VTTI to Control Italy's Biggest LNG Terminal, Snam to Get 30%

Energy storage group VTTI will get a 70% stake in Italy's biggest liquefied natural gas (LNG) terminal, with grid operator Snam owning the rest, the Milan-listed group said on Wednesday, announcing a deal to be finalised by year-end.Snam, which is controlled by the Italian government, said in a statement it had exercised its pre-emption right to increase its stake in the infrastructure dubbed Adriatic LNG to 30% from 7.3%.The move comes after ExxonMobil and QatarEnergy last week agreed to sell their stakes in the terminal to a consortium led by Dutch group VTTI.

Red Sea Crisis Adds 100,000 Bpd to Global Fuel Demand

The shipping industry is consuming an additional 100,000 barrels per day of fuel to sail longer distances needed to avoid traversing the Red Sea, Vitol Chief Executive Officer Russell Hardy said on Wednesday.Total distance traveled by ships is about 3% more than it was before Yemen's Houthi group started attacking shipping, Hardy said.Tanker traffic in the Red Sea is higher today than it was five years ago, he said, but global conflicts have shifted global trade flows."We have had to re-orientate so much all over," he said at a panel during the CERAWeek conference in Houston, Texas.

Shipping Companies Turn to Longer-Term Leases as Tanker Supply Tightens

Rising oil tanker chartering rates due to global shipping disruption are forcing oil shippers to take on longer-term shipping charters, executives said this week at an energy conference in Houston.The global oil tanker fleet must now travel further to get crude to refineries and fuel to consumers. European sanctions have forced Russian exporters to send oil to Asia that would have otherwise gone to Europe. Attacks on vessels in the Red Sea have forced some shippers to sail around…

Vitol Bunkers Receives its First Biofuel Barge in Asia

Vitol Bunkers has taken delivery of the Marine Future vessel, its first specialized biofuel bunker barge in Singapore.The addition of this specialized IMO type 2 notation bunker tanker to the V-Bunkers fleet will make it possible to supply biofuel blends including B24, B30 and up to B100, depending on customer specifications.Built in China, Marine Future is 102.6m in length and has the capacity to carry about 7,000 MT of biofuels.The current fleet of bunker tankers in Singapore are classified as ‘oil tankers’ and are therefore restricted to a maximum of 25% bio component in biofuel blends.

Equatorial, TFG and Sinopec are Singapore's Top Three Marine Bunker Suppliers in 2023

Equatorial Marine Fuel Management Services, TFG Marine and Sinopec Fuel Oil Singapore were the top three marine bunker suppliers in Singapore, the world's largest bunker hub, in 2023, latest data from the port authority showed.Equatorial maintained its top position for a second consecutive year, while Trafigura's TFG Marine rose one spot to become the second largest supplier, data from Singapore's Maritime and Port Authority showed.Sinopec Fuel Oil Singapore jumped 16 spots to become the third largest supplier, the data showed.

Vitol Completes Biofuel Delivery in the UAE

Vitol says it successfully completed its first biofuel deliveries in Fujairah.Through its wholly-owned bunker arm, Vitol Bunkers, two vessels received B24 VLSFO on December 8 and 14. The fuel was sourced from its Fujairah-based refinery FRL and blended with regionally-sourced biofuel at VTTI storage facilities.

India Resumes Imports of Venezuelan Oil

Indian refiners have resumed Venezuelan oil purchases through intermediaries, with Reliance RELI.NS set to meet executives from state firm PDVSA next week to discuss direct sales following the easing of U.S. sanctions on the South American country, people familiar with the matter said.Trade resumed between the OPEC producer and the second largest destination for its oil after Washington in October temporarily lifted sanctions banning Venezuelan oil exports, prompting a flurry of spot sales of crude and fuel through middlemen and traders…

Supertanker Chartered by Polish Firm to Load Venezuelan Oil for China

Polish oil and gas firm Orlen has provisionally chartered a supertanker to load Venezuelan oil for China, according to a shipbroker and tracking data, following a temporary easing of U.S. sanctions on the South American country.The Very Large Crude Carrier (VLCC) Olympic Trophy, chartered for $13 million, is scheduled to load in early December, according to a source and ship tracking data on Kpler.Vitol, the world's largest independent oil trader, chartered a supertanker earlier this month to load Venezuelan crude for China.

Vitol Hires Ship to Load Venezuela Crude for China after U.S. Lifts Sanctions

Vitol, the world's largest independent oil trader, has provisionally chartered a supertanker to load oil from Venezuela for China, according to two shipbrokers and data from shiptracking firms Kpler and Vortexa.The Very Large Crude Carrier Gustavia S., chartered for $11 million, is scheduled to load its cargo between Nov. 27 and Dec. 2, according to the sources.The company declined to comment on the issue.Vitol is among major European trading houses seeking to resume trade in Venezuelan oil after Washington in mid-October issued a general licence lifting…

Obscure Traders Ship Half Russia's Oil Exports to India, China After Sanctions

A Liberian-flagged oil tanker set sail in May from Russia's Ust-Luga port carrying crude on behalf of a little-known trading company based in Hong Kong. Before the ship had even reached its destination in India, the cargo changed hands.The new owner of the 100,000 tonnes of Urals crude carried on the Leopard I was a similarly low-profile outfit, Guron Trading, also based in Hong Kong, according to two trading sources.The number of little-known trading firms relied on by Moscow to export large volumes of crude exports to Asia has mushroomed in recent months…

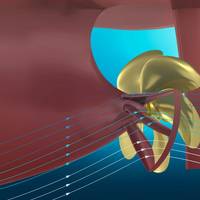

Wärtsilä Supplies Energy Saving Propulsion Devices to Vitol Tankers

Wärtsilä has delivered propulsion efficiency devices to two tankers owned by Vitol.The vessels, Elandra Sea and Elandra Star, managed by Latvian operator LSC Group, had tailored Wärtsilä EnergoFlow and EnergoProFin systems installed during summer 2022.EnergoFlow is a pre-swirl stator that creates an optimal inflow for the propeller, reducing fuel consumption and emissions in all operating conditions. The EnergoProFin is an energy saving propeller cap with fins that rotate together with the propeller.

Four Bidders Vie For Stake in Exxon LNG Terminal Offshore Italy - Sources

Four international groups are competing to buy Exxon Mobil Corp's majority stake in a liquefied natural gas (LNG) terminal offshore Italy, two sources familiar with the matter said. The deal could value the entire LNG terminal at around 800 million euros ($881 million), the sources said. Exxon said in March it was considering selling its majority stake in Adriatic LNG, Italy's main regasification terminal, as part of a wider strategy to divest non-core assets. The U.S. group is being advised by Rothschild & Co. on the process.

ZeroNorth and Vitol Team Up on Emissions Reporting

Technology company ZeroNorth has signed a long-term strategic partnership with energy and commodity company Vitol.The deal will see Vitol gain full access to the ZeroNorth platform, and ZeroNorth customers will in turn gain access to Vitol’s carbon reduction solutions and bunkering services through subsidiary Vitol Bunkers.Vitol will use the ZeroNorth platform to optimise operations in a number of key business areas, including voyage, vessel, bunker and emissions optimisation…

Singapore’s First Hybrid Electric Bunker Vessel Delivered

Singapore’s first hybrid bunker tanker, Marine Charge, has been delivered to V-Bunkers, Vitol’s Singaporean bunker operations company.The 7990-ton vessel, designed by SeaTech Solutions and built by Zhejiang Shenzhou Sunshine Heavy Industry is fitted with 480Kwh of Shift’s energy storage system (ESS).Shift Clean Energy’s ESS will be primarily used for peak shaving (storing energy during low power consumption for use during peak usage periods, allowing main generators to operate with a more stable load).

V-Bunkers Unveils Singapore’s First Electric-Hybrid Bunker Vessel

Vitol’s Singaporean bunker operations company, V-Bunkers, has announced the imminent delivery of what will be Singapore’s first electric-hybrid bunker tanker.The vessel, Marine charge, features lithium-ion batteries and an automated Power Management System expected to achieve an estimated 10% reduction in GHG emissions.The design configuration enables the auxiliary engines to operate at the most optimal specific fuel oil consumption, while the energy storage system (ESS) performs peak shaving during low power consumption periods for usage of stored energy during high consumption periods.

Finland’s New Inkoo Terminal Accepts First LNG

Finland’s new Inkoo floating storage regasification unit (FSRU) terminal on Sunday accepted its first cargo of liquefied natural gas (LNG).The cargo, which was ordered by Elenger, the largest privately owned energy company in the Finnish-Baltic region, was delivered by multinational energy and commodity trading company Vitol.The cargo, which originates from Vitol’s Venture Global Calcasieu Pass facility in the U.S., was transported aboard Vitol's LNG carrier Vivit Americas LNG.

Singapore's Top Bunker Suppliers of 2022

Equatorial Marine Fuel Management Services Pte Ltd rose one spot to become the top marine fuel supplier at world's largest bunkering hub Singapore in 2022, official data showed on Monday.Equatorial overtook PetroChina International Singapore Pte Ltd, who dipped from its top ranking in 2021 to second spot in 2022, while Trafigura's TFG Marine Pte Ltd climbed two spots to become third-largest supplier, data from the Maritime and Port Authority (MPA) of Singapore showed.Vitol Bunkers Pte Ltd maintained fourth in 2022 as with the previous year, while Shell Plc's Singapore bunkering unit, Shell Eas

VTTI Plans New 5 bcm Floating LNG Platform in Netherlands by 2024

Dutch energy company VTTI said on Monday it plans to build a new floating liquefied natural gas (LNG) terminal in the Netherlands with capacity to import 5 billion cubic meters of gas annually. On Friday the Dutch government said it was in talks with two different groups over new LNG terminals to increase Dutch import capacity by 5-8 billion cubic meters (bcm) annually as it seeks to ensure the country's energy security. Rotterdam-based VTTI said in a statement it was "striving"…

Delfin Gets More Time to Build U.S. Gulf of Mexico LNG Export Plant

U.S. energy regulators on Friday extended until September 2023 the amount of time liquefied natural gas (LNG) developer Delfin LNG has to put the onshore part of its proposed Gulf of Mexico floating export project off Louisiana into service. The U.S. Federal Energy Regulatory Commission (FERC) said in its order that Delfin sought the extension in July. Delfin is one of several North American LNG export developers that delayed construction in recent years in part because coronavirus…

US Authorities Make Checks on Oil Tanker Arrived from Russia

U.S. authorities have stopped an oil tanker traveling from Russia to New Orleans to check whether it is Russian in origin, a source confirmed to Reuters.The Vitol-chartered vessel was shipping intermediate oil products including vacuum gasoil and fuel oil from Russia's Taman port to New Orleans last week, according to a trading source and shipping data.The products were due to reach a Valero refinery in the New Orleans region, two sources said.The cargo was stopped by U.S.

Vitol Enters Jebel Ali Bunker Market

Vitol Bunkers said has extended its bunkering services to Jebel Ali—the largest container port in the Middle East—and to Dubai's Port Rashid Cruise Terminal, from July 2022.According to Vitol, the move will help it to address the supply requirements of strategic marine customers in key Middle Eastern locations.Vessels visiting Jebel Ali will have access to Vitol Bunkers’ marine products produced at the Vitol-owned FRCL refinery in Fujairah. These include a range of marine fuel grades as well as bio-marine fuels for customers wishing to mitigate their carbon emissions.

Delfin Seeks More Time to Build US Gulf of Mexico LNG Export Plant

U.S. liquefied natural gas (LNG) developer Delfin LNG has asked federal regulators to extend the amount of time it has to put the onshore part of its proposed Gulf of Mexico floating LNG export project off Louisiana into service until September 2023.The U.S. Federal Energy Regulatory Commission (FERC) said on Thursday that Delfin sought the extension on July 15.Delfin is one of several North American LNG export projects that delayed decisions to start construction in recent years…

Swiss "Take Note" of EU Sanctions Tweak for Russian Oil

The Swiss agency in charge of sanctions said it was up to the Swiss government to decide whether to adopt a tweak to EU sanctions that eases shipments of oil from Russian state-owned firms Rosneft and Gazprom to third countries.Purchases of Russian seaborne crude oil by EU companies and its export to third countries is allowed, but under tweaks to sanctions on Russia that came into force on Friday, payments related to such shipments would not be banned."We took note of the EU's decision to adopt new measures against Russia…