Esgian Week 16 Report: Rigs on the Move

Esgian reports on the many rig movements that occurred last week in its Week 16 Rig Analytics Market Roundup.Report SummaryContractsADES Holding Company has received a letter of award from an international oil company for a one-year firm drilling contract for a jackup offshore Qatar.TotalEnergies has exercised a three-well option for Transocean 12,000-ft drillship Deepwater Skyros offshore Angola at a rate of $400,000, keeping the rig working into December 2025.After initially beginning a short-term job in the US GOM in January 2024…

Esgian Week 15 Report: South America Remains Vital

Esgian reports on new contracts for Borr Drilling and Shelf Drilling (North Sea) jackups in its Week 15 Rig Analytics Market Roundup. Additionally, Energean has selected a drillship for its upcoming drilling campaign offshore Morocco. South America remains vital to the floating rig market, with ExxonMobil moving ahead on a sixth development on the prolific Stabroek block offshore Guyana and Petrobras reporting a new discovery in Brazil's Potiguar Basin.Report Outline:ContractsBorr Drilling has announced new contract commitments for three of its premium jackup rigs…

Petrobras Exec Says Gas Export Possible from Colombia Project

A promising area off Colombia's coast where Brazil state-run Petrobras is drilling this year could justify a large project to supply natural gas to the Andean country and for exports, Petrobras' head of exploration and production said on Wednesday.As oil production in Brazil's prolific presalt region is set to plateau in coming years, Petrobras is expanding its horizons to new frontiers including the Equatorial Margin, Colombia and Africa.At Colombia's Tayrona block, Petrobras…

Esgian Week 11 Report: New Discoveries in UK and Namibia

Esgian reports that drilling contracts have been announced this week for operations in Brazil and the Philippines, and new discoveries have been confirmed in the UK and Namibia in its Week 11 Rig Analytics Market Roundup.ContractsCOSL Drilling has emerged as the winner for Petrobras' moored semisubmersible tender with the 4,600-ft Nanhai 8 (also known as Nan Hai Ba Hao).Noble has secured a high-dayrate drillship contract with Prime Energy in the Philippines.Drilling Activity and…

Esgian Week 10 Report: Additional Backlog Secured

Esgian reports that offshore drilling contractors secured additional backlog in the U.S. Gulf of Mexico, Egypt, Nigeria, and Brazil and operators confirmed new discoveries in Indonesia, Côte d’Ivoire, and China in its Week 10 Rig Analytics Market Roundup.ContractsDiamond Offshore has executed a two-year contract extension with a subsidiary of bp in the U.S. Gulf of Mexico for the 12,000-ft drillship Ocean BlackHornet.Shelf Drilling’s 250-ft jackup Rig 141 has secured a two-year…

MOL and Petrobras Sign Cargo Transfer Vessels Deals

Mitsui O.S.K. Lines (MOL) and Brazil’s state-owned energy giant Petrobras have signed a charter contract for cargo transfer vessel (CTV) SeaLoader 2, and agreed to start negotiations for a new CTV shipbuilding contract by the end of 2024.MOL signed the deal through its wholly owned subsidiary, SeaLoading Holding, which owns and operates CTVs.SeaLoading started a CTV agreement with Petrobras for SeaLoader 2 on a trial period in January 2022, and successfully completed more than 30 crude oil offloading operations from Petrobras' FPSOs located in the Santos Basin…

Esgian Week 9 Report: Dolphin, Diamond and Seadrill Updates

Esgian reports rig-related updates from Dolphin Drilling, Diamond Offshore, and Seadrill in its Week 9 Rig Analytics Market Roundup.Report Outline:ContractsDespite Tullow Oil’s recent announcement that it would take a break from drilling offshore Ghana, Noble Corp. has stated that there has been no contract termination announcement and that its 12,000-ft drillship Noble Venturer is currently still contracted to Tullow into March 2025.Masirah Oil Ltd has signed a rig contract with…

ABL on Tow Job for Mero 3 FPSO’s Voyage to Brazil

Energy and marine consultancy ABL Group has secured a contract by POSH Projects to act as tow master to support and supervise the towage of the Mero 3 FPSO from Yantai in China to Brazilian waters.As part of its scope of work, ABL’s operations in Singapore will provide a tow master to act as client representative throughout the 12,108 nautical mile towage.The tow master will supervise and ensure that all marine operations for the sail away from Yantai CIMC Raffles Shipyard are carried out in-line with approved recommendations and procedural documentation.

Floating Production – A Growing Segment in Transition

The specialized deepwater oil & gas and floating offshore wind segments will share many of the same stakeholders and supply chains, competing for increasingly scarce resources.To receive a full version of Inteletus analysis, click hereThe established floating production segment is forecast to experience continued growth through this decade, driving demand for, among other things, moorings, subsea systems, umbilicals, risers, flowlines and the large anchor handlers and subsea support vessels that will install and maintain the elements.At the same time…

Solstad Offshore Hooks $70M in CSV Contracts with Petrobras

Norwegian offshore vessel owner Solstad Offshore has secured $70 million in new contracts and extensions for two of its subsea construction vessels (CSV) that will be employed offshore Brazil.The new contract is for the CSV Normand Fortress with Brazilian state-run oil company Petrobras.The contract has a duration of two years firm with possibility of two years extension. The vessel will provide accommodation services to support production activities on Brazilian continental shelf.The contract is set to start in the second quarter of 2024…

Esgian: New Contracts, Drilling Activities and Rig Moves Across the World

Esgian's last roundup of the year for the Week 52 puts spotlight on new developments for Dolphin Drilling semisub, Seadrill drillships, as well as Shell’s plans for Australia and ONGC’s new tender for jackups in India.ContractsDolphin Drilling has signed a Letter of Intent (LOI) with an undisclosed operator for the 1,500-ft semisubmersible Borgland Dolphin to undertake a 500-day drilling campaign in the UK. The drilling campaign is planned to begin directly after the firm part of the contract period with EnQuest, which was announced in late November 2023.

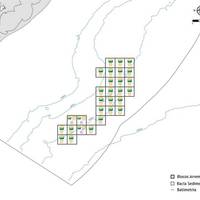

Bid Round Raises Optimism in Brazil's Deep Water Industry

On December 13, 193 blocks were auctioned in Brazil’s oil and gas licensing round, signaling strong optimism for the industry, according to Wood Mackenzie.Highlights from these bid rounds included:• The total amount in bonuses was US$85 million• 44 blocks were acquired in the Pelotas Basin, a frontier area. Petrobras will operate 29 and Chevron 15• All Basins managed to attract bids, even Parana Basin• A single Brazilian operator, Elysian, acquired 122 onshore blocks• BP, Equinor…

Brazil's Locar to Integrate Kongsberg Digital's Vessel Insight

Kongsberg Digital has partnered with Locar, a Brazilian offshore vessel operator, to enhance its digital infrastructure and optimize DP operations.Locar will integrate Vessel Insight, Kongsberg Digital’s vessel-to-cloud infrastructure to derive valuable data insights from their vessels. This implementation aims to provide Locar with a new level of transparency and optimize fleet performance.The initial vessel to undergo this digital upgrade is Marina I, a DP2 vessel from Locar's fleet; she will enter service at the beginning of 2024 for Brazilian energy company Petrobras.

Petrobras to Invest $102 Billion in Next Five Years

Brazil's Petrobras will invest around $102 billion within the 2024-2028 period, the firm's new strategic plan showed on Thursday, representing a major boost in expected investments by the state-run oil company.The plan, the first released by the oil giant since CEO Jean Paul Prates took the helm of the company, includes investments in a range of different segments, with most of it going into oil exploration and production.The figure represents a 31% leap from the $78 billion Petrobras…

Brazil: New Fortress Energy Charters FSRU Energos Winter

New Fortress Energy said Monday it had executed a definitive agreement to charter the Floating Storage and Regasification Unit (“FSRU”) Energos Winter from Brazil's Petrobras starting in December 2023. The FSRU Energos Winter will be immediately deployed to Terminal Gas Sul (“TGS”), NFE’s newest LNG import terminal in Santa Catarina, Brazil, which will start commercial operations ahead of schedule in January 2024.“We are extremely pleased to reach this agreement with Petrobras and begin operations at the TGS terminal in Santa Catarina, Brazil ahead of schedule in January 2024.

Brazilian Offshore Uptick Could Tighten US OSV Fleet

Increased activity in the Brazilian offshore oil and gas sector could help strengthen the market recovery for offshore supply vessels (OSV) in the U.S. Gulf of Mexico.In early October, Brazilian state-owned oil company Petrobras issued requests for quotations (RFQ) for up to 20 OSVs ranging from 3,000 to over 4,500 deadweight tons to support upcoming drilling and production activities. The value of all of these potential long-term charters could approach $1 billion.While Petrobras typically prefers to use Brazilian-flagged vessels…

Radix Wins $11.5M Contract from Petrobras

Petrobras awarded Radix a contract to develop projects for floating production, storage, and offloading vessels (FPSOs). The agreement will last 31 months, with services estimated at $11.5 million. The contract includes developing multidisciplinary engineering projects using digital automation tools for the state-owned company's new assets. "We are very excited about this major new contract with Petrobras, underlining our industrial expertise in this segment. Petrobras is a global reference client in the oil and gas market, where Radix continues to have a strong presence," said Augusto Castro, Radix's General Manager for Capital Projects.

DOF Secures Three Service Contracts with Petrobras Worth Over $260M

Norwegian offshore support vessel firm DOF said Monday it had won three new service contracts with the Brazilian oil firm Petrobras."The contracts were originated by a competitive bid process won by DOF and include work within our core service lines for Survey and Inspection," DOF said.These contracts represent a continuation of the services handled by DOF on the PIDF123 contracts signed with Petrobras in 2020 and under operation since December of that year.According to DOF, at least three vessels will be deployed to perform flexible pipeline, risers, and subsea equipment inspection in Campos Basin, Santos Basin, and Espírito Santos Basin. More than 3,200 inspections are expected to be executed.DOF did not say which vessel exactly would be deployed for these projects.

OceanPact Buys Two AHTS Vessels from Akastor's DDW Offshore

Brazilian offshore support vessel service company OceanPact has acquired two AHTS vessels, Skandi Saigon and Skandi Pacific, from Akastor's subsidiary DDW Offshore.OceanPact chartered the two vessels in March 2021 to support Petrobras' operations, with OceanPact having a purchase obligation at the end of the bareboat term."Following the expiry of the charter period, both vessels are now sold to OceanPact for the agreed cash payment of USD 18 million for both vessels, of which…

Petrobras Makes History, Sells First FPSO for Green Recycling in Brazil

In a first, Brazilian oil company Petrobras last week reportedly sold the P-32 FPSO for sustainable recycling in Brazil, paving the way for the development of the local ship recycling industry.The sale of the floating unit P-32 reportedly took place on July 7, 2023. In a collaboration supervised by Petrobras, the steel company Gerdau S.A. and shipyard Ecovix have been entrusted with the responsible and environmentally sound recycling of the FPSO."This decision marks the first time a commercial vessel at the end of its lifecycle will be dismantled in Brazil.

The Evolving FPSO Landscape – Healthy Demand, Changing Procurement

After a slowdown in activity during 2020/2021 due to soft commodity prices, demand for FPSOs is picking up.With exploration hotspots like Namibia’s Orange Basin and the East Mediterranean delivering new finds, the FPSO market outlook is healthy. But shipyard capacity constraints are beginning to weigh on delivery, leading to cost concerns. Furthermore, FPSO demand is competing for yard space with other construction projects.To mitigate delay risk and cost overruns, some E&Ps have reviewed their FPSO procurement strategies.

Brazil-bound FPSO Sepetiba Departs BOMESC Shipyard in China

The Brazil-bound FPSO Sepetiba sailed away from the BOMESC shipyard in China on June 16, 2023, following completion of the topsides integration and onshore commissioning phases.The unit—SBM Offshore’s third Fast4Ward FPSO—is transiting to the Mero field in the Santos Basin offshore Brazil, located 180 kilometers offshore Rio de Janeiro. SBM Offshore has a contract with Petróleo Brasileiro S.A. (Petrobras) for the 22.5 years lease and operation of FPSO Sepetiba. First oil is expected in the second half of 2023.The FPSO will have the capacity to produce up to 180…

TechnipFMC, DOF-owned Vessel Catches Fire in Brazil

Skandi Buzios, a pipelay support vessel owned by TechnipFMC and DOF, caught fire Friday morning in a Brazilian port.The Brazilian media and some social media accounts on Friday showed images and videos of the burning vessel with thick smoke billowing above it and firefighters trying to quell the fire.The incident happened at Porto do Açu, in São João da Barra, in the Brazilian state of Rio de Janeiro, and no injuries have been reported.Offshore Engineer has reached out to TechnipFMC seeking more info. "On Friday morning, June 2, a fire occurred onboard Skandi Buzios while the vessel was alongside Porto do Açu in Brazil. All personnel are safe, and no serious injuries were sustained. The fire has been brought under control after efforts by our crew, Porto do Açu, and local authorities.