Ship Recyclers "Treading Water"

The Indian sub-continent ship recycling markets continues its southward trajectory with every passing week as the final quarter of the year gradually approaches, reports cash buyer GMS.“Ongoing currency woes (especially those recently spiraling out of control in India), tariff shocks across the sub-continent, faltering steel dynamics, suffocated offerings on the back of a now sagging demand have come together to drag sentiment decisively into terminally negative territory.”The Baltic Dry Index edged modestly higher to end the week at 1…

Quiet Time for Ship Recyclers

As August winds down, global markets gave us another week of shy half-gestures and newlywed hesitant moves, says cash buyer GMS, all while confidently pretending they were marching somewhere important.“Oil traders kept one eye on inventories, the other on geopolitics, and both cockeyed on the clock as WTI closed at USD 64/barrel with Brent just above USD 68—moves so small they looked like rounding errors. Yet the steady draw of about 3 million barrels from U.S. reserves keeps feeding the illusion of momentum heading into September as U.S.

As China's Economy Slows, So Too Does Dry Bulk Shipping

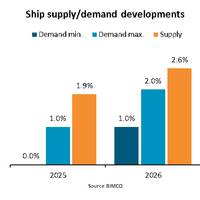

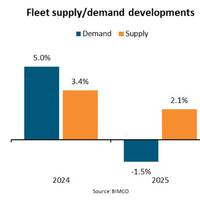

“We estimate the dry bulk supply/demand balance to weaken in both 2025 and 2026, compared to 2024. Demand growth is expected to slow, impacted by a weaker economic outlook for China and the world and a shift in US trade policy,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.The rise in tariffs and the start of trade negotiations by the US have introduced additional uncertainty and are directly impacting 4% of global dry bulk tonne mile demand. In China, this is expected to slow economic growth starting in the second half of 2025…

Steel Tariff Set to Dampen Ship Recycling Sentiment

The Trump announcement of tariffs on nations currently exporting various grades of the metal to the US is unquestionably set to dampen global steel prices and ship recycling sentiment across the Indian sub-continent, reports cash buyer GMS.“Every week is now intent on bringing with it, an entirely new economic reality for the world to re-adjust to, turning everyday business practices into an extremely erratic and volatile way of conducting any type of practical international trade…

Dry Bulk Ship Breaking Skids to 17-year Low

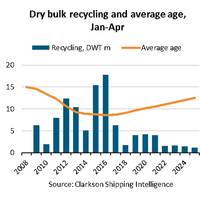

“Between January and April 2025, dry bulk ship recycling has fallen 24% y/y, reaching a 17-year low despite a 35% y/y drop in the Baltic Dry Index (BDI). While weaker freight rates typically encourage the recycling of older and less profitable ships, high uncertainty over the demand outlook could be delaying recycling decisions,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.Dry bulk ship recycling has been slow since the first quarter of 2021 when freight rates significantly strengthened due to a pickup in demand and congestion.

Sanctioned VLCCs Remain Stranded Off Bangladesh

Two OFAC-sanctioned VLCCs remain stranded outside Bangladeshi waters with no prospects of a final resting place, reports cash buyer GMS, and this is now seeing cash buyers and ship recyclers being vigilant in their due diligence prior to negotiating on units.There are reportedly still a few more units in cash buyer hands that are waiting to be introduced for a recycling resale. However, given the fate that the behemoth duo has run into outside Bangladesh, it remains to be seen how these pending and even future dealings with candidates from sanctioned source(s) will eventually transpire…

Baltic Dry Index Falls for Third Consecutive Session

The Baltic Exchange's dry bulk sea freight index, which tracks rates for ships carrying dry bulk commodities, fell for a third consecutive session on Thursday, hurt by weaker rates in the capesize segment.* The main index, which factors in rates for capesize, panamax and supramax shipping vessels, fell 13 points, or 0.8%, to 1,621 points.* The capesize index shed 54 points, or 2.1%, to reach 2,527 points, lowest level since March 11.* "On the West Australia front, we see relatively limited cargoes and some enquiries for slightly forward end April dates…

BDI Hits One-Week High as Commodity Markets Firm

The Baltic Exchange’s main sea freight index rose to its highest level in a week on Monday, supported by gains across all vessel segments amid strengthening demand and firmer commodity markets.The overall Baltic Dry Index (BDI), which tracks rates for ships carrying dry bulk commodities such as coal, iron ore, and grains, climbed 9 points, or 0.6%, to 1,652. This marks the index's highest level since March 17.Leading the upward momentum was the capesize segment, with its index rising 14 points, or 0.5%, to 2,690.

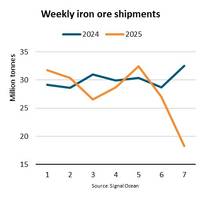

Iron Ore Shipments Fall 7%

Global iron ore shipments have fallen 7% y/y, during the first seven weeks of 2025, amid supply disruptions and weak Chinese import demand. Australian cargoes have fared the worst, down 10% y/y while shipments from Brazil have weakened by 5% y/y.“The comparatively stronger Brazilian shipments are boosting average sailing distances, but tonne mile demand is nonetheless estimated to have taken a 6% fall y/y,” says Filipe Gouveia, Shipping Analysis Manager at BIMCO.The weakness of iron ore shipments this year has intensified this past week in particular.

Ship Recycling Market Remains Jittery

As threats of trade wars loom, global shipping already seems to be reacting in kind with the Baltic Dry Exchange falling to its lowest since February 2023, says cash buyer GMS. This marks a clear shift towards easing freight rates as a gradually increasing number of over-aged assets have been making their way towards the bidding tables since the start of 2025.“Incoming Chinese New Year holidays has predictably seen an accelerated purging of older assets from Far Eastern waters including all those coming off charter amidst declining rates.

End of Tumultuous Year for Ship Recyclers

As a year of economic turmoil winds down on a quiet note, the world anticipates a 2025 that is bearing all the signs of a comparatively busier period across all sectors, says cash buyer GMS.The supply of tonnage has seen a year of record low recycling volumes, and yards are certainly yearning for busier days ahead, as freight markets increasingly start to divert more candidates for recycling, after a year of glorious charter rates across all sectors.Recycling prices have declined over the course of the year, from a high of USD 600/LDT during Q1, down to USD 450s/LDT come Q4 2025.

BIMCO's Shipping Number of the Week

Dry bulk contracting falls 70% below average amid low rates.“Over the past three months, dry bulk newbuilding contracting has been 70% below the yearly average. Declining freight rates in recent months, a cloudy outlook and high newbuilding prices contributed to the slowdown, and contracting in 2024 will likely fall short of 2023 levels,” says Filipe Gouveia, Shipping Analyst at BIMCO.Driven by healthy demand, the dry bulk market was strong throughout most of the first three quarters of 2024. However, in recent months, weaker Chinese import demand paired with a recovery in Panama Canal transits has impacted freight rates negatively.

Key Bulk Vessels Index Down 10% Despite Freight Rate Rebound

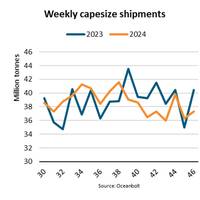

“The Baltic Dry Index (BDI) has recovered since the start of November due to stronger capesize freight rates, but the index is still down 10% y/y. The capesize market has benefited from a 1% increase in shipments so far in November compared to October 2024 and November 2023. However, the increase has not been enough to recover to the highs seen during the first three quarters of 2024,” says Filipe Gouveia, Shipping Analyst at BIMCO.On November 19, 2024, the BDI reached 1,627 points, up from 1,374 on 4 November.

Bulk Carriers: Baltic Dry Index Down for Third Straight Day

The Baltic Exchange's dry bulk sea freight index, tracking rates for ships carrying dry bulk commodities, slipped for a third straight session on Monday, weighed down by weaker rates across vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, fell 15 points, or 0.9%, to 1,655.The capesize index fell 24 points, or about 1%, to 2,413.Average daily earnings for capesize vessels, which typically transport 150,000-ton cargoes, such as iron ore and coal, declined $205 to $20,008.Prices of iron ore futures slid on Monday, dragged down by heigh

Baltic Dry Index Snaps Four-day Winning Streak

The Baltic Exchange's dry bulk sea freight index, tracking rates for ships carrying dry bulk commodities, snapped its four-day gaining streak on Thursday, as rates declined across all vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, lost 15 points, or 0.9%, to 1,683.The capesize index fell 14 points, or 0.6%, to 2,459.

BIMCO: Strong Bulk Market May Cool as 2025 Nears

The BIMCO Dry Bulk Shipping Market Overview & Outlook July 2024 by Niels Rasmussen, BIMCO’s Chief Shipping Analyst, anticipates that the supply/demand balance will strengthen in 2024 but weaken in 2025.Supply is estimated to grow by 3-4% in 2024 and 1.5-2.5% in 2025, while demand is projected to grow by 4.5-5.5% in 2024 and weaken by 1-2% in 2025.Freight rates are expected to stay strong during the rest of 2024, but demand could ease amid high inventories among importers. Freight rates are expected to weaken in 2025…

Baltic Dry Index Slides to Three-month Low

The Baltic Exchange's dry bulk sea freight index, tracking rates for ships carrying dry bulk commodities, slipped to its lowest level in three months on Tuesday, weighed down by lower rates across all vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, lost 35 points, or 2%, to 1,762, hitting its lowest level since May 1.The capesize index fell 83 points, or 3.2%, to 2,499, declining for a eighth consecutive session.Average daily earnings for capesize vessels, which typically transport 150,000-ton cargoes, such as iron ore and coal, we

Baltic Dry Index Hits Near Two-month High

The Baltic Exchange's main sea freight index, which tracks rates for ships ferrying dry bulk commodities, hit its highest level in nearly two months on Monday as capesize vessels gained on robust demand.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, rose 108 points, or 5.3%, to 2,158, its highest mark since May 9.The capesize index was up 348 points, or 10.1%, to 3,791, its highest level since March 19.Average daily earnings for capesize vessels, which typically transport 150,000-ton cargoes, such as iron ore and coal, were up $2,881 at $31,438.I

Baltic Dry Index Slips on Weaker Vessel Rates

The Baltic Exchange's dry bulk sea freight index fell on Monday, hurt by weaker demand across all vessel segments, with rates for capesize vessels hitting its lowest level in nearly three months.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, fell by 37 points, or 2.2%, to 1,684. The index was down for the sixth consecutive session.The capesize index shed 92 points, or 4.2%, to 2,080, marking its lowest level since Feb.

Improved Rates for Larger Vessels Lifts Baltic Dry Index

The Baltic Exchange's dry bulk sea freight index edged up on Wednesday, buoyed by an uptick in capesize and panamax vessel rates.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, ticked up to 1,683.The capesize index gained 16 points, or 0.8% to 2,116.

Baltic Dry Index Logs Monthly Gain

The Baltic Exchange's main sea freight index, which tracks rates for ships ferrying dry bulk commodities, rose on Friday to mark a monthly gain on the back of higher rates in capesize vessels.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, gained 19 points, or 0.9%, to 2,050. The index rose 12.9% in June.The capesize index climbed 72 points, or 2.1%, to 3,443, marking its highest level since May 9. The index recorded a monthly gain of 22.1%.Average daily earnings for capesize vessels…

Baltic Dry Index Scales to Six-week High

The Baltic Exchange's dry bulk sea freight index extended its rally on Tuesday to hit its highest in more than six weeks, supported by a jump in the large vessel segment.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, added 207 points, or 11.03%, to 2,083, touching its highest level since March 25."The dry bulk market has continued to outperform expectations...

Baltic Dry Index Falls for Third Week

The Baltic Exchange's dry bulk sea freight index fell on Friday to log its third straight weekly decline, weighed down by a dip in rates across all vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, shed 41 points or 2.5% to 1,628 points, its lowest level in seven weeks.The index was down over 10% for the week.The capesize index was down by 80 points, or 3.4%, at 2,274. It logged a weekly rise of over 13%.Average daily earnings for capesize vessels…