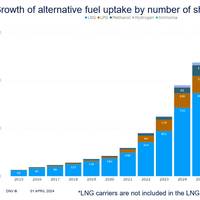

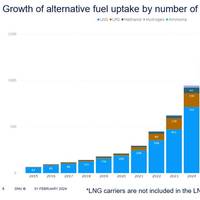

DNV: Five Alternative Fueled Vessels Ordered in March

According to the latest figures from DNV’s AFI platform, five new orders for alternative fueled vessels were confirmed in March 2024: two methanol, two ammonia and one LNG.Although this was a quiet month for the ordering of alternative fueled vessels, the overall trend remains strong, says DNV. For the first three months of 2024, 68 orders for alternative fueled vessels were made, compared to 44 in the first three months of 2023, representing year-on-year growth of over 50%.Jason Stefanatos…

QatarEnergy Inks Nakilat Deal for Operation of 25 LNG Ships

QatarEnergy signed time-charter party (TCP) agreements with Qatar Gas Transport Company Limited (Nakilat) for the operation of 25, 174,000 cubic meter LNG vessels as part of the second ship-owner tender under QatarEnergy’s historic LNG Fleet Expansion Program.The agreements were signed by His Excellency Mr. Saad Sherida Al-Kaabi, the Minister of State for Energy Affairs, the President and CEO of QatarEnergy and Mr. Abdullah Al Sulaiti, the CEO of Nakilat, in a special ceremony held at QatarEnergy’s headquarters in Doha…

QatarEnergy Charters 25 Nakilat LNG Carriers

QatarEnergy signed time-charter party (TCP) agreements with Qatar Gas Transport Company (Nakilat) for the operation of 25 conventional-size LNG vessels as part of the second shipowner tender under QatarEnergy’s LNG fleet expansion program.Seventeen of the 25 LNG vessels are being built at the Hyundai Heavy Industries (HHI) shipyards in South Korea, while the remaining eight are being built at Hanwha Ocean, also in South Korea.These agreements firm up last month’s selection of…

Japan Continues to Lead Shipowner Rankings

VesselsValue has unveils this year’s top 10 shipowning nations, reviewing the total asset values for vessels by beneficial owner country. From Japan's resolute leadership in the top position with a USD 206.3 billion fleet to the emergence of Hong Kong at USD 44.7 billion, asset values and ownership strategies have changed considerably over the last 12 months, says Rebecca Galanopoulos-Jones, Senior Content Analyst, Veson Nautical.The data provided by VesselsValue and analysed by Veson is valid as of February 2024.

QatarEnergy Pays Homage to Rex Tillerson by Giving His Name to New LNG Carrier

QatarEnergy has named the first LNG carrier to be delivered as part of its new LNG fleet expansion program as Rex Tillerson, in recognition of the former Chairman and CEO of ExxonMobil, who also served as the 69th United States Secretary of State.During his 10-year term as Chairman and CEO of ExxonMobil, Tillerson oversaw the consolidation of relations with the State of Qatar and its energy sector, resulting in strategic partnerships and significant investments in Qatar’s LNG industry.While making his mark on the global energy scene…

QatarEnergy Selects Nakilat to Own and Operate 25 LNG Vessels

QatarEnergy has selected Qatar Gas Transport Company Limited (Nakilat) to be the owner and operator of up to 25 conventional-size LNG carriers pursuant to Time Charter Parties (TCP).The 25 vessels, each with a capacity of 174,000 cubic meters, will be owned 100% by Nakilat and chartered out to affiliates of QatarEnergy. They are scheduled for construction at South Korean shipyards.This constitutes the first award in the second batch of long-term TCPs under QatarEnergy’s LNG fleet expansion project.

Alternative Fuel Newbuilding Orders Strong in January

According to the latest figures from DNV's AFI platform, it was another strong month for alternative fuel orders. This was led by methanol fueled ships, where 23 new orders were registered. Around 70% of these were in the container segment with the remainder mainly made up of vessels in the bulk and RoRo segments.LNG continues to feature strongly, with 10 more LNG fueled ships added to the database. Car carriers and tankers made up the bulk of these orders, followed by RoPax.

Seaside LNG Performs US Gulf Coast's First Ship-to-ship LNG Bunkering

Seaside LNG announced its liquefied natural gas (LNG) bunkering barge Clean Jacksonville delivered fuel to Carnival cruise ship Carnival Jubilee in Galveston, Texas, marking the first ship-to-ship LNG bunkering delivery along the U.S. Gulf Coast.The bunkering operation took place on December 30, 2023, after months of careful coordination with all parties involved, including the Port of Galveston, Seaside LNG said.The 2,200 cubic meter bunkering barge Clean Jacksonville, previously stationed in Florida…

Nakilat Grows Fleet with Six New LNG and LPG Carriers

Qatar-based energy shipping company Nakilat has placed orders to with Hyundai Samho Heavy Industries (HSHI) of South Korea for the construction of six new LNG and LPG carriers.The order includes two LNG carriers with a cargo capacity of 174,000 cubic meters each and four very large LPG/ammonia gas carriers, with a substantial cargo capacity of 88,000 cubic meters.The vessels are set to be delivered between 2026 and 2027, Nakilat said.Upon delivery, Nakilat's LNG fleet will expand to 71 vessels…

Seaside LNG and Carnival Corporation Partner to Fuel LNG-Powered Cruise Ship in Galveston

Seaside LNG and Carnival Corporation have entered into a term bunkering agreement to fuel the Carnival Jubilee, the first LNG-propelled cruise ship to call Galveston, Texas, its homeport.Seaside’s barge, the Clean Jacksonville, will move from Jacksonville, Florida, to operate out of Galveston and serve the Texas Gulf Coast with its first LNG delivery to the Carnival Jubilee in December 2023. With the assistance of the Port of Galveston, Seaside aligned all stakeholders to ensure the proper infrastructure is in place to begin the operation this winter.Initially…

Titan and 123Carbon Partner on Carbon Insetting

Fuel supplier Titan and 123Carbon, the first independent blockchain-based carbon insetting platform for the transport sector, have issued what they claim is the first LNG-based carbon insets.Carbon insetting enables fuel suppliers and vessel operators to transfer the environmental benefits of clean, lower carbon intensity fuels throughout the maritime value chain, enabling decarbonisation within their own supply chains. This contrasts with offsetting where the environmental benefits are made given to other industries or ventures.There are…

Shipyard Capacity: A Brake on Decarbonization?

The IMO’s latest crunch meeting in early July may not have aligned global shipping with mid-century targets established in the 2015 Paris Agreement. However, its 2023 Strategy indicates a clear direction of travel. Energy supplies by sea are essential for many countries and therefore ships have a key role in supporting the world’s energy transition – not only on their own account, but at a global level.As world shipping accounts for about 3% of greenhouse gas emissions, its environmental importance attracts wide attention. And plenty of criticism.

Celsius Orders Four LNG Carriers

Shipowner Celsius Tankers announced it has ordered four new liquefied natural gas (LNG) carriers from shipbuilder China Merchants Heavy Industry (Jiangsu) (CMHI) for scheduled delivery in 2026 and 2027.Celsius has formed a joint venture with an affiliate of ArcLight Capital Partners (ArcLight), a middle-market infrastructure investor, to fund two of the LNG carriers. Commodities trading house Gunvor Group Ltd will have a significant equity interest in the other two newbuildings, the first for any independent LNG trading company, demonstrating the strength of Gunvor's global position in the LNG market. All four vessels will enter long…

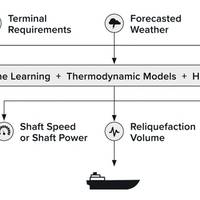

Chevron Aims to Shrink the Carbon Footprint of Its LNG Fleet

Chevron's shipping arm has set out to reduce the carbon intensity of its liquefied natural gas (LNG) fleet operations.The U.S.-based supermajor said Chevron Shipping Company has entered into an agreement with Singapore's Sembcorp Marine Repairs & Upgrades to install new technologies aboard its vessels, such as a reliquefication system, hull air lubrication and a new gas compressor, that are together expected to reduce cargo boil-off, lower fuel consumption and increase volumes…

AG&P, ADNOC L&S to Convert LNG Carrier into FSU and Deploy it in India

Atlantic Gulf & Pacific International Holdings (AG&P) have signed a charter agreement to use ADNOC L&S 's LNG Carrier Gasha, as a Floating Storage Unit (FSU).The LNG carrier will be used at AG&P's LNG import terminal in India, which will be commissioned in the second half of 2024. The charter deal is valid for 11 years with the option of a four-year extension. The two firms which have previously entered two similar agreements for FSUs in India and the Philippines. Captain Abdulkareem Al Masabi…

Chinese Shipyards Feast on Record LNG Tanker Orders as S.Korea Builders Fully Booked

China is making fast inroads in the market for newbuild liquefied natural gas (LNG) tankers as local and foreign shipowners turn to its shipbuilders for the specialty vessels because long dominant yards in South Korea are fully booked. Three Chinese shipyards - only one of them having experience building large LNG tankers - won nearly 30% of this year's record orders for 163 new gas carriers, claiming ground in a sector where South Korea usually captures most of the business.

TotalEnergies, BW LNG Partner with Nautilus Labs

TotalEnergies, signatory of the Sea Cargo Charter in 2020, identified the need for a better monitoring system that also allows to report and optimize GHG emissions for its LNG fleet. Reporting on emissions was a tedious, manual time-consuming process that was prone to error, and left little room for optimization. BW, the owner and operator of some LNG vessels chartered by the energy major, was at the same time focused on monitoring and improving the environmental performance of…

CNOOC Awards $2.4B Contracts for Construction of 12 LNG Carriers

China National Offshore Oil Company (CNOOC) has awarded 16 billion yuan ($2.42 billion) worth of contracts to build 12 liquefied natural gas tankers, the largest of their kind in the country, the company said on Thursday.China is the world's largest buyer of the super-chilled gas, while CNOOC is the country's largest importer of the fuel and among the state majors leading a drive to expand their LNG fleet to meet rising import needs and facilitate fast-growing global trade.

Nakilat Takes Delivery of Another LNG Carrier

Nakilat took delivery of a newbuild LNG carrier, “Global Sealine”, which will be commercially and technically managed in-house by Nakilat Shipping Qatar Limited (NSQL). Built by Daewoo Shipbuilding & Marine Engineering (DSME) in South Korea, this is the final LNG newbuild carrier to be delivered to Global Shipping Co. Ltd., a joint venture between Nakilat (60%) and Maran Ventures Inc. (Maran Ventures) (40%). Three of its sister vessels were delivered between 2020-2021 and are all under time charters. With a cargo carrying capacity of 174,000 cu.

SailPlan Helps Harvey Gulf Cut Offshore Vessel Emissions

U.S. offshore vessel operator Harvey Gulf International Marine has signed an agreement with SailPlan, the maritime cleantech company that reduces ship emissions, to add SailPlan to its fleet.SailPlan is an emissions monitoring and optimization platform that combines the real-time engine, fuel, and navigational data from vessels with the weather, mapping, infrastructure, and traffic data to benchmark, optimize, and report fleet emissions.According to Sailplan, Harvey Gulf has already seen quantifiable emissions reductions beginning with the Harvey Power, a 310-foot Platform Supply Vessel.

Baker Hughes Signs Deal with Shell for Renewable Energy Credits

Oil major Royal Dutch Shell's clean energy unit will provide renewable energy credits (REC) to oilfield firm Baker Hughes' facilities in United States for a two-year period, the companies said on Wednesday.

ADNOC L&S Orders Two LNG Carriers from China's Jiangnan Shipyard

ADNOC Logistics & Services, the shipping and maritime logistics arm of the Abu Dhabi National Oil Company (ADNOC), has ordered two newbuild 175,000 cubic meter LNG carriers that will join its fleet in 2025. "The new LNG vessels will be crucial enablers of ADNOC’s 2030 growth strategy, supporting its existing LNG business as well as its ambitions to grow its liquefied natural gas (LNG) production capacity. They will be built at the Jiangnan Shipyard in China," ADNOC L&S said.Captain Abdulkareem Al Masabi…

Latsco Partners with Orca AI on Fleet Navigation Safety

Orca AI and its AI-based navigation safety platform have partnered with Greece’s Latsco Shipping Limited, to enable their liquefied natural gas (LNG) fleet to increase its situational awareness and navigate safely on congested waterways.Orca’s AI-powered maritime avoidance collision system uses computer vision sensors and thermal cameras to provide real-time alerts on potentially hazardous events, designed to provide operators with greater visibility on those events with actionable insights to help reduce their probability in the future.