Euronav Concludes Billion-Dollar Acquisition of CMB.TECH

Belgian tanker operator Euronav has concluded the acquisition of 100% shares in cleantech maritime group CMB.TECH for $1.15 billion in cash.The transaction is part of Euronav’s renewed strategy of diversification, decarbonization and accelerated optimization of the its current crude oil tanker fleet, driven by CMB.TECH’s ‘future-proof’ fleet of 106 low carbon vessels, of which 46 are under construction.It was first announced in December 2023, and also entails Euronav’s proposal change its corporate name to CMB.TECH following completion of the transaction and the offer.

Stena Bulk Halts Tanker Transits in Red Sea

Tanker company Stena Bulk halted transits in the Red Sea early on Friday Central European Time, its CEO Erik Hannel told Reuters.It is the latest tanker operator to cease traversing the key shipping corridor following an advisory from the Combined Maritime Forces to stay clear of the region after the launch of U.S. and British air strikes on Houthi forces in Yemen.(Reuter - Reporting by Natalie Grover; editing by Mark Heinrich)

Euronav to Buy CMB.TECH for $1.15 Billion

Belgian tanker operator Euronav and its controlling shareholder CMB have entered into a share purchase agreement for the acquisition of 100% of the shares in cleantech maritime group CMB.TECH for $1.15 billion in cash.Euronav said the transaction is part of its renewed strategy of diversification, decarbonization and accelerated optimization of the its current crude oil tanker fleet, driven by CMB.TECH’s ‘future-proof’ fleet of 106 low carbon vessels, of which 46 are under construction.CMB.TECH builds…

Palmali Aims to Expand Shipping Ops in the Black Sea

Istanbul-based tanker operator Palmali has become the top shipper for Ukraine's Black Sea-borne sunflower oil exports, one of the country's key export products, and plans to expand further, its chairman Mubariz Mansimov said.Azeri-born Mansimov said Palmali was the most active operator in the increasingly dangerous Black Sea, and plans to expand its presence in Ukraine by placing an order for 10 more cargo carriers and starting trading operations early next year. Since pulling out of the U.N.-brokered deal that guaranteed safe shipment of Ukrainian food products in July…

Kongsberg to Design and Equip Sirius Rederi's New Chemical Tanker Pair

Kongsberg Maritime on Monday announced it has won a contract to supply design, engineering, and equipment for two MGO/biofuel and methanol-ready chemical tankers for Swedish tanker operator Sirius Rederi AB. The low emission 15,000dwt tanker vessels will feature a range of Kongsberg Maritime equipment and can operate on battery-powered hybrid propulsion. Options for further vessels are included.This latest contract builds on a current nine-ship program with fellow Swedish owner Terntank, with a similar design and equipment package.

Study Calls for 'Liberation of Data' in Shipping Shift for Decarbonization

Siloed data systems represent a “recipe for duplicative and multiplicative cost inside a company and across companies”, an OrbitMI-hosted panel at the recent Shipping Insight event in the US was told, as a Bureau Veritas-backed study highlighted this as a big barrier to data collaboration for digitalization of shipping to cut emissions.Vast amounts of data are generated from ship operations - such as from sensors onboard or vessel performance management systems - as well as from…

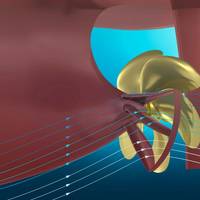

Improving Propulsion Efficiency: Wärtsilä to Retrofit Ten Hafnia Tankers

Finland-based marine technology group Wärtsilä will supply its EnergoFlow and EnergoProFin solutions for ten Bird Class oil and chemical tankers owned by the Singapore-based global tanker operator Hafnia."The combination of the two Wärtsilä systems ensures an optimized waterflow over and after the propeller, thereby improving propulsion efficiency considerably. The order was booked by Wärtsilä in October 2023," Wärtsilä said.According to Wärtsilä, EnergoFlow is an innovative pre-swirl stator that creates an optimal inflow for the propeller…

Digitalization: Maritime Charts its Course

Maritime players plotting pathways to data collaboration with digital projects in line with new BV-backed research study.Digital technologies are increasingly being leveraged by shipping players to facilitate data collaboration among different actors in areas like ship design, vessel performance and port calls as a new Thetius research study backed by Bureau Veritas (BV) shows this will be vital to drive decarbonization, an OrbitMI-hosted panel heard at the recent Shipping Insight event in the US.“Data-powered…

MOL Chemical Tankers to Acquire Fairfield Chemical Carriers

MOL Chemical Tankers has reached a deal to acquire the business of Fairfield-Maxwells' Fairfield Chemical Carriers in an all-cash transaction.Under the agreement, MOL Chemical Tankers would obtain 100% of the shares in Fairfield Chemical Carriers for about $400 million, subject to change depending on the price adjustment under the share purchase agreement.Fairfield Chemical Carriers’ fleet of 36 chemical tankers would dovetail with MOL Chemical Tankers’ fleet of 85 chemical tankers.

Nor-Shipping 2023 Awards Focus on Wind Developments

The winners of Nor-Shipping 2023's top awards are Swedish/Danish tanker operator Terntank, wind power pioneer AlfaWall Oceanbird and Bound4Blue Co-founder and COO Cristina Aleixendri Munoz.Expert judging panels described the competition for the accolades as “fiercer than ever”, reflecting on the “dynamic, ambitious and innovative state of an industry in transition.”Terntank secured the coveted Next Generation Ship Award for its Hybrid Tanker 15,000dwt newbuildings, currently under construction at CMHI Jinling Shipyard in Yangzhou, China.

Euronav CEO Hugo De Stoop Steps Down

Belgian tanker operator Euronav announced Tuesday that its CEO Hugo De Stoop is stepping down after nearly two decades with the company, including four years as CEO.Euronav said its CFO Lieve Logghe will serve as interim CEO as the company searches for a new CEO. Lieve, who joined the group in 2020, will also continue in her role as CFO.De Stoop will remain available to Euronav as a senior advisor until his permanent successor is appointed, the company said.De Stoop joined Euronav…

Tärntank Wind-Assisted Tanker Trio to Sport Kongsberg Gear

Kongsberg Maritime will supply design, engineering and equipment for three MGO/Biofuel and methanol-ready tanker ships being built for Danish tanker operator Tärntank. The 15,000-dwt tanker vessels will feature wind assist technology plus Tärntank’s own battery-powered Hybrid Solution.To be built at China Merchants Jinling Shipyard, Yangzhou and delivered in 2025, Kongsberg's portion totals nearly $12m and includes steering gear, rudders, controllable pitch propellers, tunnel thrusters and thruster control systems…

Oil Spills and Near Misses: More Ghost Tankers Ship Sanctioned Fuel

An oil tanker runs aground off eastern China, leaking fuel into the water. Another is caught in a collision near Cuba. A third is seized in Spain for drifting out of control.These vessels were part of a "shadow" fleet of tankers carrying oil last year from countries hit by Western sanctions, according to a Reuters analysis of ship tracking and accident data and interviews with more than a dozen industry specialists.Hundreds of extra ships have joined this opaque parallel trade…

AET and PTLCL Sign MOU for Zero-emission Aframax

Tanker operator AET announced it has signed a memorandum of understanding (MOU) with Malaysia's PETCO Trading Labuan Company Ltd (PTLCL) to explore a potential collaboration to deploy a future zero-emission Aframax tanker powered by green ammonia.AET said it would be responsible for selecting a suitable shipyard to build the net zero-emission dual-fuel tanker, which would be delivered to PTLCL for long-term charter by 2026.The companies also intend to collaborate on the design…

Methanol Bunkering Carried Out in the Port of Gothenburg

A milestone for the use of methanol as a marine fuel was achieved in the Port of Gothenburg on Monday, as methanol propelled vessel Stena Germanica was the first non-tanker vessel in the world to be bunkered with methanol ship to ship.“This is a door-opening demonstration, proving that there is a feasible way to handle ship to ship methanol bunkering. This strengthens our position as a bunker hub and is also showcasing for other ports that this can be done in a safe and efficient way – not only here, but in other ports around the world as well.

Euronav Seeks Urgent Arbitration over Frontline's Unilateral Merger Termination

Belgian tanker operator Euronav has filed an application for urgent arbitration in relation to tanker firm Frontline’s unilateral termination of the previously proposed merger agreement.Frontline on January 9 said that a $4.2 billion deal to merge with rival Euronav NV was terminated, a combination that would have created the world's largest publicly listed tanker company."Euronav is requesting to suspend such termination pending a determination on the merits pursuing primarily the specific performance of the combination agreement.

PTT, AET Pen MoU to Build Zero-emission Aframaxes

Thai national energy company PTT and tanker operator AET have signed a Memorandum of Understanding (MOU) for the development and construction of two zero-emission Aframaxes to be powered by green ammonia.Jointly, PTT and AET working to encourage the use of green ammonia as a main propulsion fuel. AET will select a suitable shipyard and the two zero-emission dual-fuel tankers are to be delivered to PTT for long-term charters in Q4 2025 and Q1 2026 respectively.Disathat Panyarachun…

MOL Orders Six LNG-fueled Vessels

Mitsui O.S.K. Lines, Ltd. (MOL) announced it has ordered six liquefied natural gas (LNG)-fueled vessels—four bulk carriers and two tankers—as the Japanese shipping company makes headway toward its goal of 90 LNG-fueled vessels by 2030.The company said on Friday signed a deal for construction of four 210,000 DWT-class Capesize bulkers with CSSC Qingdao Beihai Shipbuilding Co., Ltd., marking MOL's first newbuild order from the Chinese shipyard. Slated for delivery in succession from 2025 through 2026…

Keystone Charters Jones Act Tanker Pair from AMSC

American Shipping Company ASA (AMSC), A Norwegian-based ship finance company focused on the intercoastal U.S. Jones Act shipping market, announced it has entered into bareboat charters for two of its vessels commencing in December 2022 with U.S. tanker operator Keystone Shipping Co.The bareboat charters have minimum terms of three years which may be extended at the charterer’s options. The charters are secured by back-to-back time charters of the same duration between Keystone and a major U.S. based oil and refinery group.AMSC said the new charters add almost $60 million to its existing charter backlog, excluding any proceeds from the profit share component of the charters.AMSC CEO Pål Lothe Magnussen said…

International Seaways Sells Stake in Al Shaheen Oil Field FSOs to Euronav

Oil tanker operator International Seaways has sold its 50% stake in two floating storage and offshore (FSO) vessels, the FSO Asia and FSO Africa, to its joint venture partner Euronav NV. The purchase price values the two FSO vessels at $300 million in total. Net of adjustments for working capital and expenses, International Seaways received approximately $140 million in cash from the sale.The transaction has been approved by North Oil Company (“NOC”), the operator of the Al Shaheen offshore oil field in Qatar, whose shareholders are Qatar Energy and Total E&P Golfe Limited.

Kongsberg Digital to Digitalize Over 100 Ships for Tanker Operator

Kongsberg Digital (KDI) said Wednesday recently signed a fleet agreement to provide its vessel-to-cloud infrastructure, Vessel Insight to over 100 vessels. Kongsberg did not say who the client was exactly, apart from saying it was a large industrial shipowner in the tanker segment."We are very proud to announce that we recently signed a major deal to digitalize a large industrial shipowner in the tanker segment, with a fleet agreement exceeding one hundred vessels. This is a good example of digitalization as a crucial step on the journey towards greener…

Second Dual-fuel VLCC Delivered to AET

Tanker operator AET said it has taken delivery of its second liquefied natural gas (LNG) dual-fuel very large crude carrier (VLCC) Eagle Vallery, built by Samsung Heavy Industries (SHI) in South Korea.Following the delivery of Eagle Valence, one of the world’s first dual-fuel VLCCs, Eagle Vallery is the sister vessel in this series of two built for long-term charter to TotalEnergies with Eaglestar as appointed shipmanager.On delivery, Capt. John Baptist, Global Director, VLCC/PCS, said, “AET is a pioneer in LNG dual-fuel vessels with a growing fleet of dual-fuel assets.

Oil Tanker Players Euronav, Frontline Plan $4.2B All-stock Merger

Belgian oil tanker group Euronav and smaller Oslo-listed rival Frontline plan to merge in an all-stock transaction valued at $4.2 billion that they said would cut costs and help in their low-carbon transition.Euronav shareholders will own 59% of the combined group and will also receive a cash dividend before the deal closes, while Frontline owners will hold the remaining 41%, the companies said in a statement on Thursday.The merged company will use the Frontline name and will…