Gensets: New Fuels but Perennial Goals

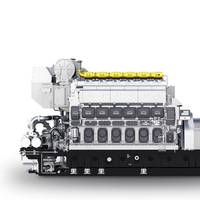

Fuel flexibility may be a key driver for recent developments in gensets, but the perennial goals of lowering CapEx and OpEx remain.Fuel flexibility is one of the pillars of decarbonization that is being embraced by genset OEMs. Fuel efficiency, a second pillar, goes hand in hand with that because new fuels will be more expensive, but these concerns come in addition to the on-going drive to reduce CapEx and OpEx for shipowners.MAN Energy Solutions introduced its auxiliary MAN 35/44DF CD engine in June 2023. It is designed to be future-proof and will be ready for methanol operation by 2026.

Angad Banga Elected Chairman of the Hong Kong Shipowners Association

Angad Banga of The Caravel Group was elected Chairman of the Hong Kong Shipowners Association at the organization’s annual meeting held on November 22, 2023.Banga succeeds Wellington Koo, of Valles Steamship, who stepped down after completing his two-year term as Chairman.Richard Hext of Swire Shipping was elected Deputy Chairman, succeeding Banga. Qian Weizhong of COSCO Shipping (Hong Kong) and Wang Yongxin of China Merchants Energy Shipping Company Limited were re-elected as the Vice Chairmen.Koo…

MAN Engine Ordered for World's First Methanol-fueled VLCC

China Merchants Energy Shipping (CMES), the Shanghai-listed shipping giant and daughter company of China Merchants Heavy Industry (CMHI), has ordered an MAN B&W 7G80ME-LGIM (-Liquid Gas Injection Methanol) main engine in connection with the construction of a very large crude carrier (VLCC). The first such dual-fuel methanol order for the ship type, Dalian Shipbuilding Industry Co (DSIC) will construct the vessel with delivery due by April 2026.CSE (China Shipbuilding Industry Corporation Diesel Engine Co.…

New Car Carriers to Include Methanol Gensets

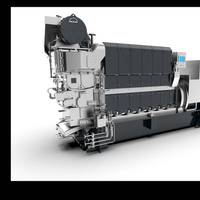

China Merchants Heavy Industry (CMHI) has ordered six small-bore, seven-cylinder 21/31DF-M, methanol-burning gensets in connection with the construction of 2 × 9,300 ceu (car equivalent units) PCTCs for China Merchants Energy Shipping (CMES).The business represents the very first order for the new methanol-powered, MAN four-stroke genset. MAN Energy Solutions’ licensee, CMP, will build the engines in China with first delivery due in Q1, 2025.The 3 × 7L21/31DF-M gensets aboard…

First PCTC Order Placed for a Methanol-Fueled Engine

China Merchants Heavy Industry has ordered two MAN B&W 7S60ME-LGIM (-Liquid Gas Injection Methanol) engines in connection with the construction of two 9,300 ceu (car equivalent units) PCTCs for China Merchants Energy Shipping (CMES).The order is the first order globally for the S60ME-LGIM variant, the first methanol-fuelled engine for a PCTC, and the first Chinese-built methanol engine.Engine manufacturer, CSE, will construct the engines in China with respective vessel delivery set for 2025 and 2026; the order also contains an option for an additional four vessels.

ADNOC's New LNG Carriers to Feature Silverstream Air Lubrication

U.K.-based Silverstream Technologies announced it has secured an order to supply its air lubrication system for a series of six new liquefied natural gas (LNG) carriers being built for Abu Dhabi National Oil Company (ADNOC) by China's CSSC Jiangnan Shipyard Group Co. Ltd.Scheduled for delivery in 2025 and 2026, the six new 175,000-cubic-meter-capacity (CBM) vessels will be the first LNG carriers built at Jiangnan Shipyard and among the first Chinese-built LNG carriers fitted with…

Chinese Shipyards Feast on Record LNG Tanker Orders as S.Korea Builders Fully Booked

China is making fast inroads in the market for newbuild liquefied natural gas (LNG) tankers as local and foreign shipowners turn to its shipbuilders for the specialty vessels because long dominant yards in South Korea are fully booked. Three Chinese shipyards - only one of them having experience building large LNG tankers - won nearly 30% of this year's record orders for 163 new gas carriers, claiming ground in a sector where South Korea usually captures most of the business.

NYK, CNOOC Sign Long-term Charters for Six LNG Carriers

Japanese shipping and logistics firm NYK has signed a long-term time-charter contract with CNOOC Gas and Power Singapore Trading & Marketing Pte. Ltd. for six liquefied natural gas (LNG) carriers, in addition to a shipbuilding contract for the vessels with Hudong-Zhonghua Shipbuilding (Group) Co. Ltd.This is NYK's first long-term time-charter contract for an LNG carrier with CNOOC. The six vessels are scheduled to be delivered between 2026 and 2027 and will be mainly engaged in LNG transportation to China.

Sovcomflot Targets at Least $500 Million in Moscow IPO

Sovcomflot plans to raise at least $500 million in an initial public offering (IPO) on the Moscow Exchange, Russia’s top shipping company said on Tuesday, in a deal that could value it at roughly $10 billion according to sources.The move by the state-controlled firm comes as Russian airline Aeroflot also plans to raise capital in a secondary public offering (SPO).For Aeroflot, the cash is needed to fight the economic fallout from the COVID-19 pandemic.Sovcomflot (SCF) which is raising money to spend on new projects and reduce debt aims to list in early October…

ABS Launches Guide for Wind-assisted Propulsion Systems

ABS has published the ABS Guide to Wind-assisted Propulsion System Installation, providing class safety standards when installing wind-assisted systems.The classification society said its new guide is applicable to both Flettner rotors and wing sails, including both rigid and soft sails. These wind-assisted propulsion technologies have been gaining attention as operators seek new ways to reduce fuel costs as well as their environmental footprint.“Wind-assisted propulsion systems…

China Merchants Orders VLCC with Sails

China Merchants Energy Shipping said it has ordered a pair of 307,000 DWT very large crude carriers (VLCC) from China Shipbuilding Group's Dalian Shipbuilding Industry Company (DSIC), including one vessel that will be fitted with sail propulsion and another with air lubrication technology.The order was formalized during a virtual ceremony attended by representatives in Beijing, Hong Kong and Dalian.The two new vessels with emissions reducing technologies follow four VLCCs ordered by China Merchants at the shipyard in November 2019.In 2018…

China Merchants Energy Shipping's Unit Orders and Sells Ships

China Merchants Energy Shipping Co Ltd says it inked a deal to order four ships worth up to $118.7 million.It has also agreed to sell three ships worth $15 million to Sinopec Fuel Oil Singapore and Sinopec Fuel Oil Sri Lanka.

Wärtsilä EGC Gets CCS Type Approval

Wärtsilä’s Exhaust Gas Cleaning (EGC) system has been Type Approved by the China Classification Society (CCS). This follows the order for the system from Dalian Shipbuilding Industry for installation onboard the ‘New Treasure’, a new Very Large Crude Carrier (VLCC). The ship is being built for Associated Maritime of Hong Kong, part of the China Merchants Energy Shipping group.Full scale testing was carried out after its shipboard installation was completed, and the relevant data was reviewed and reported by Dalian Maritime University, as an independent third party.

LR Approves New LNG-Fueled VLCC Design

The UK-based maritime classification society Lloyd’s Register (LR) has granted approval in principle (AiP) to a quartet for an LNG-fueled VLCC design that uses a prismatic GTT Mark III membrane LNG tank.The AiP was granted to China Merchants Energy Shipping (CMES), CNOOC Gas and Power Group, Dalian Shipbuilding Industry (DSIC), and Gaztransport and Technigaz(GTT).The main objectives of the AiP include developing a specification for a dual fuel VLCC that meets the IMO’s GHG 2030 emission limitations and preparing the relevant design drawings.CMES and CNOOC G&P, with assistance from LR and GTT, also performed an economic analysis in terms of capital expenditure (CAPEX) and operating expenditure (OPEX).

Partners Developing LNG-fueled VLCC

Partners involved in a new joint development project (JDP) have set out to design a very large crude carrier (VLCC) that will run on liquefied natural gas (LNG) fuel.Lloyd's Register (LR), China Merchants Energy Shipping Co., Ltd. (CMES), CNOOC Gas and Power Group, Dalian Shipbuilding Industry Co., Ltd. (DSIC), and GazTransport and Technigaz SA (GTT) have teamed up to evaluate design options for an LNG-fueled VLCC that uses a prismatic GTT Mark III membrane LNG tank. The scope of the JDP includes reviewing solutions to minimize construction costs for LNG-fueled ships…

Shanghai Waigaoqiao Shipyard Delivers World's First iVLOC

The world’s first intelligent very large ore carrier (iVLOC), the DNV GL-classed Pacific Vision, was delivered by Shanghai Waigaoqiao Shipyard to China Merchants Energy Shipping Company.Norway-headquartered international accredited registrar and classification society said in a statement that the vessel is the world’s first VLOC to implement DNV GL’s SmartShip descriptive notation.To qualify for the notation, Pacific Vision has been outfitted with an integration platform, a smart navigation decision support system, a ship energy efficiency management and optimization system, and smart-vessel operation and maintenance system.“It’s a great honour to have worked with Shanghai Waigaoqiao Shipyard…

US Crude Oil Shipments to China Halt Amid Trade War

U.S. crude oil shipments to China have "totally stopped", the President of China Merchants Energy Shipping Co (CMES) said on Wednesday, as the trade war between the world's two biggest economies takes its toll on what was a fast growing businesses.Washington and Beijing have slapped steep import tariffs on hundreds of goods in the past months. And although U.S. crude oil exports to China, which only started in 2016, have not yet been included, Chinese oil importers have shied away from new orders recently."We are one of the major carriers for crude oil from the U.S. to China.

CMES Fleet Adds Bulk Carriers

The delivery and naming ceremony of PACIFIC MERIT, an energy-saving and environment-friendly bulk carrier with 64 thousand DWT, tailor-made by China Merchants Energy Shipping (CMES), was held in Chengxi Shipyard on 4 January 2018. Capt. Zhao Yaoming, Vice President of CMES and President of Hong Kong Ming Wah Shipping, and Lu Ziyou, the President of Chengxi Shipyard, attended and witnessed the ceremony. On the same day, CMES held the naming and delivery ceremony for the 44th VLCC NEW PRIME in Dalian COSCO KHI Ship Engineering, Ms Duan Xianghui, Director of China Merchants Group, Su Xingang, Director of China Merchants Group and Chairman of CMES, Xie Chunlin, President and Director of CMES attended the ceremony.

CMES Orders Six VLCCs at Dalian Shipbuilding

China Merchants Energy Shipping Co Ltd (CMES) has firmed up orders to build six very large crude carriers (VLCCs) at Dalian Dalian Shipbuilding Industry Corp for $522 million, reports Reuters. The deliveries of 308,000dwt VLCCs are scheduled between August 2018 and October 2019. Order for six more VLCCs brings Chinese tanker operator’s total orders to ten. A week ago, CMES has placed an order for four newbuilding VLCCs, with two each at Nantong Cosco KHI Ship Engineering (Nacks) and Dalian Cosco KHI Ship Engineering (Dacks). The four orders are part of a 10-VLCC newbuild plan which was announced early last week. The eco-friendly VLCCs will be operated by China VLCC, a joint venture of CMES and Sinotrans & CSC Group.

China VLCC Sells Two VLCCs

China Energy Transport Co., Ltd. (China VLCC) has sold two secondhand VLCCs to an unrelated third party for a total price of $117.5mln. China VLCC is 51 percent owned by China Merchants Energy Shipping (CMES) and 49 percent owned by Sinotrans & CSC Group. It has signed agreements with two Marshall Island-registered companies, Coral Shipowning and Medal Shipowing, under which China VLCC will sell a 297,600 dwt VLCC of six to seven years old to each of the two companies. The entry into force of the agreement remains subject to the Board of Directors of the company and the counterparty approved by the Board. Meanwhile, China VLCC has on Thursday taken delivery of a new VLCC named New Constant in Dalian, China.

Shipping Consolidation in Asian Shores

The global shipping industry consolidation appears to be picking up, with much of the activity centering on Asia, reports Nikkei. The overcapacity and weaker global trade have fueled talk of a shakeout in the industry. CMA CGM is in “exclusive” talks with Neptune Orient Lines’ (NOL) largest shareholder, Temask, for the purchase of its APL container liner business. Over in China, the top two state-owned operators are in the final stages of merger talks. NOL announced that CMA CGM had been granted exclusive negotiating rights, through Dec. 7. Singaporean sovereign wealth fund Temasek Holdings, which owns 68% of the shipping company, has been seeking a buyer since early summer. The French suitor beat Denmark-headquartered A.P. Moller-Maersk, the world leader, for pole position.

CMES Confirms Order for 10 VLCCs

The board members of China Merchants Energy Shipping (CMES) has approved of a plan to order an additional 10 eco-friendly VLCCs. These vessels will be operated by CMES’ Hong Kong-based subsidiary, China VLCC Company Limited, a tanker JV between CMES and Sinotrans & CSC Group. China VLCC was set up in early September, will be in charge of vessel operation. CMES added that it would disclose more details on the announcement once the contracts on construction of the energy saving tankers are signed. Potential value of the deal is expected to reach around USD 920 million. China VLCC currently operates a fleet of 34 VLCCs, with an additional nine on order. In October, it sold VLCCs New Medal (297,600 dwt, built 2009) and New Founder (297,400 dwt, built 2008) to Greece’s Navios for $133m.

MAN D&T Sells 60,000th Turbocharger

MAN Diesel & Turbo marked the sale of its 60,000th turbocharger after 80 years of turbocharger business, during the Marintec 2015 marine trade fair in Shanghai, by making a presentation to turbocharger customer, China Merchants Energy Shipping Co. Ltd. (CMES). The milestone has been reached with the (coming) delivery of 2 × TCA66-21 turbochargers, bound for an MAN Diesel & Turbo MAN B&W 7G80ME-C9 two-stroke engine powering a VLCC. The ceremony took place at the MAN stand at the trade fair where MAN Diesel & Turbo’s CEO, Dr.