Euronav Concludes Billion-Dollar Acquisition of CMB.TECH

Belgian tanker operator Euronav has concluded the acquisition of 100% shares in cleantech maritime group CMB.TECH for $1.15 billion in cash.The transaction is part of Euronav’s renewed strategy of diversification, decarbonization and accelerated optimization of the its current crude oil tanker fleet, driven by CMB.TECH’s ‘future-proof’ fleet of 106 low carbon vessels, of which 46 are under construction.It was first announced in December 2023, and also entails Euronav’s proposal change its corporate name to CMB.TECH following completion of the transaction and the offer.

Euronav to Buy CMB.TECH for $1.15 Billion

Belgian tanker operator Euronav and its controlling shareholder CMB have entered into a share purchase agreement for the acquisition of 100% of the shares in cleantech maritime group CMB.TECH for $1.15 billion in cash.Euronav said the transaction is part of its renewed strategy of diversification, decarbonization and accelerated optimization of the its current crude oil tanker fleet, driven by CMB.TECH’s ‘future-proof’ fleet of 106 low carbon vessels, of which 46 are under construction.CMB.TECH builds…

Oil Spills and Near Misses: More Ghost Tankers Ship Sanctioned Fuel

An oil tanker runs aground off eastern China, leaking fuel into the water. Another is caught in a collision near Cuba. A third is seized in Spain for drifting out of control.These vessels were part of a "shadow" fleet of tankers carrying oil last year from countries hit by Western sanctions, according to a Reuters analysis of ship tracking and accident data and interviews with more than a dozen industry specialists.Hundreds of extra ships have joined this opaque parallel trade…

Profitability Still a Way Off for Tanker Shipping -BIMCO

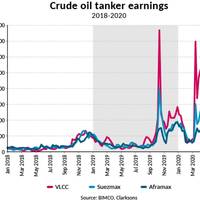

New virus mutations and outbreaks have slowed the recovery in global oil demand as some countries lock down again and international travel remains complicated.Drivers of demand and freight ratesTo say that the summer has not been kind to the crude oil shipping industry would be an understatement. Average earnings have dropped below $10,000 per day since June for all crude oil tankers, with many trades offering negative earnings; freight rates are not high enough to cover voyage expenses, let alone operating and financing costs.

HSFO Sales Rebound After Pre-IMO 2020 Correction -BIMCO

In the first quarter of 2021 high-sulpfr fuel oil (HSFO) has been the only bunker fuel to experience year-on-year growth in Singapore, the world's largest bunkering hub. HSFO sales are up 47.2% from Q1 2020, reaching 3.1 million tonnes. This is however still less than a third of high-sulfur fuel sales in Q1 2019, before the IMO 2020 Sulphur Cap came into force.The 1 million tonne increase in HSFO sales exceeded the fall in low-sulfur fuel oil (LSFO) and marine gas oil (MGO) sales, though only marginally, with total bunker sales in Singapore up by 0.8% in Q1.

Tanker Shipping Facing a Tough Year Ahead, Says BIMCO

After a turbulent year, low demand looks set to plague the market in the coming months combined with too many ships fighting for too few cargoes in both the crude oil and oil product segments, says the oil tanker shipping overview and outlook released today by BIMCO.Demand drivers and freight ratesThe realities of the pandemic are setting in for the tanker market. The record-breaking Q2 2020 is a distant memory and, instead, the market faces a slow recovery with low demand, stock…

Containerships Overtake Tankers as Most Scrubber-fitted Sector -BIMCO

Containerships with a collective cargo carrying capacity of 5.3 million 20-foot equivalent units (TEU) are now fitted with an exhaust gas cleaning system (scrubber) to remove sulphur oxides (SOx) from the exhaust gasses generated by the combustion processes in marine engines and thereby comply with the IMO 2020 global sulphur regulation which came into force on January 1, 2020.By the start of July, the share of the containership fleet with scrubbers installed exceeded that of the crude oil tanker fleet.

Geopolitics Dominate the Oil Tanker Market -BIMCO

Developments in the oil tanker market in the past decade dominated by geopolitics, says shipping association BIMCO.Crude oil and product tanker markets alike have faced high volatility in recent weeks and months, largely due to geopolitics and the constantly evolving situation in the global oil markets. The first major disturbance since the fall in the oil price between the fourth quarter of 2104 and first quarter of 2016 came in the fourth quarter of 2019, after which freight rates have bounced back despite a collapse in demand.In these extraordinary times…

BIMCO Tanker Rate Analysis: Reality Kicks In, Rates Fall

Tanker shipping: sky high freight rates replaced by reality of falling global oil demandGeopolitical tensions have now eased, leaving freight rates to feel the full effects of the weak underlying market and falling demand. Tanker shipping looks set to be under pressure for the rest of the year.Demand drivers and freight ratesThe tanker shipping industry was once again caught in a whirlwind, as freight rates skyrocketed with little regard to the poor market fundamentals before the latter once again caught up with rates.

Tanker Deliveries Up 37%: BIMCO

Delivered tonnage of crude oil tankers have grown by +37%, whereas total fleet demolitions for 2019 have slumped to the lowest in a decade with a reduction of 52% from the year before, says BIMCO, the largest of the international shipping associations representing shipowners.Newbuilding orders have remained low through the year with contracted tonnage down by 48%, it said.Amidst a market filled with uncertainty and geopolitical unrest, BIMCO maintains its bearings and turns to the market fundamentals to cut through the mist of market speculation and uncertainty-driven hype. “Through the first nine months of 2019, delivery activity has picked up substantially from last year, particularly in the crude oil tanker segment where deliveries are up 37% year-on-year.

Frontline Sees Opportunity in Tanker Market

So far in 2019, 41 VLCCs have been added to the global fleet compared to three vessel demolitions, said the world's largest oil tanker shipping company Frontline Ltd.An additional 33 VLCCs are scheduled to be delivered in 2019 with 43 more to follow in 2020 before the order-book declines sharply.It is important to note that both the VLCC and Suezmax tanker order book as a percentage of the total fleet are at the lowest levels seen in over 20 years.The order book has been the biggest challenge for the tanker markets over the last 24 months. The removal of this overhang is positive, but a surge in new orders can of course quickly change this.Despite continued deliveries of newbuilding vessels in the short term…

Frontline Predicts Tanker Market Volatility

The tanker market improved significantly in the fourth quarter ended December 31, 2018 driven by continued strong oil demand, said Bermuda-based tanker shipping company Frontline Ltd.According to the world's largest oil tanker shipping company, crude inventory draws reversed in the quarter, after having fallen below five-year levels and reduced the demand for crude tankers in the process.There is a historical correlation between inventory cycles and tanker rates, it said. Crude oil supply / demand forecasts from the IEA imply that inventories will remain relatively stable over the next several quarters, which in turn should create a…

Tanker Market Grappling with More Uncertainty

Tanker shipping: Added uncertainty is not helpful to the struggling tankersDemandJust when you thought it could not get any worse for the tanker shipping industry, the U.S. is reimposing sanctions on Iran coming into force after a six months wind-down period ending on November 4, 2018. The immediate effects are less tangible but sure to add more uncertainty to the whole shipping industry that has plenty of uncertainty to deal with already.At the same time, freight rates for both crude oil tankers and oil product tankers are mostly in loss making territory.

Frontline Posts Q3 Loss as Tanker Rates Hit 4-year Low

Frontline q3 net loss $24.1 million. The current crude oil tanker rate environment does not presently reflect that strong demand. Shares down 4.8 pct at 0840 GMT vs fall of 0.3 pct in Oslo's benchmark share index.

DVB Bank Losses on Shipping

DVB, the specialist in international shipping finance, reported a consolidated net loss before taxes of EUR 506.3 million in the first six months of 2017 (previous year: net income of EUR 14.1 million). Given persistent oil price uncertainty, oil and gas companies have continued to reduce their exploration and production spending, which has further curtailed demand for offshore vessels and equipment. Shipowners remain under pressure from low charter rates and competition for employment. Against this background, owners of vessels and drilling rigs adjusted their capacities, through lay-ups, restructuring or consolidation. Excess capacity remained a major challenge on shipping markets throughout the first half of 2017.

Frontline Hopes to Sail through Weak Tanker Market

Frontline Management said tanker markets are likely to remain weak for the next few quarters due to overcapacity. The market for Frontline's tankers will likely begin to improve in 2018, it said, as the pace of deliveries of new vessels slows and older ships are retired from the global fleet. While the weak market naturally affects our earnings in the short term, the company's strategy is not altered. "We continue to take proactive steps to increase the earnings potential of our fleet through the ongoing renewal of our fleet and by pursuing an opportunistic approach in the resale and newbuilding markets," he said. Over the last several quarters…

Tanker Shipping: Is the Oil Market Rebalancing or Not?

The one key factor to watch is the one thing that’s impossible to measure accurately on a global scale, oil stocks. Global stocks for both crude oil and oil products rose significantly following the sharp fall in crude oil prices in the second half of 2014. But while this may seem to be in the past, it is still haunting the oil market and the oil tanker market. Demand in the tanker market is below normal levels and will only increase once the global oil stocks have been reduced.

Crude Oil Tanker Demolition Bucking the Trend -BIMCO

Four very large crude carriers (VLCC) have been sold for demolition since October 2016, matching the number of VLCCs sold for demolition in the preceding two years, according to BIMCO. Most recently the 1999-built double-hull VLCC with the framing name Good News returned $15.5 million to the ship owner, as demolition prices have reached levels not seen since first half of 2015 ($400 per ltd). “January struck an upbeat tone for demolition in all sectors, but the overall pace of fleet renewal, via demolition, has slowed down since then,” said BIMCO’s Chief Shipping Analyst Peter Sand.

Record crude oil tanker deliveries adds instant freight rate pressure - BIMCO

On an unprecedented scale, 5.5m DWT of crude oil tanker capacity (up 220% from January 2016), has already been delivered in 2017 (according to preliminary data from VesselsValue.com). January 2017 already accounts for 22% of the crude oil tankers previous year’s total deliveries. In comparison to the totals of 2015 and 2014, this 2017 figure amounts to 48% and 51%, respectively. January 2016, in terms of crude oil tanker deliveries of2.5m DWT, hit record levels in relation to the previous two years. However, that level has been dwarfed by the tremendous amount of deliveries in January 2017. BIMCO’s Chief Shipping Analyst Peter Sand says: “This record-high crude oil tanker delivery growth is troubling…

Fleet Growth Squeezes Crude Oil Tanker Market

From January 2014 - October 2016 the crude oil tanker segment composing of VLCC, suexmax and aframax ships, had a net-fleet growth of 7.3 percent, which is equal to 24.3 million (m) DWT. The VLCC segment, with 20.7m DWT or a net fleet growth rate of 11 percent took the lion’s share, followed by the suezmax segment with 4.4m DWT or 5.5 percent. Whereas the aframax segment decreased by -0.8m DWT or 1 percent, in relation to the fleet size of the specific ship segment. The Baltic and International Maritime Council’s (BIMCO) Chief Shipping Analyst Peter Sand said…

Asia Tankers-VLCC Rates Slide

VLCC rates fall $10,000 in a week on dearth of cargo; demand fundamentals still appear favourable - Teekay CEO. Freight rates in Asian trades for very large crude carriers (VLCCs) are likely to slide further next week as charterers drip feed fixtures to dampen freight rates, ship brokers said on Friday. "I rather think charterers will play the same game as they have the last couple of weeks - fixing older tonnage and limiting cargoes as they try to squeeze freight rates," said a European supertanker broker on Friday. Charter rates for tankers that are 10-20 years old tend to be lower because the ships are less fuel efficient than younger vessels and owners are willing to accept a discount on the prevailing lease rate, brokers said. "Rates are going to fall even further.

Six New VLCCs Marks the Start of a Busy Delivery Year

2016 is off to a flying start when it comes to delivering brand new VLCCs from shipyards in South Korea and China to owners and investor across the globe, says a report BIMCO. The six new VLCCs were delivered in a strong winter market. Having reduced slightly, since the turn of the year, VLCC average earnings currently sit at USD 50,000 per day, in early February. For the full year, an additional 58 VLCCs are scheduled for delivery, but delays and postponements usually decrease that number to a certain degree. Taking that into consideration, BIMCO expects 37 VLCCs to be delivered during the final 11 months of 2016. South Korean shipyards will provide the lion’s share of these newbuilds.

2016 a Busy Year for VLCC Deliveries - BIMCO

When it comes to delivering brand new VLCCs from shipyards in South Korea and China to owners and investor across the globe, 2016 is off to a flying start. Six new VLCCs were delivered in a strong winter market. Having reduced slightly, since the turn of the year, VLCC average earnings currently sit at $50,000 per day, in early February, reports BIMCO. For the full year, an additional 58 VLCCs are scheduled for delivery, but delays and postponements usually decrease that number to a certain degree.