HMD's Ammonia-powered LPG Carrier Designs Earn DNV Approval

DNV has awarded HD Hyundai Mipo Dockyard an approval in principle (AIP) for the design of ammonia dual fuel 45,000 m3 liquefied petroleum gas (LPG) carriers.The presentation took place at the HD Hyundai Global R&D Center (GRC) in Seongnam, Korea. HD Hyundai Mipo (HMD), who have developed the basic ship design, provided detailed engine specifications and operational data from global engine maker, WinGD, and reviewed the safety and suitability of the design with DNV. The designs are based around a new 10…

Houthis Target Vessel in the Red Sea, Yemeni Military Source Says

Yemen's Houthis targeted a fuel tanker, Mado, in the Red Sea with naval missile and Israel's Eilat port and resort region with winged missiles, the group's military spokesperson Yahya Sarea said on Tuesday.Mado is a Marshall-Islands flagged liquefied petroleum gas (LPG) tanker heading to Singapore from Saudi Arabia, maritime shipping trackers showed. The Houthis described it as American, but Equasis's shipping database indicates that it is owned by Naftomar Shipping & Trading Co Ltd of Greece.

NYK and Astomos Energy Christen New Jointly-Owned Dual-Fuel LPG Carrier

As their first jointly owned liquefied petroleum gas (LPG) carrier in 21 years, NYK and Astomos Energy have named the new vessel Gas Garnet.The companies held a naming ceremony at the Sakaide Works of Kawasaki Heavy Industries on March 1, 2024.The 86,953 m3 capacity vessel was christened Gas Garnet by Yoshihito Takahashi, senior executive officer of Astomos Energy. This is the first jointly owned LPG vessel by the companies after they shared ownership of Gas Capricorn from 2003.The vessel has a breadth of 37.2 meters…

QatarEnergy Expanding North Field LNG Development

QatarEnergy has announced that it is proceeding with a new LNG expansion project, the “North Field West” project, to raise the nation’s LNG production capacity to 142 million tons per annum (MTPA) before the end of this decade.This represents an increase of almost 85% from current production levels.Saad Sherida Al-Kaabi, Minister of State for Energy Affairs and President and CEO of QatarEnergy, made the announcement during a press conference on Sunday. He said that extensive appraisal…

Wärtsilä Books Ammonia Fuel System Order for Two Exmar Gas Carriers

Wärtsilä Gas Solutions, part of technology group Wärtsilä, will deliver the fuel supply system for Exmar’s two new medium size gas carriers that will operate with ammonia fuel.The ships are being built at the Hyundai Mipo Dockyards (HMD) in Korea for ship owner Danish shipowner Exmar LPG, a joint venture between Exmar, a multi-disciplinary maritime and offshore solutions provider, and Seapeak, one of the largest independent owner-operators of liquefied natural gas vessels.These…

Pertamina Aims to Add Six VLGCs in 2024

Pertamina International Shipping (PIS), a unit of Indonesian state energy company Pertamina, said on Wednesday it plans to add six new very large gas carriers (VLGC) in 2024 as it eyes fleet expansion focused on gas transport.The company this week launched two VLGCs, built by South Korea's Hyundai Samho Heavy Industries, and each vessel has a 91,000 cubic metres capacity, which PIS said is among the biggest in the world.The two vessels were designed to transport liquefied petroleum gas (LPG) as well as ammonia, PIS said in a statement."We plan to add six VLGCs in 2024, starting from the two VL

Polish Seaborne LPG Import Growth Slowed to 7% in 2023

Growth in sea-borne imports of liquefied petroleum gas (LPG) to Poland slowed 7% last year to 1.084 million metric tons, from a jump of more than 70% in 2022, with sea terminals working almost at capacity, according to traders and LSEG data.Sea-borne imports account for some 35% of total LPG supplies to Poland, while deliveries by rail was more than 50%.Poland also remained the main destination for Russian LPG, which was banned by the European Union last month over the conflict…

Very Large LPG/Ammonia Carrier Phoenix Harmonia Enters Service

The Phoenix Harmonia, a liquefied petroleum gas (LPG) powered very large LPG/ammonia carrier, has been constructed by Namura Shipbuilding Co., Ltd. and delivered to MOL Energia Pte. Ltd., a Singapore-based company of Mitsui O.S.K. Lines Group, on September 29.Mitsubishi Shipbuilding Co., Ltd., a part of Mitsubishi Heavy Industries (MHI) Group, supported Namura and contributed to the delivery of the vessel, based on a technical cooperation agreement executed between the two companies in August 2021.

HMD Gets LR AIP for Dual-fuel 45,000cbm LPG Carrier

Classification society Lloyd’s Register (LR) announced it has granted approval in principle (AIP) to South Korean shipbuilder Hyundai Mipo Dockyard (HMD) for its new 45,000cbm liquefied petroleum gas (LPG) carrier design, with availability to be ordered with ammonia dual-fueled propulsion. The dual fuel system equipped on HMD’s LPG carrier allows operators and owners to prioritize their environmental, societal and governance (ESG) strategies for their fleets and align with the IMO’s revised goal of net zero CO2 emissions by 2050.

Shipyard Capacity: A Brake on Decarbonization?

The IMO’s latest crunch meeting in early July may not have aligned global shipping with mid-century targets established in the 2015 Paris Agreement. However, its 2023 Strategy indicates a clear direction of travel. Energy supplies by sea are essential for many countries and therefore ships have a key role in supporting the world’s energy transition – not only on their own account, but at a global level.As world shipping accounts for about 3% of greenhouse gas emissions, its environmental importance attracts wide attention. And plenty of criticism.

Training Issues Highlighted in LPG Carrier Engine Room Fire

The UK Marine Accident Investigation Branch (MAIB) has published its accident investigation report into the fatal engine room fire on board Moritz Schulte on August 4, 2020, citing training issues.On 4 August 2020, a fire broke out in the engine room of the liquefied petroleum gas/ethylene carrier Moritz Schulte when the recently promoted third engineer opened an auxiliary engine’s pressurised fuel filter allowing marine gas oil to spray onto an adjacent auxiliary engine’s hot…

Decarbonisation Group's Biofuel Bunkering Trial Finds Sharp Drop in Emissions

The Global Centre for Maritime Decarbonisation (GCMD) found carbon emissions fell 83% using a vegetable oil biofuel blend compared with marine gasoil in a trial for a dual-fuel liquefied petroleum gas (LPG) carrier, the center said on Tuesday.This was the third of five supply chain bunkering trials that the GCMD has undertaken as part of an $18 million project to test different biofuel blends to reduce carbon emissions. The trials are key to helping the fuel and shipping industries…

Panama-flagged Tanker Catches Fire Near Iranian Coast

A Panama-flagged tanker called White Pearl has caught fire near Assaluyeh on Iran's Gulf coast, Iranian state media reported on Thursday, adding that all crew members were safe."Twenty-two of the ship's crew have been rescued by Iranian rescue teams after the ship's captain requested assistance from the port authorities," state TV quoted a local ports official as saying. The official said that the tanker, carrying 40,000 tons of liquefied petroleum gas, had experienced "a problem in the engine room due to a fire."Panama's vessel registry…

Suez Canal Tugboat Sinks After Collision with Tanker

A Suez Canal tugboat sank on Saturday and one of its crew was missing after it collided with a Hong Kong-flagged LPG tanker though shipping traffic in the strategically important waterway was largely unaffected, the canal authority said.Convoys of ships passing through the canal from the north were not affected, while the passage of ships travelling from the south returned to normal by about midnight on Saturday, Suez Canal Authority (SCA) said in a statement.The tanker, Chinagas Legend…

KHI Gets Order for NYK's Sixth LPG Dual-fuel Very Large LPG/Ammonia Carrier

NYK ordered of its sixth liquefied petroleum gas (LPG) dual-fuel very large LPG / liquefied ammonia gas carrier (VLGC) from Kawasaki Heavy Industries Ltd. (KHI). The ship will be built at the KHI Sakaide Works shipyard and is set for delivery in 2026.This vessel is the eighth in NYK's fleet of LPG-fueled LPG carriers and the sixth in a new type of vessel capable of carrying ammonia and thus flexibly responding to various trade patterns.In addition to the LPG dual-fuel engine,…

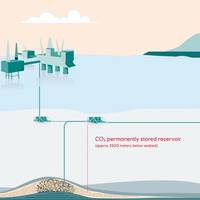

Northern Lights CCS: Trailblazing the Path to Europe’s Net Zero Emissions

In the global quest for achieving net zero emissions and slowing down global warming, carbon capture and storage (CCUS) technology has emerged as an important solution. Among the notable projects being developed in the field is the Northern Lights offshore carbon capture and storage project in Norway, a country with long experience with offshore CO2 storage.The transition to a sustainable energy future requires innovative solutions that go beyond simply halting fossil fuel projects.

Russia's Taman Port to Suspend LPG Exports over Drone Danger

Russia's Black Sea port of Taman is poised to suspend exports of highly-explosive liquefied petroleum gas (LPG) because of concerns linked to drone attacks, three sources with knowledge of the situation told Reuters on Friday. Russia has come under repeated attack in recent weeks, suffering a major cross-border incursion and drone attacks including on Moscow, oil refineries in southern Russia and a fuel depot near a strategic bridge that links Russia's mainland with Crimea. Russia says Ukraine was behind the attacks, including on the Kremlin last month. Kyiv denies it.

ADNOC L&S Adds Five New Very Large Gas Carriers to Fleet

United Arab Emirates' ADNOC Logistics & Services (ADNOC L&S) has expanded its fleet with the deployment of five new-build Very Large Gas Carriers (VLGC), state news agency WAM reported on Thursday.The carriers of the shipping and maritime logistics arm of state oil giant Abu Dhabi National Oil Company each have a capacity of 86,000 cubic metres. The carriers were built at Jiangnan Shipyard in Shanghai, China, and will be owned and operated by AW Shipping, an ADNOC L&S joint venture with Wanhua Chemical Group (Wanhua), WAM added.

NYK to Build Fifth LPG Dual-Fuel VLGC

NYK ordered its fifth liquefied petroleum gas (LPG) dual-fuel very large LPG/liquefied ammonia gas carrier (VLGC) from Kawasaki Heavy Industries Ltd. (KHI). The ship will be built at the KHI Sakaide Works shipyard and is set for delivery in 2026.This vessel is the seventh in NYK's fleet of LPG-fueled LPG carriers and the fifth in a new type of vessel that is also capable of carrying ammonia and will be equipped with separate cargo tanks designed to carry LPG and ammonia at the same time to flexibly respond to various trade patterns.In addition to the LPG dual-fuel engine…

Dorian LPG Takes Delivery of Dual-fuel VLGC

Liquefied petroleum gas (LPG) shipping company Dorian LPG announced it has taken delivery of the newly built very large gas carrier (VLGC) Captain Markos from Japanese shipbuilder Kawasaki Heavy Industries.The 84,000 cubic meter capacity VLGC is a dual-fuel vessel capable of running on on LPG and low-sulfur fuel oil.The ship is owned by a Japanese owner will be operated by Dorian LPG under a 13-year bareboat charter, trading in the Helios LPG Pool which Dorian LPG jointly operates with Phoenix Tankers Pte. Ltd., a wholly-owned subsidiary of Mitsui OSK Lines Ltd.

Wilhelmsen Takes Over Management of HLS' New VLGC

Norwegian vessel operator Wilhelmsen Ship Management announced it has taken over management of the newbuild liquefied petroleum gas (LPG) carrier HLS Blue Sapphire.The 86,000-cubic-meter-capacity very large gas carrier (VLGC) is the first managed by Wilhelmsen for new client Hyundai LNG Shipping of South Korea.The LPG dual fuel vessel was built at South Korea's Hyundai Samho Heavy Industries Ltd.

Second LPG Dual-Fuel VLGC for Astomos Named Lantana Planet

On September 16, a naming ceremony was held at Sakaide Works of Kawasaki Heavy Industries Ltd. for a new VLGC (very large gas carrier) that NYK will charter to Astomos Energy Corporation, the world's pre-eminent liquefied petroleum gas (LPG) company.At the ceremony, the ship was named Lantana Planet by Mitsuru Yamanaka, executive vice president of Astomos Energy Corporation, and the ceremonial rope holding the vessel in place was cut by his wife. NYK senior managing executive…

Gas Tankers Stranded near Russia due to Crimea Bridge Restrictions

Several tankers loaded with liquefied petroleum gas (LPG) have been unable to cross under Russia's Crimea bridge due to security restrictions, traders said on Friday, prompting suppliers to use other routes out of Russia.The 12-mile (19 km) road and rail bridge, which was personally opened by President Vladimir Putin in 2018, was bombed in October in an attack Russia said was carried out by Ukraine. The bridge spans the Kerch Strait linking the Black Sea with the smaller Azov sea. Kyiv never claimed responsibility for the bombing of the bridge on the morning of Oct. 8, a day after Putin's 70th birthday. Russia's Federal Security Service said the attack was organized by Ukrainian military intelligence.