MOL and Gaz-System Sing Long-Term FSRU Charter for New Polish LNG Terminal

Mitsui O.S.K. Lines (MOL) has signed a long-term time charter party agreement for one floating storage and regasification unit (FSRU) with the Polish gas transmission system operator Gaz-System, which is the developer and operator behind the future LNG terminal.The FSRU will be constructed by HD Hyundai Heavy Industries shipyard and is expected to be completed in 2027. Thereafter, the FSRU will be managed by the MOL group.The FSRU is being built for the project that involves the…

SFL Acquires LR2 Product Tanker Trio

Shipowner SFL Corporation on Wednesday announced it has agreed to acquire three new LR2 product tankers in combination with long term time charters to an energy and commodities company.The vessels are currently under construction in China, with the latest eco-design features, SFL said, noting the sellers are affiliates of the company’s largest shareholder Hemen Holding Ltd.SFL said it will acquire the three ships for an aggregate purchase price of approximately $230 million, in…

Stena Bulk Inks Deal for Four Additional Newbuild Tankers

Swedish shipping company Stena Bulk has expanded its fleet with new long-term charter agreements for four newbuild eco Medium Range (MR) tankers.Two of the vessels, Stena Continent and Stena Conquest, will be delivered from Hyundai Mipo by the end of 2025.Two further eco MR tankers, Stena Contender and Stena Concept, will follow in 2026. All vessels are set to use the South Korean yard’s latest 8th generation MR tanker design, which has been recognized for its excellent efficiency performance.The tankers will feature efficient fuel consumption systems…

CCUS: Bernhard Schulte Orders Its First CO2 Tanker

Bernhard Schulte ordered its first CO2 tanker, a newbuild to be constructed at Dalian Shipbuilding Offshore (DSOC) and to showcase technologies designed to reduce its carbon footprint. Planned for delivery in 2026, the ship is committed to a long-term time charter agreement with Northern Lights.The newbuilding ordered now is the first ship of this type for the Bernhard Schulte fleet and the fourth CO2 carrier for Northern Lights. The joint venture, owned by Shell, TotalEnergies and Equinor…

GTT Designing Tanks for Purus VLECs

GTT has received an order from HD Hyundai Heavy Industries for the tank design of two new very large ethane carriers (VLEs), on behalf of shipowner Purus.GTT will design the tanks of these two vessels, which will each offer a capacity of 98,000m3. The tanks will be fitted with the Mark III membrane containment system developed by GTT.Delivery is scheduled between the fourth quarter of 2026 and the second quarter of 2027.The vessels will feature dual-fuel ethane engines and optimized cargo handling systems, enabling lower CO2 and SOx emissions.

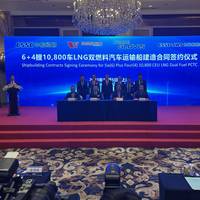

Seaspan Enters Car Carrier Segment in Order with Glovis

Containerships owner/operator Seaspan Corporation signaled its entry into the car carrier segment in confirming a deal to order a series of new pure car and truck carriers (PCTC) in partnership with Hyundai Glovis (Glovis).The 10,800 CEU are the largest PCTCs under development to date. They will be dual-fuel liquefied natural gas (LNG), as well as ammonia-and methanol-ready.Seaspan said it negotiated the purchase from Shanghai Waigaoqiao Shipbuilding, a China State Shipbuilding Corporation shipyard.

Purus Orders Two VLECs from South Korean Shipbuilder

Purus said Friday it had ordered two 98,000 cbm very large ethane carriers (VLEC) from Hyundai Heavy Industries in South Korea, scheduled for delivery in 2026 and 2027. According to Purus, the VLECs vessels will feature dual-fuel ethane engines and optimized cargo handling systems, enabling lower CO2 and SOx emissions. "Additional energy-saving devices will further contribute to emission reductions. Both vessels shall be delivered directly into long-term time charters." Purus said.Financial details were not disclosed.

Odfjell Announces Deals to Add Six Newbuilds

Norwegian shipping company Odfjell SE announced it is expanding its fleet with six newbuildings through a combination of long-term time charter and pool agreements with Japanese shipowners and shipyards.This increases the total to twelve 25,000 - 40,000 dwt stainless steel vessels to be delivered on long-term time charters and pool agreements between 2024 and 2027.The series of newbuildings will be built at multiple shipyards in Japan and are scheduled to be delivered from 1H2026 to 1H2027.

U.S. Navy Shipbuilders & Disaggregated, Dispersed Production

With a lame-duck CNO, a divided Congress and the impending launch of the next Presidential election cycle, America’s naval market is locked into something of a fragile and fearful autopilot, cruising inexorably towards whatever excitement 2024 might bring.Materially, don’t expect much change: The demand for naval platforms will continue to outstrip available funding, meaning there will be little movement or growth in America’s major shipbuilding programs of record. The procurement outlines are already set.

Celsius Orders Four LNG Carriers

Shipowner Celsius Tankers announced it has ordered four new liquefied natural gas (LNG) carriers from shipbuilder China Merchants Heavy Industry (Jiangsu) (CMHI) for scheduled delivery in 2026 and 2027.Celsius has formed a joint venture with an affiliate of ArcLight Capital Partners (ArcLight), a middle-market infrastructure investor, to fund two of the LNG carriers. Commodities trading house Gunvor Group Ltd will have a significant equity interest in the other two newbuildings, the first for any independent LNG trading company, demonstrating the strength of Gunvor's global position in the LNG market. All four vessels will enter long…

Algoma Orders Two Tankers from Hyundai Mipo

Algoma Central Corporation announced it has placed an order with Hyundai Mipo Shipyard in South Korea to build two 37,000 DWT ice class product tanker vessels for a total investment of CA$127 million (about US$96.2 million).These new ships will be entered on long-term time charters to Irving Oil under Canadian flag, servicing the energy company’s refinery in Saint John, New Brunswick, with deliveries to ports in Atlantic Canada and the U.S. East Coast.Delivery of the new vessels is expected during the first quarter of 2025.

Ardmore Shipping Builds a Better Fleet

Garry Noonan, Director, Innovation, Ardmore Shipping is candid in discussing emerging technologies and their impact on ship fuel and emissions reductions. With a fleet of product and chemical tankers under his guise, Noonan gives insights on technologies that he has seen work, as well as his thoughts on the fuel transition, which he believes won’t become mainstream until we’re well into the 2030s.While Cork, Ireland-based Ardmore Shipping, founded in 2010, is relatively new in shipping circles…

Titan Charters LNG Bunker Vessel from Fratelli Cosulich

Clean fuels supplier Titan announced it has signed a long-term time charter agreement with Italian maritime transportation group Fratelli Cosulich for the new 8,200Cbm capacity liquefied natural gas (LNG) bunker vessel Alice Cosulich.Alice Cosulich will join Titan's fleet in the fourth quarter of this year and will operate in Europe. The vessel, which has an LNG and liquified biomethane (LBM) bunkering capacity of 8,200 m3, as well as smaller parcels of biodiesel going forward…

Alternative Fuels, Newbuilds and Retrofits are Key to Marine Industry Growth

The global marine vessel market is projected to grow from $170.75 billion in 2021 to $188.57 billion in 2028 at a CAGR of 1.43%, according to research from Fortune Business Insights.From transportation vessels to workboats to marine construction ships, companies want to grow their business, stay current with new technologies, gain a competitive edge and be good stewards of our environment.Current marine market trends include adoption of alternative fuels, acquiring new construction vessels, retrofitting existing fleet, and determining ideal solutions for procuring these vessels.

MISC, Partners Secure Five Newbuild LNG Carriers

MISC Berhad (MISC), through its wholly-owned subsidiary, Portovenere and Lerici (Labuan) Pte Ltd (PLL), together with its consortium partners, Nippon Yusen Kabushiki Kaisha (NYK), Kawasaki Kisen Kaisha, Ltd. (K-Line) and China LNG Shipping (Holdings) Limited (CLNG), have been awarded long-term time charter contracts by QatarEnergy for five additional newbuild Liquefied Natural Gas (LNG) carriers to be built by Hudong-Zhonghua Shipbuilding (Group) Co., Ltd.Together with the seven long-term time-charter contracts that were secured earlier in August…

SFL to Acquire PCTC with Long-term Charter

SFL Corporation Ltd. has agreed to acquire a Pure Car Truck Carrier (“PCTC”) in combination with a long term time charter to a leading car carrier operator until 2028.The company expects to take delivery of the vessel during the fourth quarter. The fixed rate charter backlog will increase by approximately $65 million, with the possibility of additional upside from profit share related to fuel savings from the vessel’s scrubber. In addition to the PCTC transaction, SFL said it had recently taken delivery of four modern Suezmax tankers and one newbuild eco-design feeder container vessel…

SFL Buys LR2 Tanker Pair from Frontline

SFL Corporation Ltd. on Monday announced it has agreed to acquire four Aframax LR2 product tankers from tanker shipping company Frontline for an aggregate purchase price of $160 million in combination with long term time charters to a subsidiary of commodity trading and logistics company Trafigura.The vessels are built in 2014 and 2015 and have modern eco-design features including exhaust gas cleaning systems, SFL said. The vessels are expected to be delivered to their new owner between December 2021 and February 2022.Hemen Holdings Ltd., who owns approximately 20% of the SFL’s issued and outstanding shares, is also a major shareholder in the seller Frontline.The charter period of the vessels will be for minimum five years with extension options thereafter…

Eastern Pacific Shipping Orders Four LNG Containerships for Crowley Charter

Singapore-based Eastern Pacific Shipping (EPS) said it has secured a contract from U.S.-based Crowley for the charter of four dual fuel liquified natural gas (LNG) powered containership newbuilds.The 1,400-TEU vessels, which will be built by South Korea’s Hyundai Mipo Dockyard for delivery in 2025, will be deployed on Crowley’s U.S.-Central America trade connecting U.S. markets to Nicaragua, Honduras, Guatemala and El Salvador. Each ship will feature 300 refrigerated unit plugs.Using LNG significantly lowers vessel greenhouse gas emissions…

Ethylene Carrier Completes Biofuel Trials

Japan's Marubeni Corporation announced it has conducted a trial voyage onboard one of its chartered ethylene carriers using a marine biofuel blend, from Vlissingen, the Netherlands to Morgan's Point, Texas, as the maritime industry continues to explore ways to decarbonize its operations."To the best of our knowledge, this is the first biofuel supply to an ethylene carrier in the world," the company said. "The voyage was aimed at understanding whether technical issues such as combustibility…

NYK, CNOOC Sign Long-term Charters for Six LNG Carriers

Japanese shipping and logistics firm NYK has signed a long-term time-charter contract with CNOOC Gas and Power Singapore Trading & Marketing Pte. Ltd. for six liquefied natural gas (LNG) carriers, in addition to a shipbuilding contract for the vessels with Hudong-Zhonghua Shipbuilding (Group) Co. Ltd.This is NYK's first long-term time-charter contract for an LNG carrier with CNOOC. The six vessels are scheduled to be delivered between 2026 and 2027 and will be mainly engaged in LNG transportation to China.

EDF Charters Fourth LNG Carrier from NYK

NYK-affiliated company France LNG Shipping has secured a long-term charter contract for a new liquefied natural gas (LNG) carrier with EDF LNG Shipping SAS. The newly built LNG carrier is scheduled for delivery in 2025 from Hyundai Samho Heavy Industries Co. Ltd. This is the fourth NYK vessel on a long-term time-charter contract with the EDF Group.The newly built LNG carrier will be propelled by a WinGD-built, dual-fuel slow-speed diesel engine. The carrier will also feature an Air Liquide–manufactured*** Turbo-Brayton refrigeration system that can tap surplus boil-off gas.

NYK Concludes Long-Term Time-Charter for Seven New LNG Carriers

NYK said that the joint-venture companies (Comprising NYK, “K” Line, MISC Berhad, and China LNG Shipping (Holdings) Limited) that NYK is a part of have signed a long-term time-charter contract with QatarEnergy, the state energy company of Qatar, for seven liquefied natural gas (LNG) carriers. The joint-venture companies have also executed shipbuilding contracts for the seven 174,000 m3 LNG carriers with Hyundai Heavy Industries Co., Ltd.These ships will be equipped with an X-DF 2.1 iCER and air lubrication system, both of which will contribute to a reduction of GHG emissions and an improved environmental impact.LNG Carrier Main ParticularsLength, oa: approx.

Celsius Orders Two More LNG Carriers from Samsung

Celsius Tankers and partners have ordered two additional 180,000-cubic-meter-capacity (CBM) liquefied natural gas (LNG) carriers from south Korean shipbuilder Samsung Heavy Industries (SHI). The two new ships are scheduled to be delivered in 2024 and will enter into long term time charter with an energy major.According to Celsius, the new vessels’ highly efficient design minimizes CO2 emissions and methane slip from operations via installation of air lubrication, optimization of hull shape and use of the best available paint system to reduce the vessels’ friction in water.