be delivered under vastly different market conditions.

“In 2025, the share of contracted capacity designed to use alternative fuels has decreased, but the share designed to allow for future retrofitting has increased. This could reflect lingering uncertainty over the availability of alternative fuels. Overall, 12% of the current orderbook could use alternative fuels upon delivery, of which 48% could use methanol, 37% LNG and the rest could use ammonia,” says Gouveia.