Hopes Fade for Bright Start of 2026 for Ship Recyclers

The Baltic Exchange Dry Index halted a nine-session slide to mark a 2.3% U-turn, climbing to 1,567 points, reports cash buyer GMS. This was driven by gains across segments: Capes (up 2.3%), Panamax (up 4.3%), and the smaller segments adding four points by week’s end.“Notably, the overall benchmark index still finished the week down 7.2%. Oil too continued to trip on itself and stayed below the coveted USD 60/barrel mark despite a 0.4% increase, closing the week out at USD 59.44/barrel.“The U.S.

Lukoil Trading Arm Falls Apart Under US Sanctions

U.S. sanctions are dismantling what remains of Lukoil's Litasco, once Russia's biggest oil trader and a rival to top Swiss houses and oil majors, five sources told Reuters.The measures, which also target state-owned Rosneft, took effect on Friday as Washington seeks to choke off Moscow’s ability to fund its war in Ukraine. They have thrown Lukoil’s global operations into limbo, from oilfields in the Middle East to fuel pumps and refineries across Europe.Cut off from the global financial system…

Panama Canal Eyes Doubling Container Transits

The Panama Canal Authority could double in coming years the number of containers that move through the commercial waterway that links the Pacific and the Atlantic oceans, the canal's chief told a maritime conference.The authority, which has an $8 billion investment plan, is putting in place a water conservation strategy following a severe drought that forced ships between late 2023 and early 2024 to take alternative routes between the United States and Asia.As part of that, it is encouraging shippers to consolidate cargoes so less water is used for vessels to pass…

Rolls-Royce to Cut Up to 2,500 Jobs

Rolls-Royce (RR.L) said on Tuesday it would cut up to 2,500 jobs as its new chief executive seeks to build a more efficient business, the latest boss to attempt to revamp one of Britain's most prestigious engineering companies.Over the last decade, Rolls-Royce, whose engines and systems are used on the Airbus A350 and Boeing 787 as well as ships, submarines and in power generation, has been through several restructurings, axing more than 13,000 jobs.Tufan Erginbilgic, who took over in January, is the latest CEO to try to tackle the company's inefficiencies.

Mounting Evidence Shows Seismic Surveys Can Harm Marine Life

Woodside Energy last week announced it would start seismic testing for its Scarborough gas project off Australia’s west coast, before reversing the decision in the face of a legal challenge from Traditional Owners.Seismic testing is highly controversial in marine environments. Australia’s federal regulator (the National Offshore Petroleum Safety and Environmental Management Authority) is currently examining a proposal for seismic testing in the Otway Basin in Bass Strait, which conservationists say has attracted more than 30…

Recycling Quiet After Eid Holidays

With many sub-continent yards still closed after Eid holidays, mixed in with the ongoing monsoon season, cash buyer GMS reports a lack of tonnage and an inactive week in the ship recycling market.Most of the year has been quiet for recycling sales, and prices being quoted are so unworkably below market expectations at present, a bounce back anytime soon seems unlikely, says GMS.“As such, before proposing any further candidates, most cash buyers and (especially) ship owners have decided to continue to wait and watch the markets for greater stability and a better handle on pricing.”Meanwhile…

NY Waterway's New Ferry Franklin Delano Roosevelt Enters Service

A new passenger vessel entered service for operator NY Waterway, serving as both a commuter ferry and for scenic tours of the harbor with Big City Tourism.Built locally by New Jersey-based Yank Marine in Tuckahoe, N.J., the 599-passenger Franklin Delano Roosevelt was christened Thursday during a ceremony at Pier 79 in Midtown Manhattan.The FDR is powered by low-emission 2,000-horsepower twin EPA Tier 3 compliant engines and has a service speed of 21 knots. The FDR is 109 feet long and 32 feet wide and draws just six feet of water depth.The new vessel has already seen a lot of action.

Ship Recycling Prices Perk Up

Following a virtually inert 2022 and a slightly busier start to 2023 at the various recycling destinations, much of the Far East was off celebrating Chinese Lunar New Year holidays this week and it has expectedly been a quieter period - in terms of sales and activity.A larger number of container vessels have so far been sold for recycling at the start of the year, and we are beginning to see signs that older dry bulk vessels with surveys due may follow suit in the near future as well.Additionally, following a glut of tanker vessels concluded for recycling at the beginning of 2022, this is the

Finnlines Adds Two New RoPax Vessels Between Sweden and Finland

Finnlines will make major investments in its route between Sweden and mainland Finland via Åland during 2023 as the freight and passenger shipping company continues to bounce back from the pandemic slowdown.The company announced on Tuesday that it is introducing two new Superstar cargo-passenger vessels as part of general plans for increasing passenger comfort on the Kapellskär–Långnäs–Naantali route, with the first ro-pax vessel set to start operating on the route in autumn 2023.The new vessels Finnsirius and Finncanopus are part of Finnlines EUR 500 million investment program…

US Imports Headed to Lowest Level Since Early 2021

Imports at the United States’ major container ports are expected to fall to their lowest level in nearly two years by the end of 2022 even though retail sales continue to grow, according to the monthly Global Port Tracker report released today by the National Retail Federation and Hackett Associates.“The holiday season has already started for some shoppers and, thanks to pre-planning, retailers have plenty of merchandise on hand to meet demand,” NRF Vice President for Supply Chain and Customs Policy Jonathan Gold said.

Keppel Posts 66% Jump in First-half Profit

Singaporean conglomerate Keppel Corp on Thursday reported a first-half profit that rose 66%, helped by higher earnings across most of its main businesses and a rebound at its offshore & marine (O&M) unit.Keppel, which traces its roots to a small ship repair yard corporatized in 1968, has seen its renewable energy and asset management units bounce back this year, offsetting a decline in its urban development business."In an extended inflationary environment, demand for real assets with cash flow, such as those which Keppel develops, operates and manages, will continue to grow," Chief Executive

US Cruise Operators' Recovery Runs Into Rough Weather

Andrea Mather's plans for a long-awaited summer cruise around the Hawaiian islands with her financial analyst husband unraveled after her booking with Norwegian Cruise Line's Pride of America was canceled due to a staffing shortage.It was the second time this year that the 55-year-old homemaker's plan to go on a cruise was scuppered.The cruise industry is sailing in choppy waters yet again as it has to deal with a storm of labor problems, red-hot inflation and recessionary threat…

2021 in Review: The Dry Bulk and Tanker Markets

The Signal Group offers an exhaustive overview of the trends in the dry bulk and tanker markets that both defined 2021, and offer a glimpse as to what might be in store for 2022 and beyond. The report is excerpted in short below; to see the full report CLICK HERE.Using Signal Ocean data, give the insight to analyze the trends and changes across the major vessel sizes in the dry and tanker freight market for 2021. This time last year, Signal Group analyzed the effects of the coronavirus pandemic on commercial shipping with a focus on dirty tankers - VLCC…

Dry Bulk: Rates for Larger Vessels Slip

The Baltic Exchange's dry bulk sea freight index ended a 10-session winning streak on Thursday, as rates of the larger segments, capesize and panamax, vessel fell.The overall index, which factors in rates for capesize, panamax and supramax vessels, shed 80 points, or 2.3%, to 3,343.The capesize index dropped 200 points, or 3.9%, to 4,989, slipping from a more than one-month peak scaled in the previous session.Average daily earnings for capesizes, which transport 150,000-tonne cargoes such as iron ore and coal…

Expect the Unexpected on the Inland Waterways

Among transportation planners, “resilience”, describing the ability to bounce back from adversities, both economic and other, has become a top consideration as we increasingly must “expect the unexpected.” The U.S. waterway system, covering the network of inland rivers and coastwise waterways, has seen a mix of good and not so good. As the 2020-2021 pandemic moves toward winding down, a recovery from the dismal 2020 is underway, but activity on the rivers is uneven. Ken Eriksen…

Great Lakes-St. Lawrence Seaway System Sees Surge in Construction Material Shipments

U.S. Great Lakes ports and the St. Lawrence Seaway have experienced a rise in cargo shipments to feed domestic construction and manufacturing activity and global export demand, according to the latest June figures.The Great Lakes-Seaway System serves a region that includes eight U.S. states and two Canadian provinces, and is seen as a marine highway that extends 2,300 miles from the Atlantic Ocean to the Great Lakes, supporting more than 237,868 jobs and $35 billion in economic activity.If the region were a country…

Suez Canal Must Upgrade Quickly to Avoid Future Shipping Disruption

Egypt's Suez Canal must move quickly to upgrade its technical infrastructure if it is to avoid future shipping disruption, shipping industry sources said, as the major trade route tries to bounce back from a costly six-day closure.International supply chains were thrown into disarray on March 23 when the 400-meter-long (430-yard) container ship Ever Given ran aground in the canal, with specialist rescue teams taking almost a week to free her after extensive dredging and repeated tugging operations.Egypt will get two new tugboats…

BIMCO on Tanker Shipping; The Worst is Not Over

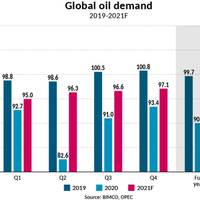

While the tanker market had a strong run at the outset of the COVID-19 pandemic, according to a report released this morning by BIMCO, tanker shipping will not benefit this year from the usual strong winter seasonal effect. Though the new lockdowns being introduced in many countries are less strict than in the spring, the effect on tanker shipping will be worse, given the supply glut of Q2. The news of an effective vaccine offers some hope of a global oil demand recovery but, however it comes about…

US Inland Waterways: High Waters & Swirling Currents

The inland waterway system, flowing through the United States heartland, is a microcosm of all that has been happening in 2020: trade tensions, infrastructure issues, shifting trends in fuel consumption and the pandemic that has gripped us since the winter months. Shortly after the initial coronavirus outbreak here in the U.S., maritime workers were deemed to be “essential”, paving the way for cargo flows to recover from their springtime nadir. As COVID-19 infections turned up on U.S. shores, the boats continued plying the waterways, albeit with reduced volumes in some cases.

Maritime Resilience and the Human Element at MRS2020

Has the age of maritime discovery and exploration actually ended? Perhaps not exactly. As the history of maritime resilience and the human element shows, as far back as the 1500s and earlier, from using new navigational aids and improved ship designs, to coastal and inland route sailing, to navigating on open seas with uncertain charts, wayward icebergs, dense fog and luckily at times, clear starry nights, mariners have faced human element and maritime resiliency challenges. "Short of food and water…

Container Shipping Hit Hard by US Lockdown -BIMCO

The coronavirus pandemic has shutdown much of the U.S. economy for months and even as parts of it reopen, the data is beginning to reveal the extent of the damage that has been done and a slow recovery is taking a tentative shape.The second estimate for gross domestic product (GDP) in the first quarter shows a 5% contraction from the previous quarter, and just 0.2% growth from the first quarter of 2019. With lockdown measures having only come into force in late March, the second quarter of the year will prove even more damaging for the U.S.

Port of LA Cargo Volume Down 30% in May

The coronavirus pandemic and ongoing U.S.-China trade tensions threaten the peak holiday shipping season for the Port of Los Angeles, which just suffered its slowest May in more than a decade, Executive Director Gene Seroka said on Wednesday.The busiest U.S. port and the No. 1 U.S. gateway for ocean trade with China logged its slowest May since the "Great Recession" of 2009.May volume fell 30% from last year after business shutdowns aimed at controlling COVID-19 infections and U.S.

Tonnage Slips at Port Houston Amid Pandemic

Monthly cargo volumes at Port Houston declined in April as the coronavirus outbreak continued to impact commerce in the U.S. and across the world.Port Houston, the 6th largest container port in the U.S., handled a total of 221,540 twenty-foot equivalent units (TEUs) in April, down 12% from the 252,693 TEUs in April 2019. For the full year, however, Port Houston handled 994,627 TEUs through April, which is 5% more than the first four months of 2019.Total tonnage at Port Houston’s public facilities was down 10% in the month of April at 3,766,756 short tons, a decrease of 3% year-to-date.