Offshore Service Vessels: Regional Bright Spots Emerge

As oil exploration and production goes, so goes the market for Offshore Service Vessels (OSVs) and Platform Supply Vessels (PSVs). Throughout 2025, the prices of oil- which drives exploration and production (E & P), have softened, moving down towards $60/barrel amidst economic uncertainty and a wider than anticipated opening of the taps by major oil producers. In the past year, the Baker Hughes overall count of U.S. rigs working has declined. September 2025’s U.S. Rig count of…

Offshore Drilling Gains Momentum in US as Onshore Fades

Rigs drilling beneath the deep waters of the Gulf of Mexico will drive U.S. oil industry growth this year and next as onshore production slows due to lower prices and maturing shale fields, and analysts and consultants expect the trend to continue as new technology and friendly regulations attract investment offshore.The offshore oil and gas sector took a backseat to shale in recent years because drilling at sea requires years of construction work and higher upfront investments. Entry costs were lower for shale production and returns quicker, so rapid expansion in shale made the U.S.

DNV: Green Fleet Readiness Surges Ahead of Fuel Supply

By 2030, the alternative-fueled fleet will be able to burn up to 50 million tons of oil equivalent (Mtoe) of low-greenhouse gas (GHG) fuels annually, double the estimated volume needed to meet the International Maritime Organization’s (IMO) 2030 emissions target. Yet today, actual consumption of low-GHG fuels remains at just 1 Mtoe. This widening gap between capacity and use highlights both the scale of industry commitment and the urgent need for fuel producers and infrastructure…

DNV 2050 Forecast Points to New Fuel Supply Challenges

New insights from DNV’s Maritime Forecast to 2050 indicate that the number of alternative-fuel-capable vessels in operation is set to almost double by 2028.By 2030, the alternative-fuelled fleet will be able to burn up to 50 million tonnes of oil equivalent (Mtoe) of low-greenhouse gas (GHG) fuels annually, double the estimated volume needed to meet the IMO 2030 emissions target.Yet today, actual consumption of low-GHG fuels remains at just 1 Mtoe.The widening gap between capacity…

Green Party Norway Pushes Oil Phaseout

In Norway, made rich by oil and gas, the idea of shutting fields sends chills, but that is exactly what the small Green Party is pushing as a global switch away from fossil fuels looms.And it's a demand with greater meaning after Monday's election, with the ruling Labour Party needing the support of the Greens - who more than doubled the seats they hold to seven - to safeguard a two-seat majority secured by left-leaning parties."We will definitely prioritise putting the climate issue at the forefront…

TotalEnergies UK Assets to Be Bought by Prax Remain Unsold

The TotalEnergies West of Shetland offshore assets it agreed to sell to Prax Group last year remain under the French oil major's ownership, it said on Wednesday, so will not be subject to disposals resulting from liquidation proceedings affecting the British company."The transaction to sell our West of Shetland asset to Prax has not yet completed and as such we remain the operator of the Shetland Gas Plant and related fields," TotalEnergies EP UK said in its statement.TotalEnergies had agreed to sell Prax a portfolio of mature offshore fields producing about 7…

Aker BP Installs New Jacket at Valhall Field in Southern North Sea (Video)

Norwegian oil and gas company Aker BP has completed the installation of a jacket for a new production platform at the Valhall field in the Southern North Sea.The Valhall production and wellhead platform (PWP) jacket has been installed with the support from Allseas' Pioneering Spirit and Heerema Marine Contractors' Sleipnir, two of the world’s largest offshore vessels, Aker BP informed on social media.The installation followed the removal of an old production and compression platform (PCP).“This marks the end of an era and the beginning of 40 more years of production at Valhall.

Vermilion Energy Sells US Assets for $87mil

Vermilion Energy will sell its United States assets for C$120 million ($87.88 million), the Canadian gas producer said on Thursday, using the proceeds to repay debt and completing its exit from the U.S. market.The transaction, expected to close in the third quarter, will allow Vermilion Energy to focus on core gas-weighted assets in Canada and Europe.

Shell Makes FID for Trinidad Offshore Gas Project

Energy producer Shell has made a positive final investment decision on its Aphrodite gas project offshore Trinidad and Tobago, the company said on Tuesday.The project is expected to produce first gas in 2027 and have a peak production of 18,400 barrels of oil equivalent per day, it added in a release.Shell is a 45% shareholder in Trinidad's Atlantic LNG plant which has a capacity to produce 12 million metric tons per annum (mtpa) of the superchilled gas, but has been plagued by a shortfall of natural gas.

Court Overturns Approval for Two Massive UK North Sea O&G Fields

A Scottish court has invalidated Britain's approvals for two major North Sea oil and gas projects, delivering a significant victory to environmental groups and raising uncertainty over future fossil fuel developments in the UK.The Court of Session in Edinburgh found that the government had unlawfully granted approval for Shell's Jackdaw gas field and Equinor's Rosebank oil and gas field by failing to consider the emissions generated when the extracted fuels are burned—known as downstream emissions.

Trump to UK: Get Rid of North Sea "Windmills"

With the British government's announced plan to increase the windfall tax on North Sea oil and gas producers to 38% from 35% and extend the levy by one year, a move to fund renewable energy projects, U.S. President-elect Donald Trump took to his social media platform Truth Social to implore the UK to "open up" the British North Sea and get rid of windmills."The U.K. is making a very big mistake. Open up the North Sea. Get rid of Windmills!" Trump's post said.As Monday, January 20, 2025 grows closer -- inauguration day for the incoming U.S.

Maersk Eyes 15-20% Alternative Fuels to Power its Fleet In 2030

Alternative fuels could account for up to a fifth of A.P. Moller-Maersk's marine fuel consumption in 2030 as part of its goal to reach net zero by 2040, a senior company executive said on Thursday.The container shipping giant typically consumes between 10 and 11 million metric tons of fuel oil equivalent per year, of which 3% were alternative fuels last year, Emma Mazhari, vice president, head of energy markets, told reporters.The world's fleet moves more than 80% of global trade…

Norway's O&G Production Beats Expectations

The Norwegian Offshore Directorate said that Norway's oil and gas production in October exceeded the official forecast by 5 percent.Norway is Europe's biggest supplier of natural gases and oil. However, output can vary from month to months depending on maintenance and other stops at over 90 offshore fields.The total oil, gas liquids, natural condensate and gas production stood at 0.657 standard cubic metres (SCM) per day. This is equivalent to 4,13 million barrels oil equivalent.The…

Santos Optimistic About 2024 Output

Australia's second-largest oil and gas producer Santos estimated its full-year production to be at the top half of its forecast range on Thursday, and said its Pikka project could start oil production as early as 2025.The company expects to report full-year production in the top end of the forecast range of 84 -90 million barrels of oil equivalent (mmboe), with 65.6 mmboe achieved year-to-date.The Adelaide-based company said its drilling program for the Pikka phase one project in Alaska's North Slope is progressing well and could start oil production as early as December 2025.

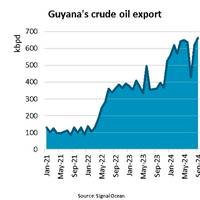

Tanker Vessels Flock to Guyana as Oil Exports Soar 58%

“Year-to-date, Guyana’s oil exports have jumped to 598 thousand barrels per day (kbpd), a 58% year-on-year increase, adding to the growth achieved in previous years. Over the past three years, the average annual growth rate has hit 76%,” says Niels Rasmussen, Chief Shipping Analyst at BIMCO.ExxonMobil first started producing from the Liza field in the Starbroek Block in late 2019. Since then, the operation in the Liza field has been expanded and production in the Payara field added.

US Gulf Coast Energy Facilities Brace for Storm Francine

Energy facilities along the U.S. Gulf Coast have begun scaling back operations and evacuating some production sites as Tropical Storm Francine swept through the energy-rich region, and was poised to strengthen into a hurricane later Tuesday.Francine was advancing toward the U.S. Gulf of Mexico, set to become the fourth hurricane of the Atlantic season, which concludes on November 30. Francine could intensify into a Category 2 hurricane, ahead of its expected landfall along the Louisiana coast on Wednesday evening, the National Hurricane Center said.Offshore production in the U.S.

Equinor Bullish on Offshore Oil

Equinor plans to invest 60 billion-70 billion crowns ($5.7 billion-$6.7 billion) per year offshore Norway towards 2035 as it expects continuing strong demand for oil, it said on Monday.Norway is Europe's largest gas supplier and a major producer of oil, pumping some four million barrels of oil equivalent per day, but many of its largest offshore fields are in decline and there are currently no new developments scheduled for the 2030s.At the same time, oil and gas investments are expected to hit a record this year and stay at elevated levels in 2025, driven by ongoing field developments and ris

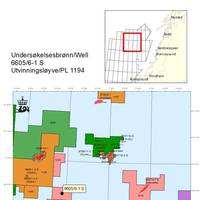

OMV Gas Discovery Could Extend Life of Aasta Hansteen Hub

OMV (Norge) has successfully completed drilling of a deepwater exploration well in the Norwegian Sea with preliminary estimated total recoverable gas volumes of between 30 and 140 million barrels of oil equivalent (mn boe).The deepwater wildcat well 6605/6-1 S is located 300km west of the Norwegian mainland at a water depth of 1,064 meters. The gas discovery, in the Haydn/Monn exploration prospects of PL 1194, is approximately 65 kilometers from the existing infrastructure of…

QatarEnergy Places $6B Order for 18 LNG Vessels to China’s CSSC

QatarEnergy has signed an agreement with China State Shipbuilding Corporation (CSSC) for the construction of 18 ultra-modern QC-Max size LNG vessels, marking a significant addition to its LNG fleet expansion program.The new vessels, with a capacity of 271,000 cubic meters each, will be constructed at China’s Hudong-Zhonghua Shipyard, a CSSC wholly-owned subsidiary, and will feature state of the art technological innovation and environmental performance.Eight of the 18 QC-Max size LNG vessels will be delivered in 2028 and 2029…

U.S. Department of Energy Advances Zero-Emissions Targets

This week at Singapore Maritime Week, the U.S. Department of Energy (DOE) is advancing ambitious decarbonization targets for the maritime transportation sector, both domestically and internationally.DOE is teaming with over 15 government and industry partners in Singapore to foster partnerships and collaborate on clean energy solutions aimed at achieving net zero-emissions in the maritime sector by 2050. Domestically, DOE’s Office of Energy Efficiency and Renewable Energy (EERE) is joining with ABS to create opportunities for data and information sharing to strengthen U.S. shipping. The U.S.

Esgian Week 12 Report: New Finds in Guyana, China and Norway

Esgian reports fresh finds confirmed in Guyana, China and Norway in its Week 12 Rig Analytics Market Roundup.Report Outline:ContractsDolphin Drilling has announced the award of a $154 million drilling contract from India's exploration and production company, Oil India Limited (Oil India), to the 6,000-ft semisub Blackford Dolphin.Malaysian offshore drilling firm Velesto confirmed Friday it had recently secured long-term contract extensions for three of its jackup rigs with Petronas Carigali…

Esgian Week 11 Report: New Discoveries in UK and Namibia

Esgian reports that drilling contracts have been announced this week for operations in Brazil and the Philippines, and new discoveries have been confirmed in the UK and Namibia in its Week 11 Rig Analytics Market Roundup.ContractsCOSL Drilling has emerged as the winner for Petrobras' moored semisubmersible tender with the 4,600-ft Nanhai 8 (also known as Nan Hai Ba Hao).Noble has secured a high-dayrate drillship contract with Prime Energy in the Philippines.Drilling Activity and…

Esgian Week 10 Report: Additional Backlog Secured

Esgian reports that offshore drilling contractors secured additional backlog in the U.S. Gulf of Mexico, Egypt, Nigeria, and Brazil and operators confirmed new discoveries in Indonesia, Côte d’Ivoire, and China in its Week 10 Rig Analytics Market Roundup.ContractsDiamond Offshore has executed a two-year contract extension with a subsidiary of bp in the U.S. Gulf of Mexico for the 12,000-ft drillship Ocean BlackHornet.Shelf Drilling’s 250-ft jackup Rig 141 has secured a two-year…