International P&I insurer continues positive trend into 2015

The American Club reported solid progress during 2014 at the annual meeting of its members held in New York today. Despite a challenging economic climate, the club’s business had developed favorably, and 2015 had started on a positive note.

Tonnage and revenue grew strongly at the outset of 2014, but faded slightly later in the year as freight markets struggled. However, premium pricing remained firm, despite the enduring effect of “churn” as older, higher-rated vessels continued to be replaced by younger, lower-rated ships.

Claims for the club’s own account had developed at a moderate pace during 2014, extending the favorable trend of recent years. International Group pool claims were also showing a benign emergence at year-end.

Net premiums earned during 2014 were about 5 percent higher than the figure for the previous year, although total income was down slightly, to $102.3 million, owing to a lower realized investment gain. Incurred losses, at $65.9 million, were marginally higher than the $65.1 million recorded for the previous year.

After-tax comprehensive income for the year was $1.3 million, generating an increase in total members’ equity to $58.6 million as of December 31, 2014, 1 percent higher than the figure a year earlier. Statutory surplus grew to $64.8 million at year-end, compared with $63.6 million for 2013.

The club’s investment earnings provided a solid contribution to its overall results. Its fixed income portfolio performed well during 2014 so that, despite lower stock market returns, an overall gain of just under 4 percent was achieved, bettering relevant benchmarks.

The trends noted in 2014 were asserting themselves with growing vigor into 2015. As of March 31, 2015, the club’s statutory surplus had increased by 9 percent to $71 million, while its Generally Accepted Accounting Principles (GAAP) free reserves were up 11 percent to $65 million. Statutory free reserves per ton were approximately $4.65 at year-end 2014. A further increase, to $5.03, was recorded by the end of the first quarter this year.

Members were also told that the 2012 policy year was being closed as originally budgeted. The small deficit for the year of just over $3 million would be subvented by the club’s contingency fund which stood at a record figure of nearly $90 million as of March 31, 2015.

Eagle Ocean Marine (EOM), the American Club’s fixed premium facility, which focuses on the operators of smaller vessels in local and regional trades, was also performing well, making a strong contribution to overall results. EOM continued to expand its market footprint during 2014, particularly in Asia. EOM’s combined ratio to date was less than 70 percent, testimony to its prudent approach to risk selection. This holds the promise of growing success over the years ahead.

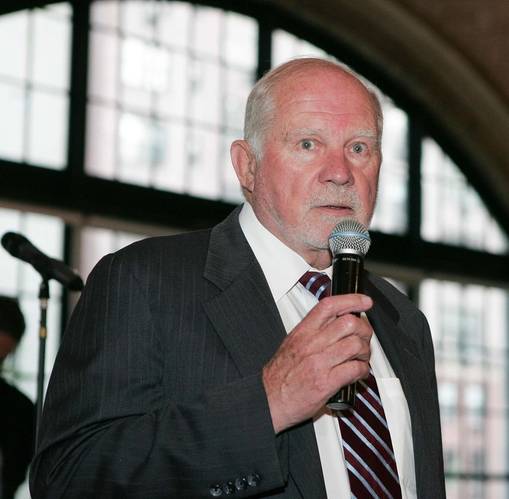

In assessing the performance, the club’s chairman, Arnold Witte of Donjon Marine Co., Inc., said, “2014 was a difficult year, not least for the shipping community itself. Nevertheless, the American Club made excellent progress. This is being sustained into 2015.”

He continued, “Many challenges lie ahead. The slump in the dry bulk markets continues to cause concern. It is to be hoped that freight rates will rise decently, at least over the medium term, as the global economy improves. The board remains optimistic about the future and the club will remain committed to an exceptional level of solidarity with its members.”

Joe Hughes, chairman and CEO of the American Club’s managers, Shipowners Claims Bureau, Inc., added, “Notwithstanding a difficult business environment, 2014 was a good year. Claims exposures continued to develop favorably, premium pricing stayed firm and investments performed well. In addition EOM saw its profits rise, the club’s surpluses increased and free reserves per ton strengthened considerably. Our loss prevention and Enterprise Risk Management (ERM) initiatives advanced energetically and our service capabilities were expanded. These positive trends have continued into 2015. It is especially encouraging to see a further increase in the club’s surplus during the first quarter.”

Hughes concluded, “The club’s recent progress will provide a firm foundation for the further development of our agenda over the years ahead. Its business plan anticipates a range of exciting opportunities to expand its outreach further throughout the global maritime community. In this, as in everything else it does, the American Club stands ready to embrace the challenges of a changing world and growing competitive pressures.”