US Gulf Coast Fuel Oil Imports Hit Five-year Low

Imports of fuel oil bound for the U.S. Gulf Coast fell to a five-year low last month as refiners ran more cheap, heavy Canadian crude and geopolitical tensions in the Middle East pressured fuel oil flows.Fuel oil deliveries to the Gulf Coast dwindled in February to just 318,000 barrels per day (bpd), a 20% drop from the prior month and marking their lowest level since February 2019, data from tanker tracking firm, Kpler showed.Heavy fuel oil feedstocks like high sulfur fuel oil…

NRL Plans to Boost Low-sulphur Fuel Oil Output for Ships

Pakistan National Refinery Limited (NRL) has started producing very low sulphur fuel oil (VLSFO) for ships and is planning to expand its monthly output by at least five-fold in six months, the company said late Tuesday.The company is producing about 2,000 metric tons of VLSFO per month, with the monthly volume likely to increase to 10,000 tons to 12,000 tons over the next six months, NRL told Reuters in an email.NRL announced the production of VLSFO in a notice to the Pakistan Stock Exchange earlier this week, stating that this comes after a "necessary change in crude mix and adjustments in pr

Value Maritime Installs First Filtree System for Ardmore Shipping

Value Maritime announced it has completed the first in a series of nine installations of its emissions reducing Filtree systems for product and chemical tanker company Ardmore Shipping Corporation.Taking place in China, this was the first time that Value Maritime has installed its system outside of Europe. The Ardmore Seaventure is also the first Ardmore vessel now fully equipped with Value Maritime’s Filtree system. The remaining installations for Ardmore Shipping are scheduled…

Singapore May Bunker Sales Hit over 5-year High as Vessel Arrivals Spike

-Monthly sales of marine fuel, also known as bunker fuel, hit over five-year highs at the world's largest refuelling hub Singapore in May as vessel arrivals spiked amid firm container throughput, official data showed on Wednesday.Singapore's bunker sales are an indicator of sentiment at one of the world's major ports and demand also affects fuel oil refining margins in Asia. Sales extended gains for a third consecutive month to 4.52 million tonnes, up 6.2% month-on-month, Singapore's Maritime and Port Authority data showed.

Record High Container Order Book Signals 'Significant Change'

“Despite the collapse in freight rates, shipowners still have an appetite for new container ship orders and the order book has continued to grow. The record high order book of 7.54 million TEU will result in significant changes to the container fleet in the coming years,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.During the last 10 quarters, 8.61 million TEU has been contracted, matching the level contracted during the preceding 30 quarters. The order book has now increased for 10straight quarters…

Decarbonization Center Finishes Two Trials for Biofuel Bunkering

The Global Center for Maritime Decarbonization (GCMD) has completed trials on two supply chains of biofuel blends for vessel bunkering, the center said on Tuesday.The maritime industry has been trying to source for green fuels to reduce carbon emissions ahead of the International Maritime Organization's 2030 and 2050 decarbonization targets. Biofuel bunkering is gaining traction in Singapore, with more than 90 biofuel bunkering operations completed last year, according to Singapore's Maritime and Port Authority.The trials were part of a $18 million global biofuels bunkering project launched by the GCMD in July last year, which is expected to span 12 to 18 months.The two trials took place from Oct. 31 to Feb.

Fujairah Bunker Sales Slide 2% in October

Marine fuel sales at the United Arab Emirates' Fujairah, the world's third-largest bunkering hub, slid 2% month-on-month in October as demand slowed.Total sales volumes at Fujairah, excluding lubricants, were at 655,126 cubic metres (about 627,000 tonnes) in October, showed latest data from the Fujairah Oil Industry Zone published by industry information service S&P Global Commodity Insights.The decline was led by a fall in low-sulphur bunker fuel sales, including low-sulphur fuel oil and marine gasoil.

Singapore Bunker Fuel Sales Steady in August

Marine fuel sales at the world's largest bunkering hub Singapore held steady at 4.12 million tonnes in August, with the number of vessel arrivals for bunkering little changed, official data showed Tuesday.Sales for low-sulphur marine fuels were steady to higher from the previous month, though total monthly sales were weighed down by a slight decline in high-sulphur fuel oil (HSFO). "HSFO bunker volumes were lower, potentially due to the two-month suspension of Glencore's bunkering license in Singapore…

Fujairah Bunker Fuel Sales Fall to Four-month Low

Marine fuel sales at the United Arab Emirates' Fujairah, third largest bunkering hub in the world, fell to a four-month low in June as high bunker premiums and tight supplies capped uptake.Total bunker sales volumes were down 13% month-on-month at 647,184 cubic meters (about 619,602 tonnes) in June, based on latest data from the Fujairah Oil Industry Zone published by industry information service S&P Global Commodity Insights."Fujairah barges have been trading above Singapore since mid-June.

Sinopec Fuel Oil Singapore Targets 50% Increase in Bunker Sales

Sinopec Fuel Oil (Singapore) Pte Ltd aims to raise its monthly bunker sales volumes by more than 50% after it received a license from the Singapore government this month, the company’s general manager said on Monday.Chinese refiners are expanding their foothold in the global marine fuels sector by increasing sales and output of 0.5% low sulphur fuel oil at key ports in Zhoushan, in China, and Singapore in recent years.The Maritime and Port Authority of Singapore (MPA) awarded the bunker license to Sinopec's Singapore fuel oil unit on June 1, the MPA said on its website, allowing the company to

Singapore Port Authority Says Tainted Bunker Fuel Came from UAE

Contaminated fuel supplied to some 200 ships in Singapore came from a tanker that loaded the oil from Khor Fakkan port in the United Arab Emirates, the Maritime and Port Authority of Singapore (MPA) said.MPA began investigations after it was notified on March 14 that a number of ships had been supplied with high-sulphur fuel oil (HSFO) containing high concentration levels of chlorinated organic compounds (COC) in Singapore.MPA said in April that the tainted oil was supplied by Glencore Singapore Pte Ltd.In further investigations to trace the oil's origin…

Singapore Port Authority Probes Alleged Bunker Fuel Contamination

The Maritime and Port Authority of Singapore, which oversees the world's biggest marine refuelling hub, said it is investigating the suspected contamination of bunker fuel supplied to several ships in the port and had ordered supply of the batch to be halted.At least 14 ships that received tainted high-sulphur fuel oil (HSFO) from Singapore suffered loss of power and engine problems, Veritas Petroleum Services (VPS) said late last week."We detected contamination in 34 fuel samples and we are aware of 14 vessels that have suffered damages.

Berge Bulk Orders More Scrubbers from Yara

Berge Bulk has returned to Yara Marine Technologies for additional in-line scrubbers in a new retrofit deal aiming to help the dry bulk shipowner to reduce emissions from its vessels.Berge Bulk is currently on a journey to zero carbon operations, and Yara Marine has already installed in-line scrubbers on about 30 of its bulk carriers."We have had good experiences using Yara Marine for emissions reduction. They have already provided several of our vessels with efficient, safe, and reliable scrubbers.

Scrubber-fitted Ships Nearly Double Since January 2020 -BIMCO

As the lion’s share of the world fleet replaced high-sulphur fuel oil (HSFO) with low-sulphur fuel oil (LFSO) as a mean of propulsion to be compliant with the International Maritime Organization's (IMO) 2020 global sulphur cap that came into force on January 1, 2020, overall bunker sales rose in the world’s by far largest bunkering hub: Singapore.Total bunker sale volumes grew by 5% in 2020 and have continued to climb in the first two months of 2021 (+2.7% y/y),a n indication of the shipping industry’s ability to deliver all the way through the pandemic.

Bunker Demand Returns to Pre-pandemic Levels

Asian refiners' profit from producing very low sulphur fuel oil (VLSFO) climbed to six-month highs this week as output cuts keep supplies tight while demand for the shipping fuel at most ports are back at pre-pandemic levels, traders and analysts said.The trend is likely to stay for the rest of the year, encouraging Asian refiners to prioritize VLSFO production along with petrochemical feedstock naphtha, where demand has also firmed.The front-month VLSFO crack was at $9.43 per barrel above Dubai crude on Tuesday, its highest since April 10.

'Strong Interest' in China's New Marine Fuel Contract

China's marine fuel futures contract that debuts on Monday on the Shanghai International Energy Exchange (INE) is likely to attract strong interest, despite weakened ship fuel demand amid the coronavirus pandemic, industry participants said. The new low-sulphur fuel oil (LSFO) contract features marine fuel meeting stricter international emissions rules and is the latest commodity futures product - and second oil contract after Shanghai crude - open to foreign investment. With few competitors…

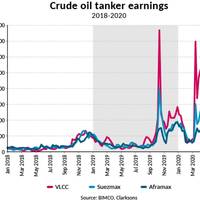

BIMCO Tanker Rate Analysis: Reality Kicks In, Rates Fall

Tanker shipping: sky high freight rates replaced by reality of falling global oil demandGeopolitical tensions have now eased, leaving freight rates to feel the full effects of the weak underlying market and falling demand. Tanker shipping looks set to be under pressure for the rest of the year.Demand drivers and freight ratesThe tanker shipping industry was once again caught in a whirlwind, as freight rates skyrocketed with little regard to the poor market fundamentals before the latter once again caught up with rates.

UAE Bans Ship Over Fuel Breach

The world's number two container line MSC is in talks with the United Arab Emirates after the Gulf country banned one of their vessels from entering its waters over what authorities said was a breach of tough new sulphur emissions rules for ships.This is one of the first punitive actions taken by a jurisdiction since regulations came into effect in January which make it mandatory for ships to use fuel with a sulphur content of 0.5%, down from 3.5% previously, or install devices that strip out the toxic pollutant - known as scrubbers.Ships were no longer able to even carry high sulphur fuel fro

Low-sulphur Fuel Sales Surge

The final quarter of 2019 marked a massive decline of high-sulphur fuel oil (HSFO) sales, as the industry transitioned into compliance of the International Maritime Organization's (IMO) 2020 Sulphur Cap (IMO 2020). In Singapore, the world’s largest bunkering hub, the bunker sale landscape saw significant change as the sale of high-sulphur fuel oil dropped tremendously in a matter of months. In contrast, the sale of low-sulphur fuels skyrocketed in the final quarter.The first wave…

Maersk to Raise HSFO Bunker Fuel Consumption to 25%

Danish shipping group A.P. Moller-Maersk plans to raise the proportion of high sulphur fuel oil it consumes from 10% to 25% by the year-end, CEO Soren Skou says.The world's largest container shipping firm consumed a total of around 11.80 million tonnes of shipping fuel last year.Maersk's current shipping fuel use comprises of around 10% ultra low sulphur (0.1%) fuel oil, 10% high sulphur fuel oil and the remaining 80% is low sulphur fuel oil. (Reporting Stine Jacobsen and Shadia Nasralla. Writing by Ahmad Ghaddar; editing by David Evans)

Low-sulphur Fuel Oil Prices Drop

Prices for very low sulphur fuel oil (VLSFO) in ports around the world have fallen within the first month since the International Maritime Organization's (IMO) new regulation for a 0.50% global sulphur cap for marine fuels has taken effect.Singapore has seen one of the largest drops in the price of VLSFO, which peaked on January 7, 2020 at $740 per metric ton (MT) and dropped $99 to $641 per MT on January 22, BIMCO points out.Prices rose in December as shipowners transitioned…

Asian Refiners Strive to Finish IMO Preparations

At SK Energy's largest refinery in South Korea, engineers are rushing to complete a new processing unit ahead of schedule as the firm looks to boost sales of low-emission fuels before new marine fuel standards take effect in just one month.In Japan, the country's second-biggest refiner Idemitsu Kosan Co is taking a more cautious stance, increasing capacity for low sulphur fuel oil (LSFO), but also relying on blending to produce IMO 2020 compliant bunker fuel.The different approaches…

Tankers Running on Fumes as Shipping Fuel Switch Causes Delays

Disruption to shipping from the long-anticipated switch to more environmentally friendly marine fuels has finally arrived, exacerbated by logistical problems as much as any shortage of the cleaner fuel.New International Maritime Organization (IMO) rules, referred to as IMO 2020, aim to stop ships from using fuels containing more than 0.5% sulphur unless they are equipped with exhaust-cleaning systems known as scrubbers.From the start of January ships must load very low sulphur…