Shipbuilding in Nova Scotia

Irving Shipbuilding’s successful C$25 billion bid for the combatant portion of the National Shipbuilding Procurement Strategy (NSPS) illustrates the strength of Nova Scotia shipbuilding industry. Under the program, Irving Shipbuilding, Inc. (ISI) will build six to eight Arctic/Offshore Patrol Ships and 15 Canadian Surface Combatants for the Department of National Defense (DND) over the next 20-30 years. The NSPS contract is in addition to ISI’s contract to build nine mid-shore patrol vessels for the Canadian Coast Guard, valued at C$219 million, and to refit seven Halifax-class navy frigates, valued at C$549 million. This article, excerpted from a recently completed report on Nova Scotia’s ocean technology sector by the Duke University Center on Globalization, Governance and Competitiveness, reviews Nova Scotia’s shipbuilding capabilities and emerging market opportunities.

Shipbuilding in Nova Scotia

Nova Scotia’s shipbuilding industry is based on three key features: a strong shipbuilding tradition and infrastructure, an emerging ocean technology sector, and continued large-scale federal shipbuilding projects.

Strong shipbuilding tradition and infrastructure: Nova Scotia and Halifax, in particular, have a history in shipbuilding dating to the 1880s. Irving Shipbuilding, the centerpiece of the region’s shipbuilding, has built 80% of Canada’s current surface combat fleet, including icebreakers. The company, owned by J.D. Irving, has in Nova Scotia two shipyards (Halifax and Woodside), one repair facility (Shelburne), and one support service affiliate (Fleetway). With 470 full-time equivalent employees in 2009, ISI’s Halifax Shipyard is a full-service shipyard, offering a range of services from fabrication to machine shops. It also provides access to a large and extensive local subcontractor community. Currently, ISI has contracts under way to build nine mid-shore patrol vessels for the Canadian Coast Guard (valued at C$219 million) and to refit seven Halifax-class navy frigates (valued at C$549 million). Beside ISI, several smaller shipbuilders are also in operation in Nova Scotia, including A.F. Theriault and Rosborough Boats. These large and small shipbuilders and suppliers make up valuable infrastructure for shipbuilding and repair.

Nova Scotia’s shipbuilding assets also include its ability to develop a skilled workforce. Higher education institutions, including the Nova Scotia Community College and Dalhousie University, are continuing to develop a workforce with the skills required in the marine construction and transportation industry. Demand for a range of shipbuilding skills, from welders to software engineers, is provided by the presence of large-scale shipyards like the Halifax Shipyard. Nova Scotia has maintained a nice balance in both the supply of and demand for a skilled shipbuilding workforce.

Emerging ocean technology sector: Ocean technology (OT) firms provide goods for ocean-related industries, ranging from marine robotics to electronic navigation equipment. They also provide services such as enhanced engineering and environmental and computer knowledge for marine industries. Nova Scotia, along with Newfoundland, represented over 80% of the OT firms in Atlantic Canada. A 2006 report estimated that the annual sales of the OT sector in Atlantic Canada were C$329.2 million based on sales figures in 2003-05. When indirect economic activities are included, the sector was responsible for close to 5,298 person-years of employment, C$201.8 million of household labor income, and C$280.9 million of gross domestic product on an annual basis. These economic impacts are largely the result of small- and medium-sized enterprises (SMEs) with high rates of investment in research and development (R&D).

Nova Scotia has a great number of SMEs specializing in various ocean technologies, from naval architecture to software engineering. These SMEs are mainly supported by the presence of a robust aerospace and defense cluster that serves the government sector, the biggest customer of the OT sector in Atlantic Canada. 45% of Canada’s military assets and a significant part of its defense R&D are present in the province. The defense cluster includes over 200 companies, 6,000 employees, and generates about C$600 million annually in Nova Scotia. Major defense multinational corporations in the province include Lockheed Martin Canada, L-3 Communications, General Dynamics, MacDonald, Dettwiler & Associates (MDA), Raytheon Canada and Ultra Electronics Maritime Systems.

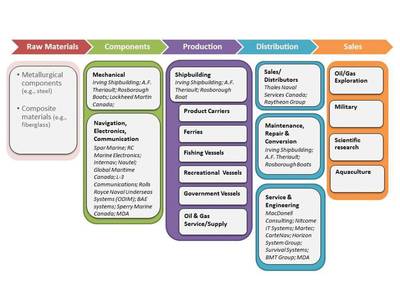

The OT sector in Nova Scotia has the potential to play a key role in global shipbuilding. Figure 1 presents the shipbuilding and enabled service providers in Nova Scotia in the shipbuilding value chain. Nova Scotia’s firms are particularly strong in the high value-added portions of the shipbuilding value chain, specifically navigation, electronic and communications equipment sub-systems, and shipbuilding engineering and support services, including integrators.

Federal shipbuilding projects: The presence of this large-scale, long-term federal project in Nova Scotia will provide several benefits to the Nova Scotia shipbuilding sector. First, it will ensure a steady demand for shipbuilding for an extended period. Most of the smaller shipbuilding sectors outside East Asia, due to unstable demand, tend to suffer from the frequent loss of accumulated local infrastructure and skilled labor. NSPS will ensure long-term stability in shipbuilding in Nova Scotia. Second, the project will generate new investments in the region. ISI has already invested C$90 million in the past few years in expanding its infrastructure, and the company is expected to invest tens of millions of additional dollars as the largest portion of the NSPS program develops. It will help upgrade infrastructure and stimulate employment across the region. Finally, NSPS will help the region attract large and small firms, skilled workers, and engineers from other Canadian provinces and foreign countries, making the region’s shipbuilding and OT cluster diverse and dynamic.

Opportunities Ahead

A number of opportunities exist for Nova Scotia’s companies in the global markets for shipbuilding and OT value chains. Although Nova Scotia does not account for a large percentage of Canadian ship exports relative to Quebec and Ontario, it is well-positioned to take advantage of three opportunities in the shipbuilding sector.

First, the increasing importance of modularization and high-tech systems offers companies in Nova Scotia opportunities to enter into global shipbuilding supply chains. Emerging economies are good candidates for expanding Nova Scotia’s exports, particularly to countries experiencing recent growth in trade, oil production, per capita income, or requiring enhanced security of their ports and territorial waters, notably Indonesia, Turkey, Vietnam and United Arab Emirates. These countries are keen to develop local shipbuilding but not yet capable of developing integrated high-tech systems, to which Nova Scotia firms can contribute.

Second, the increasing demand for Arctic vessels presents new opportunities to Nova Scotia firms. Refitting ships for Arctic conditions, in particular, appears a promising activity for firms in Nova Scotia, and the province has several companies already active in this business. In addition, Nova Scotia companies could find opportunities to collaborate with East Asian shipbuilders. East Asian shipbuilders, compared to their Northern European peers, are not particularly strong in harsh climate technology and research. As they attempt to upgrade into high value-added ships, such as icebreakers, they are requesting R&D and technology assistance from Canada. International partnership could provide opportunities for firms and researchers in Nova Scotia to participate in large commercial projects oriented to global markets.

Third, a rapidly changing environment in energy demand and use can provide new market opportunities for Nova Scotia firms. As one of Canada’s major offshore oil and gas industry bases, Nova Scotia can benefit from the need of the growing offshore oil and gas sector for specialized ships, such as platform service vessels and anchor handling tug supply vessels. Furthermore, as environmental standards tighten in the marine sector, there is a growing demand for energy-efficient ships or ships that use alternative sources of energy. This latter opportunity will introduce a new area for technological innovation in ship design and building.

About the authors

Joonkoo Lee, Ph.D.

Joonkoo Lee is a postdoctoral research scholar at the Duke University Center on Globalization, Governance and Competitiveness (CGGC). His research at CGGC focuses on ocean technology value chains and global agri-food value chains. He is a co-author of the Nova Scotia Ocean Technology report from which excerpts were taken for this article. He received his Ph.D. in Sociology at Duke University in 2011. Lee can be contacted at [[email protected]].

Lukas Brun

Lukas Brun is a senior research analyst at the Duke University Center on Globalization, Governance & Competitiveness (CGGC), and co-author of the Nova Scotia Ocean Technology report from which excerpts were taken for this article. He has more than 10 years of experience in economic analysis and economic development-related contract research. Brun can be contacted at [[email protected]].

(As published in the June 2012 edition of Maritime Reporter & Engineering News - www.marinelink.com)