ClassNK, Prevention at Sea to Deliver Dry Bulk Management Standard Training

ClassNK and Prevention at Sea have announced a strategic collaboration aimed at delivering Dry Bulk Management Standard (DryBMS) training to shipping companies worldwide.Both parties have agreed to explore future synergies and expanded cooperation in related areas, including gap analysis and benchmarking of Safety Management Systems (SMS) against DryBMS requirements and other key maritime standards such as RightShip RISQ, SIRE, and TMSA.The collaboration also envisages undertaking…

NYK Holds 2026 Dry Bulk Safety Conference in Greece

NYK convened its third annual Dry Bulk Safety Conference in Athens, Greece, on January 21. The event brought together 150 participants representing 70 Greek shipowners and other companies active in the dry bulk sector. Originally established in 2010 in Japan for domestic shipowners and ship-management companies, the conference first expanded to Greece in 2024.At the conference, we shared with Greek shipowners and related companies case studies of past accidents and incidents, along with countermeasures and measures for crew welfare.

Inmarsat Maritime to Install NexusWave Connectivity Service on Pacific Basin Dry Bulk Carriers

Inmarsat Maritime, a Viasat company, has signed an agreement with Pacific Basin Shipping Limited, one of the leading dry bulk carrier owners, to install NexusWave fully managed bonded connectivity service on board an initial five ships.Hong Kong-based Pacific Basin is prioritizing enhancements to both crew and business communications aboard its growing fleet of geared Handysize and Supramax bulk carriers, as part of a connectivity and digitalization strategy that also supports fuel efficiency and emissions reporting.Through its unique network bonding technology…

BIMCO: Dry Bulk Market Supply and Demand Balance Will Weaken in Coming Years

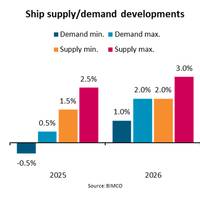

The tariff increases by the US and China in effect as of April 25 are estimated to directly affect 4% of dry bulk ton mile demand. They are expected to impact the growth of minor bulk cargo volumes, as shipments to the US may stagnate or decrease. On the other hand, China is expected to increase purchases of dry bulk cargoes from other countries, leading the US to seek alternative markets.“We expect that the dry bulk market’s supply/demand balance will weaken in both 2025 and 2026.

Veson Nautical: US Port Fees May Disrupt Dry Bulk Trade and Vessel Availability

Recent discussions on tariffs have largely overlooked the potential implementation of the Office of the United States Trade Representative (USTR)’s port fees on Chinese-built vessels. This fee, which could reach up to $3.5 million per port call, varies based on the vessel’s origin and the owner’s fleet composition. Given that typical US port calls cost a maximum of $80,000, this fee could significantly impact import and export volumes.According to VesselsValue trade data, there were 3,150 dry bulk port calls in the US in Q1 2025, involving 1,609 dry bulk carriers.

Baltic Index Rises to Over Two-Week High

The Baltic Exchange's dry bulk sea freight index extended gains on Thursday, reaching a more than two-week high, on stronger rates across all vessel segments.* The main index .BADI, which monitors rates for capesize, panamax, and supramax shipping vessels, rose by 53 points to mark its highest level since April 7, at 1,353 points.* The capesize index .BACI gained 114 points to its highest since April 8 at 1,846.* Average daily earnings for capesize vessels .BATCA, which typically transport 150…

Veson Nautical: Orders For Dry-Bulk Vessels Falldry b by 26% Y-o-Y in Q1

Global economic uncertainty and a cooling of the market has seen newbuild orders for dry-bulk vessels fall by 26% year-on-year according to Hongbeom Park, Head of Korea for global Veson Nautical, a global leader in maritime data and freight management solutions.Speaking at Veson Nautical’s Seoul Forum, Park said uncertainty around the future of fuels, historically high newbuild prices and the price premium for dual-fuel vessels was driving the fall.“The market is slowing in the newbuild sector and orders falling by over a quarter is a reflection of that,” Park said.

Baltic Dry Index Falls for Third Consecutive Session

The Baltic Exchange's dry bulk sea freight index, which tracks rates for ships carrying dry bulk commodities, fell for a third consecutive session on Thursday, hurt by weaker rates in the capesize segment.* The main index, which factors in rates for capesize, panamax and supramax shipping vessels, fell 13 points, or 0.8%, to 1,621 points.* The capesize index shed 54 points, or 2.1%, to reach 2,527 points, lowest level since March 11.* "On the West Australia front, we see relatively limited cargoes and some enquiries for slightly forward end April dates…

Baltic Index Hits Two-Week Low

The Baltic Exchange's dry bulk sea freight index, which monitors rates for vessels moving dry bulk commodities, marked its lowest level in two weeks on Wednesday, pulled down by weaker capesize rates.* The main index, which factors in rates for capesize, panamax and supramax shipping vessels, fell 8 points, or 0.5%, to 1,634 points. The index hit its lowest level since March 12.* The capesize index shed 49 points, or 1.9%, to reach 2,581 points, a two-week low.* Average daily earnings for capesize vessels…

Baltic Exchange Index Snaps Four-Day Losing Streak

The Baltic Exchange's dry bulk sea freight index, which monitors rates for vessels moving dry bulk commodities, snapped a four-session losing streak on Friday, buoyed by an uptick in rates across all vessel segments.* The main index, which factors in rates for capesize, panamax and supramax shipping vessels, added 8 points to 1,643 points. However, the index fell 2% for the week.* The capesize index gained 6 points to 2,676 points, ending a five-session losing streak, but was down close to 7% for the week.* Average daily earnings for capesize vessels…

Seanergy Maritime Grows Fleet with Two Japanese Ships

Seanergy Maritime Holdings Corp. has entered into two definitive agreements with unaffiliated third parties in Japan for the purchase of a Japanese-built Newcastlemax vessel and a bareboat charter with a purchase obligation for one Japanese-built Capesize vessel, for approximately $69 million.The Newcastlemax was built in 2013 at Imabari Shipbuilding, Saijo Shipyard, and has a cargo-carrying capacity of approximately 207,851 deadweight tons (dwt).The vessel will be renamed Meiship and is expected to be delivered within the first quarter of 2025…

MOL Grows Dry Bulk Carrier Fleet with Gearbulk Acquisition

Mitsui O.S.K. Lines (MOL) has completed the acquisition of 72% shares in Gearbulk, growing its fleet of dry bulk carriers to 338 vessels.The completion of acquisition means Gearbulk is now MOL’s consolidated subsidiary.Gearbulk has a proven track record of growth through the transport of semi-finished products such as pulp. MOL has had a 34-year partnership with Gearbulk since its equity participation in 1991.With the consolidation, the MOL Group's fleet of dry bulk carriers will total 338 vessels…

Lila Global Appoints Strategy and Innovation Leader

Dry cargo shipping and logistics company Lila Global has appointed Dr. Abdul Rahim as its Chief Maritime Strategy and Innovation Officer.Rahim will work closely with Lila Global's leadership to drive transformative strategies and foster innovation in the maritime industry. He will be based in Dubai.Rahim brings more than three decades of experience to this position, including a proven track record of leadership and innovation. Prior to joining Lila Global, he served as a Corporate Officer and Managing Director for Europe and Africa at ClassNK…

Baltic Index Snaps 3-Session Slide

The Baltic Exchange's dry bulk sea freight index, which tracks rates for ships carrying dry bulk commodities, snapped its three-session losing streak on Friday, supported by strong rates across the capesize and panamax vessel segments.The index, which factors in rates for capesize, panamax and supramax shipping vessels, rose 14 points to 990 points. The contract was down 5.8% for this week.The capesize index was up 36 points to 1,115 points. The index lost about 11.7% this week. Average daily earnings for capesize vessels .BATCA, which typically transport 150,000-ton cargoes such as iron ore and coal, increased by $299 to $9,244.Iron ore futures prices fell for a fourth straight session on Friday and were set for a weekly loss…

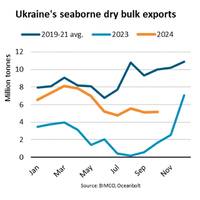

Russian Attacks on Ukranian Vessels Pinch Dry Bulk Market

“Since September 2024, five merchant ships have been hit by Russian missiles while in Ukrainian ports or waters. These were the first attacks on merchant ships since November 2023 and they could threaten 1% of the world’s dry bulk exports if safety is not improved. The price of war risk insurance has already increased but the impact on exported volumes has so far been limited,” says Filipe Gouveia, Shipping Analyst at BIMCO.Throughout 2024 Ukraine has been exporting dry bulk cargoes from its ports in greater Odesa via a corridor close to its coast.

US Exporters Race to Ship Soybeans as Looming Election Stokes Tariff Worries

U.S. soybean export premiums are at their highest in 14 months, as grain merchants race to ship out a record-large U.S. harvest ahead of the U.S. presidential election and fears of renewed trade tensions with top importer China, traders and analysts said.Nearly 2.5 million metric tons of U.S. soybeans were inspected for export last week, including almost 1.7 million tons bound for China, the most in a year, according to U.S. Department of Agriculture data released on Monday.But while this export flurry is a bright spot for U.S.

Ukraine Asks IMO to Monitor Odesa Ports Amid Russian Attacks

Ukraine has asked the International Maritime Organization to send a monitoring mission to ports in the southern Odesa region amid intensified Russian attacks, Foreign Minister Andrii Sybiha said on Wednesday.In recent weeks, Russian troops have ramped up missile strikes on Ukraine's southern port infrastructure and damaged a total of four foreign-flagged civilian vessels since Oct. 6."Amid increased Russian terror, Ukraine has officially appealed to the International Maritime Organization to immediately send an international monitoring mission to the ports…

Great Lakes Limestone Trade Up 9.4%

Shipments of limestone on the Great Lakes totaled 3.8 million tons in September, an increase of 9.4% compared to a year ago, according to latest figures from trade group the Lake Carriers’ Association (LCA). Limestone cargos were also above the month’s 5-year average by 4.5%.Loadings from U.S. quarries totaled 3.1 million tons, an increase of 10.6% from 2023. Shipments from Canadian quarries totaled 678,580 tons, an increase of 4.2%, LCA said..LCA data shows that year-to-date the limestone trade stands at 20.8 million tons, an increase of 1.8% compared to a year ago.

Great Lakes Iron Ore Trade Dips 1.9%

Shipments of iron ore from U.S. ports on the Great Lakes totaled 5.5 million tons in September, a decrease of 1.9% compared to a year ago, according to latest figures from industry trade group the Lake Carriers’ Association (LCA). Shipments were above the month’s 5-year average by 6.6%.Year-to-date the iron ore trade stands at 36.5 million tons, a decrease of less than 1% compared to the same point in 2023, LCA said.Through September iron ore loadings are 7.3% above their 5-year average for the first three quarters of the year.

Baltic Index Hovers Near Three-month High

The Baltic Exchange's main sea freight index rose to its highest in close to three months on Thursday, propelled by higher rates in the capesize vessel segment.The overall index, which factors in rates for capesize, panamax and supramax shipping vessels, rose 75 points to 2,091 points, hitting its highest since July 2.The capesize index jumped 265 points to 3,580 points, its highest since early July.Average daily earnings for capesize vessels, which typically transport 150,000-ton cargoes such as iron ore and coal, increased $2,195 to $29,690.The panamax index was down 45 points or 2.9% at 1,4

Rand Logistics CEO Dave Foster to Retire, Greg Binion Named Interim CEO

Rand Logistics, Inc., a provider of bulk freight shipping in the Great Lakes region, announced that Dave Foster has informed the Board of his decision to retire from his role as Chief Executive Officer, following a nearly 40 year career in the maritime industry, including the past four as CEO of Rand.Greg Binion, a seasoned transportation and logistics executive and most recently a Board Member of Rand, as well as the Executive Chairman of Andrie Marine, has been appointed interim…

Ukraine's Maritime Food Exports Fall in August

Ukraine's food exports by sea and river totalled 4.13 million metric tons in August, down from 4.25 million tons in July, agriculture ministry data showed on Friday.That included 2.18 million tons of wheat, 553,732 tons of corn and 454,641 tons of barley, the data showed.Ukraine's UGA grain traders union said this month that overall grain and oilseed exports totalled 4.3 million tons in August, up from 4.2 million in July.UGA said that included 2.2 million tons of wheat, 794,000 tons of rapeseed and 646…

Low Water Hampers Barge Shipping on the Mississippi River

Low water conditions have led to several barges running aground along a key stretch of the lower Mississippi River, the U.S. Coast Guard told Reuters on Wednesday, just as the busiest U.S. grain export season gets underway.Low water levels are slowing export-bound barge shipments of grain and oilseeds from the Midwest farm belt for a third straight year, making U.S. exports less competitive in a world market awash in supplies - just as farmers are set to harvest a record soy and large corn crop and as prices hover near four-year lows.The U.S.