BIMCO Adopts FuelEU Maritime and ETS Clauses for S&P

The Documentary Committee of BIMCO has adopted a FuelEU Maritime Clause and an ETS Clause for incorporation into Memoranda of Agreements (MoAs) for the sale and purchase of ships.The FuelEU Maritime Regulation and the EU Emissions Trading System (EU ETS) impact the sale and purchase of ships, and the clauses have been developed to help provide certainty for both parties during the process.“Regulations such as the FuelEU Maritime and EU ETS are complex and reshape our industry. Therefore, contractual clarity is essential.

Panama Canal Bets on LPG Transits

The Panama Canal expects an increase in transits of liquefied petroleum gas (LPG) vessels and carriers of some agricultural commodities to help it compensate for a reduction in world trade next year, the waterway's chief told Reuters on Monday.The world's second-busiest interoceanic waterway registered a 14% revenue increase to $5.7 billion in the fiscal year ended in September and saw 19% more transits, with LPG vessels and container ships moving more cargoes through the canal that connects the Pacific and Atlantic oceans."LPG is a product that will be even more valuable in the next 20…

IMF Warns of a "Disorderly" Global Market Correction Amidst Geopolitical Tensions

Global markets are getting too comfortable with risks like trade wars, geopolitical tensions and yawning government deficits, which, combined with already overpriced assets, increase the chance of a "disorderly" market correction, the International Monetary Fund said on Tuesday.Underscoring the IMF's warning, President Donald Trump's revived threats on Friday to hike tariffs on China stoked investor fears of a major asset price correction. The comments sparked a sell-off in U.S.

TKMS Targets Higher Profit Margins as Defense Spending Rises

TKMS, the defence business that German conglomerate Thyssenkrupp aims to spin off this autumn, plans to raise its profit margin to more than 7% to close a gap with rivals, banking on soaring military demand amid fears of Russian aggression.TKMS, which makes submarines, frigates as well as sensor and mine-hunting technology, has more than tripled its order backlog in five years. It now stands at 18.6 billion euros ($21.8 billion) as governments around the world beef up warship fleets.In the medium term…

Panamanian President Meets with Japanese Shipowners to Share New Ship Registry Strategy

President José Raúl Mulino met with more than 40 representatives of shipping companies from Japan’s Kanto region, where he presented Panama’s new ship registry strategy aimed at safeguarding its global leadership through enhanced safety standards and fully digitalized processes.Mulino emphasized that Panama’s registry is positioning itself as the flag of the future, driven by new policies aligned with international benchmarks for safety, efficiency, and environmental protection.The stakes are high for Japan: 7 out of 10 Japanese shipowners already fly the Panamanian flag…

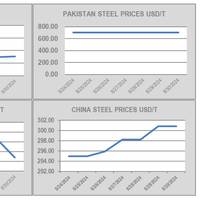

Asian Nations Battle for Shipbuilding Share

China’s share of the tanker orderbook rose from 32.4% in 2022, to 62.6% in 2023 and then 71.2% in 2024. Its share of the container ship orderbook has shown a similar growth trajectory. The nation has ranked first in the world for new orders since 2012. Labor costs are about half of what they are in Korea and Japan, and China is the world’s cheapest steel manufacturer.Niels Rasmussen, Chief Shipping Analyst at BIMCO, says that during the past five years Chinese shipyards have built 50% of the ship capacity delivered, and Chinese shipyards now hold 66% of the ship capacity in the orderbook.

WFW Advises on Financing for ONE Newbuild Fleet

Watson Farley & Williams (WFW) advised a consortium of lenders on an ECA-backed JOLCO financing for Ocean Network Express Pte. Ltd. (ONE) to finance four newbuild container vessels. The consortium comprised BNP PARIBAS (acting through its Tokyo Branch and as ECA Coordinator), The Hongkong and Shanghai Banking Corporation Limited, Tokyo Branch and Citibank, N.A., Tokyo Branch (as mandated lead arrangers) as well as Japanese export credit agencies Japan Bank for International Cooperation…

Norwegian Cruise Maintains Profit Forecast, Bookings Rebound

Norwegian Cruise Line Holdings signaled a demand rebound for its cruise vacations and maintained its annual profit target, sending its shares up 12% on Thursday.The company had earlier warned that geopolitical tensions and economic uncertainty around tariffs had weakened consumer spending on its premium vacations, particularly for its longer itineraries in Europe.The 12-month forward booked position was ahead of historical levels in recent months after having softened in early April, while on-board spending was strong, CEO Harry Sommer said in a statement.The reaffirming of annual forecast was

DHT Secures Post-Delivery Finance for VLCCs

Tanker company DHT Holdings, Inc. has entered into a $308.4 million senior secured credit facility for the post-delivery financing of the company’s four newbuildings.The vessels are currently under construction at Hyundai Samho Heavy Industries and Hanwha Ocean, in South Korea and are scheduled for delivery during the first half of 2026.The facility is co-arranged by ING Bank and Nordea Bank Abp, with ING Bank as Coordinator, Facility Agent, Security Agent and ECA Agent. The facility bears interest at a rate equal to SOFR plus a weighted average margin of 1.32%.

Royal Caribbean Raises Annual Profit Forecast, Hoping for Steady Demand

Royal Caribbean raised its annual profit forecast on Tuesday, banking on resilient demand for its luxury destinations, even as the cruise operator faces pressure from higher fuel costs.The company forecast current-quarter profit below estimates, sending its shares down about 7% in early trading. The stock has gained about 53% this year.Escalating Israel-Iran tensions as well as a recently announced trade deal between the U.S.

Most G7 Members Ready to Lower Russian Oil Price Cap Despite US Engagement

Most countries in the Group of Seven nations are prepared to go it alone and lower the G7 price cap on Russian oil even if U.S. President Donald Trump decides to opt out, four sources familiar with the matter said.G7 country leaders are due to meet on June 15-17 in Canada where they will discuss the price cap first agreed in late 2022. The cap was designed to allow Russian oil URL-E to be sold to third countries using Western insurance services provided the price was no more than…

US Targets Iran With New Sanctions Amidst Shadow Banking

The U.S. issued Iran-related sanctions targeting more than 30 individuals and entities it said are part of a "shadow banking" network that has laundered billions of dollars through the global financial system, the Treasury Department said on Friday.The sanctions, which target Iranian nationals and some entities in the United Arab Emirates and Hong Kong, were announced as U.S. President Donald Trump's administration is working to get a new nuclear deal with Tehran. Treasury said…

Obituary: A Personal Reflection on “Shipping Legend” Jim Lawrence

“Shipping is a people business”, so the saying goes. Jim Lawrence, who passed away at the beginning of June, truly embodied that. Certainly, he was a great participant at maritime events. When not up on the podium serving as the moderator, he would be walking around, shaking hands, talking about a particular transaction or development (and, sometimes, the intrigue behind it), along with everything that goes along with networking. He will certainly be remembered as a “people person” and deservedly celebrated for that aspect.

South Korean Navy Patrol Aircraft Crashes, Killing All Four Crew

A South Korean maritime patrol aircraft crashed soon after takeoff near a military base in the southern city of Pohang on Thursday, killing all four crew members, the navy said.The P-3 aircraft went down about six minutes after it left the airfield on a training mission at 1:43 p.m. (0443 GMT), the navy said in a statement.Witness video footages aired on YTN television showed the plane banking at low altitude, then a plume of smoke and fire after it crashed.The remains of the crew members have been recovered and no civilian casualties were reported, the navy said.

Debriefing Russia's "Shadow Fleet' of Oil Tankers Amidst Recent Conflicts

Western sanctions imposed on Russia for invading Ukraine and aimed at cutting its oil revenues have led to the rise of a vast "shadow fleet" of tankers helping Moscow keep its crude exports flowing.Here are some key points about these unregulated vessels.WHY IS THIS FLEET IN THE NEWS?Estonia on Tuesday tried to stop an oil tanker, which the UK sanctioned last week, for sailing without a flag against maritime rules, in international waters between Estonia and Finland in the Baltic Sea…

EU Shipowners Want Maritime Included in Sustainable Transport Investment Plan

European Shipowners (ECSA) and Sea Europe have issued a joint statement calling on the European Commission to include the maritime sector in the European Industrial Maritime Strategy as well as in the Sustainable Transport Investment Plan (STIP).“Both initiatives should ensure the international competitiveness of European shipping which is a prerequisite for a strong and competitive European maritime industrial cluster. Addressing the widening innovation gap in Europe is the only way to enhance the European industrial base.

CMA CGM seeks 2025 Singapore biofuel bunker supply

French shipping major CMA CGM is seeking marine biofuel for term delivery in Singapore, the world's largest bunker hub, between January and December 2025, according to market sources.The company has been one of the top lifters of marine biofuel in Singapore this year, and is expanding its lifting period from half-year term supply this year to full-year supply next year, the sources said.It is looking to lift a monthly volume of 35,000 to 50,000 metric tons of the B24 blend, which comprises 24% used cooking oil methyl ester (UCOME) biofuel blended with conventional fuel. The tender closes on Dec. 16, the sources added.The shipping industry…

BIMCO Adopts FuelEU Maritime Clause

On January 1, 2025, the FuelEU Maritime Regulation will come into force. The regulation may require stakeholders to start taking measures now and the BIMCO FuelEU Maritime Clause for Time Charter Parties 2024 is developed to help stakeholders align their contractual frameworks. The clause was adopted by BIMCO’s Documentary Committee on November 25, 2024. The shipping industry faces an increase in decarbonization regulations from the EU and the International Maritime Organization (IMO), BIMCO continues to add to its portfolio of carbon clauses to support the industry.

Navtor Touts "Compliance without Complexity"

The regulatory landscape is about to get a whole lot more complicated, with the advent of FuelEU Maritime from January 1, 2025. This ambitious framework, focusing on the ‘well-to-wake’ GHG intensity of vessels trading within Europe, laughs in the face of traditional methods of calculating and tracking emissions, making Excel sheets strictly yesterday’s news. However, argues NAVTOR’s Director of Performance Jacob Clausen, there may be a simple way to voyage to compliance.The easy way to achieve FuelEU Maritime compliance for your fleet is simple.

Drug Gang Used Commercial Ships & Chinese Money Brokers, Italian Police Says

Italy police said on Wednesday they had arrested 61 people across four countries and seized 60 million euros ($67.1 million) following an investigation into international drugs trafficking and money laundering.The case had revealed criminal drugs ties between Albania and Latin America, and once again showed how criminals in Europe are using shadow networks of illicit Chinese money brokers, police said.Finance police in the northern city of Brescia said 400 officers had carried out the arrests and searches in Italy, Albania, Switzerland and Poland, with the cooperation of local law enforcement

European Shipowners Want 40% Local Production of Clean Fuels

The European Community Shipowners’ Association (ECSA) has released a position paper on a European Maritime Industrial Strategy as part of the new Clean Industrial Deal, saying that European shipping is a geopolitical asset for Europe and a cornerstone of the energy, food and supply chain security of the continent.European shipping controls 39.5% of the global tonnage. ECSA says that the European Maritime Industrial Strategy must be a core pillar of the upcoming Clean Industrial Deal…

Ship Recycling: Vessel Offerings Have Declined

Action in the Middle East, including a repeat Houthi attack on container vessel Groton in the Red Sea, has increased volatility in the region, and the already slim pickings of tonnage for recycling only got worse through August, reports cash buyer GMS.“The desperate question unraveling in everyone’s mind is whether this is expected to be the case through 2024 / early 2025? Interestingly, even though we have seen sub-continent ship recycling nations take independent measures to curtail the devastating state of economic affairs…

OceanScore Opens Singapore Office

OceanScore has opened a new office in Singapore that will enable it to better serve regional clients as the company sees rising Asian demand for its digital solutions geared towards efficient regulatory compliance with the EU ETS and FuelEU Maritime.The new locale in the Lion City marks the latest expansion by the Hamburg-based maritime technology firm, which also has offices in Poland and Madeira, Portugal.The office was formally opened on 30 July at a high-profile event attended by honorary guest Kenneth Lim…