Seatrium and Maersk Settle $475M WTIV Dispute

Singapore-based Seatrium has resolved its dispute with an affiliate of Maersk Offshore Wind, over the delivery of a wind turbine installation vessel (WTIV), originally intended for Equinor’s Empire Wind 1 project in the United States.Under the agreement Seatrium Energy reached with Maerk’s affiliate Phoenix II A/S, the parties will discontinue all legal proceedings related to the contract, agreeing to deliver the vessel by February 28, 2026.The settlement follows months of dispute after Phoenix II issued a termination notice in October 2025…

Seatrium, Maersk Offshore Wind Head to Arbitration Over $475M WTIV Dispute

Singapore’s Seatrium has received a notice of arbitration from Maersk Offshore Wind’s affiliate, regarding the dispute over the termination of a $475 million contract for a nearly completed wind turbine installation vessel (WTIV) originally intended for Equinor’s Empire Wind 1 project in the United States.The arbitration notice, received on October 21, comes just one day after Seatrium Energy (International) (SEI), a subsidiary of Seatrium, informed the buyer that the vessel would be ready for delivery by January 30…

Maersk Offshore Wind Terminates $475M WTIV Order with Seatrium

Singapore-based offshore contractor Seatrium has received a termination of the $475 million contract for the construction of a Wind Turbine Installation Vessel (WTIV) that was set for deployment at Equinor's Empire Wind 1 offshore wind farm in the United States.The contract - secured by Sembcorp Marine Rigs & Floaters in 2022, which is now known as Seatrium Energy (International) - was for the construction of a WTIV for Maersk Offshore Wind through its affiliate.Seatrium received the contract termination notice on October 9…

Keppel, Seatrium in $53M Arbitration Case Over Brazil Corruption Scheme

Singapore's Keppel has initiated arbitration proceedings against local shipbuilder Seatrium for a S$68.4 million ($53.33 million) claim related to a corruption crackdown in Brazil, the companies said on Tuesday.In 2023, Seatrium had made provisions worth S$82.4 million to pay Keppel against claims related to the crackdown, named Operation Car Wash.Seatrium noted the obligation to pay Keppel expired in February of this year and there were no binding and legally enforceable agreements signed with the Brazilian authorities before that.Earlier this year…

Sembcorp Signs 10-Year LNG Supply Contract with Chevron

Sembcorp Industries has signed a Sale and Purchase Agreement (SPA) with Chevron’s Singapore branch to import up to 0.6 million tonnes of liquefied natural gas (LNG) year, starting from 2028.The LNG deliveries will take place over the course of 10 years as agreed by the companies.The SPA will further strengthen Sembcorp’s existing natural gas supply portfolio from diversified piped and liquefied sources globally.As a key natural gas importer for Singapore, Sembcorp reiterated its…

Esgian Week 36 Report: New Contracts Awarded in India, Guyana and West Africa

Esgian provides an update on new contract awards for Greatship, Transocean, Noble and Stena Drilling in its Week 36 Rig Analytics Market Roundup.Report SummaryContractsGreatship has secured a contract with Cairn for its 350-ft Greatdrill Chetna jackup drilling rig in India. The contract is firm for six months at a dayrate of approximately $90,000, starting in late November or early December 2024.Transocean has secured a binding letter of award from Reliance Industries for its 6th generation 12…

Seatrium and NTU Prioritize Ammonia and Carbon Capture Research

Seatrium Limited and Nanyang Technological University, Singapore (NTU Singapore) have signed an MoU during the renaming ceremony of the former Sembcorp Marine Lab, reaffirming both parties’ commitment to advancing green and sustainable energy solutions.The newly named Seatrium New Energy Laboratory will focus on addressing challenges related to new energies, offshore renewables, marine decarbonisation and digitalisation within the offshore and marine industry.The areas of research…

Offshore Wind: Inside the Financial Web

Early 2024 saw a group of financial deals that have implications, in a broad sense, for how offshore wind projects may be financed. While offshore wind projects might be thought of as being in the ‘utility finance’ basket, they are ultimately high-risk deals that might better suit the portfolios of ‘infrastructure investment’ which, in recent years, has taken a shift towards tolerating more uncertainty when it comes to cash flows.A 2022 article from consultants McKinsey, titled “Infrastructure investing will never be the same”…

Singapore Shortlists Two Consortia for Ammonia Power and Bunkering Project

Singapore's Energy Market Authority (EMA) and the Maritime and Port Authority of Singapore (MPA) have shortlisted two consortia for the next proposal evaluation round of an ammonia power and bunkering project, they said in a joint statement on Thursday.The project aims to develop a low- or zero-carbon ammonia project on Jurong Island in Singapore to generate power and explore ammonia as a potential marine fuel.The two shortlisted consortia were Keppel's Infrastructure Division and Sembcorp-SLNG, who will conduct engineering, safety and emergency response studies for the proposed project.The bu

Seatrium Names Adrian Teng CFO

Singaporean shipbuilding group Seatrium announced it has appointed Adrian Teng as Chief Financial Officer (CFO), effective January 1, 2024.Teng brings over two decades of diverse international experience in strategy, finance, restructuring, operations and corporate management across developed and emerging markets. Prior to his current appointment, Teng was Group Chief Financial Officer and Chief Operating Officer of Clifford Capital Holdings, with responsibilities in finance, treasury…

Offshore Wind: US Shipbuilders Answering the Call

It’s a big deal when a U.S. president visits an American shipyard, and these trips always send a message. When President Obama spoke at HII’s Newport News Shipbuilding in 2013, he warned of the consequences of sequestration. President Trump’s 2020 speech at Fincantieri Marinette Marine touted a $5.5 billion naval contract that gave a welcome boost to the Wisconsin shipyard and its supply chain partners. Most recently, President Biden traveled to Philadelphia’s Philly Shipyard…

Keppel Profit Soars on One-off Gain from O&M Unit Sale

Singapore's Keppel Corp KPLM.SI on Thursday reported a more than seven-fold jump in its first-half profit boosted by a one-off gain from the sale of its offshore and marine (O&M) unit and strong performance from the infrastructure business.Keppel sold its offshore and marine business in February for S$4.50 billion ($3.40 billion) to Sembcorp Marine, recognising a gain of S$3.3 billion, as it aims to transform into an asset manager overseeing $150 billion by 2030 and focus on green energy.It managed S$53.2 billion in funds as of June 30.In May…

Transocean's Deepwater Titan Begins Inaugural Contract for Chevron

Offshore drilling contractor Transocean said its new eighth-generation drillship Deepwater Titan has started its inaugural contract with supermajor Chevron in the U.S. Gulf of Mexico.Built by Singapore's Sembcorp Marine and delivered to Transocean subsidiary Triton Titan GmBH in December 2022, Deepwater Titan is the world’s second eighth-generation drillship, constructed based on the builder’s Jurong Espadon 3T design.The dual-derrick ultra-deepwater drillship is the first-ever unit delivered with two 20…

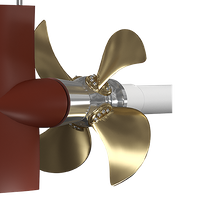

Brunvoll to Equip Brazilian Research Support Vessel

Norway-based Brunvoll said it has secured an "extensive" contract with shipbuilder Estaleiro Jurong Aracruz LTDA in Brazil for the delivery of a propulsion and maneuvering package for the Brazilian Ministry of Defense’s new Antarctic Research Support vessel.The delivery from Brunvoll comprises a variety of its own products and from its partners. Low noise and vibration levels arecrucial for conducting scientific research onboard an oceangoing vessel. Utilizing a fixed pitch propeller…

Keppel's Profit Boosted by Sale of Offshore & Marine Business

Singaporean conglomerate Keppel Corp Ltd on Thursday posted a higher net profit for the first quarter, boosted by a significant one-off gain recognized from the sale of its offshore & marine unit.In February, Sembcorp Marine completed a S$4.50 billion ($3.37 billion) buyout of Keppel's offshore & marine unit after receiving the necessary shareholder approvals.Keppel recognized a gain of S$3.3 billion and received S$500 million of cash in the first quarter following the transaction, it said.The company did not disclose a profit figure, but said that revenue for the quarter was S$2.26 billion, u

Sembcorp Marine Proposes Name Change Following Merger with Keppel Offshore & Marine

Singapore-based Sembcorp Marine said Monday it was proposing to change its name from “Sembcorp Marine Ltd” to “Seatrium Limited."This follows the completion of the combination of the company's businesses and Keppel Offshore & Marine Ltd on February 28, 2023, and will adopt a new branding for the enlarged entity."The proposed change of name is subject to shareholders’ approval and will not affect the identity of the Company or any of its rights and obligations, nor will it affect any of the rights of shareholders or the Group’s daily business operations and financial standing…

Singapore's Keppel Completes $3.34B Sale of Offshore Unit to Sembmarine

Singapore's Keppel Corp said on Tuesday that Sembcorp Marine (Sembmarine) has completed a S$4.50 billion ($3.34 billion) buyout of its offshore & marine unit after receiving the necessary shareholder approvals. ($1 = 1.3484 Singapore dollars) (Reuters - Reporting by Jaskiran Singh in Bengaluru; Editing by Savio D'Souza)Sembcorp Marine to Buy Keppel Offshore & Marine for $3.2B, Scraps Merger Plan

Chevron Aims to Shrink the Carbon Footprint of Its LNG Fleet

Chevron's shipping arm has set out to reduce the carbon intensity of its liquefied natural gas (LNG) fleet operations.The U.S.-based supermajor said Chevron Shipping Company has entered into an agreement with Singapore's Sembcorp Marine Repairs & Upgrades to install new technologies aboard its vessels, such as a reliquefication system, hull air lubrication and a new gas compressor, that are together expected to reduce cargo boil-off, lower fuel consumption and increase volumes…

Sembcorp Marine Names LNG Hybrid Tug in Singapore

Sembcorp Marine celebrated the naming of JMS Sunshine, its first of a series of LNG hybrid tugs specially designed for domestic service in Singapore.Sembcorp Marine commissioned the design and build of the world’s first LNG hybrid tug in 2018, and the company plans to build a fleet of tugs to progressively replace the existing diesel-powered fleet operated by Jurong Marine Services (JMS), a wholly owned subsidiary of Sembcorp Marine Ltd and a licensed operator of the Maritime and Port Authority of Singapore.

Sembcorp Delivers 8th-generation Drillship Deepwater Titan to Transocean

Singapore-based shipbuilder Sembcorp Marine has delivered Deepwater Titan, the world’s second 8th-generation drillship, to Transocean subsidiary Triton Titan GmBH.Deepwater Titan is the second of two new 8th-generation drillships constructed by Sembcorp Marine based on the group’s Jurong Espadon 3T design. The dual-derrick drillship is the first-ever unit delivered with two 20,000-psi blowout preventers (BOPs), well-control, riser and piping systems for high-pressure and high-temperature drilling and completion operations.

Great Ships '22: Deepwater Atlas, “World’s First Eighth-Gen Ultra-Deepwater Drillship”

Marijana Sosic, Manager, Technical Marketing at Transocean, discusses some of the outstanding features of the Deepwater Atlas – Built in Singapore at Sembcorp Marine's Jurong Shipyard and flying the Marshall Islands flag – and sister-ship Deepwater Titan , which together represent an investment of more than $2 billion.The Deepwater Atlas was launched this year in Singapore. What, specifically, is so special about it?The Deepwater Atlas is the first of its kind eighth-generation drillship that will offer 20,000 psi well control capabilities and a 3.4 million pound hoisting capacity.

Shell's 34,000t North Sea-bound Penguins FPSO Leaves Chinese Shipyard

Shell's Penguins FPSO has set sail from China loaded aboard Boskalis' White Marlin semi-submersible heavy transportation vessel.In a social media post on Thursday, Boskalis said: "Boskalis’ semi-submersible transport vessel White Marlin departed from Qingdao, China with an impressive cargo; the 34,000-ton cylinder-shaped Shell Penguins FPSO. After a smooth and safe float-on and [seafastening] campaign, the vessel started her journey to Norway." At the time of writing, the White Marlin was sailing past the east coast of Taiwan…

Fortunes Return to the Sea as the Wind Blows Offshore

The results of fortunes and failures are often described as a “perfect storm”. The COVID pandemic, domestic inflation, labor issues and current geopolitical events have brought that description to a peak. A promise of a “new normal” emerged post pandemic, with a vision of alternative energy, alternative fuels and alternative supply chain logistics to help toward solving some of the problems, heralding a world of change with reduced emissions, government support and the end of fossil fuels as we know them in energy and marine operations.With those promises came big movements in the U.S.