Scarcity of Ship Recycling Tonnage Continues

Despite the occasional smaller LDT candidate popping up for sale over recent weeks, there regrettably remains the ongoing scarcity of tonnage that is simply unable to fill the most basic of demands at the major ship-recycling destinations, reports cash buyer GMS.“As plots across Indian sub-continent markets gradually recycle through their respective shares of vessel deliveries through the first quarter of 2024, both Bangladeshi and Pakistani markets remain well-positioned despite the onset of the traditionally quieter month of Ramadan…

Sleepy Week for Ship Recyclers

Even though the Indian sub-continent ship recycling markets have taken on a collection of smaller vessels of late, the week remains “sleepy” says cash buyer GMS.Virtually no deals have been concluded, and this has put the squeeze on the global ship recycling sector.“Dry bulk charter rates have been pushing on by the week as ship owners monetize the most from this sector. Containers and tankers too remain oddly off the recycling buffet, and this in turn is driving the ongoing dearth of viable candidates into overdrive…

GMS: Ship Recycling Market Still Slow

Despite Chinese new year holidays concluding on Friday, a pervading theme of an unrelenting dearth in the overall availability of tonnage across global ship recycling markets has been enduring for several quarters now, says cash buyer, GMS.This has resulted in another dreary week of market inactivity and silence across all recycling destinations.Charter rates continue to remain artificially elevated (especially) in the dry bulk sector, consequently placing a tighter squeeze on the overall supply of vessels for recycling.

Baltic Index Rises on Strong Capesize, Supramax Demand

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, rose on Tuesday, aided by higher rates for capesize and supramax vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, gained 40 points, or 2.6%, to its highest in eight weeks at 1,598.The capesize index was up 125 points, or 5.2%, at 2,509 — its highest since Dec. 22.Average daily earnings for capesizes, which typically transport 150…

Offshore Support Vessels in High Demand as Solstad Secures New Deals, Extensions

Norwegian offshore support vessel owner Solstad Offshore said Monday it had secured multiple new contracts and contract extensions.The contracts and extensions are for various platform supply vessels and anchor handling tug supply vessels."The contracts have a combined firm duration of approximately 10 vessel years and will support various clients in the global markets. The contracts will be executed by 14 of the company's PSVs and AHTS vessels and have a value of approximately NOK 830 million [~81…

Ship Recycing: Plates Plunge

While activity seemed as though it had been steadily increasing going into the final quarter of the year, the last couple of weeks have sent mixed signals as to whether the fourth quarter will actually be better for the ship recycling sector as many have been anticipating.A couple of weeks ago, we saw currencies plummet in Pakistan and Bangladesh to the point, a wait-and-watch attitude encompassed both markets – at least until the first sale to a local recycler establishes the new baseline for a type of unit in that market.This week…

Marco Polo Marine to Build, Operate CSOV as Offshore Wind Industry 'Grapples with Shortage'

Singapore-listed firm Marco Polo Marine said Tuesday it planned to build, own and operate a new Commissioning Service Operation Vessel (CSOV) to meet the rising demand for support vessels required to service the booming offshore wind farm industry in Asia. When completed in the first quarter of 2024, the vessel will also be the first CSOV to be designed in Asia."The group will be funding the construction of the vessel with its existing resources and borrowings from financial institutions.

Markets: Ship Scrapping Perks Up

Following the sale of Capesize bulkers for recycling last week, the trend has continued this week as well, with further transactions reportedly taking place on units – including Capes and a Suezmax tanker, as the market finally shows signs of life after an absolutely inert summer, according to GMS.All of the major ship recycling destinations are still poised rather precariously, and Pakistan has seen some further depreciations on the currency towards the end of this week, whilst the country continues to battle floods…

Rollercoaster Containershipping Rates Continue, says Xeneta

South American spot rate gap set to narrow as shippers take advantage of lower Far East to West Coast ratesThe latest ocean freight rate data from Xeneta reveals that spot rates are currently $3,700 more expensive for shipping 40-ft. containers from the Far East to the South American East Coast, compared to the West Coast corridor. This huge gap – the norm is usually around a $55 East Coast premium – has opened up since 1 July. However, shippers looking to take advantage of the disparity should move quickly…

Ship Recycling Market Slows with Dearth of Tonnage for Scrap

Sub-continent markets are going to be (seemingly) deprived of tonnage in the foreseeable future, as recycling rates continue their downward descent and tighter restrictions are placed on importing large LDT tonnage into Bangladesh and now Pakistan (with limits on large $ value L/Cs).Firm chartering freight rates across the board are also seeing Ship Owners preferring to maintain their vessels for further voyages, rather than deal with the ongoing headaches associated with present day sub-continent recycling (despite seeing some of the firmest recycling rates in a while), all the challenges currently associated with questionable performances…

Container Shipping Rates: Has the Peak Been Reached?

Despite another slew of rises in long-term contracted ocean freight rates across key global trade corridors, month-on-month growth is slowing - and spot rates continue to weaken – suggesting prices may have peaked. However, according to the latest Xeneta Shipping Index (XSI), which crowd-sources real-time data from the world’s leading shippers, today’s valid long-term agreements stand 112% higher than this time last year, and a massive 280% up against July 2019.“The carriers have enjoyed staggering rates rises…

Xeneta says Long-term Container Shipping Rates to Rise Again

It’s been another bumper month for long-term contracted ocean freight rates, as the cost of securing container shipments climbed by 10.1% in June. Following on the heels of a record 30.1% hike in May, this now means rates stand 169.8% higher than this time last year, with just two months of declines in the last 18 months. Despite a degree of macro-economic uncertainty clouding the horizon, all major trades saw prices moving up, with some corridors showing significant gains.Xeneta has released the figures…

Shipbreaking: Starved of Supply!

India finally leads the way on pricing this week, as all of markets i.e. Pakistani, Bangladeshi and even the Turkish markets work their way towards Eid holidays and the end of the Holy month of Ramadan, GMS, which describes itself as the world's largest buyer of ships & offshore vessels, said in its latest weekly commentary.In fact, GMS said, several markets are likely to be closed anywhere from a couple of days (as in the sub-continent) with the Turkish market celebrating until Thursday.Overall…

'World's Largest OSV Fleet': Tidewater to Buy Swire Pacific Offshore

U.S.-based offshore support vessel owner Tidewater said Wednesday it had agreed to acquire Swire Pacific Offshore Holdings Limited (SPO), a subsidiary of Swire Pacific Limited for around $190 million. Tidewater said the transaction would create the industry’s largest fleet of offshore support vessels with 203 vessels in total, including crew boats, tug boats and maintenance vessels. "SPO’s fleet of 50 OSVs consists of 29 AHTS vessels and 21 PSVs; pro forma for the transaction…

Profitability Still a Way Off for Tanker Shipping -BIMCO

New virus mutations and outbreaks have slowed the recovery in global oil demand as some countries lock down again and international travel remains complicated.Drivers of demand and freight ratesTo say that the summer has not been kind to the crude oil shipping industry would be an understatement. Average earnings have dropped below $10,000 per day since June for all crude oil tankers, with many trades offering negative earnings; freight rates are not high enough to cover voyage expenses, let alone operating and financing costs.

Ship Scrap Prices Cool

A noticeable degree of concern remains evident in the sub-continent ship recycling markets, as both Bangladesh and (especially) India witnessed unexpected declines in steel plate prices over the week. Even the Turkish market recorded a cooling of its own, with sentiments there reportedly starting to simmer off.Bangladesh saw steel prices cool off and jump back up by about USD 20/LDT over the last couple of weeks and a healthy number of Chattogram Buyers have subsequently decided…

Ship Recycling Prices March Higher, Doubling in a Year

Far from the traditionally expected slowdown during the monsoon / summer months, sub-continent recycling markets fired on at pace once again this week, and a slowdown in the supply of tonnage of late is likely contributing to some overly aggressive offerings from hungry end buyers.Steel plate prices in Bangladesh and Pakistan continue to firm, while India has cooled off and remains tentative on any fresh/incoming vessels, especially after a bullish last few weeks.Notwithstanding, there certainly must be a ceiling on proceedings as prices have doubled over the last year, reaching the ongoing un

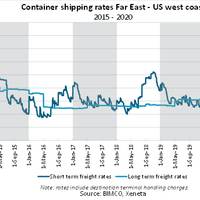

Container Shipping Rates Continue to Deliver 'Positive Surprises', BIMCO says

Trans-Pacific short vs long contract freight rate gap hits record $2,400 per FEUAs the year 2020 continues to deliver positive surprises for the container shipping sector, the gap between short and long term contract freight rates on the Trans-Pacific trade lane has never been wider, according to a recent market note from BIMCO, noting that conditions are right for carriers to achieve higher long term contract rates.On 17 September, for containers shipped from the Far East into the US west coast…

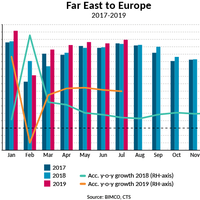

BIMCO: Fleet Growth, Ship Size Up

Global growth in container volumes has picked up slightly in the second quarter of the year, with growth in the first seven months reaching 1.2%, compared to the just 0.8% in the first quarter.Global growth in container volumes has picked up slightly in the second quarter of the year, with growth in the first seven months reaching 1.2%, compared to the just 0.8% in the first quarter. Despite this rise, the growth figure remains substantially below what the industry has been used to…

Dry Bulk Rates Continue to Slide

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, fell on Wednesday for the eleventh straight session as demand fell across all vessel segments.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, was down 15 points, or 1.4 percent, at 1,042 points.The index fell for the eleventh straight session and hovered at over six-week lows.The capesize index also fell for the eleventh straight session and lost 48 points, or 3.6 percent, at 1,276 points.Average daily earnings for capesizes, which typically trans

ZIM Turns Around, Posts Profit for 2017

The biggest cargo shipping company in Israel ZIM Integrated Shipping Services (ZIM) has posted adjusted net profit of $50 million in 2017, compared to adjusted net loss of $150 million in 2016. The net Profit was $11 million, compared to net loss of $163 million in the comparable period of 2016. It has recorded a total revenues were $2.99 billion in 2017, compared to $2.54 billion in 2016, registering a 17% increase. During 2016-2017, the container shipping industry went through a structural change as a result of the extensive activity of mergers and acquisitions that also led to reorganization of the global alliances. Since Q3 2016 we have been witnessing a positive trend in the industry with improved freight rates.

Asia Dry Bulk-Capesize Rates to Climb Again

Number of spot capesize cargoes double from January levels; Pacific capesize earnings now around $14,000 per day. Freight rates for large capesize dry cargo vessels on key Asian routes, which hit multi-month highs this week, are set to jump further next week on tight tonnage supply and buoyant cargo volumes, brokers said. Rates on the capesize route from Brazil to China soared to the highest level in nearly 18 months on Thursday, fuelled by chartering activity by Brazilian iron ore major Vale and ship operators including Louis Dreyfus, according to ship brokers and chartering data on the Reuters Eikon terminal. "I think we'll see rates continue to go up. The supply of tonnage for April loading is very tight. Tonnage is tight generally," a Singapore-based capesize broker said.

Higher Rates Continue to Perk Up Baltic Index

The Baltic Exchange's main sea freight index, tracking rates for ships carrying dry bulk commodities, rose on Friday, boosted by stronger rates across all vessel segments. The overall index, which factors in rates for capesize, panamax, supramax and handysize shipping vessels, was up 7 points, or 0.95 percent, at 745 points. The capesize index rose 3 points, or 0.29 percent, to 1,023 points. Average daily earnings for capesizes, which typically transport 150,000-tonne cargoes such as iron ore and coal, were up $19 at $7,548. The panamax index was up 21 points, or 2.49 percent, at 863 points. Average daily earnings for panamaxes, which usually carry coal or grain cargoes of about 60,000 to 70,000 tonnes, increased $168 to $6,896.