LOOP Crude Exports Surge Surprisingly

Crude exports from the Louisiana Offshore Oil Port (LOOP) are hitting a record high even as U.S. crude exports have fallen as the coronavirus pandemic has chopped worldwide fuel demand.Oil majors Royal Dutch Shell Plc and BP Plc are the main winners from rising LOOP exports, because they pump most of the mid-sour crude exported from the terminal.LOOP largely ships out Mars crude, a medium-sour grade of oil produced from the Mars platform, a joint venture of majority-owner Shell and BP, located about 130 miles (210 km) off the coast of New Orleans.

US Crude Futures Plunge to Lowest on Record

U.S. crude oil futures collapsed below $0 on Monday for the first time in history, amid a coronavirus-induced supply glut, ending the day at a stunning minus $37.63 a barrel as desperate traders paid to get rid of oil.Brent crude, the international benchmark, also slumped, but that contract was nowhere near as weak because more storage is available worldwide.While U.S. oil prices are trading in negative territory for the first time ever, it is unclear whether that will trickle down to consumers…

Corpus Christi Crude Exports Boom

U.S. crude exports from Corpus Christi, Texas, have surged to a record in recent weeks, often surpassing hubs such as Houston and Beaumont, Texas, thanks to faster-than-expected infrastructure additions.The infrastructure boom at Corpus Christi helped push crude exports there to a weekly record of 1.59 million barrels per day (bpd) in late December, more than doubling levels that held for the first eight months of last year, and above Houston's 2019 peak of 1.36 million bpd, according to vessel-tracking firm ClipperData.The heavy flows suggest that fears of a bottleneck that would impede U.S.

Eye in the Sky for Inland INTEL

Genscape Maritime’s Vessel Coverage of U.S. Inland Waterways offers new perspectives and a leg up on the competition. In today’s transportation markets, information is everything.It was back in 2016 that Genscape announced the complete integration of more than 400 terrestrial AIS antennas in North America, providing an impressive level of data accuracy and visibility into ship movements in the U.S. today, Genscape’s proprietary antenna network offers customers insights into ship movements, commodity flows, and other important data metrics in North America.Genscape’s private monitoring network covers every commercial port in the U.S., and over 90 percent of U.S. inland waterways, including extensive coverage of key regions such as the Mississippi and Ohio Rivers, and the Gulf Coast.

Fire burns out of control at Philadelphia refinery

A fire was burning out of control at an oil refinery in Pennsylvania on Friday morning, a Philadelphia fire department official said, as local media reported a series of explosions on site.NBC Philadelphia said the "massive" blaze at the 335,000 barrels per day Philadelphia Energy Solutions refinery was visible from miles away and triggered explosions that were felt as far away as South Jersey.The crude section at the Girard Point portion of the refinery was shut down due to the fire, intelligence provider Genscape said.There were no immediate reports of casualties at the complex, which the NBC affiliate said employs around 1,000 people.A company spokeswoman was not immediately available for comment.Three fire stations and a hazardous materials response crew were mobilised, the fire depart

US LNG Projects Buoyed by China Import Talks

China's interest in reducing its trade surplus with United States through increased energy imports could advance plans for U.S. liquefied natural gas (LNG) plants, said energy executives involved in developing new facilities.The White House and China on Saturday said a U.S. trade team would travel to China to explore new energy and agricultural deals. The joint communique lowered trade tensions, lifting stock markets in Asia and the United States on Monday.There are over two dozen proposed U.S.

Fleet Storing Gasoline off Europe's Coast Growing

Gasoline stored in ships off Europe's coast has ballooned to more than 400,000 tonnes, putting pressure on the continent's traders to compete for buyers once summer demand starts. Several vessels have joined the three initially booked to store fuel off Europe's ports in mid-March, and brokers said even barges have held cargoes of gasoline for three to four weeks as the volumes traded in Europe hit record levels last month. The tankers Torm Tevere, Ridgebury John B and STI Clapham are now parked off Europe's Amsterdam-Rotterdam-Antwerp hub…

Oil Backlog Off China Limits Prospects for Fresh Atlantic Basin Shipments

A backlog of crude cargoes has built up off the coast of China, limiting prospects for new shipments to the world's largest oil importer, trading and shipping sources said. The amount of oil floating in tankers off China has risen partly due to tax changes and an anti-pollution drive that have depressed oil demand from small, independent refiners, known as "teapots". Maintenance has curtailed run rates at others. This has combined with aggressive selling, particularly from West Africa, that pushed vessels to the region even when early warning signs showed crude demand could falter.

Rare Suezmax Gasoline Cargo Sails to West Africa

Nigeria's push to keep its citizens stocked with fuel is drawing close to a million tonnes a month of gasoline from Europe - including now on a rare Suezmax vessel booked by Vitol. The country is working overtime to replenish its tanks after shortages and queues popped up across the nation of more than 180 million in early December - sparking a scramble for state oil company NNPC. The restocking comes as gasoline demand in other regions was waning in winter, and has helped boost fuel and refining margins in Europe just as the continent's refineries prepare to shut for seasonal maintenance. The Vitol-booked, 115,000-tonne cargo aboard the newly built Sea Icon is sailing to West Africa from the Latvian port of Ventspils, according to Reuters ship tracking and trading sources.

Colonial Pipeline Demand at 2-Month Nadir

Demand to ship gasoline on Colonial Pipeline has sunk to a two-month low as Gulf Coast supplies are increasingly being exported or sent to the Midwest rather than to the New York harbor, three sources familiar with the matter said on Wednesday. Colonial Pipeline Co, the largest U.S. fuel network, has consistently allocated space for at least the past two months, meaning demand has exceeded capacity on the pipeline. But it would not ration space on its main gasoline line for the next five-day shipping cycle, known as "Cycle 2," the sources said, which suggests lower demand. Colonial spokeswoman Malesia Dunn said the company does not speculate on rumors. The sources could not speak for attribution because the information is not public.

Full Tanks & Tankers: A Stubborn Oil Glut Despite OPEC Cuts

After the first OPEC oil production cut in eight years took effect in January, oil traders from Houston to Singapore started emptying millions of barrels of crude from storage tanks. Investors hailed the drawdowns as the beginning of the end of a two-year supply glut - raising hopes for steadily rising per-barrel prices. It hasn't worked out that way. Now, many of those same storage tanks are filling back up or draining more slowly than investors and oil firms had expected, according…

Traders Sending European Gasoline Across Big Pond

More than half a million tonnes booked Europe-U.S.; more bookings could follow in May. Traders are shipping more gasoline from Europe to the U.S. East Coast ahead of the summer driving season as a steady reduction in inventories there props up prices. At least 16 tankers carrying some 600,000 tonnes of gasoline blending components including naphtha have been booked in recent days by traders including Glencore, ExxonMobil, Mercuria, Repsol and Total, shipping data shows. That compared with an average of around 300,000 tonnes per week booked throughout March. The exports are helping to clear Europe's tanks of oil products and boosting profits for refining gasoline from just under $6 per barrel at the end of March to more than $13 per barrel on Thursday.

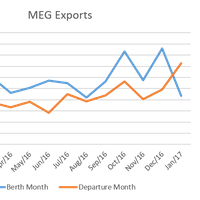

Middle East Gulf Exports Soar in January 2017

During January – a month when all eyes were on oil production cuts – exports leaving the Middle East Gulf (MEG) region hit the highest level in at least two years, according to Genscape. At the end of November 2016, the Organization of the Petroleum Exporting Countries (OPEC) addressed the perceived global oversupply of oil and consequent low prices. OPEC members agreed that all countries, except Iran, would cut total production by 1.2 million barrels per day (bpd), starting on January 1.

Oil Steady; Record High Russian Output Forecast Offsets Weak Dollar

Oil prices were little changed on Tuesday as forecasts for record production out of Russia in 2017 helped offset earlier gains related to a decline in the U.S. dollar and Saudi Arabia saying it would adhere to OPEC's commitment to cut output. Brent futures were up 5 cents, or 0.1 percent, at $55.91 a barrel by 11:26 a.m. EST (1626 GMT), while U.S. West Texas Intermediate crude rose 32 cents, or 0.6 percent, to $52.69. Both contracts were up by $1 earlier Tuesday. Earlier gains were capped by forecasts for rising U.S. and Russian production and scepticism that the Organization of the Petroleum Exporting Countries (OPEC) as a whole would comply with its commitment to reduce supplies.

Genscape Increases US Inland Waterways Coverage

Genscape, a provider of real-time data and intelligence for the global commodity and energy markets, has announced the complete integration of more than 400 terrestrial AIS antennas in North America, providing an unprecedented level of data accuracy and visibility into ship movements in the U.S. Genscape’s private monitoring network covers every commercial port in the U.S., and over 90 percent of U.S. inland waterways, including extensive coverage of key regions such as the Mississippi and Ohio Rivers, and the Gulf Coast.

First US LNG Shipment Goes to China

The first liquefied natural gas vessel from the lower 48 U.S. states is on its way to China, according to a Reuters interactive map on Friday, the latest sign that the expanded Panama Canal is allowing U.S. exports to reach the world's top LNG buyers in Asia. Royal Dutch Shell's Maran Gas Apollonia loaded up with gas at Cheniere Energy Inc's Sabine Pass LNG export plant in Louisiana, the map showed. It passed through the canal earlier this week and was moving northwest up the west coast of Mexico on Friday afternoon.

Oil Sheds 5% on Brexit Worry, Supply Builds

NEW YORK, July 5 (Reuters) - Oil prices tumbled nearly 5 percent on Tuesday as investors worried that Britain's exit from the European Union would slow the global economy, making it unlikely energy demand will grow enough to absorb a supply glut. Brexit worries hit Britain's property market and drove the pound to a 31-year low. A flurry of data from China in coming weeks is likely to show weaker trade and investments. Traders also cited data from market intelligence firm Genscape showing a build of 230,025 barrels at the Cushing, Oklahoma storage hub for U.S. crude futures, during the week to July 1. "There are risk-off trades across the board," said David Thompson, executive vice-president at Washington-based commodities broker Powerhouse.

Oil Ends Higher in Choppy Trade ahead of Britain's EU Vote

Oil prices closed 2 percent higher after a volatile session on Thursday, with investors less worried about prospects for the global economy after the last pre-vote opinion polls showed Britain was likely to remain in the European Union. Oil prices were also supported by market intelligence firm Genscape's report of a drawdown of nearly 1 million barrels at the Cushing, Oklahoma storage base for U.S. crude futures during the week to June 21, traders who saw the data said. Brent crude settled up $1.03, or 2.1 percent, at $50.91 a barrel. U.S. crude settled at $50.11 a barrel, up 98 cents. Both contracts shot up in the last few minutes of trading. Commodities and other financial markets have been on tenterhooks ahead of Britain's referendum on EU membership.

Israeli Shipping Data Firm to Enter Commodities Game

Analysts say intelligent analytics could give firm an edge. A young Israeli technology company believes the expertise it has built up in tracking ships for governments and security agencies could help it break into the much larger market for providing information on seaborne commodities. Windward, founded just over five years ago by two former Israeli navy officers, plans to launch a maritime information service later this year for banks, investors and trading houses, its chief executive Ami Daniel told Reuters in an interview. About 90 percent of global trade is transported by sea, but there is little visibility on what ships are doing and what cargo they carry.

Europe's Diesel Market Hits Crunch Time

Tankers that took a longer route set to arrive; storage in main hub nearly 70 percent full. Europe's new status as the dumping ground for the world's excess diesel comes to a head this month as mild weather, strong refinery runs and months of building stocks combine. The glut has been building for months as margins fattened by cheap crude have prompted European refiners to boost output and as exports from new refineries in the Middle East have headed to Europe. "Europe is not performing. There is lots and lots coming from the Middle East and more tenders for exports from the Middle East and India," one trader said. Vessels that took a longer trip around the southern tip of Africa to delay their landing are now arriving, and lingering at ports.

Oil Tankers Queueing in US Gulf Seen as New Symbol of Glut

A traffic jam of oil tankers has emerged along the U.S. Texas coast this month, a snarl that some traders see as the latest sign of an unyielding global supply glut. More than 50 commercial vessels were anchored outside ports in the Houston area at the end of last week, of which 41 were tankers, according to the Houston Pilots, an organization that assists in the navigation of larger vessels in and around port areas. Normally there are between 30 to 40 vessels anchored offshore, of which two-thirds are tankers, according to the pilots. Although the channel has been shut intermittently due to fog or flooding in recent weeks, pilots said those issues were not significant enough to create the backlog.

Unwanted Diesel, Jet Ships Could Sink Oil Prices

Backlog of vessels at port threaten loading delays; ships with half a million tonnes taking the long route to Europe. Unwanted diesel and jet fuel cargoes are backing up outside Europe's ports and taking longer, slower routes around the southern tip of Africa, traders say. A symptom of the world's excess of oil, it also paints a gloomy picture of the chance of an oil price rebound. The abundance of crude that roiled commodity markets and turned the balance sheets of oil majors on their head also encouraged under-pressure European oil refineries to run at full clip. Refineries from Rotterdam to India to Louisiana, drunk on cheap crude, ran regardless of whether the world wanted what they were making. Meteoric demand growth earlier this year for products such as gasoline masked the surplus.

Brent Closes Up, U.S. Crude Down After Saudi King Dies

Brent crude was buoyed on Friday by market uncertainty over the future of Saudi oil output, while U.S. crude fell on more signs of oversupply. Saudi Arabia's new king, Salman, who took the throne on Friday morning after the death of his brother Abdullah, is expected to continue OPEC's policy of keeping oil output steady to protect market share. Some traders did not want to believe that, "clinging on some faint hope that the news is wrong, the Saudis can't possibly mean what they're saying," said Walter Zimmerman, chief technical analyst at United-ICAP. OPEC announced last November it would keep output steady at 30 million barrels a day, despite pleas from some members for it to cut output to support prices and revenues.